AI Revolution 2025: Building the Future Workforce Today

December 21, 2025 / Bryan ReynoldsThe AI Renaissance: How the 2025 Investment Boom is Rewiring the American Workforce, Constructing a New Economy, and Redefining Value

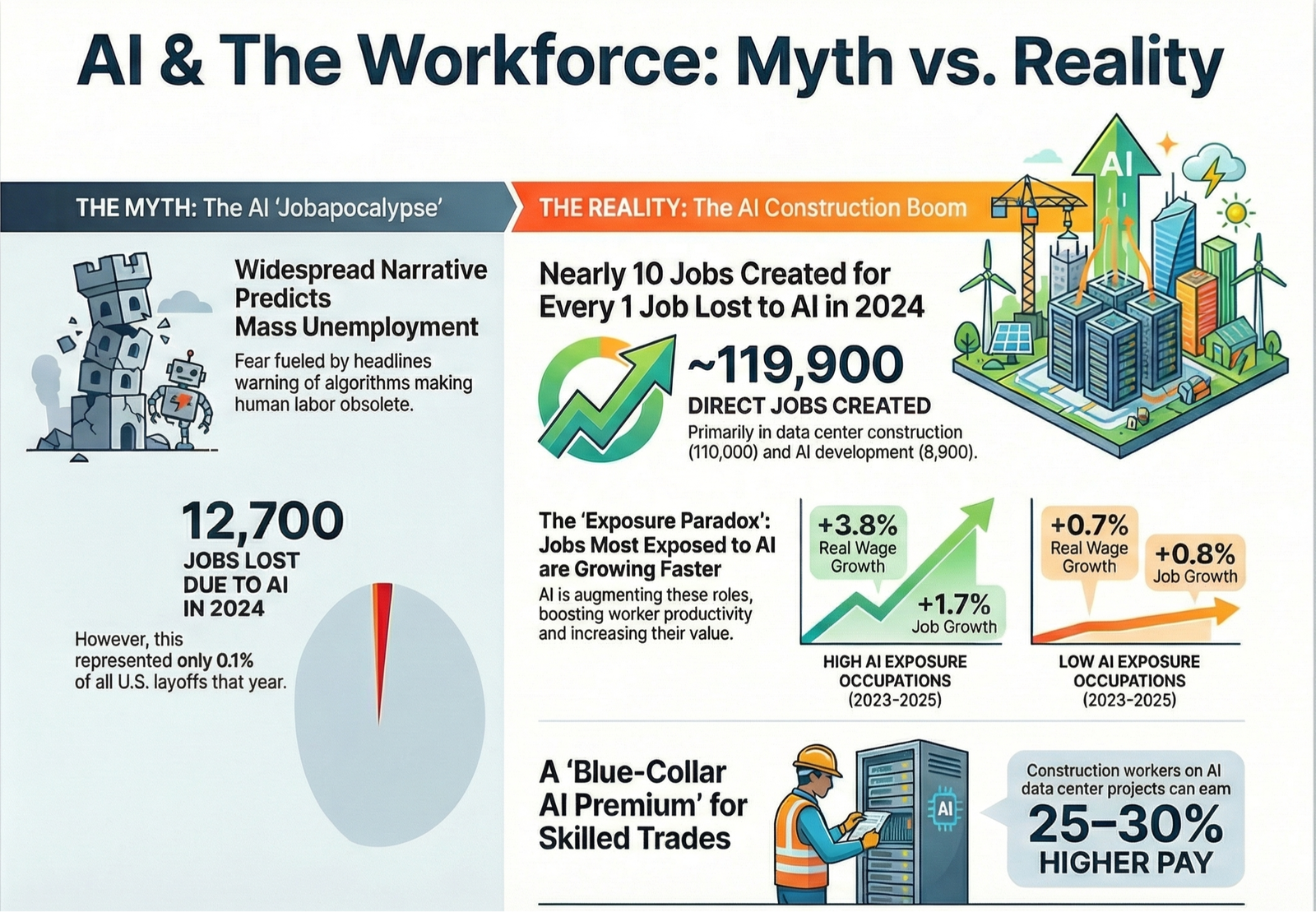

For the better part of a decade, the cultural and economic conversation surrounding Artificial Intelligence (AI) has been dominated by a singular, persistent specter: the "Jobapocalypse." It is a narrative deeply embedded in the collective psyche, fueled by dystopian science fiction and sensationalist headlines warning of a near-future where algorithms render human labor obsolete. The prevailing fear has been that generative AI, with its uncanny ability to write, code, analyze, and create, would trigger a mass extinction event for employment, starting with the truck driver and ending with the software engineer.

