Vibe Coding Revolution: Why CFOs Are Building Not Buying

February 06, 2026 / Bryan ReynoldsThe Asset-Based Software Strategy: How 'Vibe Coding' and AI Economics Are Reversing the Build vs. Buy Calculus

A Strategic Research Report for the Modern CFO

Prepared for: Strategic CFOs and Financial Leaders Presented by: Baytech Consulting Date: January 30, 2026

Executive Summary

For the past two decades, the dominant logic in enterprise technology strategy has been governed by a single, unassailable maxim: Buy, don't build. The rise of Software-as-a-Service (SaaS) promised a future of predictable operating expenses, rapid deployment, and outsourced maintenance. For Chief Financial Officers (CFOs), this model offered a seductive proposition: trade the capital risk of custom development for the liquidity of monthly subscriptions. The "Build vs. Buy" calculus was effectively solved; building was reserved for the top 1% of proprietary core competencies, while buying was the default for everything else.

In 2026, that logic has collapsed.

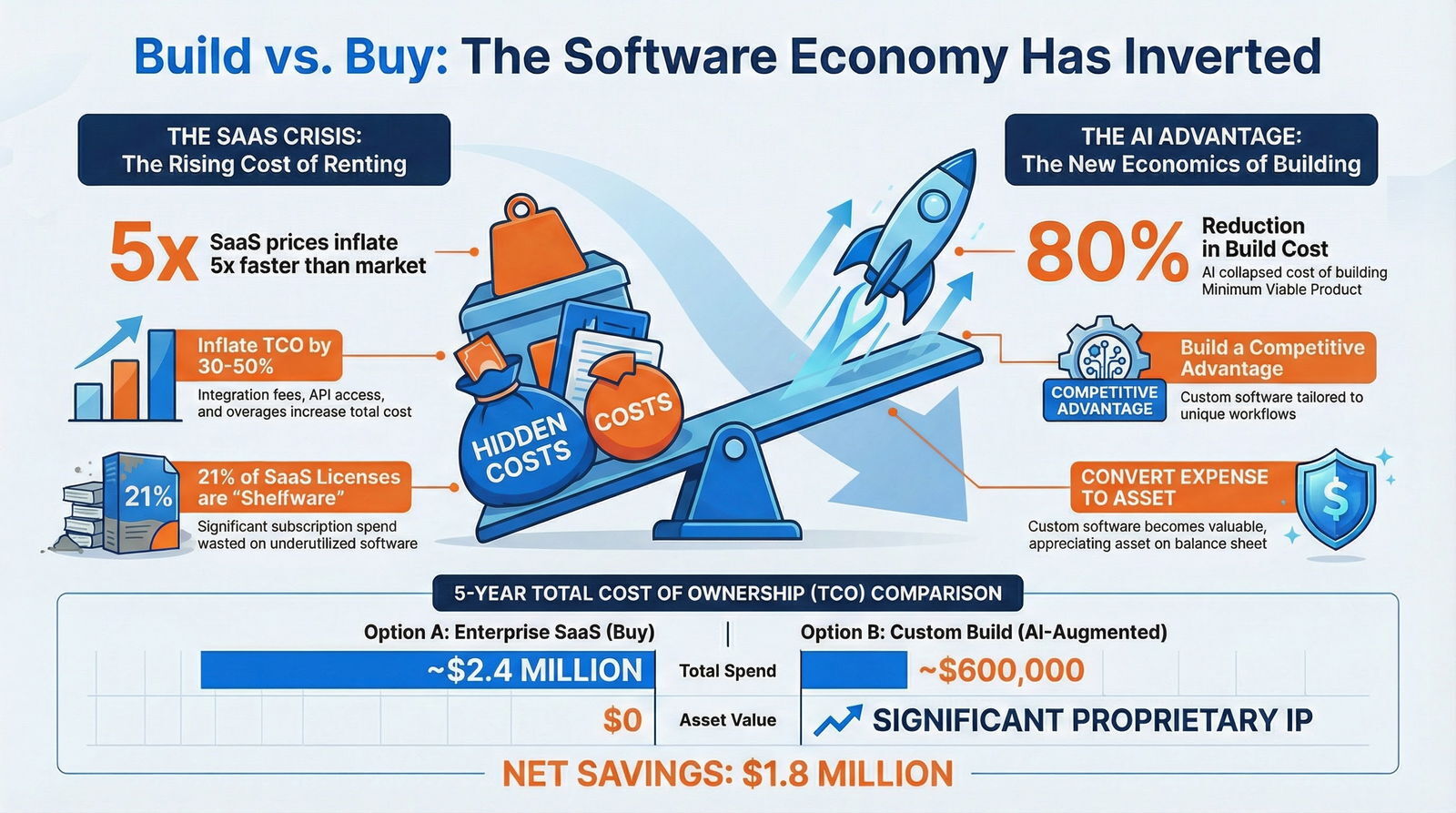

We are witnessing a structural inversion of the software economy driven by two converging forces: the hyper-inflation of SaaS pricing and the hyper-deflation of software production costs via Artificial Intelligence (AI). While SaaS vendors aggressively raise prices—upwards of 12-20% annually, outpacing general inflation by 4x—a new paradigm known colloquially as "Vibe Coding" has emerged. This trend, defined by the use of generative AI to translate natural language prompts directly into functional software, has fundamentally altered the unit economics of writing code.

However, for the enterprise CFO, "Vibe Coding" presents a paradox. While it democratizes software creation and slashes the cost of "building," it introduces profound risks of technical debt, security vulnerabilities, and unmaintainable "spaghetti code." The market is currently awash in "throwaway" AI projects that function as liabilities rather than assets.

This report posits that the future of enterprise technology lies not in renting generic software, nor in reckless AI experimentation, but in Engineered Custom Development. By leveraging AI under strict architectural governance—what Baytech Consulting terms the "Tailored Tech Advantage"—organizations can now build proprietary, asset-grade software for less than the long-term cost of renting. For a deeper look at how AI-native lifecycles are being structured at the CTO level, see our companion report on the AI-native SDLC.

This document serves as a comprehensive guide for the Strategic CFO to navigate this shift. We provide a detailed financial analysis of the new Build vs. Buy calculus, expose the hidden long-term costs of the SaaS model, and outline the governance frameworks necessary to convert "Vibe Coding" from a risky trend into a rigorous competitive advantage.

