Unlocking Recurring Revenue: The Subscription Economy in 2026

January 12, 2026 / Bryan Reynolds1. Introduction: The Strategic Imperative of the Relationship Economy

We are witnessing the final gasps of the transactional economy. For the better part of a century, the dominant business model was discrete and linear: a company made a product, a customer purchased it, and the relationship largely ended at the point of sale. Revenue was recognized immediately, value was transferred instantly, and the ledger was closed. Today, that model is being systematically dismantled and replaced by the Subscription Economy—a dynamic, circular ecosystem where revenue is recurring, value is continuous, and the relationship is paramount.

For the C-Suite—specifically the Chief Financial Officer (CFO), Chief Executive Officer (CEO), and Head of Product—this transition represents the single most significant strategic shift of the decade. It is not merely a pricing change; it is an operational metamorphosis. The "end of ownership," a concept accelerated by the digital transformation waves of the 2020s, has matured into a dominant economic force. Manufacturing firms are no longer selling industrial turbines; they are selling "uptime-as-a-service." Software companies have long since abandoned perpetual licenses for consumption-based SaaS. Even the media and automotive sectors are pivoting toward Mobility-as-a-Service (MaaS) and content access models. Many leaders are now seeking the right software development partners to guide them through this fierce transformation and ongoing digital disruption.

However, the allure of predictable Recurring Revenue (ARR) often masks a treacherous operational reality. Subscription businesses are exponentially more complex than their transactional predecessors. A one-time sale has a distinct beginning and end. A subscription is a living, breathing entity that changes state constantly—upgrades, downgrades, pauses, prorations, usage spikes, and churn. To support this, the enterprise technology stack must be reimagined. It requires a move away from rigid, monolithic ERPs toward flexible, modular architectures capable of handling high-velocity metering, complex billing logic, and rigorous revenue recognition standards.

This report serves as an exhaustive guide for executives navigating this complexity. It dissects the anatomy of the subscription stack, moving beyond high-level generalities to the gritty technical and financial realities of billing mediation, revenue recognition (ASC 606), and the critical "build vs. buy" decisions that define long-term scalability. We will explore how firms like Baytech Consulting leverage tailored technical advantages to solve these problems, particularly when off-the-shelf solutions hit their breaking points.