However, as we stand firmly in the midst of the 2024–2025 AI investment cycle, the data tells a radically different story. We are not witnessing the destruction of the workforce; we are witnessing its reconstruction. The "AI Revolution" is proving to be less of a demolition derby and more of a massive, capital-intensive construction project—one that is pouring concrete, wiring servers, and rewriting the fundamental code of American business productivity.

A comprehensive analysis of labor market data, investment flows, and sector-specific trends reveals that AI-related investment is creating substantially more jobs than it is eliminating. The ratio is staggering: for every job lost to AI displacement in 2024, approximately ten new jobs were created in the sprawling ecosystem required to build, maintain, and integrate these technologies. 1 Far from a collapse, we are seeing a "construction boom" of historic proportions, a counter-intuitive rise in wages for the very white-collar roles predicted to vanish, and a strategic pivot in the enterprise toward custom integration that prioritizes human-centric engineering.

This report serves as a definitive guide for B2B executives—CTOs, CFOs, and strategic leaders—who must navigate this new terrain. We will dismantle the myths of displacement, explore the physics of the data center boom that is employing armies of skilled tradespeople, and dissect the "Exposure Paradox" where high-tech vulnerability translates into higher wages. Furthermore, we will examine the critical role of agile, custom software development—the kind championed by firms like Baytech Consulting—in bridging the gap between raw AI potential and real-world business value.

The verdict is clear: The robots aren't coming for our jobs; they are creating a massive waiting list for new ones.

1. The Macro Labor Market: A Reality Check on Displacement

To understand the true impact of AI on the workforce, we must first look at the aggregate numbers. The gap between the perception of AI-driven layoffs and the reality of AI-driven hiring is the defining economic divergence of our time.

1.1 The 10:1 Creation Ratio

The headline statistic for 2024–2025 is unequivocal: AI activity created an estimated 119,900 direct U.S. jobs in 2024 alone. 1 These are not speculative projections for a distant future; these are payroll-generating positions filled by real people today. They span a diverse spectrum of the economy, from the highly visible machine learning engineers developing the next iteration of Large Language Models (LLMs) to the often-overlooked electrical foremen managing the power grids of hyperscale data centers.

In stark contrast, the number of jobs eliminated by AI—where a human role was directly substituted by an algorithmic process—was estimated at roughly 12,700 for the same period. This yields a creation-to-destruction ratio of nearly 10:1 .

Table 1: The AI Employment Balance Sheet (2024 Estimates)

| Category | Estimated Jobs Impacted | Description | Ratio |

|---|---|---|---|

| Jobs Created | 119,900 | Direct roles in AI development, data center construction, and systems integration. | 10 |

| Jobs Eliminated | 12,700 | Roles directly displaced by automation or AI efficiency gains. | 1 |

| Net Gain | +107,200 | The positive delta added to the U.S. labor force. | N/A |

Source Data: Information Technology and Innovation Foundation (ITIF) 1

This ratio challenges the fundamental premise of "technological unemployment." While it is true that specific tasks are being automated, the net result of the technology's deployment is a significant demand for labor to build the infrastructure and software layers required to make AI useful.

1.2 Putting Layoffs in Context

The fear of AI layoffs is often amplified by high-profile announcements from tech giants. However, when viewed against the backdrop of the total U.S. labor market, AI-driven displacement is statistically negligible.

The 12,700 jobs lost to AI in 2024 represented approximately 0.1% of all U.S. layoffs that year. 1 To put this in perspective, the vast majority of job losses were driven by traditional macroeconomic factors: interest rate sensitivity, post-pandemic rightsizing, corporate restructuring, and standard business churn.

Data from Challenger, Gray & Christmas supports this view. Through November 2025, employers announced 54,694 layoffs explicitly attributed to AI. 2 While this number is rising—and reflects a real and painful transition for those affected—it remains a small fraction of the more than 1.1 million total job cuts announced over that period. 2

Insight: The narrative that AI is the primary driver of unemployment is a distortion. Executives who base their workforce planning on the assumption of inevitable mass redundancy are misreading the market. The real challenge for 2025 is not managing a surplus of labor, but competing for talent in a market where AI skills —and the "blue-collar" skills needed to power AI—are in critically short supply.

1.3 The Historical Echo

This pattern—fear of displacement followed by explosive job creation—is not unprecedented. It echoes the introduction of the ATM in the banking sector. When Automated Teller Machines were introduced, the prediction was that bank tellers would disappear. Instead, the cost of operating a branch fell, banks opened more branches, and the number of tellers actually increased, though their jobs shifted from counting cash to customer relationship management.

