AI's New Era: Why Waiting is No Longer an Option in 2025

December 12, 2025 / Bryan ReynoldsAspects of AI Growing Up: Why the Grace Period is Over for Investing in AI

For years, investing in artificial intelligence was a strategic choice for the forward-thinking. Today, it’s a matter of survival. With over 99% of Fortune 500 companies now using AI technologies, the question is no longer if your business will use AI, but how far behind you will be when you finally do. The era of AI experimentation is over. We are in a new phase of maturity defined by massive market momentum, proven ROI and widespread, mission-critical adoption. For business leaders, the “wait and see” approach has shifted from a smart strategy to a major competitive risk. This post will answer the questions on every executive’s mind to show why the time to act is now.

Is AI Just Hype or Has It Finally Reached Maturity?

The question of whether AI is a sustainable technological shift or another tech bubble is top of mind for any executive considering a big investment. The answer, backed by the numbers, is that AI has well and truly moved beyond the “hype” phase and is now a foundation of the global economy. The scale of the market and investment is a permanent, structural shift in how business will be done for the foreseeable future.

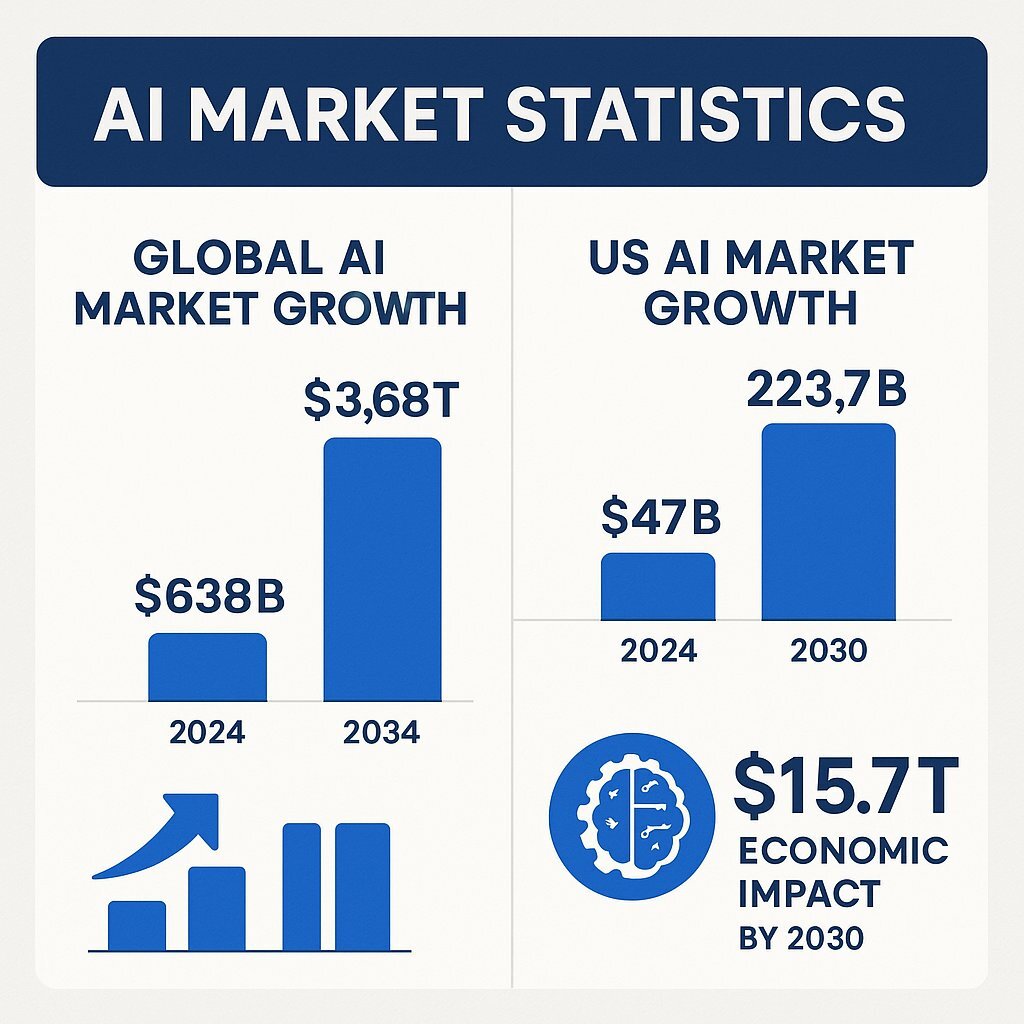

The global AI market is not a niche; it’s a rapidly growing economic force. Worth $638.23 billion in 2024, it will grow at 19.2% CAGR to $3.68 trillion by 2034. In the US alone, the market will grow even faster, 28.3% CAGR to $223.70 billion by 2030. This is not a bubble, this is a technology embedding itself into the heart of global commerce. By 2030, AI will add $15.7 trillion to the global economy. Investment trends are a leading indicator of long term confidence. In 2024, corporate AI investment hit a record $252.3 billion, while private investment in the US reached $109.1 billion. This is not speculative capital chasing ideas. Unlike previous tech booms that were often driven by potential rather than performance, today’s AI investments are flowing into a market that is already delivering results. The software segment, which provides tangible tools, accounted for the largest share at 51.40% in 2024. This is the world’s most sophisticated investors backing a technology with proven applications and a clear path to profitability.

