Why Enterprises Are Switching to Consumption-Based Software Pricing

September 06, 2025 / Bryan Reynolds

The End of the "One-Size-Fits-All" License: Why Enterprises Are Shifting to Consumption-Based Pricing

Are you paying for software you don’t use? For years, this question has been a quiet frustration in boardrooms and budget meetings. The traditional seat-based software license, a relic of a bygone era, has often led to a costly phenomenon known as "shelfware"—licenses bought and paid for, yet sitting unused, gathering digital dust while draining budgets. Enterprises are now demanding a change. They are tired of paying for promises and are instead shifting toward a model that reflects reality: consumption-based pricing. This isn't just a new way to bill; it's a fundamental realignment of how software's value is defined, delivered, and paid for, promoting unprecedented cost efficiency and a truer partnership between vendors and customers.

This movement is more than a fleeting trend; it represents a strategic evolution in the technology landscape. It is a direct response to deep-seated changes in how businesses operate and innovate, driven by the scalability of the cloud, the resource-intensive nature of artificial intelligence, and a new generation of buyers who demand demonstrable ROI before committing to significant spend. The market is moving decisively from selling access to selling outcomes. For executives—from the CTO architecting the future to the CFO safeguarding the bottom line—understanding this shift is no longer optional; it's a critical component of modern business strategy.

What is Consumption-Based Pricing? A Clear Definition

At its core, the difference between the old and new models can be understood through a simple analogy: the gym membership versus the utility bill.

- Seat-Based Licenses (The Gym Membership): For a fixed monthly fee, you get unlimited access. It’s predictable, but if you only go once or twice, you're paying for a service you barely used. This model is built on access, not actual usage, often leading to a misalignment where light users are overcharged and heavy users are subsidized by the rest.

- Consumption-Based Pricing (The Utility Bill): You are billed directly for what you consume—the electricity that powers your lights, the water you run from the tap. The cost perfectly mirrors your usage, ensuring fairness, efficiency, and a direct link between what you pay and the value you receive. This approach is also known by several other names, including usage-based pricing (UBP), metered pricing, or pay-as-you-go (PAYG).

This model operates on the principle of value alignment. It directly links the price a customer pays with the value they extract from a product or service. The specific unit of consumption that is measured—be it API calls, data processed, or tasks completed—is called a "value metric," and it is carefully chosen to represent the primary way a customer benefits from the software. This approach eliminates the waste inherent in unused licenses and fosters a relationship built on transparency and trust.

