How to Budget for Custom Software in 2026: Cost Drivers, Risk, and ROI Revealed

September 13, 2025 / Bryan ReynoldsStrategic Budgeting for Custom Software Development: A 2026 Forecast and Financial Playbook

Executive Summary

As organizations navigate the technological landscape of 2026, the strategic imperative to develop custom software solutions has never been more pronounced. However, the financial methodologies underpinning these investments must evolve with equal rapidity. This report provides a comprehensive financial playbook for senior leadership, outlining a strategic framework for budgeting, risk mitigation, and investment justification for custom software projects. The analysis demonstrates that successful budgeting in 2026 is no longer a simple exercise in minimizing upfront costs; it is a sophisticated practice of optimizing for long-term value, agility, and resilience in an increasingly AI-driven and economically complex environment.

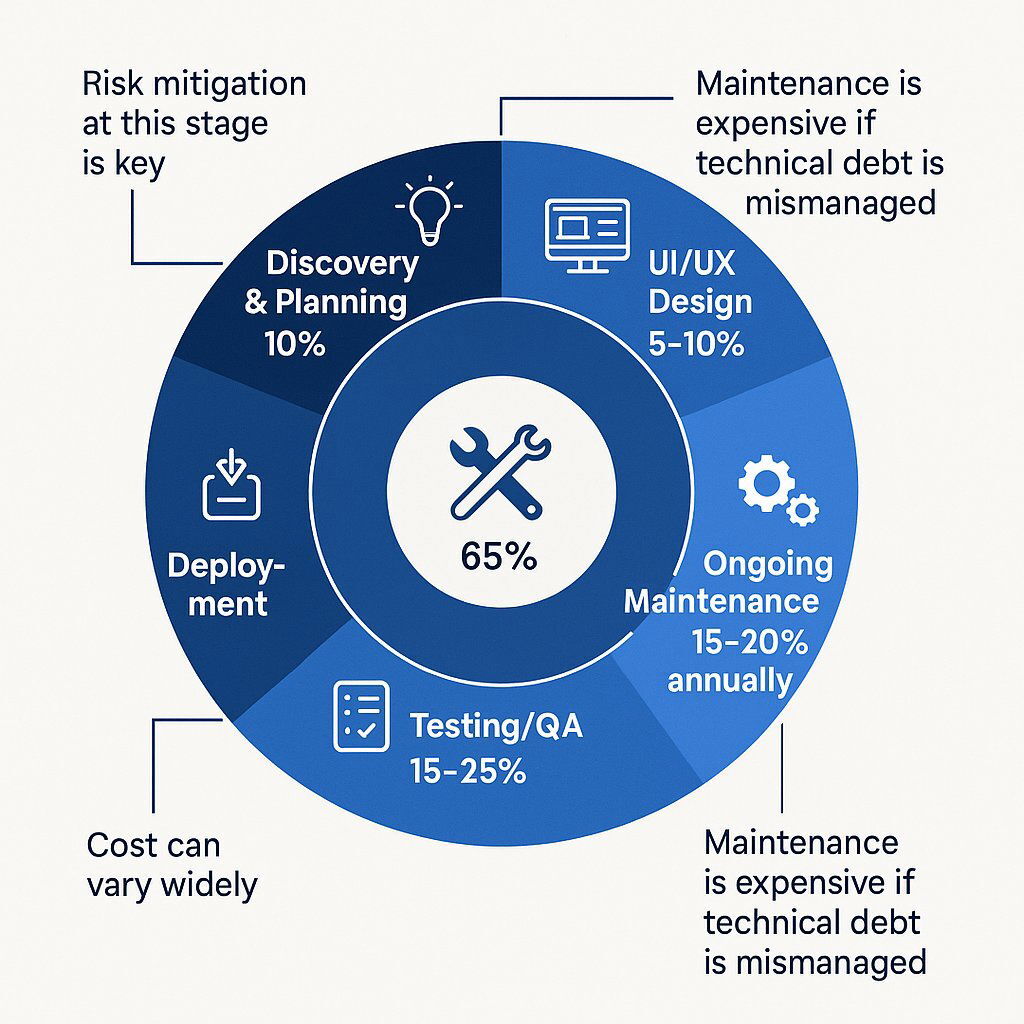

The primary cost drivers for custom software remain rooted in project scope, complexity, and team composition. However, their interplay is becoming more intricate. A project's financial lifecycle consumes resources predictably across distinct phases—with development (coding) commanding up to 65% of the initial budget—but the true determinant of long-term cost is the rigor applied during the initial discovery and planning phase. A marginal over-investment in upfront strategy yields a disproportionate reduction in total cost of ownership (TCO) by mitigating expensive rework and technical debt.

Strategic sourcing and engagement models present a critical lever for cost management. The global talent market offers significant labor arbitrage opportunities, with hourly rates for senior developers in regions like Eastern Europe or Latin America being 40-60% lower than in North America. Yet, these savings are frequently offset by hidden costs associated with communication overhead, quality control, and reduced innovation in poorly managed offshore engagements. The optimal 2026 strategy will be a "blended-shore" model, pairing onshore strategic oversight with nearshore development and leveraging hybrid pricing models that balance budget predictability with agile flexibility.