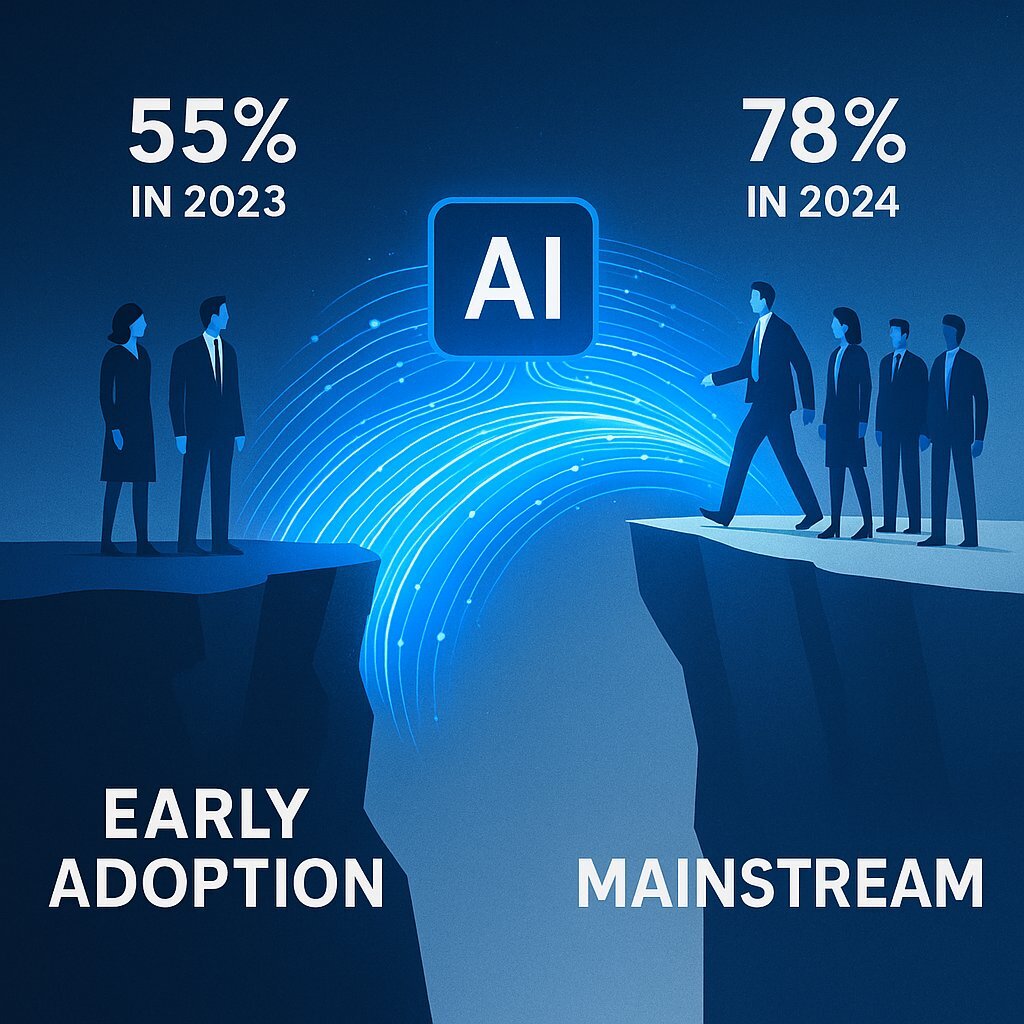

Perhaps most tellingly, adoption rates have reached a tipping point. The percentage of companies using AI in at least one function jumped from 55% in 2023 to 78% in 2024. This rapid acceleration means AI has crossed the chasm from early adopters to the mainstream business majority. It’s no longer a tool for just tech giants; it’s a competitive necessity, with nearly 90% of companies investing in AI to keep up with rivals. The risk is no longer in making a bad investment, but in being left out of this fundamental economic shift entirely.

| Metric | 2024/2025 Value | 2030-2034 Forecast | CAGR (2025-2034) |

|---|---|---|---|

| Global AI Market Size | ~$638 Billion | ~$3.68 Trillion | 19.2% |

| U.S. AI Market Size | ~$47 Billion | ~$223.70 Billion | 28.3% |

| Global Private AI Investment (2024) | $130.26 Billion | ||

| AI Contribution to Global Economy | $15.7 Trillion (by 2030) |

Beyond the Buzzwords: What’s the Real-World ROI of AI?

