A CFO’s Playbook: Pragmatic AI Investment for Real-World ROI

October 23, 2025 / Bryan ReynoldsBeyond the Buzzword: A CFO’s Pragmatic Guide to Investing in AI

The CFO's AI Dilemma: Navigating the Chasm Between Hype and ROI

The directive has likely come down from the board, the CEO, or a chorus of market analysts: "We need an AI strategy." It’s the defining mandate of our era, a technological arms race where falling behind feels like a critical failure of foresight. Simultaneously, your mandate as a financial leader is clearer than ever: optimize costs, de-risk the balance sheet, and preserve capital in a cautious economic climate. According to a recent Grant Thornton survey, 58% of CFOs rank cost optimization as their absolute top concern, with a sharp focus on reducing headcount, travel, and consulting fees. This creates a fundamental conflict at the heart of the modern enterprise.

The challenge is not whether to invest in artificial intelligence, but how. The market is saturated with buzzwords and futuristic promises, but the CFO's role demands a rigorous translation of technological potential into the language of the P&L: working capital optimization, operating margin improvement, and tangible, defensible return on investment (ROI). This task is made exponentially more difficult by a pervasive mood of risk aversion. A Deloitte survey found that only about one in four (26%) CFOs believe now is a good time to be taking on greater risks, a clear signal of fiscal prudence.

This environment forces a paradigm shift in the CFO’s role. The days of being a simple budget gatekeeper are over. With worldwide generative AI spending projected to reach a staggering $644 billion by 2025, the CFO is now a central figure in technology strategy. This strategic elevation is amplified by a notable leadership vacuum in the C-suite; with only 15% of organizations having a dedicated AI-related executive role, the responsibility for evaluating and championing these massive investments often falls squarely on the CFO's shoulders. You are no longer just approving budgets; you are shaping the future competitive posture of the company.

This guide is designed to cut through the noise. It provides a pragmatic, finance-first framework for senior leaders to build a bulletproof business case for AI, choose the right investment model for their strategic goals, ask the tough questions that de-risk the decision, and, most importantly, measure what matters to prove its value to the board and shareholders.

First, a Hard Truth: Your AI Strategy Is Only as Strong as Your Data Foundation

Before a single dollar is allocated to AI models, vendors, or platforms, there is a foundational truth that must be addressed: AI runs on data governance. The old adage of "Garbage In, Garbage Out" is no longer just a cautionary phrase; in the age of AI, it represents a multi-million-dollar liability. The most sophisticated algorithm in the world will fail, produce biased results, or "hallucinate" fanciful answers to mission-critical questions if it is trained on unreliable, siloed, or poorly governed data. For this reason, prioritizing data management is not a preliminary step; it is the non-negotiable prerequisite for any successful AI initiative.

Framing data governance as a critical investment rather than a mere cost center is the first crucial step in building a business case. The financial consequences of negligence are severe and well-documented. Gartner estimates that poor data quality costs organizations an average of $12.9 million every year, while other analyses place the figure closer to $15 million. The impact extends across the entire economy, draining an estimated $3.1 trillion from the U.S. economy annually. These are not abstract figures. Unity Software, for instance, reported a loss of $110 million in revenue and a staggering $4.2 billion drop in its market cap, citing "consequences of ingesting bad data from a large customer".

Beyond direct financial losses, poor data quality creates a massive drain on an organization's most valuable resources. According to Forbes, data scientists—highly skilled and expensive professionals—spend up to 80% of their time simply cleaning, preparing, and validating data before any actual analysis can begin. This represents a colossal opportunity cost, diverting top talent from innovation to remediation.