1.1 The Macro Trajectory: A $1.5 Trillion Market Opportunity

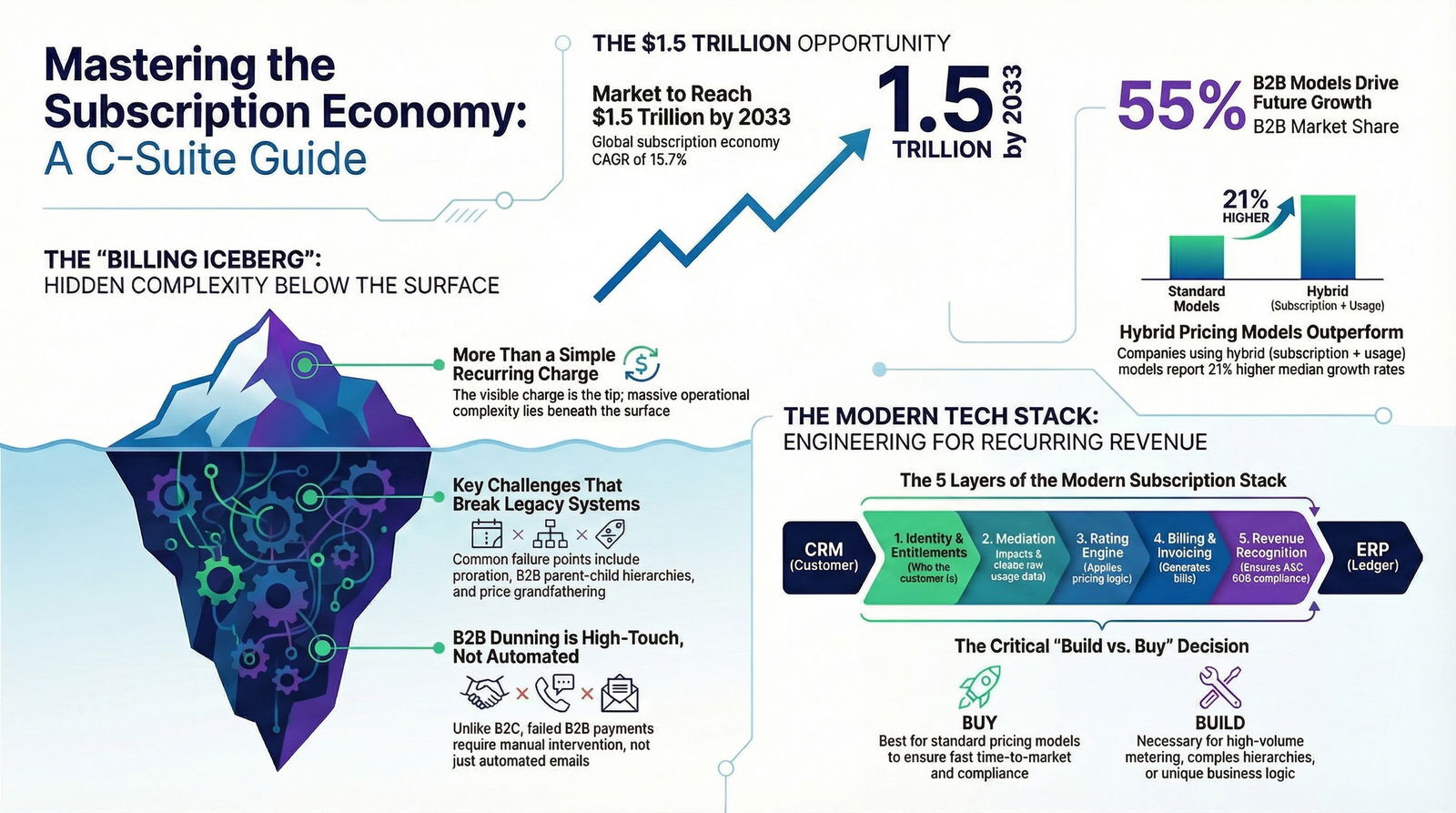

The economic data underscores the urgency of this transition. The shift is not a temporary trend but a fundamental restructuring of global commerce. Analysis indicates that the global subscription economy market is poised for explosive growth. While estimates vary slightly by methodology, the trajectory is undeniable. The market is projected to reach a value of approximately $2,095.7 billion by 2034, growing from a base of roughly $565.6 billion in 2025 at a Compound Annual Growth Rate (CAGR) of 15.7%. Other reputable market analysis corroborates this, estimating the global market size at nearly $500 billion in 2024 with a projection to reach $1.5 trillion by 2033.

Crucially, the composition of this revenue is shifting. The early days of the subscription economy were dominated by simple "access" models (e.g., Netflix or Spotify). However, the next decade of growth will be driven by the B2B sector, which already accounts for over 55% of the market share. The fastest-growing segments are complex, high-stakes models in Mobility-as-a-Service, which is forecast to grow over 540% between 2025 and 2030, and IoT-driven manufacturing.

The dominance of web-based platforms, which are expected to capture 53% of the delivery platform market share by 2025 , highlights the digital-first nature of this evolution. Yet, as the market expands, the models are becoming less "flat-rate" and more dynamic. The data reveals a significant pivot toward hybrid monetization strategies—combining flat subscriptions with usage-based pricing—which are proving to be superior engines for retention and growth compared to pure-play models.

1.2 The C-Suite Dilemma: Pricing as Infrastructure

For the executive leadership team, the implications of these market dynamics are profound. In the transactional world, pricing was a marketing decision. A price tag was printed, a discount was negotiated, and the deal was done. In the Subscription Economy, pricing is an infrastructure decision.

If a Head of Product decides to launch a new "Pay-as-you-Go" AI feature where customers are charged per token generated, that decision ripples through the entire organization.

- Engineering must build a metering service to count the tokens in real-time.

- The CTO must ensure the ingestion pipeline can handle millions of events without latency.

- Sales needs a CPQ (Configure, Price, Quote) tool that can quote complex variable tiers.

- The CFO needs a revenue recognition engine that can separate the "billed" cash from the "recognized" revenue under ASC 606, which prohibits recognizing variable fees until the usage actually occurs. If you want to master these decisions, don't miss our guide on evaluating software proposals for strategic transformation.

Legacy systems, designed for the predictable cadence of shipping physical goods, invariably fail under this pressure. They lack the granularity to meter usage, the flexibility to handle mid-cycle upgrades, and the intelligence to manage the customer lifecycle. Consequently, companies are forced to either buy specialized platforms or build custom solutions using modern cloud architectures—a decision matrix we will explore in depth later in this report.

2. The New Complexity: Why "Standard" Billing Fails in B2B

For years, the go-to advice for B2B pricing was simple: "raise prices" or "add a tier." In the matured market of 2025, that advice is obsolete. The market has shifted toward Usage-Based Pricing (UBP) and Hybrid Monetization, strategies that align price with value but impose massive technical debt on unprepared organizations. If you are considering these pricing shifts, explore modern risk strategies for software investment to safeguard your decisions.