We are seeing a similar "ATM Effect" in the AI economy. The cost of generating intelligence (content, code, analysis) is falling, which is increasing the demand for the applications of that intelligence. This demand is driving the need for custom software developers, data architects, and systems integrators who can tailor these cheap cognitive resources into valuable business products.

2. The Physical Reality: The Data Center Construction Boom

While the digital impact of AI is debated in boardrooms and on social media, its physical impact is undeniable in the mud and steel of construction sites across North America. The training and operation of massive AI models require unprecedented amounts of compute power, triggering a capital expenditure (CapEx) boom that rivals the great infrastructure projects of the 20th century.

2.1 The Scale of the Build-Out

The "cloud" is not an abstract concept; it is a physical network of massive industrial facilities filled with servers, cooling systems, and power distribution units. The shift to AI has supercharged the demand for these facilities.

The ITIF analysis attributes over 110,000 U.S. construction jobs in 2024 directly to data center build-outs. 1 These are not short-term gigs; a single large-scale hyperscale data center (like those built by Microsoft, Google, or Amazon) requires a workforce of roughly 1,500 on-site workers and can take up to three years to complete. 1

Key Drivers of Construction Intensity:

- Power Density: AI server racks consume significantly more power than traditional web hosting servers. This requires complex, heavy-duty electrical infrastructure.

- Cooling Requirements: The heat generated by GPU clusters (like NVIDIA's H100s) often necessitates liquid cooling systems, requiring specialized plumbing and HVAC expertise. 4

- Redundancy: These facilities are "mission-critical," meaning they require redundant power supplies, backup generators, and fortified physical security, all of which increase the labor intensity of construction.

2.2 The "Blue-Collar" AI Salary Premium

The most immediate beneficiaries of the AI boom are not just Silicon Valley software engineers, but the skilled tradespeople building the physical backbone of the internet. The scarcity of labor in the construction sector, combined with the urgent deadlines of tech giants racing for AI supremacy, has led to a significant wage spike.

Construction workers moving onto AI data center projects can earn 25–30% higher pay compared to standard commercial construction. 1 In dollar terms, this can translate to a premium of nearly $10 more per hour . 1

Table 2: The Data Center Wage Premium

| Role | Standard Commercial Pay (Est.) | Data Center Project Pay (Est.) | Premium |

|---|---|---|---|

| General Construction | ~$29.80/hr | ~$39.33/hr | +32% |

| Electrician (Specialized) | 70,000 - 90,000/yr | 100,000 - 140,000/yr | +40-50% |

| Project Manager | 90,000 - 110,000/yr | 120,000 - 180,000/yr | +30-60% |

Source Data: Skillit, The Wall Street Journal, ITIF 5

This wage inflation is creating a new class of "blue-collar tech workers." In regions like Northern Virginia (Data Center Alley) and Oregon, electricians and foremen are earning annual compensations exceeding $200,000 when overtime and bonuses are factored in. 6 To attract talent, construction firms are offering perks previously associated with the tech sector, such as signing bonuses, daily incentive pay, and high-quality on-site amenities. 6

2.3 Regional Shifts: The "Traveler" Workforce

The boom is reshaping the economic geography of the United States. While Northern Virginia remains the global capital, the demand for power and land is pushing development into the Midwest and the South.

- Louisiana: The state saw a record $61 billion in capital investment in 2025, largely driven by energy and digital infrastructure projects, including a massive $10 billion AI data center by Hut 8. 9

- The Midwest: States like Ohio, Michigan, and Wisconsin are seeing a surge in proposals, though this is often met with local resistance regarding water usage and grid strain. 11

- The "Traveler" Phenomenon: The localized intensity of these projects often outstrips the local labor supply. This has revived the "traveler" workforce—skilled tradespeople who migrate from project to project, living in temporary housing or RVs, chasing the high wages and overtime offered by the AI rush. 6

This physical build-out is the foundation of the AI economy. Before a single line of AI code can generate revenue, a welder must fuse a pipe and an electrician must wire a server rack.

3. The "Exposure Paradox": Why Vulnerable Jobs Are Growing

Moving from the physical to the digital workforce, we encounter the most counter-intuitive finding of the 2024–2025 period. Economic theory and sci-fi predictions suggested that jobs with high exposure to AI—such as data analysis, copywriting, and administrative support—would be the first to collapse.

The data reveals the exact opposite. This phenomenon, which we term the "Exposure Paradox," suggests that high exposure to AI currently correlates with higher job growth and higher wage growth.