Part I: The Macro-Economic Shift in Software Economics

1.1 The SaaS Crisis: Inflation, Shrinkflation, and the Rent-Seeker’s Trap

For the last 15 years, the Software-as-a-Service (SaaS) model has been the bedrock of enterprise IT. It promised to liberate CFOs from the unpredictability of on-premise servers and the heavy CapEx of custom development. In exchange for a predictable per-user monthly fee, companies received continuous updates and maintenance. It was a model built on the premise of efficiency and shared infrastructure costs.

However, as we enter 2026, the SaaS model has fundamentally broken its covenant with the enterprise customer. We are currently in the midst of a "Great Price Surge," characterized by aggressive monetization tactics that have turned software subscriptions into one of the fastest-growing line items in the OPEX budget. The era of cheap, scalable software rental is over, replaced by a landscape of aggressive rent-seeking from mature vendors.

The Inflationary Spiral

The data is stark and undeniable. In 2024, SaaS prices increased by an average of 12.2%, while general inflation hovered around 2.7%. This trend accelerated in 2025, with major vendors pushing price hikes of 15-25%. This divergence represents a fundamental decoupling of software pricing from the underlying economic reality. It is not merely a reflection of increased costs; it is a strategic pivot by legacy vendors. As customer acquisition growth slows in mature markets, public SaaS companies are under immense pressure from Wall Street to demonstrate revenue growth. They have turned to their existing customer base as a captive source of expansion revenue.

This phenomenon is described by industry analysts as a shift from "growth at all costs" to "pricing power assertion." Vendors like Salesforce, Microsoft, and others have realized that the switching costs for core business systems are high enough that customers will absorb significant price increases rather than migrate. SaaS inflation inside the broader Subscription Economy is now running at approximately 5x the rate of general market inflation, creating a compounding burden on the P&L that is unsustainable for many mid-market and enterprise organizations.

The compounding effect of these hidden costs means that the "predictable" SaaS bill is often anything but. Overage charges for data storage, premium fees for Single Sign-On (SSO) integration, and "true-up" costs at renewal time introduce significant volatility into the IT budget.

1.2 The Deflationary Force: AI and the Rise of "Vibe Coding"

While the cost of renting software is skyrocketing, the cost of producing software is in freefall. This is the central economic contradiction of our time and the primary catalyst for the new Build vs. Buy analysis.