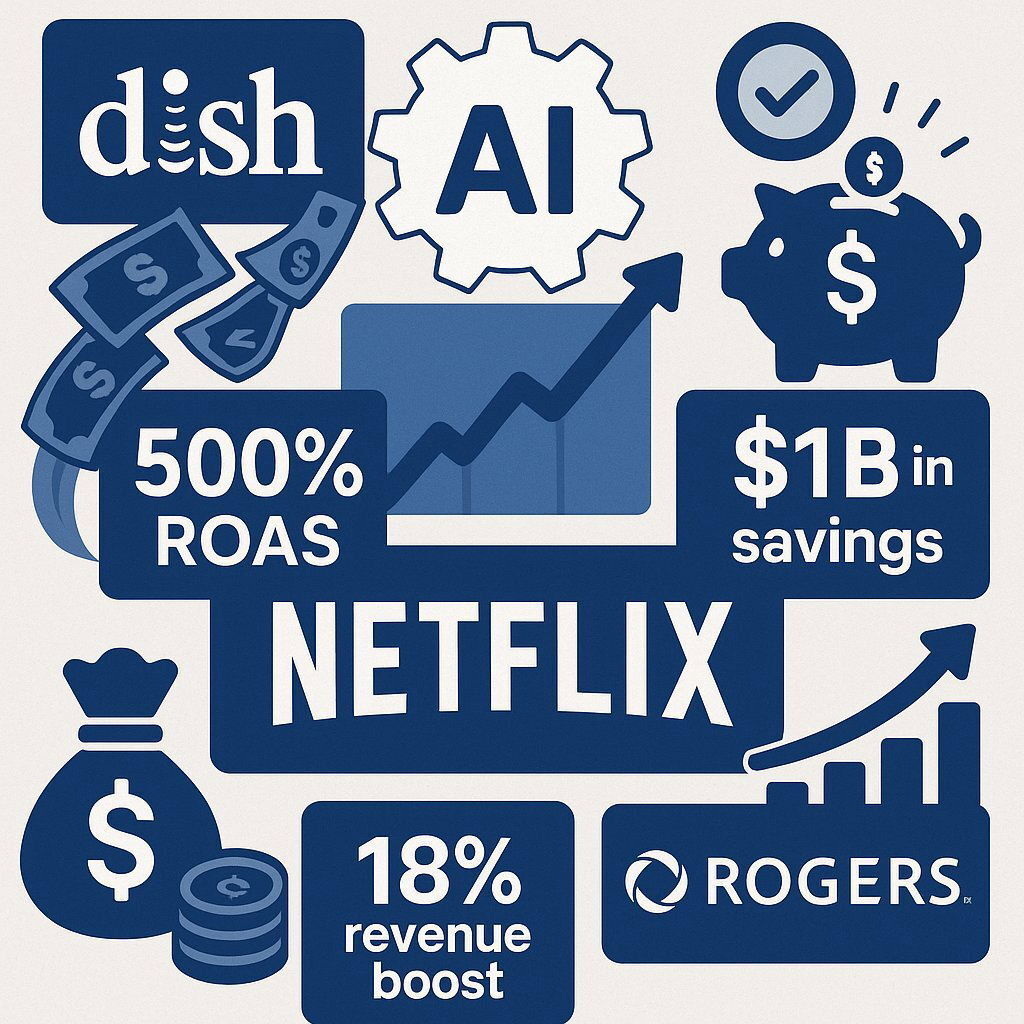

For executives, talk of “transformation” and “efficiency” means nothing without a line to the profit and loss statement. The good news is AI investment is no longer a leap of faith. A growing body of evidence shows clear, quantifiable returns on both top and bottom line, with 74% of executives saying they get ROI in the first year of deployment. The most compelling evidence comes from direct, unambiguous financial wins. DISH Network, by applying AI-driven conversation intelligence to its marketing, saw a 500% lift in return on advertising spend (ROAS) . Netflix, by using machine learning to power its recommendation engine, saves an estimated $1 billion annually in content acquisition and customer retention costs. And in a clear example of top-line growth, Canadian telecom giant Rogers Communications saw an 18% boost in net revenue from its paid search efforts after implementing AI-powered ad bidding strategies. These are not small wins; they are big financial impacts that prove the investment.

Operational efficiency has also emerged as a powerful and direct profit driver. According to the Thomson Reuters Future of Professionals Report , many organizations are saving an average of five hours per employee per week by automating manual tasks. This is not just a convenience; it’s a massive productivity dividend, freeing up highly skilled—and highly paid—professionals to focus on strategic, revenue-generating activities. This efficiency translates directly into cost savings. Rogers Communications, in addition to its revenue gains, reduced its cost per acquisition by 82%, while Rick’s Custom Fencing & Decking cut its cost per lead by 70%.

But focusing solely on these immediate financial metrics can cause leaders to miss the bigger picture. The most forward-thinking organizations are adopting a more sophisticated ROI framework that accounts for strategic benefits. The Future of Professionals Report identifies several of these key factors, including tangible benefits like error reduction and risk mitigation (preventing fraud and costly litigation) and intangible, yet measurable, benefits like improved decision quality, enhanced client experience and higher talent retention.