3.1 Growth Where Decline Was Predicted

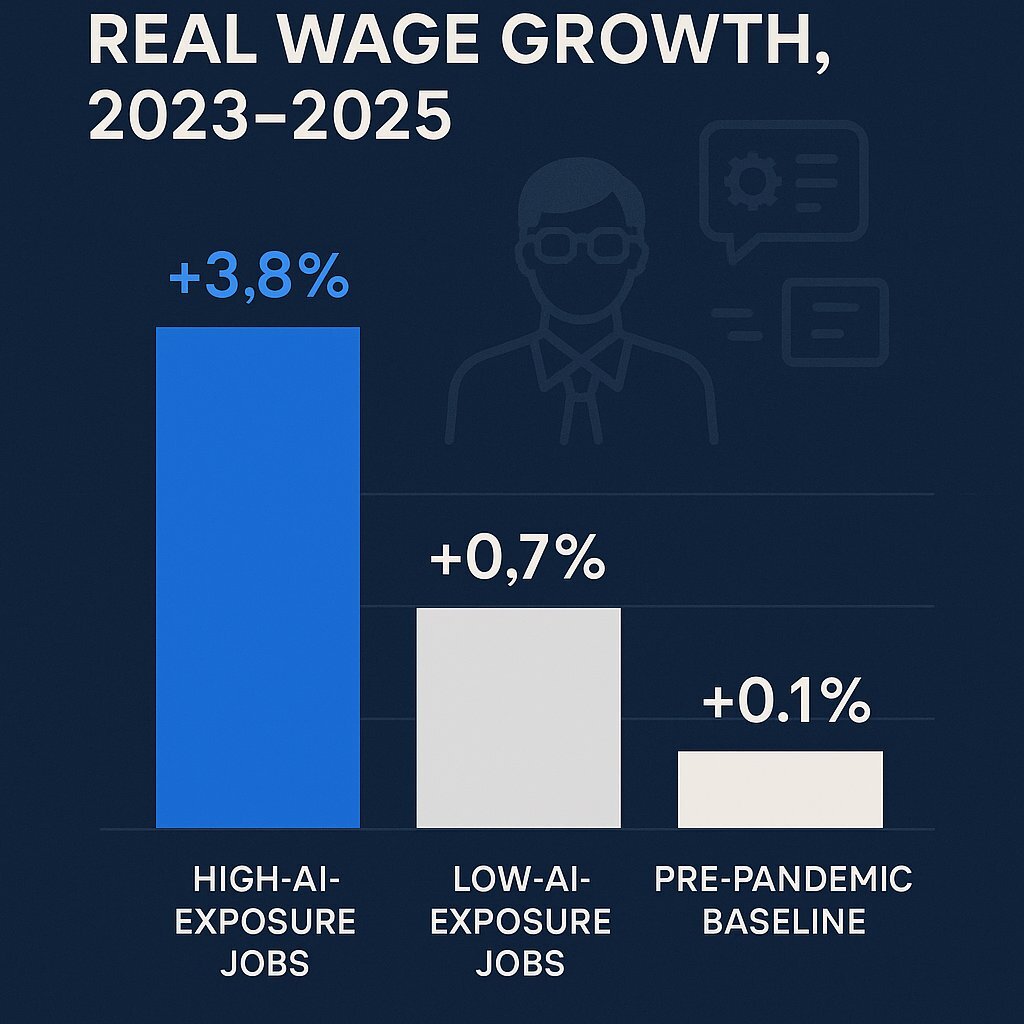

Research from Vanguard, analyzing labor market trends from mid-2023 to mid-2025, turns the conventional wisdom on its head. Employment in occupations with high AI exposure grew by 1.7% , significantly outpacing the 0.8% to 1% growth seen in less-exposed occupations. 12

Instead of shrinking, roles like office clerks, HR assistants, and junior data analysts are expanding. Why?

- Induced Demand: As AI lowers the cost of performing a task (e.g., analyzing a dataset), the demand for that task increases. Companies are doing more analysis, more content creation, and more customer outreach because it is cheaper to do so, requiring more humans to manage the process.

- The "Augmentation" Effect: AI is removing the drudgery of these roles—data entry, basic summarization, syntax correction—allowing professionals to focus on higher-value problem solving. This makes these workers more productive and, consequently, more valuable to their employers.