Generative AI has introduced a new paradigm in software engineering. Early in 2025, Andrej Karpathy coined the term "Vibe Coding" to describe a workflow where the primary input is natural language and the output is functional code. In this model, the human acts less as a manual typist of syntax and more as an architect and reviewer, guiding the AI to generate implementation details based on the desired "vibe" or functional outcome. This mirrors what we describe as the emerging future of AI-driven software development across the 2026 landscape.

The Economics of "Vibe Coding"

The impact on productivity is measurable and massive. Developers using AI assistants report productivity gains of 20% to 55%. But the impact goes beyond speed; it fundamentally changes the barrier to entry for creating custom software.

- Reduced Labor Intensity: Tasks that previously required a team of five senior engineers can now be accomplished by two engineers leveraged with AI agents. The "lift" required to generate boilerplate code, standard UI components, and database schemas has been reduced to near zero.

- Commoditization of Syntax: The ability to write syntactically correct code in Java, Python, or React is no longer a scarce skill; it is a commodity provided by the AI. The scarce skill has shifted to system architecture, problem definition, and orchestration. Organizations that invest in strong architecture and enterprise application architecture get far more leverage from these tools than those that don’t.

- Cost Collapse: For specific classes of software, the cost to build a Minimum Viable Product (MVP) has dropped from 150,000 to as low as 30,000. This 80% reduction in initial capital outlay fundamentally alters the risk profile of custom development.

This massive reduction in production costs challenges the foundational assumption of the SaaS model: that it is cheaper to share the development costs of a standard platform with thousands of other companies than to build it yourself. When building becomes 80% cheaper, the premium paid for a generic SaaS solution is no longer justifiable for many use cases.

The chart below illustrates the "Economic Crossing Point." For nearly two decades, the blue line (Custom Build Cost) was prohibitively high compared to the red line (SaaS Cost). Today, those lines have crossed. For a growing number of enterprise use cases, building is now the rational economic choice.

Part II: Deconstructing "Vibe Coding" — Opportunity and Threat

2.1 The Definition and Mechanics of Vibe Coding

"Vibe Coding" is more than a cultural meme; it represents a fundamental abstraction layer shift in computer science. Historically, software development required a practitioner to translate business logic into rigorous, machine-readable syntax (code). The "Vibe Coding" paradigm shifts this interaction. The practitioner describes the intent (the "vibe" or desired behavior) in natural language, and a Large Language Model (LLM) generates the syntax.

This shift is analogous to the move from Assembly Language to C, or C to Python. Each abstraction layer democratizes access and increases velocity by removing low-level friction. Andrej Karpathy notes that in its purest form, Vibe Coding allows a user to "forget the code even exists," focusing entirely on the product's behavior and user experience. This democratization mirrors the AI code revolution we’re seeing across engineering teams.

However, the implications for enterprise adoption are nuanced. While "hobbyist" Vibe Coding allows an individual to build a game or a simple tool over a weekend, "Enterprise Vibe Coding" requires a completely different framework. The reliance on AI to generate implementation details creates a significant risk if not managed with professional discipline.

2.2 The Paradox: Productivity vs. Technical Debt

For a Strategic CFO, unchecked "Vibe Coding" represents a massive accumulation of potential Technical Debt. The very ease with which code can be generated is its danger.

- The Illusion of Competence: AI can generate code that runs but is fundamentally flawed—insecure, unscalable, or riddled with logic errors that only manifest under load. Because the "creator" did not write the code line-by-line, they often lack the deep contextual understanding required to debug it when it inevitably breaks. This phenomenon is known as "Comprehension Debt," a new and dangerous liability on the technical balance sheet and one of the core forms of AI technical debt emerging in modern stacks.

- Spaghetti Code Renaissance: Without an overarching architectural vision, AI generates disparate snippets of code that are stitched together poorly. This results in a fragile codebase—a "Frankenstein’s Monster" of logic—that is impossible to maintain or upgrade.

- Security Vulnerabilities: AI models are trained on public code, which includes vulnerabilities. Blindly trusting AI output can introduce critical security flaws (SQL injection, XSS) into enterprise systems. The risk of introducing security vulnerabilities is a primary critique of the Vibe Coding movement.

- The "Maintenance Cliff": "Vibe Coding" is excellent for Day 1 (creation) but can be catastrophic for Day 100 (maintenance). When the AI-generated code encounters an edge case, who fixes it? If the team relies solely on the "vibe" and does not understand the underlying logic, the software becomes a "black box" that must be discarded and rebuilt rather than repaired.