2.1 The Rise of Hybrid and Usage-Based Models

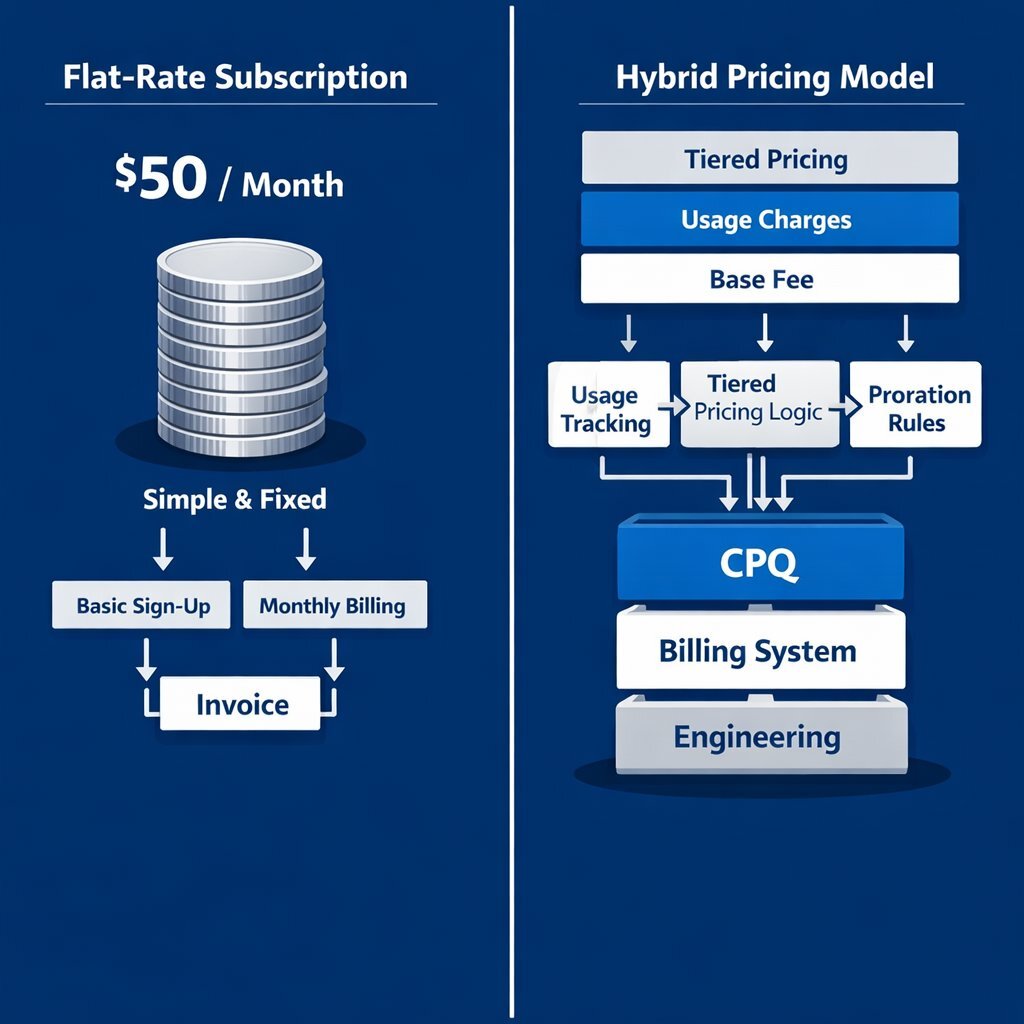

Pure subscription models—charging a flat $50/month regardless of usage—are increasingly viewed as rigid and disconnected from customer value. Customers, particularly in the B2B space, are sophisticated; they demand transparency and alignment. They want to pay for what they use.

This has given rise to the Hybrid Model , which combines a recurring platform fee (ensuring a baseline of predictable revenue) with consumption-based charges (capturing the upside of customer growth). The data supports the efficacy of this approach: companies utilizing hybrid models report median growth rates of 21%, significantly outperforming both pure subscription and pure usage models.

The adoption rates are staggering. As of 2025, approximately 85% of software companies have adopted some form of usage-based pricing. This is particularly prevalent in the AI sector, where 44% of SaaS companies now monetize AI features separately, often via token-based or compute-based metrics. Need a deeper dive on AI’s influence? Read about the impact of AI on the future workforce and its pivotal role in these evolving models.

However, this shift creates a "complexity gap." While the strategy is sound, the execution is difficult. Over 71% of finance leaders report major breakdowns in their back-office systems when trying to support these new pricing models. The root cause is often a mismatch between the dynamic nature of the business model and the static nature of the underlying billing infrastructure.

2.2 The "Billing Iceberg": Operational Realities

To the uninitiated observer, subscription billing appears to be a simple recurring transaction: "Charge Customer X $50 on the 1st of the month." In reality, this is merely the visible tip of the iceberg. The submerged complexity—the operational reality that consumes engineering cycles and frustrates finance teams—is vast and treacherous.

2.2.1 The Mathematics of Proration

Proration is the practice of calculating the proportional cost when a subscription plan is changed mid-cycle. While the concept is simple, the execution in a B2B context is fraught with edge cases. Consider a customer on a $30/month "Gold" plan who upgrades to a $60/month "Platinum" plan on the 14th day of a 30-day month.

- The Logic: They used 13 days of Gold. They will use 17 days of Platinum.

- The Calculation: The system must credit back the unused portion of the Gold plan and charge the pro-rated portion of the Platinum plan.

- The Complexity: Now, introduce variables common in global B2B:

- Timezones: The upgrade happened at 4:00 PM EST. Is that "Day 14" or "Day 15" for a customer in Tokyo?

- Leap Years: Does "monthly" mean 30 days, or the actual days in the calendar month?

- Volume Discounts: If the Platinum plan has a volume discount that kicks in at 10 users, and they added the 11th user mid-cycle, does the discount apply retroactively to the prorated amount?