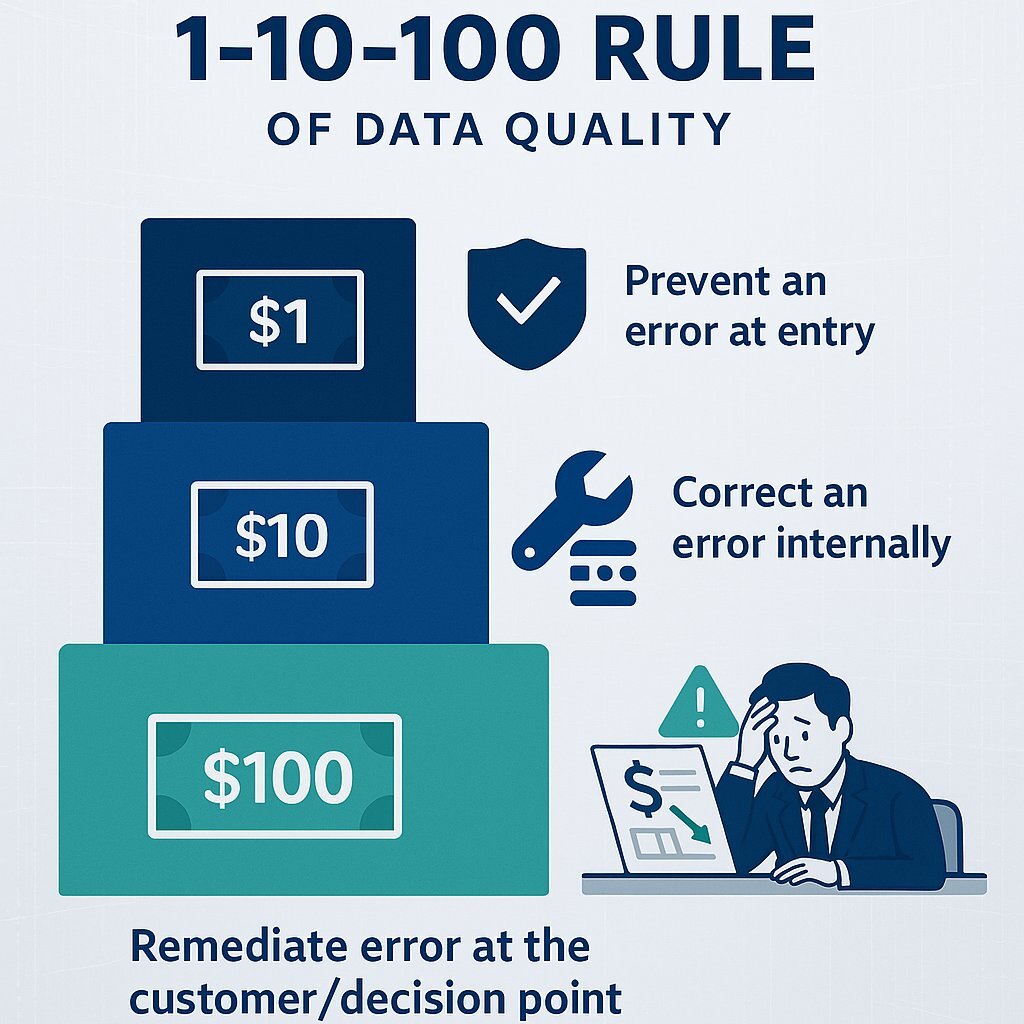

For financial leaders, the "1-10-100 Rule" provides a simple yet powerful framework for understanding this investment. The principle states that the cost to prevent a data error at the point of entry is approximately $1. If that error is not caught and must be corrected later within your systems, the cost escalates to $10. If the error reaches the customer or influences a key business decision, the cost to remediate the consequences skyrockets to $100. This exponential cost curve makes a clear and compelling financial argument for proactive, upfront investment in a robust data governance framework.

This does not mean embarking on an endless, purely technical cleanup project. Instead, it involves establishing the strategic pillars of an AI-ready data foundation:

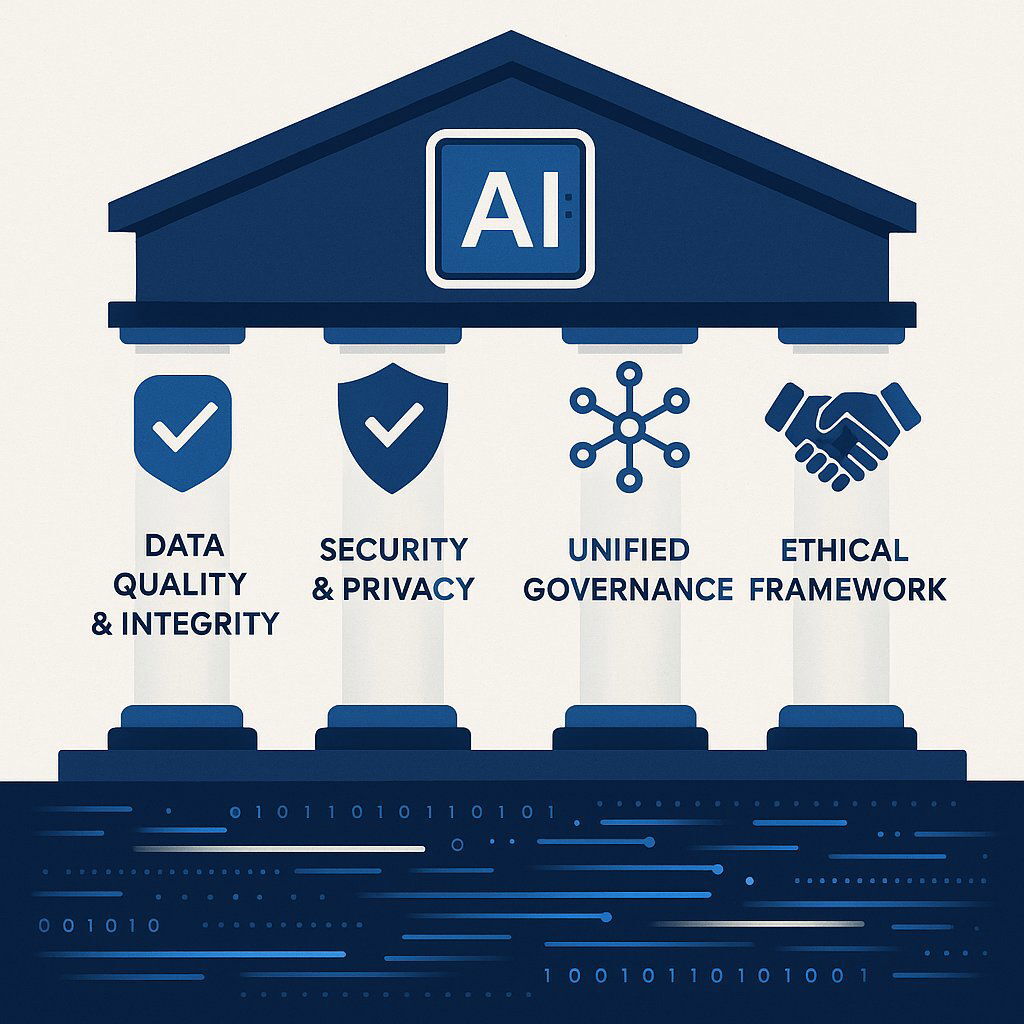

- Data Quality & Integrity: The first pillar is ensuring that the data used to train and operate AI models is accurate, complete, consistent, and trustworthy. This involves establishing processes for data validation, cleansing, and standardization to prevent flawed inputs from corrupting AI outputs.

- Security & Privacy: With AI systems accessing vast and often sensitive datasets, implementing robust security controls is paramount. This includes data encryption, role-based access controls, and strict protocols to ensure compliance with evolving regulations like GDPR in Europe and the EU AI Act. A data breach in an AI context is not just a compliance failure; it's a catastrophic loss of trust.

- Unified Governance: Many organizations suffer from "data silos," where critical information is trapped within disparate departments and legacy systems. An AI-ready framework breaks down these silos, creating a unified catalog and a single source of truth for all data and AI assets. This ensures consistency and allows AI models to draw insights from the entire breadth of the organization's knowledge.

- Ethical Framework: Finally, a forward-looking data strategy must proactively address the ethical dimensions of AI. This means establishing clear guidelines from the outset to mitigate bias, ensure fairness in algorithmic decision-making, and maintain transparency in how AI models arrive at their conclusions. Failing to do so exposes the organization to significant legal, reputational, and financial risks.

Building this foundation may seem like a daunting prerequisite, but it unlocks a powerful, self-reinforcing cycle. While clean data is essential for AI, AI itself is becoming a transformative tool for automating and enhancing data governance. Modern AI-powered tools can automatically classify sensitive data, monitor data quality in real-time, detect security anomalies, and track changes in the regulatory landscape to ensure continuous compliance. This creates a virtuous cycle: an initial investment in data readiness enables the deployment of foundational AI tools, which can then be turned inward to reduce the ongoing cost, complexity, and manual effort of maintaining the very data governance framework they rely on. This transforms data governance from a static, expensive project into a dynamic, continuously improving asset—a narrative that resonates powerfully in the CFO’s office.