While many companies are seeing positive ROI, the most common reported revenue gains are still small, often less than 5%. Meanwhile a recent Harvard Business Review article notes that only 4% of companies are using AI to create a true, defensible competitive advantage. This highlights a critical difference: most companies are harvesting the “low-hanging fruit” of AI—automating simple tasks for incremental returns. The real, transformative opportunity lies in using AI not just to cut costs but to build a moat. The companies that master this will see their ROI compound over time, while their competitors are stuck in a cycle of marginal improvements. So the goal must shift from “getting ROI from AI” to “using AI to build an advantage that generates compounding ROI.”

| Company/Industry | AI Application | Quantifiable Result |

|---|---|---|

| DISH Network | Conversation Intelligence for Ad Spend | 500% lift in Return on Ad Spend (ROAS) |

| Rogers Communications | AI-Powered Google Ads Bidding | 82% decrease in Cost Per Acquisition (CPA) |

| Rick's Custom Fencing | AI Call Tracking & Lead Analysis | 70% reduction in Cost Per Lead |

| Netflix | Machine Learning Recommendations | $1 billion in annual savings |

| Salesforce | Generative AI for Email Campaigns | 28% increase in user engagement |

| Bayer | Predictive Market Trend Analysis | 2.6x increase in website traffic |

| Healthcare (General) | AI-Assisted Nurse Staffing | 10-15% lower staffing costs, $700k savings |

How Are My Competitors Actually Using AI to Win?

Artificial intelligence is not a one-size-fits-all technology, but a set of tools being applied to solve specific, high-value problems across every industry. The early AI applications were often on the periphery of the business—customer service chatbots or basic marketing automation. Today the trend is clear: AI is moving from the “edge” to the “core” of the business, re-engineering how companies deliver value. If your competitors are embedding AI into the heart of their business models, you’ll fall behind not just on a technology project but on your entire operational and cost structure.