3.2 The Wage Premium for "AI-Exposed" Talent

The most striking metric is wage growth. Real wages in AI-exposed fields have accelerated to 3.8% in the post-pandemic era (2023–2025). Compare this to the meager 0.1% growth rate these same roles saw prior to the pandemic, and the 0.7% growth in less-exposed occupations today. 13

Table 3: Wage Growth by AI Exposure Level

| Metric | High AI Exposure Occupations | Low AI Exposure Occupations |

|---|---|---|

| Real Wage Growth (2023–2025) | +3.8% | +0.7% |

| Employment Growth (2023–2025) | +1.7% | +0.8% |

| Pre-Pandemic Wage Growth | +0.1% | (Historical Baseline) |

Source Data: Vanguard Research 13

Insight for Executives: This data suggests a "skill-biased" shift. The market is paying a premium for workers who can leverage AI tools to amplify their output. The "augmented" worker—a developer using GitHub Copilot, a marketer using Jasper, a legal aide using Harvey—is generating more value per hour than their non-augmented peers. Executives should focus not on replacing workers with AI, but on equipping workers with AI to capture this productivity dividend.

4. The Iceberg Index: Quantifying the Hidden Potential

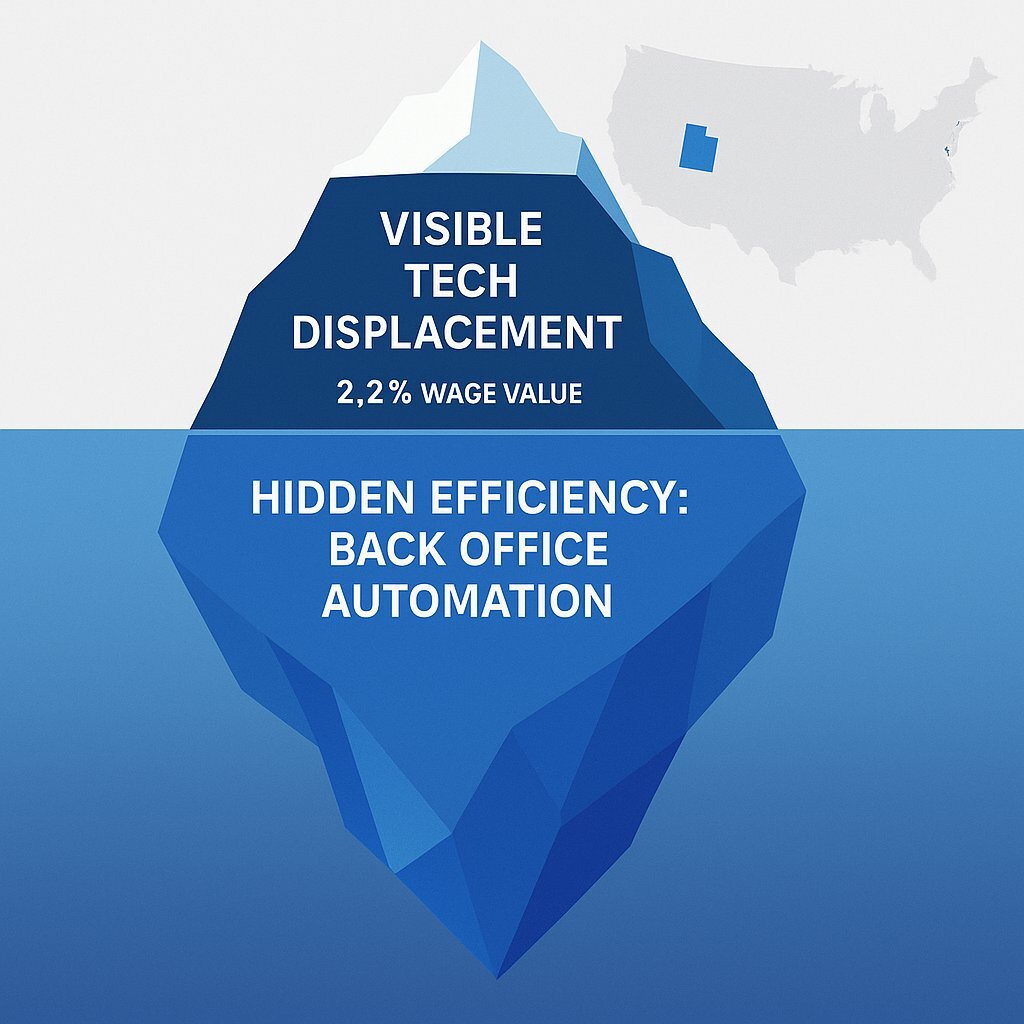

If the data center boom is the visible tip of the AI economy, the "Iceberg Index" developed by MIT researchers represents the massive, submerged potential for transformation that lies beneath the surface. Understanding this index is crucial for strategic planning, as it identifies where the next wave of efficiency gains will come from.

4.1 Capability vs. Displacement

The MIT study uses the "Iceberg Index" to measure the technical capability of AI to perform tasks currently done by humans. Their findings are sobering but nuanced:

- AI is technically capable of automating tasks performed by 11.7% of the U.S. workforce.