This leads to the Baytech Thesis: "Vibe Coding" is a powerful accelerant, but it is not a strategy. To harness the economic benefits without the risks, organizations need a new breed of development rigor that we term Engineered AI Development. This aligns closely with the disciplined approach to AI-native workflows described in our analysis of Google’s Antigravity AI IDE.

Part III: The New Build vs. Buy Calculus — A Financial Framework

3.1 The Financial Framework: Asset vs. Expense

The decision to build or buy has traditionally been a choice between Capital Expenditure (CapEx) and Operating Expenditure (OpEx).

- Buy (SaaS): Pure OpEx. Predictable (historically), scalable, but offering no asset value. The money leaves the building every month, effectively paying "rent" for capability.

- Build (Custom): Heavy upfront CapEx. Creates a balance sheet asset (intangible software asset) that is amortized over time.

In the pre-AI era, the CapEx required to build enterprise-grade software was prohibitive (500k - 2M+), and the risk of project failure was high. The "Depreciation" of the asset was often faster than its utility; the code would become obsolete before it was fully paid off.

The AI Shift: AI changes this calculus by drastically lowering the upfront CapEx. If a custom CRM for a niche workflow previously cost $300,000 to build, and AI reduces that to $60,000, the "Break-Even Point" against a SaaS subscription moves drastically forward.

Consider a mid-market company with 100 users paying $150/user/month for a SaaS platform.

- SaaS Cost: $180,000 per year. (Plus 12% annual inflation).

- Traditional Build Cost: $400,000. Break-even: ~2.5 years.

- AI-Assisted Build Cost: $100,000. Break-even: < 7 months.

After month 7, the company is effectively saving $15,000/month (minus minor maintenance costs). Furthermore, they own the asset. This software can be valued on the books, does not require renegotiation of contracts, and contributes to the enterprise value of the company. A structured approach to this decision looks very similar to our framework for software investment risk strategies in 2026.

3.2 The "Tailored Tech Advantage"

Beyond simple cost savings, the "Build" option offers a strategic premium that Baytech Consulting defines as the "Tailored Tech Advantage".

Generic SaaS is designed for the mass market ("The Average User"). To serve everyone, it must compromise on specific workflows. This leads to the "Square Peg in a Round Hole" problem, where highly paid employees adjust their productive workflows to fit the limitations of the software.

- Process Efficiency: Custom software is built around the company's unique "Secret Sauce"—the proprietary processes that give it a competitive edge. It encodes the company's best practices into the tool itself.

- Data Sovereignty: In an era of increasing data privacy regulation (GDPR, CCPA) and AI training concerns, owning the database is critical. SaaS vendors often hold data hostage or use it to train their own models. Custom software ensures data residency and complete ownership. In many cases, this also pairs naturally with building a private AI stack or "walled garden," as described in our guide to corporate AI fortresses.

- Integration Agility: SaaS platforms charge premiums for API access and limit integration points. Custom software can be architected API-first, allowing for seamless, zero-cost integration with other internal tools.

3.3 Strategic Total Cost of Ownership (TCO) Analysis

To rigorously evaluate the financial impact, we must look beyond the initial build or first year's subscription. We present a Total Cost of Ownership (TCO) model comparing a standard Enterprise SaaS implementation against a Baytech-led Custom Build over a 5-year horizon.

Scenario: A mid-market logistics firm needs a "Field Operations Management" system for 200 users.

Option A: Enterprise SaaS (Buy)

- License: $125/user/month (increasing 10% annually).

- Implementation/Onboarding: $50,000 (Year 1).

- Hidden Costs (Integrations/Overage): 20% of license fee.

- Year 1 Cost: 300,000 (Base) + 50,000 (Setup) + $60,000 (Hidden) = $410,000.

- Year 5 Cost (with compounding inflation): ~$600,000.

- 5-Year Total Spend: ~$2.4 Million.

- Asset Value: $0.

Option B: Baytech Custom Build (AI-Augmented)

- Initial Build (CapEx): $250,000 (Traditional cost would be $600k; AI saves ~60%).

- Hosting/Infra (OpEx): $2,000/month (Scales linearly).

- Maintenance/Retainer (OpEx): $40,000/year (20% of build cost).

- Year 1 Cost: 250,000 (Build) + 24,000 (Host) + $40,000 (Maint) = $314,000.

- Year 5 Cost: 24,000 (Host) + 40,000 (Maint) = $64,000.