Decoding Your Options: The Three AI Investment Models at a Strategic Crossroads

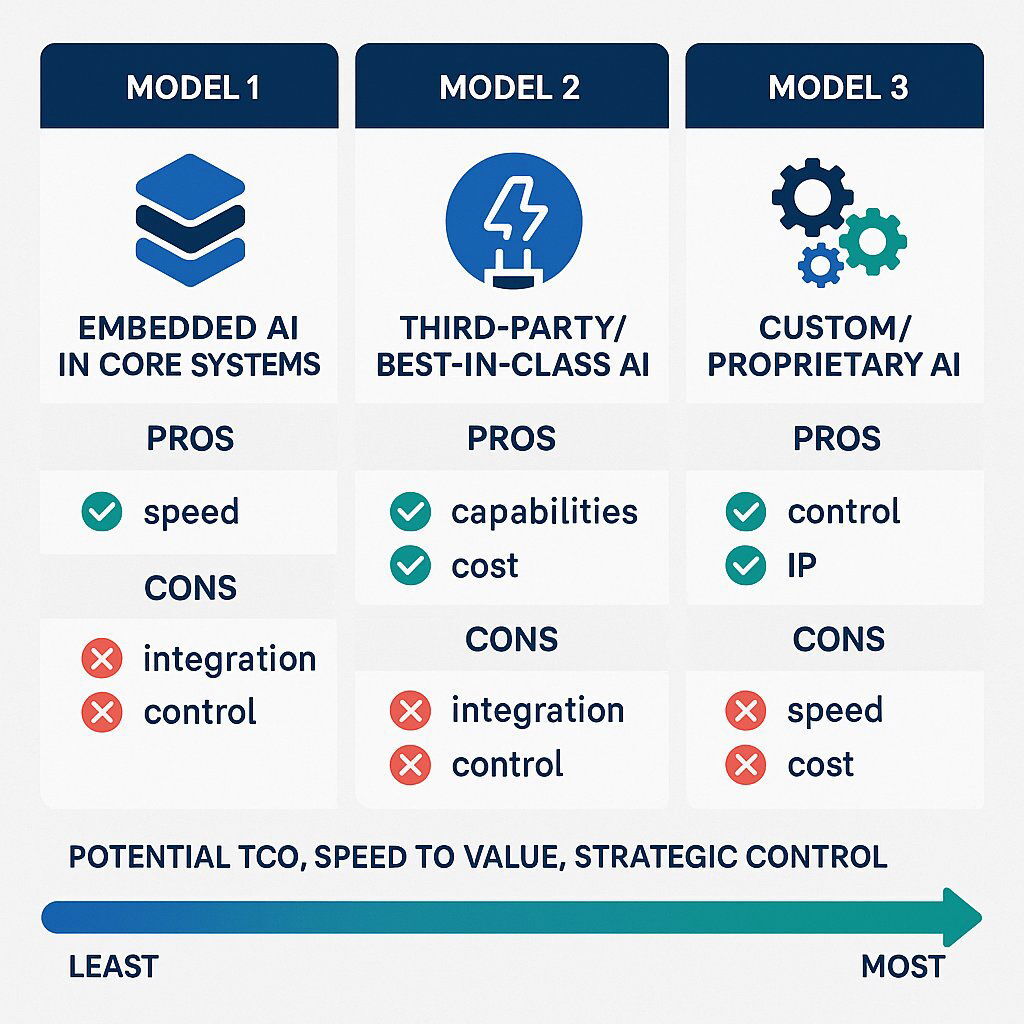

Once the data foundation is addressed, the next critical decision point is determining the right investment model. This is far more than a simple "build versus buy" calculation; it is a fundamental strategic choice that will dictate your organization's total cost of ownership (TCO), competitive positioning, and long-term agility. This decision should not be delegated to the IT department alone; it is a C-suite conversation with profound financial and strategic implications. There are three primary models to consider, each with a distinct profile of costs, benefits, and risks.

Model 1: The "Embedded" Approach – AI from Your Core System Vendor (ERP/CRM)

The first and often most accessible path is to leverage the AI capabilities being built directly into the enterprise systems you already use, such as your ERP or CRM platforms from vendors like Oracle, Salesforce, or SAP. This approach is gaining significant momentum; Gartner predicts that a remarkable 80% of independent software vendors will have embedded Generative AI capabilities into their enterprise applications by 2026, up from less than 5% in 2024.

- The Advantages: The primary appeal of this model is seamless integration. The AI features are designed to work natively within your existing workflows and data structures, theoretically reducing implementation friction. You benefit from a unified support structure from a single, familiar vendor and can avoid the complexities of integrating disparate systems.

- The Disadvantages: The trade-off for this convenience is a significant loss of control and customization. These embedded AI features are, by nature, "one-size-fits-all" solutions designed for a broad market. They may automate standard processes effectively but are unlikely to address the unique operational nuances or strategic challenges that create a true competitive advantage. Furthermore, you become entirely dependent on your vendor's innovation roadmap, pricing structure, and release cycles, creating a significant risk of vendor lock-in.

Model 2: The "Specialist" Approach – Integrating a Third-Party AI Solution

The second model involves augmenting your core systems with specialized, best-in-class AI solutions from third-party vendors, a strategy increasingly common in modern enterprise software adoption. This could mean implementing a dedicated AI platform for fraud detection, a sophisticated engine for marketing personalization, or a tool for supply chain optimization.

- The Advantages: This approach allows you to tap into cutting-edge technology for specific, well-defined business problems without waiting for your core vendor to catch up. Deployment can be significantly faster than a custom build, with some solutions going live in as little as 3 to 9 months, compared to the 12 to 24 months typical for an in-house project. This model is ideal for filling critical capability gaps quickly.

- The Disadvantages: The primary challenges are integration complexity and long-term cost. Connecting a third-party tool to your core systems can be a difficult and expensive undertaking, potentially creating new data silos if not managed carefully. More critically for a CFO, most of these solutions operate on a recurring subscription or per-use pricing model. While this may lower the initial upfront cost, these fees can escalate dramatically as your usage grows, leading to an unpredictable and potentially unsustainable TCO over the long term. You are also entrusting sensitive company data to an external provider, making their security and compliance posture a critical point of due diligence.

Model 3: The "Proprietary" Approach – Building a Custom AI Solution

The third model is the most ambitious and potentially the most valuable: developing a bespoke AI solution tailored specifically to your organization's unique data, proprietary processes, and strategic objectives. This is the path chosen when AI is not merely an operational tool but a core component of your competitive advantage, optimized for ROI.