- This represents approximately $1.2 trillion in wages. 15

However, the report emphasizes a critical distinction: Technical capability is not economic inevitability. Just because a task can be automated does not mean it will be immediately.

- Economic Friction: It may still be cheaper to have a human do a task than to license, train, and maintain a complex AI agent.

- Integration Challenges: Connecting an AI model to legacy enterprise systems (often running on decades-old tech) is difficult and costly.

- Regulatory Barriers: In sectors like healthcare and finance, "human-in-the-loop" requirements slow down full automation. 19

4.2 The "Hidden" Geography of Tech

One of the most profound insights from the Iceberg Index is the geographic shift of tech exposure. Traditionally, "tech disruption" was viewed as a coastal phenomenon affecting Silicon Valley, Seattle, and New York.

The Iceberg Index reveals that white-collar exposure is nationwide. Administrative, financial, and logistical tasks—the "back office" of the American economy—are distributed across every state.

- Surprising Hotspots: States like Delaware (finance/corporate registration), South Dakota (banking operations), and Utah (admin/tech services) show higher Iceberg Index values than California. 19

- The "Surface" vs. "Submerged": MIT classifies visible tech disruption (layoffs in Big Tech, coding automation) as the "Surface Index," which accounts for only about 2.2% of total wage value ($211 billion). The "submerged" portion—administrative and professional services—is five times larger. 21

Strategic Implication: For B2B firms, the biggest ROI for AI adoption is likely not in your IT department, but in your operations, finance, and HR departments. Automating the "boring" back-office workflows in Sioux Falls or Wilmington offers a massive, untapped reservoir of efficiency.

5. Enterprise Strategy: The "Build vs. Buy" Pivot and the Role of Custom Software

For the C-suite, the question has moved from "Should we use AI?" to "How do we implement AI without failing?" The 2024–2025 period has been a crucible of hard lessons regarding enterprise AI adoption.

5.1 The Failure of the "Science Project"

Gartner and other analysts report high failure rates for initial GenAI projects. Estimates suggest that between 40% and 85% of AI projects fail to move from Proof of Concept (PoC) to production. 22 The "Science Project" era—where companies hired PhDs to build proprietary Large Language Models from scratch—is ending.

Primary Causes of Failure:

- Data Quality: 64% of organizations cite data quality as their top barrier. "Garbage in, hallucination out" has become the hard reality. 24

- Governance Gaps: The inability to secure data or explain model decisions halts deployment. 25

- Lack of Integration: A brilliant model that sits in a silo, unconnected to the ERP or CRM, provides zero business value.