Finance & Banking

The financial services industry has moved way beyond chatbots. AI is now core to operations, powering real-time fraud detection systems that analyze transaction patterns to spot anomalies in an instant. In investment banking, algorithmic trading platforms use AI to execute complex strategies faster than any human. In lending, AI-driven underwriting processes are not only faster but can also reduce bias by analyzing a wider range of alternative data, leading to more equitable credit decisions. Bank of America’s virtual assistant, Erica, gives you a sense of scale, having handled over 2 billion customer interactions to date. AI is transforming patient care from diagnosis to treatment. In oncology, AI models are analyzing mammograms and CT scans to detect cancers earlier and more accurately than human radiologists. At Johns Hopkins University, a machine learning model was able to quantify a lung cancer patient’s response to treatment five months earlier than traditional clinical methods, allowing for much faster adjustments to care plans. In hospitals, predictive AI systems are monitoring patient data in real-time to provide early warnings for life-threatening conditions like sepsis, resulting in better patient outcomes.

Marketing & Sales

In marketing, AI has moved from simple automation to a powerful engine for hyper-personalization and performance optimization. Companies like Nutella have used generative AI to create 7 million unique, one-of-a-kind jar labels, all of which sold out instantly. L’Oréal’s AI-powered virtual try-on tool has been used over a billion times and has proven to make users three times more likely to buy. Beyond creative applications, AI is driving advertising efficiency as seen in the massive ROAS and CPA improvements for DISH Network and Rogers Communications.

Mortgage & Real Estate

The paper-intensive mortgage industry is being streamlined by AI. Intelligent document processing tools use AI to automatically extract and verify information from loan applications, tax returns and pay stubs, reducing manual labor and processing time by 90%. AI is also enhancing credit scoring by incorporating alternative data sources to build a more complete picture of a borrower’s financial health. For customers, AI-powered chatbots and virtual assistants are providing 24/7 guidance through the complex application process, improving the overall experience.

Gaming & Entertainment

The gaming industry is using AI to create incredibly dynamic and immersive experiences. Procedural content generation, an AI technique, allows games like No Man’s Sky to create a virtual universe with billions of unique planets for players to explore. In other games, AI is used to create intelligent Non-Player Characters (NPCs) that learn from and adapt to a player’s skill level, so the game remains challenging and fun. AI is also working behind the scenes to improve the player experience, with AI-powered development tools like NVIDIA’s DLSS technology using AI to upscale graphics to higher resolutions in real-time.

We’re convinced. But how do we avoid becoming another failed AI project?

The pressure to act on AI is intense but the data on success is alarming. A recent MIT study found that 95% of enterprise AI initiatives fail to deliver their expected ROI. This high failure rate isn’t a failure of the technology itself but of a technology-first approach. The market is moving fast and leaders are tempted into a “spend-scale-speed” mindset. But the evidence shows that to ultimately move faster and gain a sustainable advantage you must first slow down, build a strategy and address the predictable points of failure. The successful 5% are defined not by speed but by “strategic alignment and disciplined execution”.

Research has identified five key challenges that derail most AI projects :

- No Business Value: Initiatives are launched without clear, measurable KPIs so it’s impossible to prove success or justify further investment.

- Bad Data: The “garbage in, garbage out” principle is true for AI. Models trained on incomplete, inconsistent or outdated data will produce rubbish results.

- Talent Shortage: A lack of in-house expertise to build, manage and interpret complex AI systems is a major bottleneck for many organizations.

- Integration: Trying to bolt on new AI tools to complex legacy systems without a clear architectural plan will lead to technical failure and low user adoption.

- Ethical and Governance: Ignoring issues of bias in data, lack of transparency in model decision-making and unclear accountability can create significant legal and reputational risk.