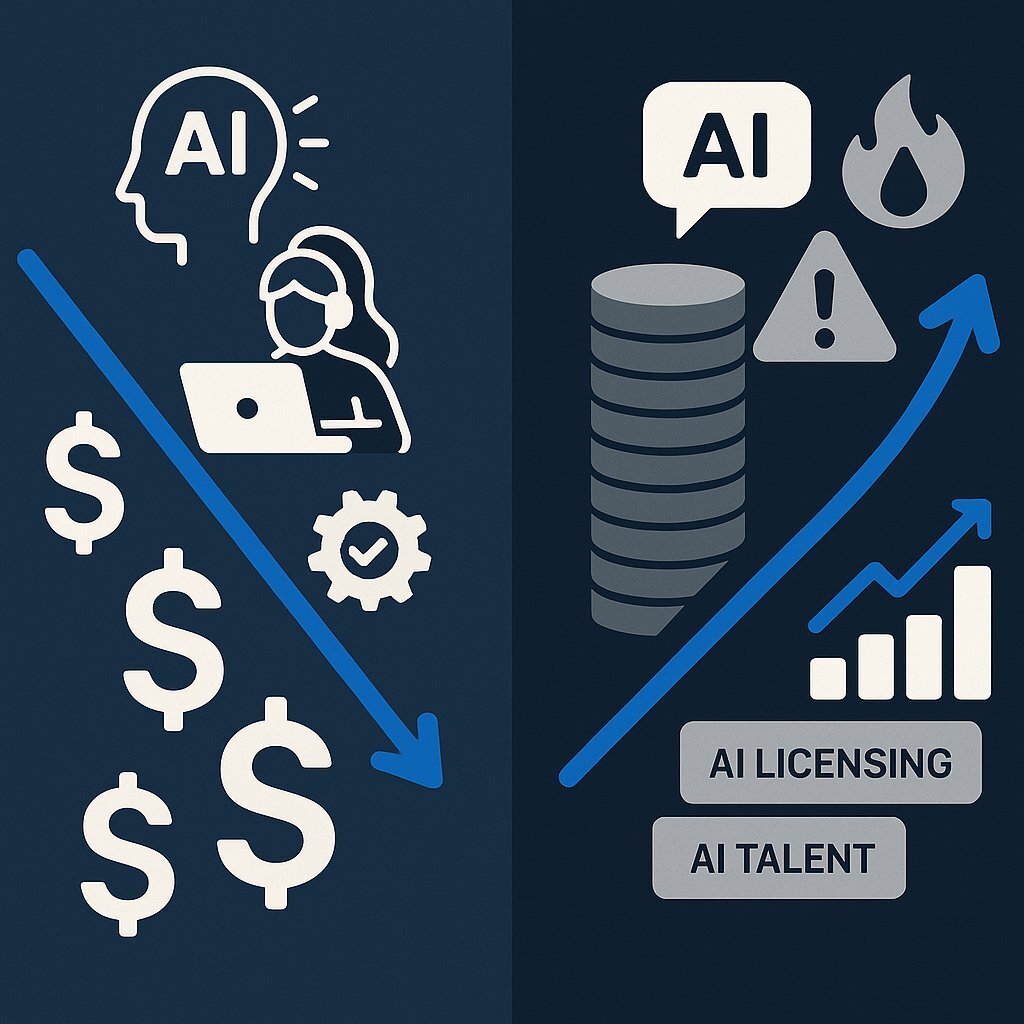

Looking toward 2026, several transformative trends will fundamentally alter the structure of software budgets. The integration of Artificial Intelligence (AI) presents a dual impact: AI-powered development tools promise to enhance developer productivity and reduce coding costs (learn how AI contributes to software development efficiency), while the creation of custom AI features introduces a new, significant, and high-risk expense category that could consume 20-25% of the total IT budget. Concurrently, the labor market is bifurcating, with flattening demand for generalist developers and soaring, premium salaries for specialists in AI, cybersecurity, and cloud financial operations (FinOps). These trends, coupled with the non-negotiable and growing costs of advanced cybersecurity and regulatory compliance, necessitate a paradigm shift from static, project-based budgeting to a dynamic, portfolio-based financial management system.