Handling this manually is impossible at scale. Handling it with a rigid legacy system leads to billing errors, which trigger customer disputes and churn.

2.2.2 Grandfathering and Price Book Versioning

Successful B2B companies evolve their pricing constantly. However, you rarely force a price increase on your entire loyal customer base overnight. Instead, you "grandfather" existing customers on their legacy rates while signing new customers at the current rates. From a database perspective, this means the billing system cannot simply look up "Product Price." It must look up "Product Price associated with Contract Version X." Over five years, a company may have 50 different active price points for the exact same SKU. The entitlement engine must accurately map each customer to their specific, protected price tier without error.

2.2.3 Complex Hierarchies: The Parent-Child Problem

In B2B, the "customer" is rarely a single entity. It is often a complex corporate hierarchy. A software vendor might sell to a global conglomerate (The Parent) which has five regional divisions (The Children).

- Scenario: The Parent negotiates a corporate-wide volume discount.

- Usage: The Usage is generated by the employees in the regional divisions.

- Billing: The invoices must be sent to the regional divisions, but the price on those invoices must be calculated based on the aggregate volume of the Parent.

- Payment: Perhaps the Parent pays for the base license, but the Regions pay for their own overage usage.

This "Split Billing" and "Hierarchical Rating" capability is a common breaking point for lightweight billing platforms like Stripe Billing, which—while excellent for simpler models—often struggle with deep multi-level account modeling.

2.2.4 Dunning: The Collections Strategy

When a payment fails, the "Dunning" process begins. In B2C, this is a volume game: retry the credit card on Friday, send an email, and if it fails three times, cancel the account. In B2B, a failed payment of $50,000 is rarely a sign of insolvency; it is usually a process error, an expired card, or a champion leaving the company. B2B dunning requires a High-Touch strategy.

- Logic: If the invoice is >$10,000, do not send an automated "Account Suspended" email. Instead, create a high-priority task in Salesforce for the Account Manager to call the client.

- Net Terms: B2B often involves Net 30 or Net 60 terms. The dunning clock doesn't start when the invoice is generated; it starts when the Net term expires. Managing these "Aging Buckets" requires sophisticated logic that integrates with the ERP.