- The Advantages: The foremost benefit of a custom build is the creation of a proprietary asset. The resulting AI model and the intellectual property behind it are owned entirely by you, forming a powerful competitive moat that cannot be easily replicated by rivals. This approach offers complete control over customization, allowing the solution to be finely tuned to your specific business logic. It also provides the highest level of data security and governance, as sensitive data can remain entirely within your own infrastructure. While the initial capital expenditure is higher, a custom solution can deliver a significantly lower TCO over the long run by avoiding the escalating usage fees associated with commercial models.

- The Disadvantages: This model requires the highest upfront investment in talent, infrastructure, and time. The time-to-value is the longest of the three options, and the project carries inherent execution risk if it is not managed by a team with deep, proven expertise in AI development and agile deployment. This is precisely where engaging a specialized development partner like Baytech Consulting can be a strategic decision, providing the necessary engineering talent and project management rigor to mitigate the risks while securing the full long-term benefits of a proprietary build.

To aid in this critical decision, the following table provides a CFO-centric comparison of the three models across key financial and strategic criteria.

| Evaluation Criterion | Model 1: Core Vendor AI | Model 2: Third-Party AI | Model 3: Custom Build AI |

|---|---|---|---|

| Total Cost of Ownership (TCO) | Moderate (Embedded in existing licenses but with potential upgrade fees) | High (Recurring subscription/usage fees escalate with scale) | High initial CapEx, but potentially lowest long-term TCO |

| Speed to Value | Moderate to Fast (Depends on vendor release cycle) | Fast (Often deployable in 3-9 months for specific use cases) | Slow (Typically 12-24 months for full production) |

| Strategic Control & IP | Low (Dependent on vendor roadmap and terms) | Low (Vendor owns the core IP) | High (Full ownership of the model and IP, creating a competitive asset) |

| Customization & Differentiation | Low (Standardized features for a broad market) | Moderate (Some configuration possible, but not core model changes) | High (Fully tailored to unique data, processes, and business logic) |

| Data Security & Governance | Moderate (Tied to vendor's security posture) | Moderate to Low (Requires sharing data with a third party) | High (Data can remain entirely within your infrastructure) |

| Best For... | Automating standard processes within an existing ecosystem. | Solving specific, non-core business problems quickly. | Creating a core competitive advantage and long-term strategic value. |

The CFO's AI Investment Checklist: 7 Questions to De-Risk Your Decision

With a clear understanding of the investment models, the next step is to apply a rigorous due diligence framework to any proposed AI project. This checklist is designed to be the CFO's primary tool for this process, shifting the conversation from the technical capabilities of AI to its tangible business and financial impact. These seven questions should be asked of any team—internal or external—proposing a significant AI investment.

1. The Value Question: How will this directly impact a core financial metric?

Vague promises of "enhanced efficiency" or "improved decision-making" are insufficient. A compelling business case must draw a clear, direct line from the AI initiative to a key financial lever on the income statement or balance sheet. The project champion must be able to articulate the mechanism of value creation in financial terms. For example:

- "How, specifically, will this AI-powered forecasting tool reduce our inventory carrying costs, and by what projected amount will it improve our working capital?"

- "By what percentage do we project this automated collections agent will reduce our Days Sales Outstanding (DSO), and what is the corresponding cash flow impact?"

2. The Measurement Question: What are the specific KPIs, what is our baseline, and how will we track ROI?

Success must be defined before a single dollar is spent. This requires establishing clear baseline metrics for the current process to provide a point of comparison. The proposal should identify a balanced set of Key Performance Indicators (KPIs), including both leading indicators (e.g., "average processing time per invoice," "call containment rate") and lagging financial indicators (e.g., "reduction in SG&A expense as a percentage of revenue," "increase in customer lifetime value"). If you want to ground your evaluation in sound finance, see this executive guide to total cost and ROI in enterprise technology initiatives. While the standard ROI formula,

ROI (%) = (Net Benefit / Total Investment) × 100, serves as a critical starting point, the evaluation must also account for intangible benefits like improved employee morale or enhanced brand reputation, which are harder to quantify but still hold significant value.

3. The Data Question: Do we have the clean, accessible, and governed data required for this to succeed?

This is the ultimate go/no-go question that links directly back to the foundational importance of data readiness and upfront discovery. Any credible AI project proposal must include a formal data audit and a realistic assessment of the organization's data readiness. The budget must explicitly account for the cost and time required for data preparation, cleansing, and integration. A project that glosses over or underestimates this critical phase is almost certainly destined for delays, budget overruns, and disappointing results.

4. The Vendor/Partner Question: What is their roadmap, and how do we ensure a healthy partnership?

For any "buy" or "partner" decision, you are not just acquiring software; you are entering into a long-term strategic relationship. It is imperative to scrutinize the vendor's AI roadmap to ensure it aligns with your company's future direction. This involves asking tough, detailed questions about their data privacy policies, security protocols, strategies for mitigating algorithmic bias, and compliance with emerging regulations like the EU AI Act. For a "build" decision, the evaluation criteria for a development partner should focus on their technical expertise, their commitment to agile and transparent processes, and their track record of on-time, on-budget delivery.