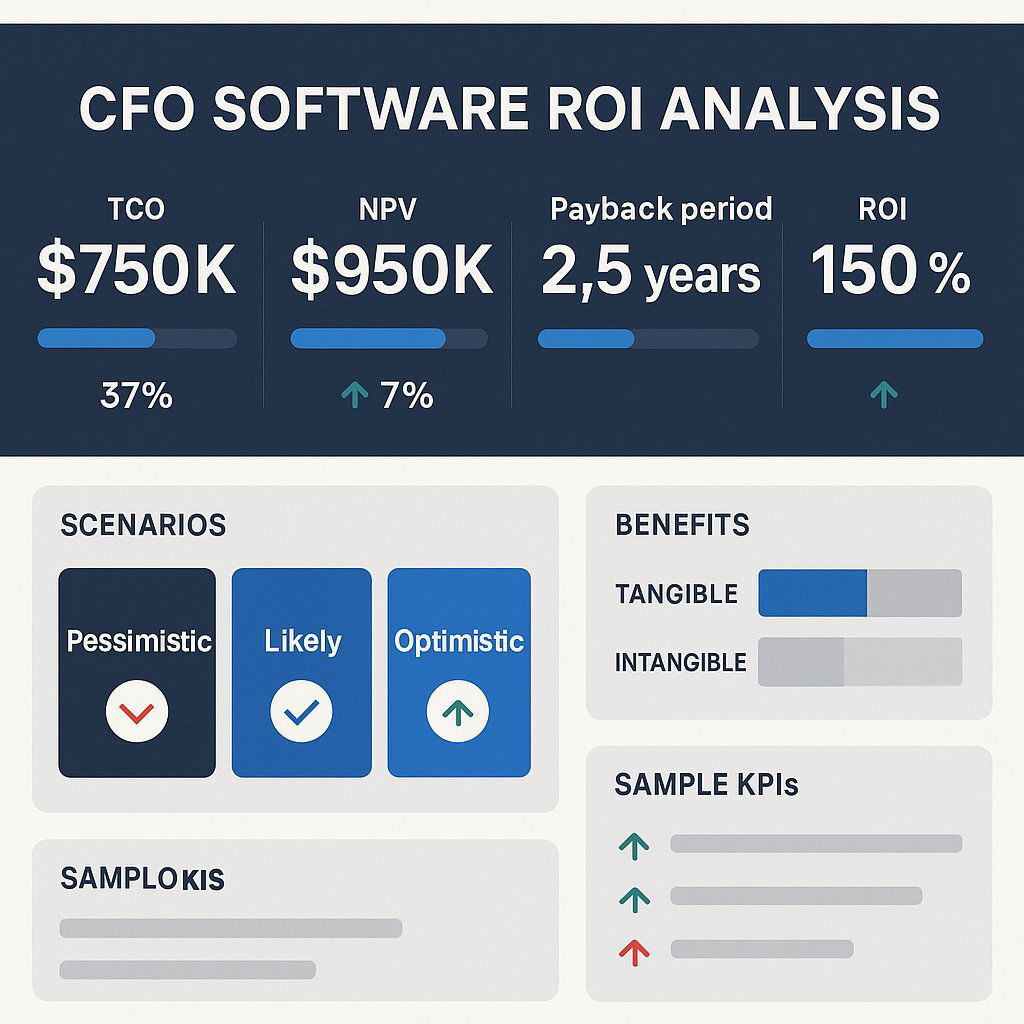

Finally, justifying this multifaceted investment requires a financial narrative that resonates with CFOs and boards of directors. This report concludes by providing a robust framework for calculating not just simple Return on Investment (ROI), but also more sophisticated metrics such as Total Cost of Ownership (TCO), Net Present Value (NPV), and Payback Period. By quantifying both tangible benefits like operational efficiency and intangible gains like enhanced customer satisfaction, leaders can build a compelling business case that frames custom software not as an expense, but as a strategic investment in future growth and competitive advantage.

Section 1: Anatomy of a Custom Software Budget

Establishing a defensible and realistic budget for a custom software project begins with a granular understanding of its core financial components. The final cost is not a monolithic figure but the sum of numerous interconnected variables. Deconstructing these drivers, understanding how costs are allocated across the project lifecycle, and recognizing the profound impact of team structure are the foundational pillars of effective financial planning. This section provides a detailed analysis of these elements, moving beyond a simple list of expenses to explain the causal relationships that shape the economic reality of software development.

1.1 Deconstructing the Core Cost Drivers: From Scope Complexity to Technology Stack

The primary inputs into any software cost model are a set of fundamental project characteristics. These variables are not independent; a decision in one area, such as technology stack, has cascading effects on others, like team composition and long-term maintenance costs.

- Project Scope & Complexity: This is the most significant determinant of cost. It is crucial to distinguish between project size—the number of features, screens, or user stories—and project complexity, which refers to the intricacy of the underlying business logic, the sophistication of algorithms, and the depth of required integrations. For instance, a basic, informational website or mobile application with limited backend functionality may fall within a $5,000 to $30,000 range. In stark contrast, an enterprise-grade, AI-driven analytics platform or a multi-tenant SaaS application can easily exceed $100,000 and often surpasses $500,000. This vast delta is driven by complexity factors such as the number of distinct user roles and profiles, the need for real-time data processing, intricate backend systems, and highly customized user interface designs.

- Technology Stack: The specific combination of programming languages, frameworks, libraries, and databases chosen to build the application directly influences the budget. Technologies that are widely adopted, such as JavaScript (with frameworks like React) and Python, benefit from large global talent pools, which can exert downward pressure on labor costs. Conversely, projects requiring niche or highly specialized technologies—such as certain AI/ML frameworks, blockchain protocols, or legacy system languages—will command premium rates due to the scarcity of proficient developers. Furthermore, the choice between open-source and proprietary technologies has direct financial implications. Leveraging open-source frameworks can reduce or eliminate licensing fees, while opting for proprietary software or platforms may entail significant upfront and recurring costs.

- Integrations: Modern software rarely exists in isolation. The necessity of integrating with existing third-party systems—such as Customer Relationship Management (CRM) platforms, Enterprise Resource Planning (ERP) systems, payment gateways, and marketing automation tools—is a major and frequently underestimated cost driver. These integrations can add a substantial 30-50% to the total cost of enterprise-level projects. The complexity arises from ensuring data compatibility, establishing secure communication protocols via APIs, and handling potential conflicts between systems. Many of these third-party services also carry their own licensing, subscription, or usage-based API fees, which become a recurring operational expense.

- Security & Compliance: For projects in regulated industries such as healthcare, finance, or government, adherence to strict security and compliance standards is a non-negotiable and significant cost center. Meeting regulations like HIPAA or GDPR requires specialized development practices, robust data encryption, rigorous security audits, penetration testing, and comprehensive documentation. The financial consequences of non-compliance are severe; the cost of remediation, legal settlements, and business disruption can be nearly triple the cost of proactive implementation, making this a critical area for upfront investment.

1.2 The Financial Lifecycle of a Software Project: A Phase-by-Phase Cost Breakdown

A software budget is not consumed in a single transaction but is allocated across a well-defined project lifecycle. Understanding the typical distribution of costs across these phases allows for more accurate forecasting and provides a framework for identifying potential budgetary imbalances.

| Development Phase | Percentage of Initial Budget | Key Activities & Deliverables | Cost Optimization Notes |

|---|---|---|---|

| Discovery & Planning | 10% | Requirements gathering, stakeholder interviews, feasibility analysis, Software Requirements Specification (SRS) document. | Thorough discovery minimizes costly rework and scope creep in later, more expensive phases. |

| UI/UX Design | 5-10% | Wireframes, high-fidelity mockups, interactive prototypes, user journey mapping. | Utilize established design systems or templates for non-critical user interfaces to accelerate this phase. |

| Development (Coding) | 65% (40% Backend, 25% Frontend) | Writing backend (server, API, database) and frontend (user interface) code. | Leverage open-source frameworks and low-code/no-code platforms where appropriate to speed up development of standard features. |

| Testing & Quality Assurance | 15-25% | Manual testing, automated test script development, performance testing, security audits, bug reports. | Implementing automated testing early reduces long-term manual effort and catches bugs when they are cheapest to fix. |

| Deployment & Launch | Variable | Server setup and configuration, CI/CD pipeline implementation, release management, data migration. | A well-planned deployment strategy avoids costly downtime and rollback scenarios. |

| Ongoing Annual Maintenance | 15-20% of Initial Cost (Annually) | Bug fixes, security patches, performance tuning, updates for new OS/browsers, infrastructure monitoring. | This is a recurring operational expense, critical for calculating Total Cost of Ownership (TCO). Proactive maintenance prevents larger, more expensive failures. |