- 5-Year Total Spend: ~$600,000.

- Asset Value: Significant proprietary IP.

The Bottom Line: The Custom Build option delivers $1.8 Million in cash savings over 5 years. The break-even point occurs in Year 1. Furthermore, the CapEx investment in Year 1 can be amortized, offering tax advantages that pure OpEx does not.

Part IV: Industry Specific Analysis — Where Buying Fails

The limitations of the "Buy" model are not uniform across all sectors. The pain is most acute in complex, regulated industries where generic software fails to capture the nuances of the operational reality. In these sectors, the "Tailored Tech Advantage" is not just a financial optimization; it is an operational necessity.

4.1 Healthcare: Escaping the Rigid Workflow Trap

In the healthcare sector, the "Buy" option is dominated by massive, monolithic Electronic Health Record (EHR) systems. While necessary for core clinical data, these systems are notorious for their rigidity, often forcing clinicians into inefficient workflows that contribute to burnout.

The SaaS Failure: Off-the-shelf SaaS tools in healthcare often struggle with the "last mile" of care delivery. A specialized oncology clinic, for example, has a patient journey workflow that is fundamentally different from a general practitioner's office. Generic tools force the clinic to adopt a "least common denominator" process. Furthermore, data ownership is a critical issue; SaaS vendors often aggregate patient data for their own analytics, creating privacy concerns and limiting the provider's ability to extract insights from their own data.

The Custom Advantage: AI-assisted custom development allows healthcare providers to build "wrapper" applications or specialized modules that integrate with the core EHR but provide a tailored user experience. A custom build can ensure HIPAA and SOC2 compliance from the ground up, designed specifically for the clinic's unique protocols. It allows for "Role-Based Access" that is granular and specific to the organization's hierarchy, rather than the vendor's preset roles. The result is a system where the software adapts to the clinician, not the other way around.

4.2 Real Estate & Property Management: The Local Compliance Challenge

The Real Estate sector deals with highly localized regulations and varying asset classes (commercial, residential, industrial, mixed-use).

The SaaS Failure: Generic property management SaaS is built for the "average" property in the "average" jurisdiction. It often lacks the flexibility to handle complex, non-standard lease structures or localized compliance reporting (e.g., specific rent control reporting formats for a single city). Property managers often find themselves managing 80% of their work in the SaaS tool and the critical, complex 20% in disconnected spreadsheets because the software cannot handle the edge cases.

The Custom Advantage: Custom software allows for "Jurisdiction-specific forms" and automated compliance checks that generic tools cannot offer. A custom solution can automate the specific reporting requirements of local housing authorities, integrate with local banking systems for payments, and handle complex lease calculations that are unique to the portfolio. This eliminates the "spreadsheet gap" and creates a single source of truth for the portfolio.

4.3 Financial Services: Engineering Trust and Alpha

For CFOs and wealth managers, trust, compliance, and speed are paramount.

The SaaS Failure: Generic financial SaaS often lacks the hyper-personalization required for high-net-worth client management or the specific audit trails required by niche regulators. More critically, in finance, the method of analysis can be a competitive advantage. Using the same SaaS tool as every competitor neutralizes that advantage. If everyone uses the same "AI Market Analyzer," everyone gets the same signal.

The Custom Advantage: Custom software enables "Financial Engineering" where the tool itself becomes a source of alpha. Firms can build proprietary trading strategies, risk assessment models, or client reporting engines that reflect their unique investment philosophy. It also allows for total control over data sovereignty—critical when handling sensitive financial data that cannot be exposed to third-party AI training sets.

Part V: Baytech’s Methodology — Engineered AI Development

Baytech Consulting distinguishes itself not by rejecting AI, but by taming it. We transition clients from the chaotic world of "Vibe Coding" to the disciplined methodology of Engineered AI Development. This approach retains the speed and cost benefits of AI while applying the rigor of traditional software engineering.

5.1 The "Clean Code" Protocol

Baytech implements a rigorous quality assurance framework designed specifically for AI-generated code. This ensures that the cost savings of AI do not result in long-term technical debt. Our practices build directly on the QA and testing principles outlined in our guide to operationalizing QA for profit.

- Human-in-the-Loop Architecture: AI is never the "approver." Every line of generated code is reviewed by a senior software architect. The AI is the "junior developer," and the Baytech engineer is the "lead." This maintains the "chain of custody" for code quality.