5. The People Question: What is the impact on our workforce, and do we have the right talent?

AI adoption is, at its core, a change management challenge. A technology-focused proposal that ignores the human element is incomplete. The business case must include a detailed plan and budget for upskilling or reskilling employees whose roles will be augmented or transformed by AI. A recent Deloitte survey identified GenAI adoption as a top internal risk for CFOs, driven largely by a lack of available talent and execution risk. Therefore, the proposal must realistically address how the necessary talent will be developed internally or acquired externally.

6. The Risk Question: What are the security, compliance, and ethical exposures?

This evaluation must go beyond standard IT security reviews. The unique nature of AI introduces new categories of risk that fall squarely within the CFO's purview of enterprise risk management. For a deep dive on how supply chain attacks and phishing have threatened mission-critical AI deployments, see this recent review of supply chain resilience strategies. Key questions include:

- How does the model architecture prevent the leakage of proprietary or sensitive customer data during training and operation?

- What safeguards are in place to protect the model from "data poisoning" attacks, where malicious actors intentionally feed it bad data to corrupt its outputs?

- How do we ensure that the model's decisions are explainable and auditable, particularly in highly regulated functions like credit scoring or financial reporting, to avoid "black box" scenarios?

7. The "Why Now?" Question: What is the Risk of Non-Investment (RONI)?

Finally, the investment decision should be framed not just by the cost of action, but by the potential cost of inaction. This requires a strategic analysis of the competitive landscape. What is the tangible risk to market share, operational efficiency, or customer retention if we delay this investment by 12, 18, or 24 months? Will we fall irrevocably behind competitors who are moving more aggressively? Calculating the RONI provides a powerful and necessary counterbalance to purely cost-based objections and elevates the discussion from a tactical budget item to a strategic imperative.

The table below serves as a quick-reference summary of this due diligence framework.

| Question Category | Core Question for the C-Suite |

|---|---|

| 1. Value | How does this project directly improve a specific line item on our financial statements (e.g., revenue, COGS, SG&A)? |

| 2. Measurement | What is the baseline metric, what is the target KPI, and what is the projected ROI and payback period? |

| 3. Data | Has a formal data audit been completed, and is the cost of data readiness included in the budget? |

| 4. Vendor/Partner | Does their long-term roadmap align with our strategy, and have we vetted their security, compliance, and ethics? |

| 5. People | What is the detailed plan and budget for change management, training, and acquiring necessary talent? |

| 6. Risk | What are the top 3 risks (security, regulatory, ethical), and what is the mitigation plan for each? |

| 7. Urgency | What is the calculated financial and competitive impact of not making this investment now (RONI)? |

From Theory to Practice: Quantifiable ROI of AI in the Finance Function

The strategic frameworks and checklists are essential, but for a finance leader, the ultimate validation comes from tangible results. A well-executed AI investment is not a theoretical exercise; it delivers real, measurable value that appears on the bottom line. The evidence from early adopters across industries is compelling, particularly within the core functions that report directly to the CFO.