1.3 Team Composition as a Primary Cost Lever: Structuring for Efficiency and Expertise

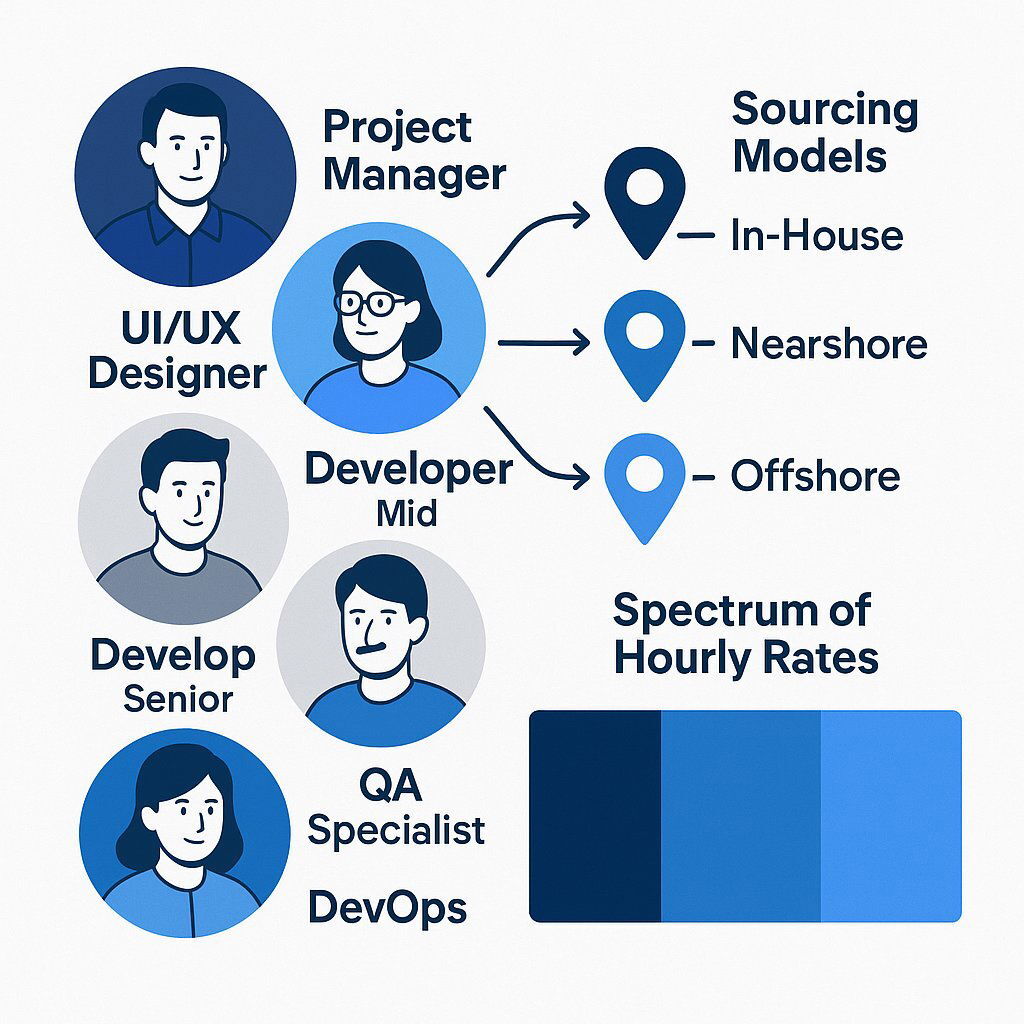

The single largest expense in most software budgets is labor. Consequently, the size, structure, seniority, and sourcing model of the development team are primary levers for controlling project costs.

- Team Roles & Structure: A standard software development team is a cross-functional unit comprising several key roles. These typically include a Project Manager (responsible for timeline and budget), a UI/UX Designer (responsible for user experience), Software Developers (writing the code), and QA Engineers (testing the application). For more complex projects, a DevOps Engineer (managing infrastructure and deployment pipelines) may also be essential. The required seniority mix is a key cost determinant. A project that can be effectively handled by a team of mid-level developers led by a single senior architect will be significantly less expensive than a project demanding multiple senior specialists for complex tasks like machine learning or cybersecurity.

- In-House vs. Outsourcing: One of the most fundamental strategic decisions is whether to build an in-house team or to outsource development to an external partner. Building and maintaining an in-house team, particularly in high-cost regions like the United States, is a substantial financial commitment. An eight-person team can easily cost over $1 million per year in salaries, benefits, and overhead alone. Outsourcing, by contrast, provides access to a global talent pool at a wide range of price points and offers greater flexibility to scale the team up or down as project needs change. This decision extends beyond pure cost; it involves a strategic trade-off between control, speed to market, long-term knowledge retention, and capital expenditure.

- Hourly Rates by Experience: Labor costs are typically calculated based on hourly rates that vary significantly by role, experience level, and geographic location. As a baseline, typical hourly rates in the global market for outsourced talent can range from $50-$150 for a Project Manager, $40-$150 for a Software Developer, and $30-$100 for a QA Engineer. These figures underscore the importance of team structure; adding a single senior developer at the high end of the range can impact the weekly burn rate by thousands of dollars.

Section 2: Strategic Sourcing and Engagement Models

Beyond the intrinsic costs of a software project, the strategic decisions regarding who builds the software and how that engagement is structured are paramount in shaping the final budget. These choices determine how financial risk is allocated, how flexible the project can be, and how effectively labor costs can be managed. This section provides a framework for navigating these critical decisions, comparing financial models, analyzing the global talent market, and uncovering the often-overlooked costs of distributed teams.