Market Momentum: The Data Behind the Shift

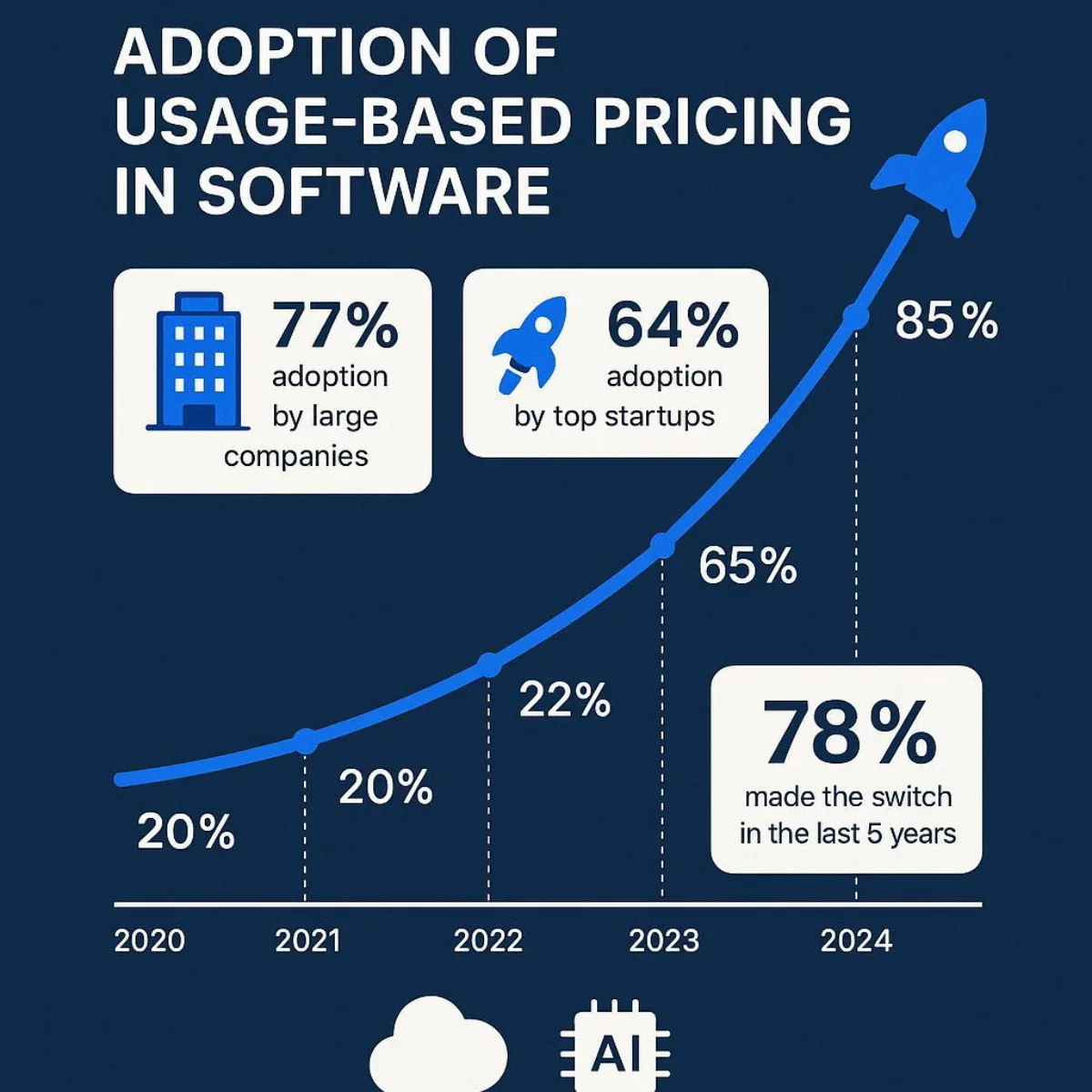

This is not a niche movement confined to tech startups. The adoption of consumption-based models is a mainstream, accelerating phenomenon across the entire B2B software industry. Recent data paints a clear picture of a market in transformation:

- A January 2025 survey revealed that an overwhelming 85% of software companies have now adopted some form of usage-based pricing.

- This adoption spans the entire market, including 77% of the largest software companies and 64% of the high-growth startups on Forbes' Next Billion-Dollar list, validating its effectiveness at every scale.

- The pace of change is quickening. Of the companies that have adopted UBP, 78% did so within the last five years, with nearly half making the switch in the last two years alone, indicating a snowball effect as the model proves its value.

- This represents a dramatic increase from just a few years ago. In 2020, only 35% of SaaS companies had adopted UBP; by 2023, that number had surged to over 55%, and according to Maxio's 2025 pricing trends report, it has now reached 67%.

The primary catalysts for this rapid adoption are the maturation of the cloud, which provided the technical foundation for dynamic consumption, and the recent explosion in AI and machine learning, where resource-intensive models make fixed-price licenses impractical and misaligned with underlying costs.

| Year | UBP Adoption Rate |

|---|---|

| 2020 | 35% |

| 2022 | 52% |

| 2023 | 67% |

| 2025 | 85% |

| Data synthesized from industry reports by OpenView, Maxio, and Metronome | |

The Win-Win Scenario: Benefits for Your Business and Your Customers

The rapid adoption of consumption-based pricing is fueled by a powerful dynamic: it creates a clear win-win scenario, offering compelling advantages for both the customers who buy the software and the companies that sell it. This alignment of interests fundamentally transforms the vendor-customer relationship from a periodic, transactional negotiation into a continuous, collaborative partnership.