3. Anatomy of the Modern Subscription Stack

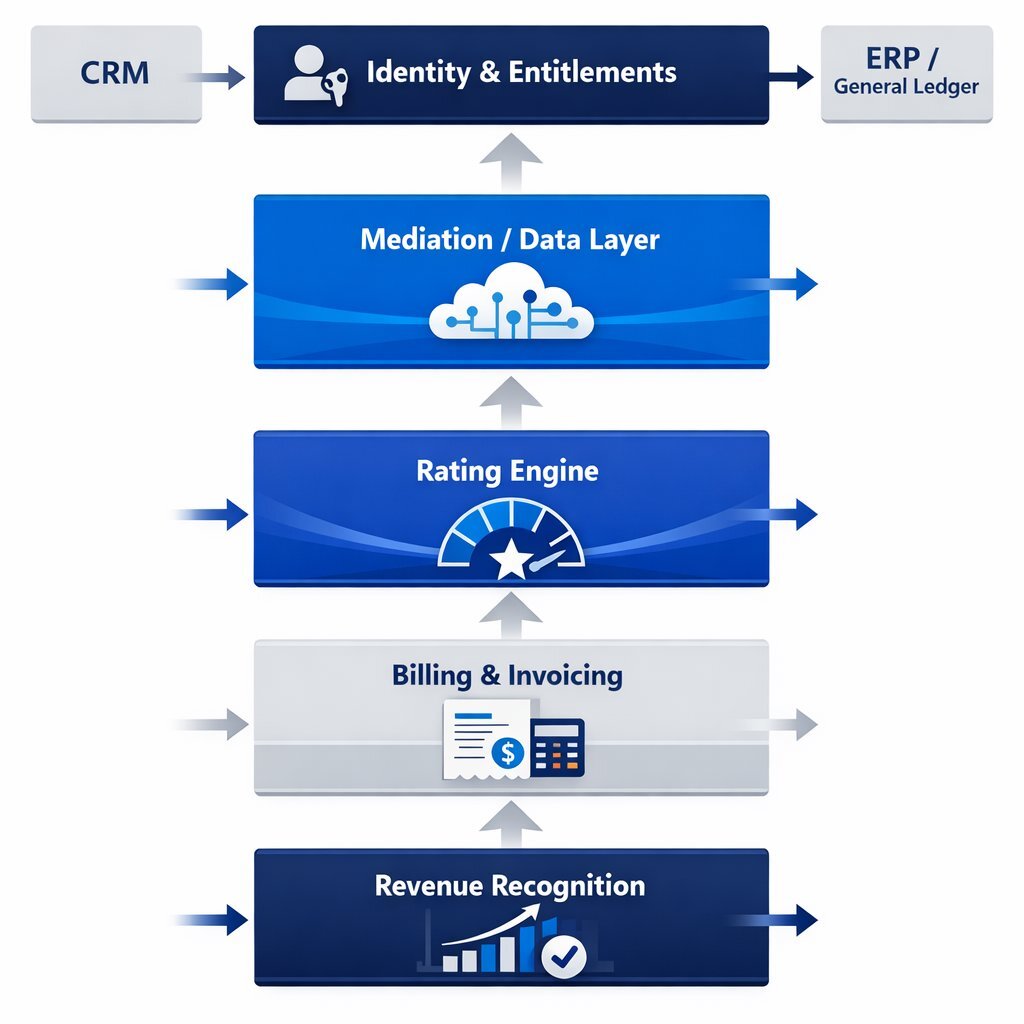

To support this multifaceted complexity, the enterprise technology stack has evolved. It is no longer sufficient to have a Customer Relationship Management (CRM) system and an Enterprise Resource Planning (ERP) system. A specialized, intermediate layer has emerged to bridge the gap between the customer (CRM) and the ledger (ERP).

The modern subscription stack consists of five distinct but integrated layers:

- Identity & Entitlements: The source of truth for who the customer is and what they are allowed to access.

- Mediation (The Data Layer): The engine for ingesting, cleaning, and aggregating raw usage data.

- The Rating Engine: The calculator that applies price logic to the aggregated data.

- Billing & Invoicing: The system that generates the legal document of debt and manages the accounts receivable.

- Revenue Recognition: The compliance engine that recognizes revenue according to accounting standards (ASC 606).

3.1 The Mediation Layer: The Unsung Hero of Usage-Based Pricing

In a simple subscription model, the billing system is the source of truth. In a usage-based model, the product is the source of truth, and the billing system is merely a consumer of that data. The gap between the two is bridged by the Mediation Layer.

Raw usage data—API calls, gigabytes stored, active user logins—is messy. It is often duplicated, out of order, or granular to the millisecond. If a company feeds 50 million raw API log lines directly into a billing system like NetSuite or Salesforce Billing, the system will almost certainly crash or become prohibitively expensive due to storage costs.

Mediation performs three critical functions:

- Ingestion: Accepting high-velocity data streams (often via Azure Event Hubs, Kafka, or AWS Kinesis). For a deep-dive on how real-time data is driving new architectures, see our Kafka real-time data processing guide.

- Normalization: Cleaning the data. For example, converting diverse timestamp formats into a standard UTC format, or calculating "duration" by subtracting a "start_time" event from an "end_time" event.

- Aggregation: Summing up the usage for the billing period. Instead of sending 1,000 separate records of "1 minute usage," the mediation layer sends one record of "1,000 minutes" to the billing engine.

For B2B enterprises, the lack of a robust mediation layer is often the primary cause of revenue leakage. An EY report estimates that companies lose up to 5% of revenue due to leakage, often stemming from the inability to accurately capture and rate usage data. The mediation layer acts as the audit trail, ensuring every deliverable unit of value is accounted for before it ever reaches the invoice.

3.2 The Rating Engine: Where Strategy Meets Execution

Once data is mediated (cleaned and counted), it must be rated (priced). The rating engine applies the complex business logic defined in the customer's contract.

- Tiered Pricing: "The first 100 units are free; the next 900 are 1.00 each; any units above 1,000 are 0.80 each."

- Time-of-Day Pricing: Peak vs. off-peak rates, which are critical in telecom and IoT energy management.

- Multi-Attribute Pricing: Pricing based on a dynamic combination of variables. For example, a logistics company might charge based on "Distance" AND "Weight" AND "Urgency."

This engine must be tightly coupled with the CPQ (Configure, Price, Quote) system used by sales. A disconnect here leads to the classic B2B disaster: Sales negotiates a custom deal (e.g., "special pricing for the Northeast region") that the billing engine effectively cannot calculate because it lacks the "Region" attribute in its rating logic. This forces Finance to calculate invoices manually in Excel every month, destroying efficiency and increasing audit risk.

3.3 Subscription Management: The System of Record

The Subscription Management platform (e.g., Zuora, Chargebee, Maxio) sits at the center. It holds the "State" of the customer relationship.

- Plan Management: It stores the product catalog and the rules for plan transitions (upgrades/downgrades).

- Lifecycle Events: It handles renewals, pauses, and cancellations.

- Billing Triggers: It tells the rating engine when to rate (e.g., "Bill this customer on the 1st," "Bill that customer on the 15th").

Crucially, in 2025, the trend is for this layer to become more "headless" or API-driven, allowing product teams to build custom customer portals where users can self-serve upgrades without needing to call a sales rep. For more on custom solutions, our breakdown of software product development services offers actionable next steps.