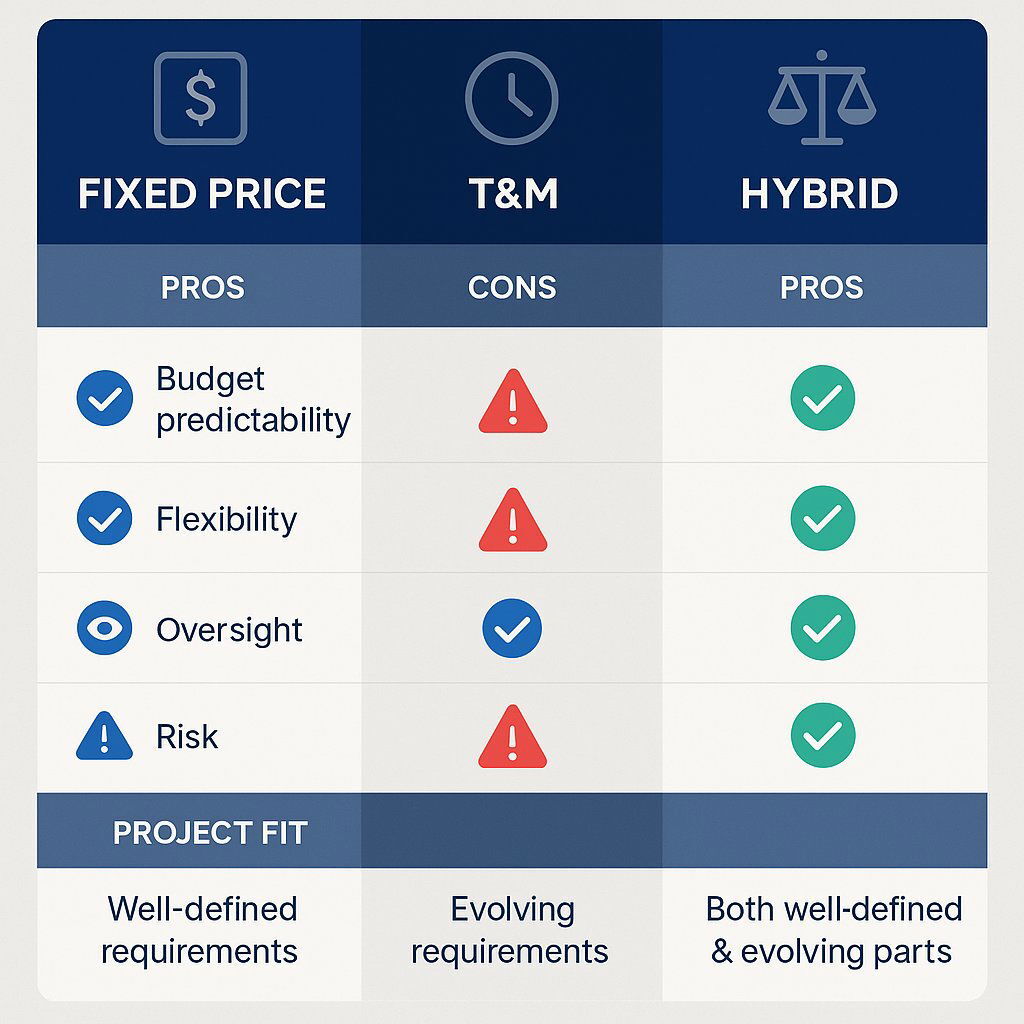

2.1 Choosing Your Financial Framework: A Comparative Analysis of Fixed Price, Time & Materials, and Hybrid Models

The pricing model of a software development contract is not merely a payment mechanism; it is a framework that defines risk, flexibility, and the nature of the client-vendor relationship. For a detailed exploration of these software contract models and ROI implications, see Time & Materials vs. Fixed Price: Which Software Development Contract Model Delivers Better ROI?.

- Fixed Price (FP): In this model, the vendor agrees to deliver a specific scope of work for a single, predetermined price.

- Advantages: The primary benefit is budget predictability. The client knows the total cost upfront, which simplifies financial planning and requires minimal ongoing oversight of the development process.

- Disadvantages: The FP model is notoriously rigid. Any change to the initial requirements, no matter how small, typically requires a formal, often bureaucratic and costly, change order process. This inflexibility is a poor fit for the inherently iterative nature of software development. To protect themselves from unforeseen complexity, vendors often build a significant risk premium (a buffer) into the fixed price, meaning the client may be overpaying. More dangerously, if a vendor underbids, they may be forced to cut corners on quality to protect their margins, leading to technical debt and long-term maintenance issues.

- Best Fit: This model is only suitable for small, short-term projects where the requirements are exceptionally well-defined, stable, and carry virtually no ambiguity.

- Time & Materials (T&M): This model operates on a pay-as-you-go basis. The client is billed for the actual time spent by the development team, typically at agreed-upon hourly or daily rates, plus the cost of any materials or third-party services.

- Advantages: The greatest strength of T&M is its flexibility. It allows the project scope to evolve and adapt as new information is discovered or business priorities shift, making it the natural choice for Agile development methodologies. Projects can often start more quickly as there is no need for an exhaustive upfront scoping exercise.

- Disadvantages: The primary drawback is the lack of budget predictability. The final cost is not known at the outset and can escalate if the project scope expands or is managed inefficiently. This model requires a high degree of trust and active client involvement to monitor progress, prioritize tasks, and prevent issues like scope creep or the inflation of billable hours.

- The Hybrid Model (Fixed-Price, Scope-Controlled): Recognizing the significant drawbacks of the two traditional models, a more modern, hybrid approach has emerged. This model seeks to combine the budget certainty of FP with the flexibility of T&M. A fixed budget and timeline are established for a core, well-defined set of essential features—often the Minimum Viable Product (MVP). This provides a predictable cost baseline. Beyond this core scope, a flexible, T&M-like approach is used for additional features, allowing the team to iterate and adapt based on user feedback and evolving priorities. This balanced model offers a strong framework for managing innovative projects within realistic financial constraints and is often the most effective choice.