For Your Customers: The Power of Control and Efficiency

For enterprises adopting new software, the benefits are immediate and tangible, placing control firmly in their hands.

- Pay Only for Value Received: The most significant advantage is the elimination of waste. Costs are directly tied to actual usage, ensuring that every dollar spent generates a return. In fact, 80% of customers report that usage-based models provide a better alignment with the value they receive.

- Lower Barrier to Entry: High upfront costs and long-term commitments often create significant friction in the procurement process. Consumption models allow teams to start small, often with a free tier or at a very low cost, to experiment with a tool and prove its value before scaling their investment. This can bypass complex, executive-level approval cycles for initial adoption.

- Flexibility and Scalability: Business needs are not static. Consumption pricing allows costs to scale up or down seamlessly with demand, accommodating seasonal peaks, periods of rapid growth, or market downturns without the need to renegotiate contracts or pay for unused capacity.

- Increased Transparency and Trust: Metered billing provides clear visibility into how costs are generated. Customers can monitor their consumption in real-time, control their spending, and trust that the pricing is fair, which strengthens the vendor relationship.

For Your Company: A Sustainable Growth Engine

For software vendors, adopting a consumption model is not an act of charity; it is a powerful strategy for driving sustainable, long-term growth.

- Increased Customer Acquisition: By lowering the financial barrier to entry, companies can attract a much wider range of customers, including smaller businesses or departments within large enterprises that would otherwise be priced out. This expands the total addressable market (TAM) without a proportional increase in sales and marketing spend.

- Organic Revenue Expansion: This is perhaps the most powerful benefit. As customers find more value in a product, their usage naturally increases, and so does revenue. This "passive upselling" leads to superior Net Dollar Retention (NDR), a critical measure of a SaaS company's health. Companies with usage-based models have been shown to grow revenue 38% faster than the broader SaaS index.

- Deeper Customer Insights: The granular usage data collected is a strategic asset. It provides a real-time feedback loop, revealing which features are most valuable, how different customer segments behave, and where there are opportunities for product improvement. This data-driven approach informs the product roadmap and helps sales teams identify expansion opportunities proactively.

- Stronger Investor Appeal: The financial markets have taken notice. Investors increasingly favor companies with usage-based models due to their higher growth rates and best-in-class NDR. Publicly traded UBP companies often trade at a significant valuation premium compared to their subscription-only peers, as investors recognize the durability of a growth model tied directly to customer success.

This model forces a vendor to become deeply invested in its customers' success. If customers don't use the product, the vendor doesn't generate significant revenue. This creates a powerful incentive for every team—from product and engineering to sales and support—to focus on a single, unifying goal: helping customers achieve their desired outcomes. This virtuous cycle, where customer success drives vendor revenue, which in turn funds further product improvements, creates a far more resilient and healthy business model than one based on periodic contract renewals.

A Practical Guide to Consumption Models: Finding the Right Fit

"Consumption-based pricing" is not a monolithic concept but rather a spectrum of models, each designed to suit different products, customer types, and business objectives. The most successful companies often blend these approaches into a hybrid model that balances customer flexibility with revenue predictability. Understanding these variations is the first step for any executive team considering a transition.