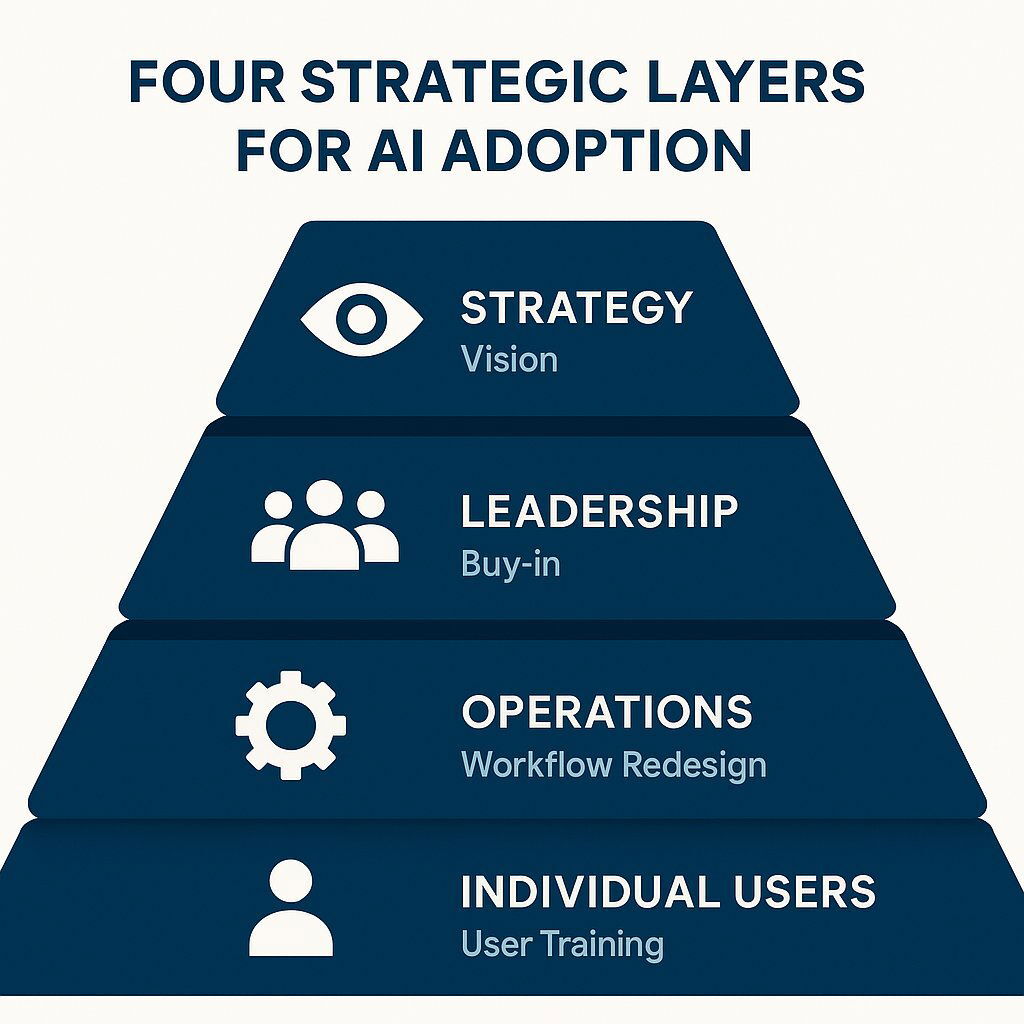

The solution to these challenges is a strategic four-layer adoption framework that starts with business outcomes not technology. Organizations that have a detailed Strategy for AI are nearly four times more likely to experience revenue growth. This strategy must be championed by committed Leadership at the C-suite level. It requires a willingness to redesign Operations — adjusting workflows, processes and even pricing models to leverage AI’s capabilities. And it depends on creating a culture that supports Individual Users through training, upskilling and clear communication to lower anxiety and encourage adoption. These challenges are why simply buying an off-the-shelf AI tool is not a strategy. True success requires a partner who starts not with the technology but with your business outcomes. Baytech Consulting does just that. They partner with clients to build a solid data foundation, align AI initiatives with core business KPIs and manage the complex integration process to de-risk the investment and provide a clear path to value.

The Big Decision: Off-the-Shelf Tool or Custom AI Engine?