Comparison of financial engagement models for custom software projects in 2026.

2.2 The Global Talent Equation: Onshore, Nearshore, and Offshore Cost-Benefit Analysis

With developer salaries constituting the largest portion of any software budget, strategic sourcing of talent from the global market is one of the most powerful cost-management levers available. The decision of where to locate the development team has profound financial implications. For a deeper look at global developer rates and sourcing strategy, see Scaling Kubernetes in the Enterprise: A Strategic Guide to Cost, Complexity, and Competitive Advantage.

- Defining the Sourcing Models:

- Onshore: Engaging a development team located within the same country as the client (e.g., a US-based company hiring a US-based agency). This model offers the highest degree of real-time collaboration and cultural alignment but comes at the highest cost.

- Nearshore: Outsourcing development to a neighboring country or one in a similar time zone (e.g., a US company partnering with a team in Latin America). This model aims to balance cost savings with the benefits of overlapping work hours.

- Offshore: Outsourcing to a country in a distant time zone (e.g., a US company working with a team in Eastern Europe or Asia). This model typically offers the most significant labor cost savings but presents the greatest communication and management challenges.

- Global Cost Differentials: The primary driver for nearshoring and offshoring is labor arbitrage. The disparity in hourly rates for software developers across the globe is substantial. For example, a senior software developer in North America can command an hourly rate of $120-$200 or more. In contrast, a developer with equivalent skills and experience might cost $80-$120 per hour in Eastern Europe, $70-$110 per hour in Latin America, and $60-$100 per hour in Asia. For a team of five developers, this difference can translate into hundreds of thousands of dollars in savings over the course of a year.

2.3 Beyond Hourly Rates: Quantifying the Hidden Costs and Productivity Impacts of Distributed Teams

A simplistic comparison of hourly rates is dangerously misleading. The lower sticker price of offshore talent is often accompanied by significant hidden costs and productivity drains that can erode or even eliminate the anticipated savings. A sophisticated budget must account for these qualitative factors. To help identify these, use the custom software competitive advantage checklist for hidden cost analysis.

- Communication Overhead and Productivity Lag: The most significant challenge of offshoring is the communication friction caused by large time zone differences. A simple question that could be resolved in minutes with an onshore team can result in a 24-hour delay when teams are 10-12 hours apart. This lag slows down decision-making, impedes problem-solving, and inhibits the fluid, collaborative brainstorming that is essential for innovative and complex projects. This friction translates directly into increased project hours and, therefore, increased cost.

- Increased Ramp-Up Time and Attrition Costs: Offshore teams often require a longer "ramp-up" period to understand the client's business context, industry nuances, and specific project requirements. Furthermore, some offshore markets experience high rates of developer attrition, with turnover exceeding 20% per quarter in certain cases. This means the client is caught in a costly cycle of constantly paying to onboard and train new team members, leading to a continuous loss of project-specific knowledge and persistent delays.

- Quality Degradation and Rework: Miscommunication, whether due to language barriers or cultural differences in work practices, is a leading cause of defects and low-quality code. Rework to fix these issues is a massive financial drain, with some studies indicating it can consume 40-70% of a project's total budget. The initial cost advantage is nullified if an offshore team takes four times as long to deliver a feature of acceptable quality compared to an onshore or nearshore counterpart.

- The Strategic Cost of Knowledge Transfer: When development is outsourced, critical technical expertise and business logic are built within an external organization. This knowledge is not easily retained or reinvested into the client's own company. By offshoring, an organization forgoes the opportunity to cultivate its own internal talent, who could otherwise grow into future technology leaders and form the core of an in-house innovation community.

Section 3: The Executive's Playbook for Budget Formulation

Creating a successful software budget is a structured process that transforms a business objective into a financially viable and executable plan. It requires a disciplined approach that begins with value, codifies requirements, controls scope, and strategically plans for uncertainty. This section provides a practical, step-by-step playbook for executives to guide their organizations through the budget formulation process.

3.1 Step 1: From Business Value to Ballpark Estimate

Before a single dollar of cost is calculated, the first and most critical step is to estimate the potential value the software will create for the business. This exercise fundamentally reframes the budget from a pure expense to a strategic investment. The key question is not "What will this cost?" but rather "What is this worth?". Leaders must work with stakeholders across the organization to quantify the project's expected impact. Will the software generate new revenue streams? Will it create operational efficiencies that reduce costs? Will it improve customer retention or automate manual processes?

Quantifying this value—even as a rough order of magnitude—is essential. For example, a project aimed at automating a manual data entry process can be valued by calculating the number of labor hours it will save annually, multiplied by the fully-loaded cost of those employees. This value calculation establishes the rational upper bound for the project's budget; it is impossible to know if a project makes business sense without first understanding its potential return.

Once the value is established, the next action is to develop a ballpark cost estimate. This is best achieved through a two-pronged approach. First, if an internal technology team exists, they should be tasked with creating a high-level estimate of the time (in hours or person-months) required to build the product. This provides a crucial internal baseline. Second, the high-level project concept should be shared with two or three trusted external software development firms to solicit preliminary, non-binding ballpark estimates. The convergence of these internal and external estimates will provide a realistic budget range to work with.

3.2 Step 2: Crafting the Software Requirements Specification (SRS) as a Financial Blueprint

With a value proposition and a ballpark budget in place, the next step is to translate the high-level business goals into a detailed technical and functional plan. The Software Requirements Specification (SRS) is the single most important document for ensuring budget accuracy and project success. It serves as the contract between stakeholders and the development team, meticulously detailing what the software must do. For a modern template and further discussion, refer to the Practical Guide to Software Requirements for Executives.