| Model Type | How It Works | Best For | Real-World Example(s) |

|---|---|---|---|

| Pay-As-You-Go (PAYG) | Pure usage-based billing with no base fee. Customers pay only for the resources they consume. | Infrastructure (IaaS), APIs, cloud services with highly variable or unpredictable demand. | Amazon Web Services (AWS), Google Cloud Platform (GCP) |

| Tiered Consumption | Predefined usage tiers with set prices and features. Customers automatically move to a higher tier as their usage grows. | SaaS platforms with clear customer segments and predictable growth paths. | Zapier (charges by tasks), OpenAI (charges by tokens) |

| Volume-Based | The price per unit decreases as the total consumption volume increases, creating an incentive for higher usage. | Communication platforms (CPaaS), data services, and API-heavy products. | Twilio (per-message/minute rates decrease with volume) |

| Prepaid Credits (Tokens) | Customers purchase a block of credits upfront and draw them down as they use the service. This provides predictability for customers and guaranteed upfront revenue for vendors. | AI services, email marketing platforms, and services where usage can be easily unitized. | Mailchimp, Snowflake (credits for compute) |

| Hybrid (Base + Overage) | A fixed recurring fee includes a generous usage allowance. Any consumption beyond the allowance is billed at a per-unit overage rate. | Enterprise SaaS where customers need budget predictability but also the flexibility to exceed limits without service interruption. | Datadog, New Relic |

| Commit & Drawdown | Customers make a large, annual commitment, often for a discounted rate. They can then draw down from this commitment flexibly throughout the year, with an annual "true-up" for overages. | Large enterprises with significant but fluctuating usage needs that want to lock in favorable rates and simplify procurement. | Microsoft Azure (Reserved Instances), Snowflake (Capacity Plans) |

The C-Suite Playbook: What Consumption Pricing Means for Your Role

Transitioning to a consumption-based model is a strategic business transformation, not just a finance project. It requires buy-in and active participation from every corner of the C-suite, as it fundamentally reshapes technology, finance, and go-to-market strategies.

For the Visionary CTO: Architecture is Strategy

For a Chief Technology Officer, the shift to UBP elevates the role of technical architecture from a backend necessity to a core component of the business strategy. The pricing model's success or failure rests on the engineering team's ability to build systems that can support it.

- The Challenge: A consumption model is not a simple switch in a billing system; it's a profound engineering challenge. The architecture must be designed from the ground up to enable, not constrain, monetization. This requires:

- Real-Time Metering: The ability to accurately track and aggregate billions of usage events (like API calls or data processed) without failure is non-negotiable. This requires a robust, scalable data pipeline—like solutions you find in enterprise-ready systems described in the executive blueprint for Industry 4.0 transformation.

- Flexible Billing Engine: The system must handle complex pricing logic, including tiers, volume discounts, and custom enterprise contracts, without requiring constant re-engineering.

- Customer-Facing Transparency: Customers will demand real-time dashboards to monitor their usage and forecast their costs. This transparency is a feature in itself and is critical for building trust.

- The Opportunity: While challenging, a well-architected UBP system becomes a strategic asset. The granular usage data it generates provides a direct, unfiltered view into customer behavior, highlighting which features drive the most value and informing the product roadmap with quantitative evidence. It also creates a framework for rapid pricing experimentation, allowing the company to A/B test different models and optimize for revenue growth.

- The Baytech Consulting Approach: For a CTO, the choice of a development partner becomes paramount. At Baytech Consulting, our Tailored Tech Advantage philosophy means we architect systems with monetization as a primary consideration. Leveraging a modern tech stack that includes Kubernetes, Docker, and Azure DevOps , we build scalable, resilient architectures designed to handle the high-volume, real-time event tracking essential for accurate metering. This ensures that your pricing strategy is built on a rock-solid and future-proof technical foundation.

For the Strategic CFO: Taming the Predictability Beast

For a Chief Financial Officer, the word "variable" often triggers alarm bells. The primary challenge of UBP is navigating the shift from the predictable, recurring revenue of fixed subscriptions to a more dynamic model.

- The Challenge: The biggest hurdle for CFOs is the perceived lack of revenue predictability, which can complicate forecasting, budgeting, and cash flow management. The financial volatility, especially in pure pay-as-you-go models, can make long-term planning more difficult.