Use Case Spotlight 1: Transforming Working Capital Management

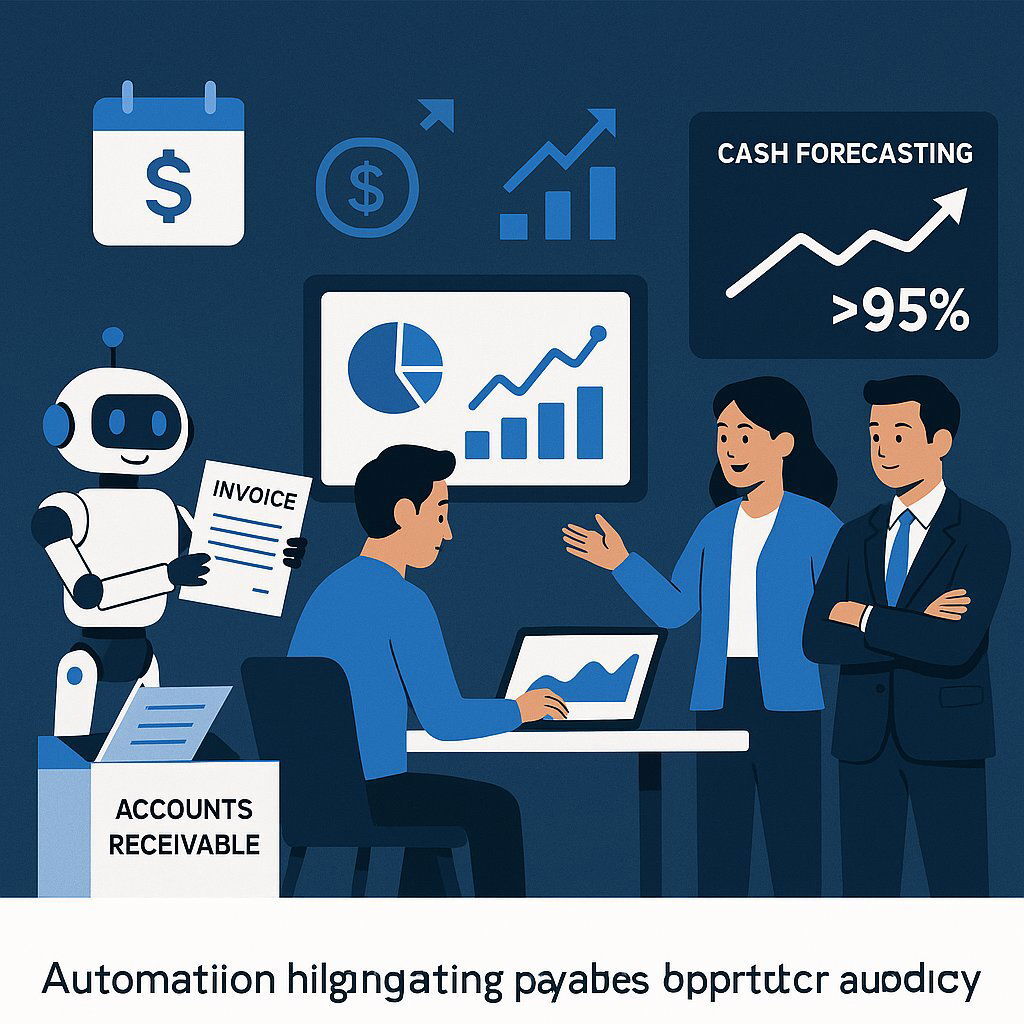

For any CFO, unlocking cash trapped on the balance sheet is a primary objective. AI is proving to be an exceptionally powerful tool for optimizing the components of working capital—receivables, payables, and cash forecasting using the cloud.

- Accounts Receivable (DSO): Manual, inefficient collections processes are a major drain on liquidity. AI transforms this function by automating invoice reminders, predicting which customers are most likely to pay late, and optimizing collections strategies for different customer segments. The results are dramatic. Studies show AI-driven interventions can reduce late payments by an average of 45%. In one real-world case, a technology distributor implemented an AI-enhanced dispute resolution process that cut its Days Sales Outstanding (DSO) by six days, directly improving cash flow by $50 million.

- Accounts Payable (DPO): On the payables side, AI-assisted systems automate the entire invoice ingestion and approval workflow, reducing processing costs and errors. More strategically, these systems can analyze payment terms and cash positions to identify and capture opportunities for early payment discounts, effectively generating a higher return on cash balances than short-term deposits.

- Cash Flow Forecasting: Accurate cash forecasting is the bedrock of effective liquidity management. Historically a manual and often inaccurate process, AI-powered predictive analytics can improve cash flow forecast accuracy to over 95%. This allows treasury teams to make smarter short-term investment decisions and build greater long-term financial resilience. A case study from the life sciences industry showed that using predictive modeling to forecast late payments boosted the company's cash flow by up to $33 million annually.

Use Case Spotlight 2: Revolutionizing Financial Planning & Analysis (FP&A)

The traditional FP&A function has often been mired in historical data aggregation and manual report generation. AI is liberating these teams, enabling a crucial shift from backward-looking reporting to forward-looking, predictive strategic guidance.

- Forecasting Accuracy and Speed: By analyzing vast internal and external datasets, AI models can identify patterns that human analysts might miss, leading to more accurate and resilient financial forecasts. PwC reports that organizations using AI agents in finance can achieve up to a 40% improvement in forecasting accuracy and speed.

- Enhanced Efficiency and Strategic Focus: The most immediate impact of AI in FP&A is the automation of routine tasks. AI can handle data collection, consolidation, and the generation of standard reports, freeing up highly skilled analysts to focus on value-added activities. According to PwC's research, this automation can redirect up to 60% of an FP&A team's time from manual processing to strategic insight work. A compelling example comes from BDO Colombia, which deployed a virtual AI assistant that reduced the operational workload for its finance teams by 50%.

- Advanced Scenario Modeling: AI's computational power allows for sophisticated scenario modeling on a scale previously unimaginable. Finance teams can now simulate thousands of potential outcomes—from sudden market downturns and interest rate shifts to supply chain disruptions—to develop more robust contingency plans and make more agile strategic decisions.

Use Case Spotlight 3: Fortifying Risk Management and Compliance

Reducing financial losses and mitigating the ever-growing burden of regulatory risk are core responsibilities of the CFO. AI has emerged as a game-changing technology in this domain, particularly in fraud detection and compliance automation.

- Fraud Detection: This is one of AI's most prominent success stories. AI algorithms can analyze millions of transactions in real-time, detecting subtle anomalies and patterns indicative of fraudulent activity with a level of accuracy that far surpasses human capabilities. Mastercard, a pioneer in this space, reported that its AI systems improved fraud detection accuracy by up to 300%. Similarly, PayPal leveraged AI to double its detection rate of compromised cards while simultaneously reducing the number of false positives—legitimate transactions incorrectly flagged as fraudulent—by an impressive 200%.