3.3 Step 3: The Minimum Viable Product (MVP) as a Cost-Control Strategy

One of the most powerful strategies for managing a software budget is to adopt a Minimum Viable Product (MVP) approach. An MVP is not a half-finished product; it is a strategically lean version of the product that includes only the most essential, core features necessary to solve a primary problem for a specific set of early users.

The financial benefits of this approach are substantial.

- Reduced Upfront Investment: By focusing solely on core functionality, the MVP significantly reduces the initial development cost and time, lowering the barrier to entry and minimizing initial financial risk.

- Accelerated Time-to-Market: A smaller scope allows the product to be launched much faster, enabling the organization to begin generating value (and revenue) sooner.

- Market Validation and De-risking: The most significant benefit of an MVP is that it allows the organization to test its core business assumptions with real users in a real-world environment. The feedback gathered from these early adopters is invaluable. It provides data-driven insights into which features are truly valuable and which are not, preventing the organization from investing heavily in developing complex features that nobody wants or uses. This feedback loop is a powerful mechanism for de-risking the overall investment.

3.4 Step 4: Securing Capital and the 150% Contingency Mandate

The final step in budget formulation is securing the necessary capital, which involves a critical principle of risk management often overlooked by inexperienced teams. Custom software development is an exercise in discovery, and with discovery comes uncertainty. Unforeseen technical challenges will emerge, requirements may need to evolve based on market feedback, and previously unknown complexities will be uncovered.

A rigorous approach to contingency planning and risk assessment is crucial, especially for projects in rapidly changing sectors. To learn more about how to assess and mitigate these risks, see AI Governance and Asset Management: The Strategic Framework for the Modern Enterprise.

Section 4: Navigating the Unseen: Hidden Costs and Financial Risk Mitigation

A common reason for software project failure is a budget that accounts only for the visible costs of development while ignoring the significant, often-unseen expenses that emerge during and after the project. A robust financial plan must proactively identify, quantify, and mitigate these hidden costs. This section provides a framework for uncovering these financial risks and building a budget resilient enough to withstand them.

4.1 Identifying and Quantifying Hidden Costs: A Comprehensive Checklist

Many expenses are frequently omitted from initial quotes and internal estimates but can dramatically inflate the Total Cost of Ownership (TCO). Leaders must be vigilant in seeking these out. For advice from the construction and manufacturing sectors—where hidden costs can be substantial—see How Custom Software Solves Manufacturing’s Supply Chain Crisis.

- Technical Debt: This is the implicit cost of rework caused by choosing an easy, limited solution now instead of using a better approach that would take longer. Often incurred to meet tight deadlines, these "hacks" and shortcuts result in suboptimal code that is brittle, difficult to maintain, and a drag on future development velocity. Paying down this debt through code refactoring is a real and significant long-term expense.

- Scope Creep: This refers to the uncontrolled and gradual expansion of project requirements beyond the initially agreed-upon scope. As stakeholders request "just one more feature," the project's timeline and budget can be silently eroded. It is one of the most common and dangerous causes of budget overruns because each small addition adds complexity and delays that are difficult to quantify in isolation.

- Third-Party Services & Integrations: The initial development quote rarely includes the ongoing operational costs of the services the software relies on. These recurring fees for APIs, cloud platforms (like AWS or Azure), payment gateways, email services, and other licensed tools can escalate quickly, especially as the user base and data volume grow.

- Infrastructure & Hosting: The costs for servers, databases, data storage, and bandwidth are not a one-time setup fee but a recurring monthly or annual expense. These costs are variable and will increase as the application scales to support more users and traffic.

- Internal Resource Costs: A significant but often unbudgeted cost is the time that an organization's own employees dedicate to the project. The hours spent by executives, project managers, subject matter experts, and end-users in meetings, providing feedback, and participating in user acceptance testing represent a substantial indirect cost that should be acknowledged.

- Training & Onboarding: The launch of new custom software often requires a significant investment in training the team that will use it. This includes the direct costs of creating training materials and conducting sessions, as well as the indirect cost of temporary productivity loss as employees adapt to new workflows and interfaces.

4.2 Building a Resilient Budget: A Framework for Risk Assessment and Contingency Planning

Identifying potential hidden costs is only the first step. A resilient budget must incorporate specific mechanisms to manage and mitigate these financial risks. If your team is transitioning to agile methods or scaling modern DevOps practices, you may benefit from DevOps Efficiency Services to proactively address cost, quality, and risk.

- The Contingency Fund Mandate: The most critical defense is a dedicated contingency fund. This reinforces the "150% Rule" discussed in the previous section. This buffer is not for discretionary features; it is explicitly reserved for absorbing the costs of unforeseen technical challenges and other risks that emerge during development.

- Formal Change Control Process: To combat scope creep, a formal change control process is essential. Any request for a change to the agreed-upon scope must be submitted through a standardized process. This process should require a formal assessment of the proposed change's impact on the project's budget, timeline, and overall business value. This ensures that decisions to alter the scope are made consciously and with a full understanding of their financial consequences, rather than being approved in an ad-hoc manner.

- Probabilistic Cost Estimation: Instead of relying on a single, deterministic cost estimate, a more sophisticated approach is to use a probabilistic model. Techniques like three-point estimating involve creating three separate estimates for the project: an optimistic scenario (best-case), a pessimistic scenario (worst-case), and the most likely scenario. These three points can be used to create a weighted average that provides a more realistic cost forecast and an inherent budget range, which better reflects the project's uncertainty.

- Ruthless Prioritization Frameworks: To manage stakeholder expectations and provide a clear, objective way to control scope, teams should employ a prioritization framework. A widely used method is MoSCoW, which categorizes all potential features into four buckets:

- Must have: Non-negotiable features essential for the product to be viable.

- Should have: Important features that are not critical for launch.

- Could have: Desirable but not necessary features; "nice-to-haves."