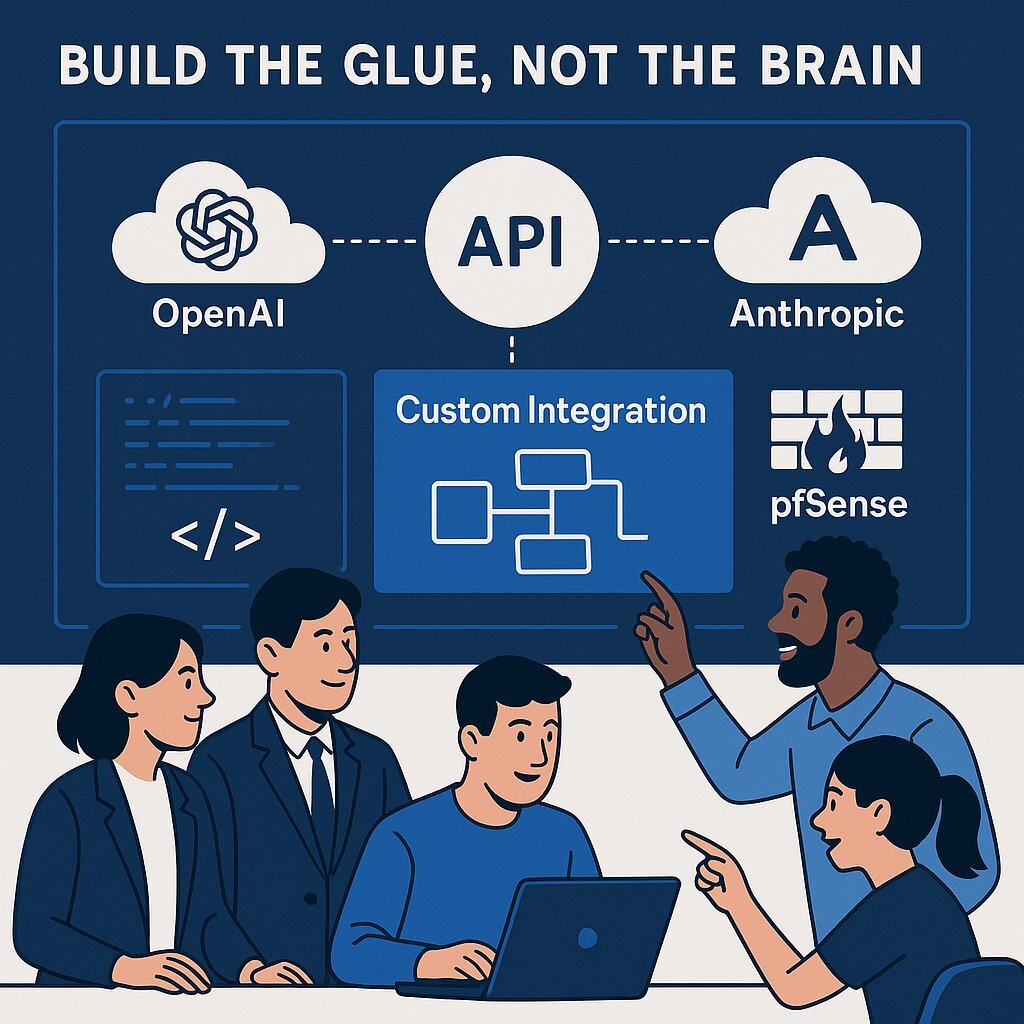

5.2 The Strategic Pivot: Buy Intelligence, Build Integration

In response to these failures, 2025 sees a massive strategic swing. Approximately 76% of enterprises are now opting to "buy" ready-made intelligence (via APIs from OpenAI, Anthropic, Microsoft, or Google) or "integrate" best-of-breed solutions rather than building models from the ground up. 26

However, "buying" doesn't mean just purchasing a SaaS subscription. It drives a massive demand for custom software development. The competitive advantage is no longer the model itself (which is becoming a commodity); it is the integration layer—the custom software that connects the AI brain to the company's proprietary data and workflows.

5.3 The Baytech Paradigm: Custom-Crafted Tech Advantage

This shift plays directly to the strengths of specialized firms like Baytech Consulting. In an era where off-the-shelf software rarely fits the nuanced needs of a complex enterprise, the "Tailored Tech Advantage" becomes a critical differentiator.

Why Custom Development is Essential for AI Success:

- Data Orchestration: To make an AI model useful, data must be pulled from SQL Servers, Postgres databases, and legacy systems, cleaned, and contextualized. This requires robust backend engineering using tools like Azure DevOps, Kubernetes, and Docker—core competencies of firms like Baytech.

- Security and Governance: Executives cannot simply paste sensitive customer data into a public chatbot. Custom solutions allow for the deployment of private instances (e.g., via OVHCloud or private Azure tenants) protected by enterprise-grade firewalls (like pfSense) and strict role-based access controls.

- Agile Adaptation: The AI field moves at breakneck speed. A monolithic 2-year software project will be obsolete before it launches. The Rapid Agile Deployment methodology ensures that software evolves alongside the AI models, delivering value in weeks, not years.

The Tech Stack of 2025:

Successful AI integration isn't just about Python scripts. It requires a robust enterprise stack:

- Containerization: Docker and Kubernetes (managed via Rancher) are standard for deploying AI microservices that can scale with demand.

- Data Integrity: SQL Server and Postgres (managed via pgAdmin) remain the bedrock of truth. AI is the engine, but structured data is the fuel.

- Development Environment: VS Code and Visual Studio 2022 have become the cockpits for AI-augmented development, allowing engineers to weave AI copilots directly into their workflow.

Actionable Advice: Do not try to be an AI research lab. Be an AI engineering shop. Buy the smartest model you can afford, and invest your budget in the custom software "glue" that makes that model work for your specific business case.

6. The Talent War 2.0: From Researchers to Builders

As the market matures, the profile of the "ideal hire" is changing. We are moving from the "Scientific Phase" (inventing the math) to the "Engineering Phase" (building the product).

6.1 The Rise of the "AI Architect"

In 2023, the war for talent was fought over PhDs in machine learning. In 2025, the battlefield has shifted to application and integration.

- Automation Overtakes Development: In Q3 2025, automation-related positions represented 44% of all AI job postings, overtaking pure AI development roles for the first time. 28

- The "Hybrid" Skill Set: Companies are seeking "AI Architects" or "AI Systems Engineers"—professionals who can stitch together LLMs, vector databases, and front-end applications. They need to understand APIs, latency, token costs, and user experience as much as they understand neural networks. 29

6.2 The Entry-Level Crisis and Opportunity

A concern emerging from the data is the pressure on entry-level roles. Vanguard's analysis notes that while experienced workers are seeing wage gains, hiring for entry-level positions has slowed. 30 The "grunt work" that used to train junior analysts—summarizing reports, writing basic code, data entry—is exactly what AI does best.