- Readability Standards: AI often writes cryptic or overly complex code. Baytech mandates that all code must be "human-readable" and follow strict style guides. This ensures that future developers can maintain the system without relying on the specific AI prompt that generated it.

- Test-Driven Generation: We do not just ask AI to write code; we ask it to write the tests for that code first. This ensures that every function is verified against strict logic requirements before it enters the codebase.

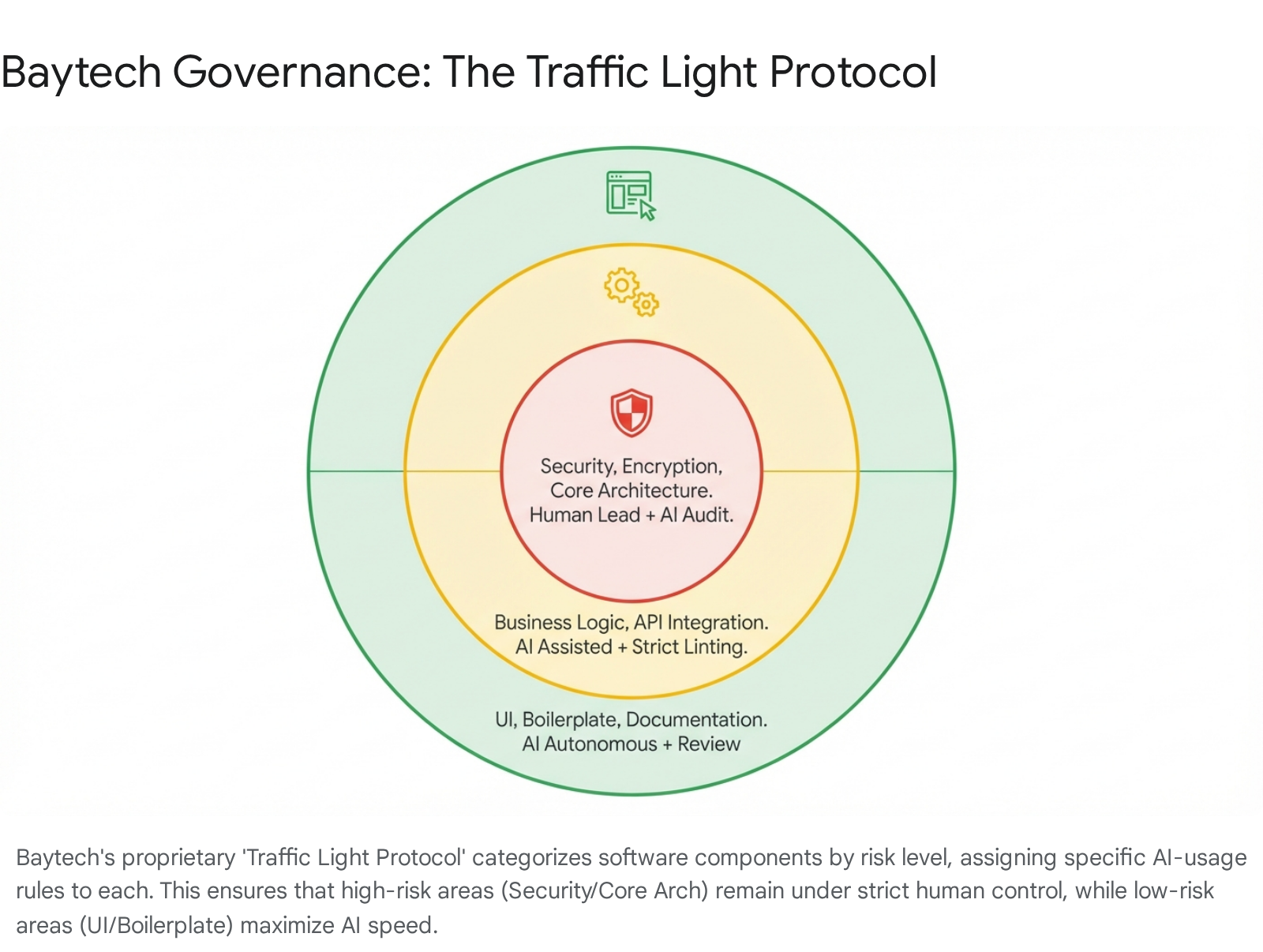

5.2 The Traffic Light Protocol

To manage risk, Baytech applies a "Zoned" governance model to AI usage. This protocol dictates where and how AI can be used within a project, ensuring that high-risk areas receive maximum human oversight.