- Compliance (RegTech): The cost and complexity of regulatory compliance continue to mount. AI-powered "RegTech" solutions automate the monitoring of transactions and communications to ensure adherence to anti-money laundering (AML) and other regulations. HSBC provides a powerful case study: by deploying AI across its financial crime systems, the bank now detects two to four times more suspicious activity while simultaneously reducing the volume of false positive alerts by 60%. This not only strengthens their compliance posture but also drastically cuts the costly and time-consuming manual review process.

The following table aggregates some of the most compelling, quantifiable ROI metrics from real-world AI implementations, providing concrete evidence of the technology's financial impact.

| Company / Industry | AI Application | Quantifiable Result |

|---|---|---|

| Mastercard | Fraud Detection | Up to 300% improvement in fraud detection accuracy. |

| PayPal | Fraud Detection | Doubled detection rate of compromised cards; reduced false positives by 200%. |

| HSBC | Compliance / Anti-Crime | Detects 2-4x more suspicious activity while reducing false alerts by 60%. |

| Life Sciences Firm | Cash Flow Forecasting | Boosted cash flow by up to $33 million annually with 95% forecast accuracy. |

| Upstart | Loan Underwriting | Approves 27% more loans with 16% lower average APRs than traditional models. |

| PwC Benchmark | Financial Operations | Teams using AI agents redirect up to 60% of their time to insight work. |

| EchoStar | Process Automation | Projected to save 35,000 work hours and boost productivity by at least 25%. |

| Acentra Health | Healthcare Admin | Saved 11,000 nursing hours and nearly $800,000 with an AI letter-drafting tool. |

Conclusion: Your Next Move as a Strategic Financial Leader

The evidence is clear: an investment in artificial intelligence, when approached with the financial rigor and strategic foresight outlined in this guide, is not a speculative bet on a fleeting buzzword. It is a calculated, decisive move to build a more resilient, efficient, and competitive enterprise for the future. The conversation in the boardroom and the C-suite must evolve beyond if we should invest in AI to a more urgent and strategic discussion of how and when. The risk of inaction is now arguably greater than the risk of a well-vetted investment.

As a strategic financial leader, your role is to champion this transformation with a clear-eyed, pragmatic approach. To move from reading this guide to taking decisive action, consider the following three steps as your immediate plan:

- Initiate a Data Readiness Assessment. The journey does not begin with a vendor demo or a technology pilot. It begins with a foundational understanding of your most critical asset: your data. Commission a cross-functional audit of your organization's data assets, governance framework, and overall AI maturity. This assessment is the essential first investment, providing the blueprint for everything that follows.

- Identify a High-Impact Pilot Project. To build momentum and demonstrate value quickly, select a "quick win" candidate for an initial pilot project. Look for a business process with clear, universally acknowledged pain points and easily measurable outcomes. Areas like invoice processing in accounts payable, customer churn prediction, or lead scoring in sales are often ideal candidates. Use this pilot to test your evaluation framework, refine your ROI calculations, and build the internal credibility needed for larger-scale initiatives.

- Engage a Strategic Technology Partner. Navigating the complex AI landscape requires specialized expertise. Whether you are leaning towards a "buy" or "build" strategy, engaging an expert partner early in the process is crucial. A skilled partner can help you objectively evaluate the vendor ecosystem, conduct a thorough TCO analysis of different models, and de-risk the integration process. If you determine that a custom solution is the right path to creating a durable competitive advantage, a partner can provide the deep engineering talent and agile project management required to build a proprietary AI engine that drives market leadership.

At Baytech Consulting, we specialize in crafting these proprietary AI solutions. We partner with forward-thinking leaders to move beyond off-the-shelf tools and build the custom AI engines that drive true financial and operational transformation. When you are ready to have a serious conversation about how a tailored AI strategy can create lasting value for your organization, let's connect.

Further Reading

- https://www.mcksey.com/capabilities/strategy-and-corporate-finance/our-insights/how-ai-is-transforming-strategy-development

- https://www.paloaltonetworks.com/resources/whitepapers/ai-governance

- https://research.isg-one.com/analyst-perspectives/use-ai-and-technology-to-optimize-working-capital

About Baytech

At Baytech Consulting, we specialize in guiding businesses through this process, helping you build scalable, efficient, and high-performing software that evolves with your needs. Our MVP first approach helps our clients minimize upfront costs and maximize ROI. Ready to take the next step in your software development journey? Contact us today to learn how we can help you achieve your goals with a phased development approach.

About the Author

Bryan Reynolds is an accomplished technology executive with more than 25 years of experience leading innovation in the software industry. As the CEO and founder of Baytech Consulting, he has built a reputation for delivering custom software solutions that help businesses streamline operations, enhance customer experiences, and drive growth.

Bryan’s expertise spans custom software development, cloud infrastructure, artificial intelligence, and strategic business consulting, making him a trusted advisor and thought leader across a wide range of industries.