4. The "Build vs. Buy" Decision Framework

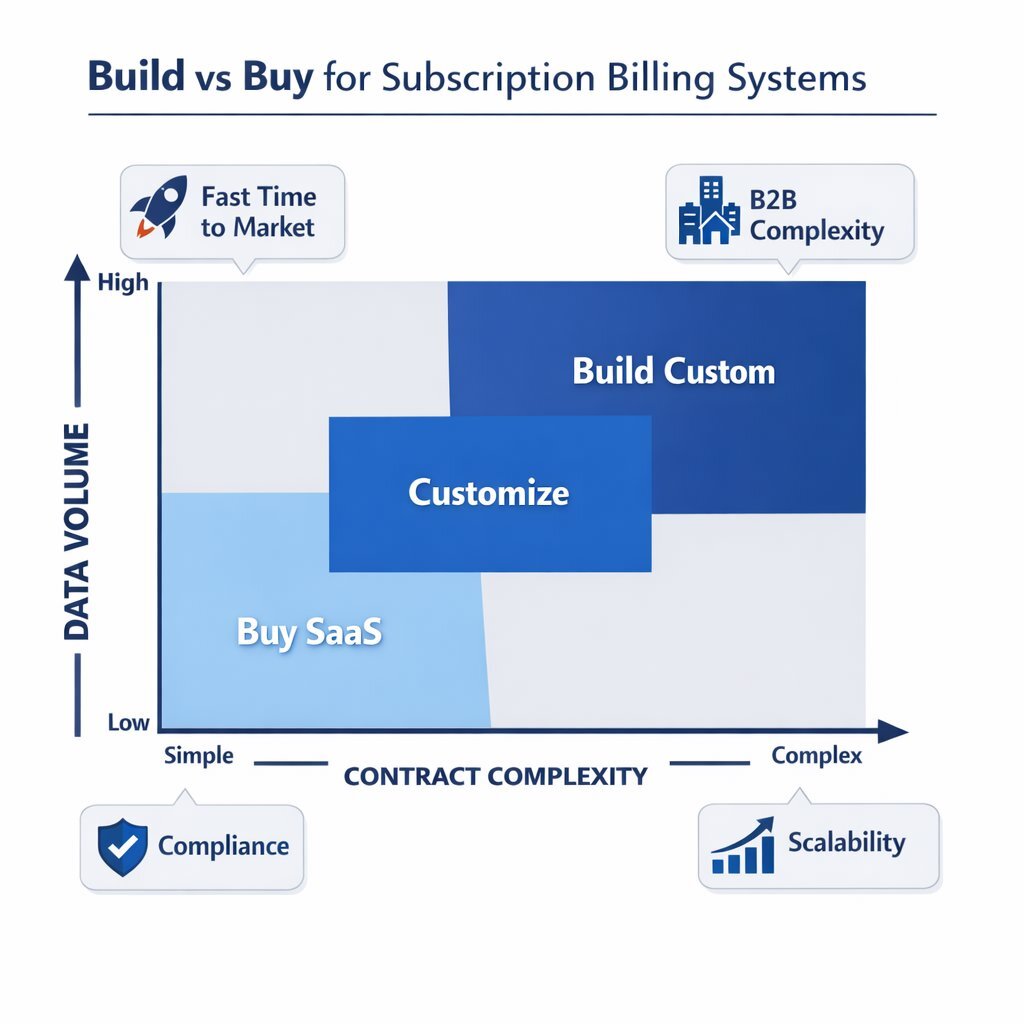

For the CTO and Head of Product, the most contentious decision in the subscription stack is: Do we buy a commercial platform like Zuora, Stripe Billing, or Chargebee? Or do we build our own billing engine?

This is not a binary choice, but a spectrum. However, a clear decision framework has emerged for 2025, influenced heavily by the scale of usage data and the complexity of B2B contracts.

4.1 The Case for "Buy" (Commoditized Complexity)

For 90% of businesses, building a billing system from scratch is a strategic error. The maintenance burden of tax compliance (global VAT/GST), PCI security, and gateway integrations is immense and offers zero competitive advantage.

- Time to Market: Platforms like Stripe or Chargebee allow companies to launch in days, not months.

- Compliance: Vendors handle the nightmare of changing tax regulations and data privacy (GDPR/CCPA).

- Standard Features: If your pricing model is "Standard Gold/Silver/Bronze" or simple "Per-Seat," commercial platforms are vastly superior to custom builds.

4.2 The Case for "Build" (Strategic Differentiation)

However, for a specific subset of B2B enterprises, commercial platforms can become a constraint. You should consider building (or heavily customizing) if:

- High-Volume Metering: You process millions of usage events per day. Commercial platforms often have API rate limits or costs that scale punitively with volume. For instance, Stripe Billing limits invoices to 250 line items, which can be a showstopper for granular enterprise billing where a customer might have thousands of active resources. Zuora also imposes strict API rate limits that can bottleneck high-frequency trading or ad-tech use cases.

- Complex Hierarchies: Your customer structure involves multi-level parent-child relationships where usage is aggregated at the child level, discounted at the parent level, and paid by a third-party partner. Most SaaS billing tools struggle with this "B2B2X" complexity.

- Unique Business Logic: If your pricing depends on real-time external variables (e.g., the current price of spot electricity or a dynamic risk score), a rigid SaaS data schema may not support it.

Companies like Baytech Consulting often step in here. By leveraging a "Tailored Tech Advantage," they help firms build the specific components that need to be custom (like the mediation engine) while integrating them with standard tools for the commodity parts (like the payment gateway). This hybrid approach avoids the "all or nothing" trap.