The Challenge: How do companies train the next generation of senior experts if the junior rung of the ladder is automated?

The Solution: Forward-thinking firms are shifting entry-level training from "task execution" to "AI oversight." Junior staff are being taught to audit AI outputs rather than generate the raw material themselves. They are becoming "Editors-in-Chief" of AI-generated work, requiring critical thinking skills earlier in their careers.32

7. Conclusion: The Blueprint for 2026

The data from 2024 and 2025 dismantling the "Jobapocalypse" narrative is not an invitation to complacency; it is a call to action. We are witnessing a Great Reallocation of human potential. The economy is shedding low-value tasks and creating high-value roles at a ratio of 10:1.

For the B2B executive, the path forward involves three strategic pillars:

- Invest in Infrastructure: Whether it's the physical data center or the digital cloud environment, your foundation must be robust.

- Empower, Don't Replace: Use AI to augment your workforce. The wage data proves that "centaur" employees (human + AI) are the most valuable assets in the market.

- Build the Bridge: Leverage custom software development to bridge the gap between generic AI models and your specific business needs. Partner with experts who understand the engineering reality—the "plumbing" of DevOps, data integrity, and secure deployment—that makes AI viable.

The future isn't about humans versus machines. It's about humans building the machines that build the future. And right now, business is booming.

Frequently Asked Questions

Q: Is AI actually replacing jobs right now, or is it just hype?

A: The data confirms that AI is a net job creator by a significant margin. In 2024, AI activity created roughly 119,900 jobs (primarily in development and infrastructure construction) while displacing approximately 12,700 jobs. This creates a 10:1 ratio of gains to losses. While individual displacement is real, it represents only 0.1% of total U.S. layoffs. The primary economic engine right now is the massive "build-out" phase—construction, power, and implementation—which is labor-intensive.

Q: Why are wages rising in jobs that AI is supposed to automate?

A: This is the "Exposure Paradox." In many white-collar roles (finance, analysis, admin), AI isn't replacing the worker; it's replacing the boring parts of the worker's day. This makes the worker more productive. Vanguard's research shows that real wages in high-AI-exposure jobs grew by 3.8% post-COVID, compared to just 0.7% in low-exposure jobs. Companies are paying a premium for professionals who can leverage AI to amplify their output.

Q: Should our company build our own AI model or buy off-the-shelf?

A: For most B2B firms, building a foundation model from scratch is a strategic error. The 2025 trend is "Buy and Integrate." Approximately 76% of enterprises are choosing to use existing powerful models (like GPT-4 or Claude) and integrate them. The sweet spot is Custom Integration—using firms like Baytech Consulting to build the custom software layer that connects these models to your proprietary data and workflows securely.

Q: What is the "Iceberg Index" and why does it matter?

A: The Iceberg Index is an MIT metric measuring the "hidden" potential for automation. It finds that 11.7% of the U.S. economy is technically ready for AI automation, but most of this isn't in Silicon Valley—it's in finance, healthcare administration, and logistics in states like Delaware and South Dakota. This highlights that the biggest ROI for AI is likely in automating your back-office operations to unlock efficiency.

Q: What is the #1 reason AI projects fail in 2025?

A: Data Quality. Roughly 64% of organizations cite poor data quality as their primary barrier. If internal data is unstructured or "messy," even the smartest AI will fail. Successful implementation starts with data governance—often requiring custom software solutions (using tools like SQL Server and Postgres) to structure data before the AI touches it.

Supporting Resources

- https://itif.org/publications/2025/12/18/ais-job-impact-gains-outpace-losses/

- https://corporate.vanguard.com/content/dam/corp/research/pdf/isg_vemo_2026.pdf

- https://iceberg.mit.edu/report.pdf

About Baytech

At Baytech Consulting, we specialize in guiding businesses through this process, helping you build scalable, efficient, and high-performing software that evolves with your needs. Our MVP first approach helps our clients minimize upfront costs and maximize ROI. Ready to take the next step in your software development journey? Contact us today to learn how we can help you achieve your goals with a phased development approach.

About the Author

Bryan Reynolds is an accomplished technology executive with more than 25 years of experience leading innovation in the software industry. As the CEO and founder of Baytech Consulting, he has built a reputation for delivering custom software solutions that help businesses streamline operations, enhance customer experiences, and drive growth.

Bryan’s expertise spans custom software development, cloud infrastructure, artificial intelligence, and strategic business consulting, making him a trusted advisor and thought leader across a wide range of industries.