- The Solution: The market has evolved sophisticated solutions to this very problem. Rather than adopting a pure PAYG model, CFOs should champion hybrid approaches that offer the best of both worlds:

- Hybrid Models: Implementing models like Prepaid Credits or Commit & Drawdown provides a predictable revenue floor from upfront commitments while still capturing the upside from increased consumption—as discussed in this executive guide to AI-driven software ROI.

- Customer Empowerment: Providing customers with tools like real-time usage dashboards, spending forecasts, and automated alerts for approaching thresholds empowers them to manage their own budgets. This proactive transparency prevents "bill shock," reduces billing disputes, and builds immense customer trust.

- The Hidden Upside for Finance: While monthly revenue may fluctuate, UBP is a powerful driver of Net Dollar Retention (NDR) —a metric that measures revenue growth from the existing customer base. It is a far more potent indicator of company health than simple revenue predictability. For enterprise-focused SaaS companies with UBP, an NDR above 125% is considered a strong benchmark, signifying that the existing customer base is a powerful, organic growth engine that is highly attractive to investors.

For the Driven Head of Sales & Marketing: Rewriting the Go-to-Market Playbook

For sales and marketing leaders, the transition to UBP requires a fundamental rethinking of the entire go-to-market (GTM) strategy, from lead generation to sales compensation.

- The Challenge: The traditional enterprise sales motion—focused on "hunting whales" and closing large, multi-year upfront contracts—is often at odds with the UBP model. Sales compensation plans tied to Total Contract Value (TCV) can inadvertently incentivize reps to push for large commitments that a usage-based model is designed to avoid—as seen in the discussions on the business risks of public AI tool adoption.

- The New Strategy: The GTM playbook must shift from a transactional focus to a relational one, centered on a "land-and-expand" motion.

- Marketing: The marketing message shifts to emphasize the low barrier to entry, flexibility, and fairness of the model. This is a powerful tool for product-led growth (PLG), using free tiers or low-cost entry points to acquire a wide base of users who can experience the product's value firsthand— similar to modern digital-first platforms in healthcare.

- Sales: The salesperson's role evolves from a deal-closer to a strategic advisor. Their goal is to get customers started and then use usage data to identify opportunities for expansion, proactively helping customers get more value from the product, which in turn drives more consumption.

- Compensation: Sales incentives must be realigned. Instead of rewarding only the initial booking, compensation plans should be tied to metrics that reflect the new goals, such as consumption growth, expansion revenue, or net retention rates.

This transformation necessitates deep, cross-functional alignment. A usage-based model cannot be implemented in a silo. Engineering must build the infrastructure, product must design for valuable usage, sales and marketing must sell the model, and finance must forecast the revenue. This interdependence forces a level of collaboration that breaks down traditional departmental barriers, uniting the entire organization around the singular goal of driving customer success.

Navigating the Transition: Acknowledging and Overcoming the Hurdles

While the benefits are compelling, the path to implementing a consumption-based model is not without its challenges. A successful transition requires acknowledging these hurdles upfront and developing a thoughtful, phased strategy to overcome them.

Challenge 1: Choosing Your Value Metric (The One-Way Door)

This is the most critical and difficult decision in the entire process. The value metric is the foundation of the pricing model; if it's wrong, the entire structure is flawed. It must be:

- Value-Aligned: It must directly correlate with the value the customer receives. The more they use it, the more benefit they should get.

- Easy to Understand: Customers should be able to intuitively grasp what they are being charged for and why.

- Scalable: It should apply to both small and large customers and grow with them.

For example, a customer support chatbot that charges per "message sent" has a weak value metric; a customer could send many messages without resolving an issue. A chatbot that charges per "issue resolved" has a strong, outcome-oriented value metric that customers are happy to pay for. For a broader industry perspective on how metrics impact operational efficiency versus real outcomes, see this piece on IoT and Edge Computing value drivers.