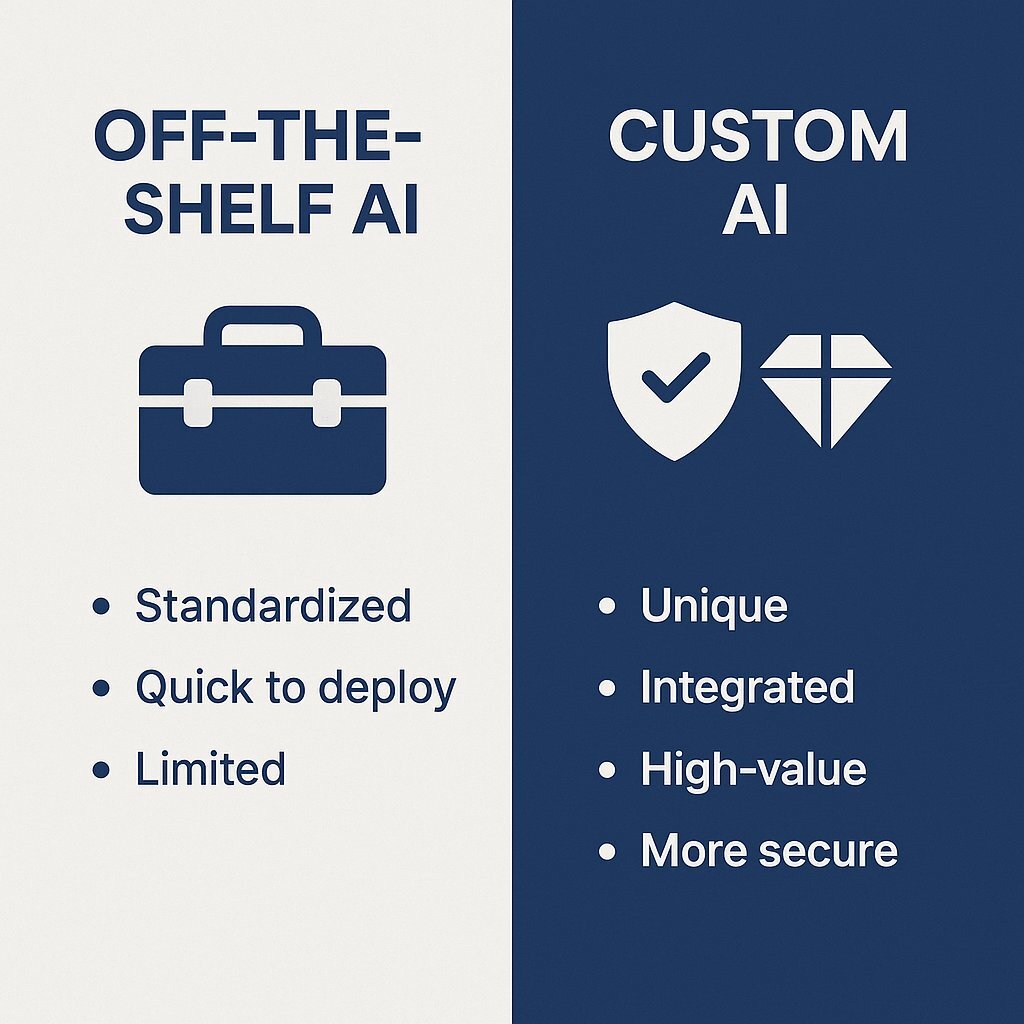

As executives commit to an AI strategy they face a big decision: buy a pre-built, off-the-shelf AI tool or build a custom AI solution? Off-the-shelf tools are great for getting started. They are lower cost, faster to deploy and non-technical teams can use them so they are perfect for automating standard tasks and testing initial use cases.

But for businesses that want to go beyond incremental efficiency gains the limitations of these generic tools become apparent quickly. First, they offer no sustainable competitive advantage; your competitors can subscribe to the same service and nullify your edge. Second, they are inflexible; you must adapt your business processes to fit the tool’s rigid workflows rather than the other way around. Third, they introduce significant data security and sovereignty risks as your proprietary data is processed and stored on a third-party platform. Finally, many of these tools are a “black box” providing little transparency into their decision-making logic—a non-starter for companies in regulated industries like finance or healthcare.

To build a lasting, defensible competitive advantage businesses must eventually invest in custom AI solutions. This is the pivot from renting a capability to owning a strategic asset. A custom AI solution gives you:

- Better Performance: Models trained on your company’s specific, proprietary data will always outperform generic models trained on broad public datasets.