- Green Zone (High AI Autonomy): Documentation, Unit Tests, UI Mockups, Boilerplate Code. Strategy: Maximum Speed. In these areas, AI can generate 80-90% of the output, with human review focusing on accuracy and style.

- Yellow Zone (Assisted Mode): Business Logic, Data Transformation, API Integrations. Strategy: AI Drafts, Human Refines. Here, the AI acts as a pair programmer, suggesting implementation strategies that the human engineer then refines and optimizes.

- Red Zone (Human-Only): Security Protocols, Encryption, Authentication, Core Architectural Decisions. Strategy: Human Written, AI Audited. These critical components are written by senior engineers. AI is used only to audit the code for potential vulnerabilities, acting as an adversary to test robustness.

5.3 Phased Delivery & ROI Maximization

Baytech utilizes a "Rapid Agile Deployment" methodology to align technical output with business value. This contrasts with the traditional "Waterfall" approach that delays value delivery and draws on our long-standing expertise in Agile methodology and iterative delivery.

- Phase 1: The AI-Accelerated MVP. By leveraging Vibe Coding techniques within the Green Zone, Baytech can deliver a functional MVP in weeks, not months. This minimizes upfront capital risk and allows for rapid market validation.

- Phase 2: User Validation & Hardening. Once the concept is proven, the code is "hardened"—refactored and optimized for scale. This is where the technical debt incurred during the MVP phase is deliberately paid down.

- Phase 3: The Asset Maturity. The software is integrated deeply into the enterprise, becoming a depreciating asset that drives increasing value over time.

Part VI: Legacy Modernization — The Hidden Opportunity

While "Vibe Coding" is often associated with new builds (Greenfield projects), its most profound financial impact may lie in Legacy Modernization (Brownfield projects). Enterprises are sitting on trillions of dollars of "Legacy Debt"—mainframes, outdated codebases (COBOL, older Java), and sprawling monoliths that are expensive to maintain and impossible to change.

6.1 The "Innovation Tax" of Legacy Systems

Legacy systems impose a heavy "Innovation Tax." A significant portion of the IT budget is consumed simply by keeping the lights on (maintenance), leaving little for new initiatives. Modifying these systems is slow and risky; a simple feature change can take months of regression testing. This rigidity is a primary driver of the move to SaaS—CFOs often choose to replace a legacy system with SaaS simply to escape the maintenance burden.

6.2 AI-Driven Refactoring

AI fundamentally changes the economics of modernization. LLMs are exceptionally good at translating code from one language to another and at documenting undocumented systems.

- Automated Documentation: AI can crawl a legacy codebase and generate documentation, explaining how the system works. This de-risks the project by removing the "tribal knowledge" dependency on a few senior engineers.

- Code Translation: AI agents can translate legacy code (e.g., COBOL) into modern languages (e.g., Java, Python) with high accuracy. This allows organizations to migrate off expensive mainframes to modern cloud infrastructure without the massive manual rewrite costs of the past. These same patterns show up in our work helping teams modernize DevOps pipelines with AI-enabled tooling.

- Test Generation: One of the biggest fears in modernization is breaking existing functionality. AI can generate comprehensive test suites for the legacy code, ensuring that the new modern system behaves exactly the same way (functional parity).

Baytech leverages these capabilities to offer "modernization at a fraction of the cost." Instead of a multi-year, high-risk "rip and replace" project, we use AI to incrementally strangle the monolith, extracting value and modernizing it piece by piece. This allows the CFO to convert a high-maintenance liability into a modern, agile asset.

Part VII: Implementation Strategy & Change Management

Transitioning from a "SaaS-first" to a "Build-first" strategy requires more than just new technology; it requires a shift in organizational mindset and management.

7.1 The Decision Matrix: When to Build?

Not every software needs to be custom. We recommend the following framework for evaluating opportunities:

| Feature | Buy (SaaS) | Build (Baytech Custom) |

|---|---|---|

| Core Function | Commodity (Payroll, Email, Basic CRM) | Competitive Differentiator (Proprietary Algo, Unique Workflow) |

| User Count | Low (< 50 users) | High (> 50-100 users) |

| Workflow | Standard Industry Process | Unique / Complex / Regulated |

| Integration Needs | Low / Standard | High / Custom API |

| Data Requirement | Standard Storage | High Security / Sovereignty Needed |

| Budget Strategy | Predictable OpEx (Short Term) | Asset Creation (Long Term ROI) |

7.2 Managing the Transition

- Audit the Stack: Conduct a comprehensive audit of existing SaaS subscriptions. Identify tools with high costs, low utilization, or poor workflow fit. These are the prime candidates for replacement.