Challenge 2: The Risk of "Bill Shock" and Customer Resistance

Customers, especially those in enterprise finance departments, value predictability. The fear of a runaway, unpredictable bill is the single greatest source of resistance to UBP. A single instance of "bill shock" from an unexpectedly large invoice can irreparably damage trust.

- Mitigation: The solution is radical transparency and proactive communication. Companies must provide customers with tools to monitor their usage in real time, set budget alerts, and forecast future spending—approaches that are now best practice when rolling out true usage-based or agile digital service models. Furthermore, the transition itself must be over-communicated, leading with the value proposition and giving customers ample time and support to adjust.

Challenge 3: The Need for Organizational and Technical Readiness

As highlighted in the C-suite playbook, this is a company-wide transformation that requires significant investment in both technology and people. It demands:

- Executive Alignment: A "Chief Alignment Officer" or a dedicated cross-functional team must be empowered to drive the change across departments.

- Technical Implementation: The backend systems for metering, billing, and analytics must be robust, scalable, and accurate.

- GTM Realignment: Sales and marketing teams need to be retrained, and compensation plans must be completely overhauled.

Successfully navigating this transition requires both strategic foresight and flawless technical execution. A partner with proven expertise in agile development and building enterprise-grade systems can significantly de-risk the process. At Baytech Consulting, our Rapid Agile Deployment methodology ensures that the complex systems needed for metering and billing are built efficiently and transparently, allowing your team to focus on the critical strategic and go-to-market shifts.

The Future is Usage-Based: Your Next Steps

The enterprise shift from seat-based licenses to consumption-based pricing is an inevitable and overwhelmingly positive evolution. It marks the maturation of the software industry, moving from selling promises in a box to delivering measurable results as a service. This model better aligns the cost of technology with the value it creates, fostering stronger partnerships, driving sustainable growth, and ultimately rewarding the companies that deliver the most tangible outcomes for their customers.

For executives charting the course for their organizations, the time to act is now. Here are three actionable steps to begin your journey:

- Analyze Your Data: The first step is to look inward. Instrument your product to gain a deep understanding of current usage patterns. Who are your power users? Which features create the most value? This data is the foundation of any future pricing strategy.

- Talk to Your Customers: Go directly to the source. Survey your key accounts and strategic partners. Ask them about their preference for predictability versus flexibility. Most importantly, work with them to identify what they consider to be your product's primary "value metric." Their answer may surprise you.

- Assess Your Technical Readiness: Engage your CTO and engineering leaders in a frank discussion. Can your current systems accurately and reliably meter usage in real-time? Do you have a billing system that can handle the complexity of a hybrid consumption model? This technical audit is a critical prerequisite for a successful transition.

This transformation presents a significant opportunity for growth and competitive differentiation, but the technical and strategic path can be complex. If you're exploring how a custom software solution can be architected from the ground up to support a modern, consumption-based business model, the team at Baytech Consulting is ready to help. Let's have a conversation about building your future.

Further Reading

- https://metronome.com/state-of-usage-based-pricing-2025

- https://www.lek.com/insights/tmt/us/ei/navigating-consumption-based-pricing-models-enterprise-customers

- https://www.forbes.com/sites/metronome/2025/08/01/the-proven-playbook-for-shifting-to-usage-based-pricing/

About Baytech

At Baytech Consulting, we specialize in guiding businesses through this process, helping you build scalable, efficient, and high-performing software that evolves with your needs. Our MVP first approach helps our clients minimize upfront costs and maximize ROI. Ready to take the next step in your software development journey? Contact us today to learn how we can help you achieve your goals with a phased development approach.

About the Author

Bryan Reynolds is an accomplished technology executive with more than 25 years of experience leading innovation in the software industry. As the CEO and founder of Baytech Consulting, he has built a reputation for delivering custom software solutions that help businesses streamline operations, enhance customer experiences, and drive growth.

Bryan’s expertise spans custom software development, cloud infrastructure, artificial intelligence, and strategic business consulting, making him a trusted advisor and thought leader across a wide range of industries.