- True Differentiation: A custom AI model is a form of intellectual property. It’s a strategic asset that competitors can’t buy or replicate, creating a moat around your business.

- Seamless Integration: A custom solution is engineered from the ground up to integrate with your existing legacy systems, CRMs and ERPs so high adoption and maximum value. Full Control and Autonomy: With a custom build you own the model, the data and the infrastructure. No risk of vendor lock-in and you can meet any industry specific compliance and governance requirements.

This is where market leaders separate from the pack and this is what Baytech Consulting focuses on. While many vendors can sell you an off-the-shelf tool, Baytech partners with you to build a proprietary AI engine. Their team of experts will work with you to understand your unique business challenges, harness your proprietary data and engineer a custom solution that becomes a lasting source of competitive advantage. They don’t just deliver a product; they deliver a strategic asset that is yours and yours alone.

| Factor | Off-the-Shelf AI Solution | Custom AI Solution (Baytech Consulting) | Verdict |

|---|---|---|---|

| Competitive Edge | Low. Available to all competitors. | High. A proprietary, non-replicable asset. | Custom AI wins for differentiation. |

| Long-Term ROI | Good for short-term wins, but limited. | Higher initial cost, but superior long-term economic value. | Custom AI wins for sustainable value. |

| Data Security & Ownership | Potential risk. Data processed by a third party. | Full control. Data remains a secure, in-house asset. | Custom AI is the clear leader. |

| Integration & Flexibility | Limited. Must adapt processes to the tool. | Total. Designed to integrate with your existing systems. | Custom AI wins for deep integration. |

| Speed to Deployment | Fast. Quick to launch for immediate needs. | Slower. Requires strategic planning and development. | Off-the-shelf wins for immediate tasks. |

Next Steps: From AI Awareness to AI Advantage

The data is clear: the AI era is here, the ROI is real and the competitive landscape is being redrawn in real-time. The path to market leadership is not in frantic, tactical adoption of every new tool but in a deliberate, strategic approach to solving your core business challenges. For your most critical priorities this will mean custom solutions that transform your unique data and processes into a durable competitive edge. The observation period is over; the time for action is now.

Here are three things to do now:

- Stop and Reflect: Get your leadership team together and ask one question: “Where is our single greatest opportunity to build a competitive advantage with AI?” Focus on strategic differentiators not just point solutions.

- Get Realistic: Do an honest assessment of your data infrastructure, talent, and strategic alignment. Is your data clean and accessible? Do you have the skills in-house or do you need a partner? Is the entire leadership team aligned on the objective?

- Find a Partner: The data shows going it alone is a high risk. Engage a strategic partner who can help you build a pragmatic roadmap, de-risk your investment and co-create a solution that delivers real, measurable business value.

From AI awareness to AI advantage requires a guide. Baytech Consulting is that guide. Contact us today for a strategic readiness assessment to see how a custom AI solution can turn your biggest challenge into your greatest competitive strength.

Related Articles

- Stanford University AI Index 2025 Report : For the base data on global AI investment, adoption and performance trends.

- Harvard Business Review: "Are Your AI Investments Creating Value?" : For more on the strategic frameworks to move AI from a cost center to a value driver.

- Thomson Reuters: "The ROI of AI: How to get the full value" : For the expanded definition of AI ROI and the four-layer roadmap to successful adoption.

- The Four Types of Software Maintenance : For a breakdown of ongoing maintenance considerations as AI solutions mature and require updates, bug fixes, and performance improvements for long-term ROI.

About Baytech

At Baytech Consulting, we specialize in guiding businesses through this process, helping you build scalable, efficient, and high-performing software that evolves with your needs. Our MVP first approach helps our clients minimize upfront costs and maximize ROI. Ready to take the next step in your software development journey? Contact us today to learn how we can help you achieve your goals with a phased development approach.

About the Author

Bryan Reynolds is an accomplished technology executive with more than 25 years of experience leading innovation in the software industry. As the CEO and founder of Baytech Consulting, he has built a reputation for delivering custom software solutions that help businesses streamline operations, enhance customer experiences, and drive growth.

Bryan’s expertise spans custom software development, cloud infrastructure, artificial intelligence, and strategic business consulting, making him a trusted advisor and thought leader across a wide range of industries.