- Identify the "Pilot": Do not start with the ERP. Choose a non-critical but high-friction internal tool to rebuild using the Baytech AI methodology. This proves the ROI and builds internal confidence without risking core operations.

- Capitalize the Development: Work with accounting to properly classify the AI-assisted development costs as CapEx. Ensure that the internal labor and external consulting fees are captured accurately to maximize the asset value on the balance sheet.

- Cultural Shift: Prepare the internal IT team for the shift. They will move from being "integrators of purchased tools" to "owners of product." This may require upskilling, which Baytech supports through our co-development model. Many executives approach this similarly to how they choose a long-term software partner to guide that change.

Conclusion

The era of default "Buying" is over. The "Vibe Coding" revolution, when tempered with professional engineering rigor, provides a once-in-a-generation opportunity for Strategic CFOs to reclaim control over their technology stacks.

The economic inversion is real: SaaS costs are rising while the cost of building is falling. By shifting from a model of renting capability to building assets, organizations can insulate themselves from SaaS inflation, secure their data, and build genuine competitive advantages—all while drastically reducing their long-term Total Cost of Ownership.

Baytech Consulting stands ready to be your partner in this transition. We do not just build software; we build assets. Our Tailored Tech Advantage and Engineered AI Development protocols ensure that you harness the speed of AI without the risks, delivering a financial and operational victory for the modern enterprise. Our dedicated AI-powered services practice is built specifically to support this shift from vision to execution.

FAQ: Common C-Level Questions

Q: Isn't "Vibe Coding" just a buzzword for amateur development?

A: In the wild, yes. "Vibe Coding" often refers to hobbyists using AI to build simple apps. However, Baytech applies the economics of Vibe Coding (AI-generated syntax) within a professional engineering framework. We use the speed of AI but the governance of senior architects. It’s not amateur; it’s accelerated professional engineering.

Q: Will AI-generated code be secure?

A: Not by default. Public AI models can suggest insecure patterns. That is why Baytech's "Red Zone" protocol requires human experts to handle all security, authentication, and encryption logic. We use AI for efficiency, not for security architecture.

Q: How do we handle maintenance if the AI wrote the code?

A: This is the "Comprehension Debt" risk. Baytech mitigates this by requiring AI to write "human-readable" code and comprehensive documentation. We also enforce a "human review" of every line. Our engineers understand the code because they architected it and reviewed it—the AI simply did the typing.

Q: Can we capitalize AI-assisted software development?

A: Generally, yes. Under US GAAP (ASC 350-40), costs incurred during the "Application Development Stage" of internal-use software are capitalizable. Because AI reduces the duration but often increases the velocity of feature creation, you are effectively creating a larger asset value for the same spend. Note: Always consult your technical accounting team.

Q: Why Baytech over a massive generic dev shop?

A: Large shops often rely on "body count" models—billing for hours. AI threatens their revenue model because it reduces the hours needed. Baytech is built on outcome and efficiency. We embrace AI to lower your costs, not to inflate our billable hours. Our "Tailored Tech Advantage" is designed specifically for this high-efficiency AI era.

Q: What is the typical ROI timeframe?

A: While it varies by project complexity, our TCO models often show a break-even against enterprise SaaS fees in 7-12 months. Over a 3-5 year horizon, the savings can exceed 60-70% of the projected SaaS spend, as shown in our financial analysis.

Supporting Articles

About Baytech

At Baytech Consulting, we specialize in guiding businesses through this process, helping you build scalable, efficient, and high-performing software that evolves with your needs. Our MVP first approach helps our clients minimize upfront costs and maximize ROI. Ready to take the next step in your software development journey? Contact us today to learn how we can help you achieve your goals with a phased development approach.

About the Author

Bryan Reynolds is an accomplished technology executive with more than 25 years of experience leading innovation in the software industry. As the CEO and founder of Baytech Consulting, he has built a reputation for delivering custom software solutions that help businesses streamline operations, enhance customer experiences, and drive growth.

Bryan’s expertise spans custom software development, cloud infrastructure, artificial intelligence, and strategic business consulting, making him a trusted advisor and thought leader across a wide range of industries.