4.3 Architectural Pattern: The "Sidecar" Approach

A distinct trend in 2025 is the Hybrid or Sidecar architecture. In this model, the company uses a commercial platform (like Salesforce Billing or Zuora) for the "General Ledger" and invoicing functions, but builds a custom Mediation and Rating Microservice on cloud infrastructure.

This is where specialized engineering expertise becomes vital. A company might use Azure Event Hubs to ingest millions of IoT signals, Azure Stream Analytics to aggregate them in real-time, and Azure SQL to store the rated usage. Only the final, calculated "Billable Line Item" is pushed to the commercial billing platform via API. This bypasses the volume limits of the SaaS tool while retaining its invoicing and tax compliance benefits.

5. Deep Dive: Building the Custom Mediation Layer (The "Build" Option)

For the technical leadership (CTO/VP Engineering), this section details the specific architectural patterns required for high-volume usage metering, a common differentiator for enterprise B2B SaaS.

When a business surpasses the capabilities of out-of-the-box SaaS metering, the "Build" route often leads to a cloud-native architecture. The goal is to ingest millions of events without latency while ensuring 100% accuracy—because dropping a usage event is literally dropping revenue. Learn why DevOps efficiency is a must as teams shoulder this growing technical challenge.

5.1 The Azure-Based Reference Architecture

A proven reference architecture for B2B billing mediation utilizes Microsoft Azure's PaaS offerings to create a scalable pipeline. This aligns with the tech stack often deployed by high-performance engineering teams, such as those at Baytech Consulting.

- Ingestion (Event Hubs): The entry point is Azure Event Hubs, which acts as the high-throughput buffer. It functions similarly to Apache Kafka but as a fully managed service. Applications, IoT devices, or API gateways push raw JSON usage payloads (e.g.,

{tenant_id: 123, bytes_transferred: 500, timestamp: 167888...}) into the hub.- Why: It decouples the production systems from the billing systems. If the billing database goes down for maintenance, the Event Hub simply buffers the incoming data, preventing data loss. It is designed to handle millions of events per second with low latency.

- Processing & Aggregation (Stream Analytics): Azure Stream Analytics (ASA) reads from the Event Hub. This is where the business logic lives. ASA can run SQL-like queries on the stream in real-time.

- The Logic:

SELECT TenantID, SUM(Bytes) as TotalBytes, System.Timestamp AS WindowEnd FROM Input TIMESTAMP BY EntryTime GROUP BY TenantID, TumblingWindow(hour, 1) - The Result: Instead of storing every single 5KB transfer event, the system aggregates usage into hourly buckets. This reduces the data volume by orders of magnitude before it reaches the database.

- The Logic:

- Storage & Rating (Azure SQL / Cosmos DB): The aggregated data is output to Azure SQL Database or Cosmos DB. Here, a "Rating Stored Procedure" runs periodically (e.g., nightly). It joins the aggregated usage table with the "Pricing Plan" table (which holds the customer's specific contract rates) to calculate the daily cost.

- Why: Storing checkpoints in SQL allows for transactional integrity. If a rating job fails, it can be rolled back to the last checkpoint, ensuring no customer is double-billed.

- Sync to Ledger (The "Swivel"): Finally, the calculated line items are pushed via API to the General Ledger or Invoicing Platform (like Zuora or NetSuite) for final bill presentation. This "Sidecar" pattern keeps the heavy compute off the expensive SaaS platform.

5.2 Handling B2B Edge Cases in Code

Custom builds allow for handling specific B2B edge cases that often defeat SaaS tools:

- The "High Water Mark" Problem: Some contracts charge based on the maximum number of concurrent users in a month, not the total or average. Calculating this requires scanning the entire month's timeline to find the peak—a computationally expensive operation that is trivial in custom SQL but impossible in many SaaS billing configurators.

- Pre-Paid Drawdowns: A customer pre-pays $50,000. As usage flows in, the system must decrement this balance in real-time and trigger a "Top-Up" alert when the balance hits 10%. This requires low-latency coupling between the Mediation Layer and the Notification Service, often achieved using Azure Functions triggered by Stream Analytics outputs.

By controlling the Mediation Layer, the business owns its data destiny, free from the API rate limits and "black box" calculations of third-party vendors. For the enterprise scaling toward $100M+ ARR, this control is often worth the engineering investment.

6. Revenue Recognition: The CFO's Nightmare (ASC 606)

For the CFO, the shift to subscription and usage-based models triggers a significant compliance burden under ASC 606 (IFRS 15). This standard transformed revenue accounting from a rules-based system to a principles-based framework, focusing on the transfer of control. To fully grasp the stakes here, explore our article on operationalizing QA for profit, which examines the roles of automation and compliance alongside technical quality.

In a traditional sale, you ship the widget and book the revenue. In a subscription, revenue recognition is decoupled from billing. You might bill a customer $120,000 upfront for an annual contract, but you can only recognize $10,000 per month as the service is delivered. This creates a "Deferred Revenue" liability on the balance sheet that must be carefully managed.

6.1 The Usage-Based Trap: Variable Consideration

Usage-based pricing complicates this further. Under ASC 606, usage fees represent "variable consideration." The CFO must estimate the expected usage to allocate the transaction price, but must also apply a constraint : revenue can only be recognized to the extent that it is "probable" that a significant reversal will not occur when the uncertainty is resolved.

Practical Example: A cloud storage company sells a contract with a $10,000 monthly minimum commit (which includes 10TB of data) and an overage fee of $0.05 per GB.

- The Minimum: Recognized ratably (or as the 10TB is consumed, depending on the specific "Performance Obligation" definition).

- The Overage: Recognized only when the usage actually occurs.

If the billing system cannot distinguish between the "committed usage" and the "overage usage" in real-time, the finance team cannot close the books accurately. This is why Revenue Recognition Software (like Zuora Revenue, Netsuite Advanced Revenue Management, or specialized modules) is not optional for scale—it is a compliance necessity to avoid restatements.

6.2 The Audit Trail Requirement

Under ASC 606, you must be able to re-create the history of a contract. If a customer modified their contract in Month 3, changing the price and the usage tiers, the system must preserve the "Performance Obligations" as they existed in Month 1 and Month 2 for historical reporting, while applying the new logic forward. Spreadsheets cannot handle this "time travel" requirement. A database-driven revenue engine is required to maintain the "Contract Object" state over time, linking every dollar of recognized revenue back to a specific delivery event (e.g., a specific day of service or a specific batch of usage).

7. Dunning: The Art of Collections in B2B

Finally, the technology stack must address the end of the cycle: getting paid. Dunning (the process of communicating with customers about overdue bills) is often treated as a purely financial function, but in the subscription economy, it is a Customer Success function.

There is a stark difference between B2B and B2C dunning, and applying B2C logic to B2B clients can be disastrous.

7.1 B2C vs. B2B Collections Strategies

- B2C: High volume, low value. The primary mechanism is the Smart Retry . Payment gateways like Stripe use machine learning to determine the optimal time to retry a failed card (e.g., "This card issuer accepts more transactions on Friday afternoons"). The communication is automated: a generic email blast ("Update your card") followed by cancellation.

- B2B: Low volume, high value. A failed $50,000 payment is rarely due to a lack of funds; it is due to a process error (e.g., the PO number was missing from the invoice), an expired card, or a champion leaving the company.

7.2 The High-Touch Dunning Workflow

For B2B, the dunning logic must be high-touch and integrated with the CRM.

- Pre-Dunning: Send a reminder before the credit card expires or the Net terms are up.

- The "Soft" Touch: If a payment fails, the system waits 2 days (to allow for banking glitches) before sending a polite, personalized email from the "Finance Team" (not a noreply address).

- The "Hard" Touch: If the invoice is still unpaid after 15 days, the billing system should trigger a task in Salesforce for the Account Manager. The AM calls the client to resolve the friction.

- Suspension: Only after manual intervention fails should the entitlement system be triggered to suspend service.

Net Terms Complexity: B2B often involves Net 30 or Net 60 terms. The dunning clock doesn't start when the invoice is generated; it starts when the Net term expires. Managing these "Aging Buckets" requires sophisticated logic that integrates with the ERP to ensure that if a check arrives in the mail today, the "overdue" email doesn't go out tomorrow.

8. Conclusion: Engineering the Future of Revenue

The transition to the Subscription Economy is not merely a change in how you charge; it is a transformation of how you value, measure, and deliver your product. The technology stack required to support this—spanning Identity, Mediation, Rating, Billing, and Revenue Recognition—is complex, but it is the spine of the modern enterprise.

For the CEO, the mandate is alignment. Do not let Sales buy a CPQ system that cannot talk to Finance's ERP. Silos are the enemy of recurring revenue. For the CFO, the lesson is investment. Invest in Revenue Recognition automation before you think you need it. The cost of unwinding a year of spreadsheet-based revenue recognition is 10x the cost of the software. For the Head of Product, the opportunity is data. Embrace the Mediation Layer. If you are moving to usage-based pricing, do not pollute your billing system with raw logs. Build a robust infrastructure to clean and aggregate usage data before it ever touches an invoice.

Whether you choose to buy a suite of platforms or build a custom high-performance engine with partners like Baytech Consulting, the imperative is the same: agility. In 2025, flexibility is the ultimate competitive advantage. The ability to launch a new pricing model tomorrow, to bundle a new service next week, or to enter a new market next month depends entirely on the agility of your billing stack. Build it wisely.

About Baytech

At Baytech Consulting, we specialize in guiding businesses through this process, helping you build scalable, efficient, and high-performing software that evolves with your needs. Our MVP first approach helps our clients minimize upfront costs and maximize ROI. Ready to take the next step in your software development journey? Contact us today to learn how we can help you achieve your goals with a phased development approach.

About the Author

Bryan Reynolds is an accomplished technology executive with more than 25 years of experience leading innovation in the software industry. As the CEO and founder of Baytech Consulting, he has built a reputation for delivering custom software solutions that help businesses streamline operations, enhance customer experiences, and drive growth.

Bryan’s expertise spans custom software development, cloud infrastructure, artificial intelligence, and strategic business consulting, making him a trusted advisor and thought leader across a wide range of industries.