- Won't have (this time): Features explicitly excluded from the current project scope. This framework creates a clear hierarchy that guides decision-making when budget or timeline constraints arise.

| Cost Category | Specific Hidden Cost |

|---|---|

| Third-Party & Infrastructure | API & Licensing Fees |

| Data Storage & Hosting Scaling | |

| Data Migration | |

| Implementation & Rollout | User Training & Documentation |

| Business Disruption | |

| Implementation & Configuration | |

| Long-Term & Strategic | Technical Debt Refactoring |

| Scope Creep Buffer | |

| Annual Maintenance & Support | |

| Regulatory & Compliance Audits |

Section 5: The 2026 Horizon: Budgeting for Emerging Technological and Economic Shifts

Budgeting for a 2026 software project requires looking beyond established cost models and forecasting the impact of powerful, transformative trends. The rise of Artificial Intelligence, a bifurcating labor market, and the escalating importance of cybersecurity and cloud financial management are not future concerns—they are present-day realities that will be mature, non-negotiable factors in any 2026 financial plan. This section analyzes these shifts and provides concrete guidance on how to incorporate them into a forward-looking budget.

5.1 The AI Revolution's Impact on Your Bottom Line: AI as a Cost-Saver and a New Expense Category

The integration of Artificial Intelligence into the software development lifecycle presents a profound duality for budget planners. AI will simultaneously act as a powerful tool for cost reduction and a significant new category of expense. To see practical case studies in how organizations are integrating AI efficiently into custom software, review this recent analysis from the enterprise development field.

- AI for Efficiency (Cost Reduction): By 2026, AI-powered development tools will be standard. AI coding assistants like GitHub Copilot are already demonstrating the ability to make developers significantly more productive by automating the writing of boilerplate code, suggesting optimizations, and even helping to debug. This has the potential to reduce the time, and therefore the labor cost, associated with the core coding phase of a project. Furthermore, AI is being applied to automate repetitive tasks in Quality Assurance, such as generating test cases and analyzing results, which can further lower labor expenses. A 2026 budget must account for the software licensing costs of these productivity-enhancing tools for the entire development team.

- AI as a Feature (Cost Increase): While AI tools can lower the cost of building traditional software, building AI-powered features into custom software is a far more complex and expensive endeavor. Developing capabilities like predictive analytics engines, natural language processing for custom chatbots, or computer vision applications requires a different and more costly process than standard software development. Key cost drivers for AI projects include:

- Data Collection & Preprocessing (10-20% of AI project cost): AI models are only as good as the data they are trained on. This phase involves gathering, cleaning, labeling, and preparing massive datasets, which is a labor-intensive and costly process.

- Model Training & Tuning (20-30% of AI project cost): This involves the computationally expensive process of training and fine-tuning machine learning models, which requires significant cloud computing resources (e.g., high-end GPUs).

- Specialized Talent: AI/ML engineers and data scientists are among the most highly paid specialists in the technology industry, and their expertise is essential for a successful AI project. An AI-powered SaaS platform can cost anywhere from $100,000 to over $500,000, and even a "simple" AI chatbot can cost between $15,000 and $40,000.

- The 2026 Budgetary Shift: This dual impact will force a strategic reallocation of IT budgets. By 2026, AI will transition from an experimental, peripheral line item to a core component of technology spending, with some analysts projecting it could consume as much as 20-25% of the total IT budget. Budgeting for AI will require a two-pronged strategy: 1) investing in AI-powered tools to reduce the development cost of the entire software portfolio, and 2) allocating separate, significant, and high-risk capital for building strategic AI capabilities. Given the sobering statistics on the failure rate of custom enterprise AI initiatives—with some analyses suggesting 95% deliver zero measurable ROI—organizations must carefully weigh the risks. For many, partnering with specialized AI vendors or leveraging pre-trained models will be a more cost-effective and less risky approach than attempting to build everything in-house.

5.2 Forecasting Labor Costs: Developer Salary Trends and the Talent Market in 2026

The labor market for software developers, the largest single cost in any project, is undergoing a significant structural shift. The trends observed in 2024 and 2025 indicate that a simple, median-based approach to salary forecasting will be inadequate for 2026. For a deep dive into how these trends are shaping software delivery, see Knack Review 2025: Is It the Best No-Code Platform for Scalable B2B Apps?.

- The "Barbell" Effect on Salaries: The explosive, across-the-board growth in software developer jobs seen in the late 2010s and early 2020s began to stagnate in 2024. This cooling is attributable to a combination of macroeconomic factors, such as higher interest rates chilling speculative investment, and the nascent efficiency gains from AI development tools. This suggests that the demand for generalist developers with common skill sets may be flattening. However, at the other end of the spectrum, demand and compensation for highly specialized roles are soaring.

- The Premium for High-Demand Specialists: A 2026 budget must be prepared to pay a significant premium for top-tier talent in high-demand fields. AI-driven salary forecasting models, which analyze real-time hiring trends and skill demand, predict continued rapid salary growth for experts in AI/ML, cybersecurity, cloud automation (DevOps), and cloud financial management (FinOps). These are the roles that are most critical for building modern, scalable, secure, and intelligent applications.

- Beyond Government Projections: While government data, such as the U.S. Bureau of Labor Statistics' projection of 7% job growth for web developers through 2034, provides a useful long-term baseline, it does not capture the nuance of this market bifurcation. The economic value in software development is shifting away from the ability to simply write code—a task increasingly augmented by AI—and toward the strategic skills of system architecture, complex problem-solving, and deep expertise in specialized domains. Therefore, a budget based on attracting a "median" developer may leave an organization unable to hire the talent actually required to execute its strategic technology initiatives.

5.3 The New Necessities: Allocating for Advanced Cybersecurity, Cloud FinOps, and Regulatory Compliance

Several areas of technology spending that were once considered secondary are becoming primary, non-discretionary budget items. If you're transitioning mission-critical systems to the cloud or need to modernize your compliance, consider best practices for cloud-native business architecture and compliance.

- Cybersecurity as a Core Operational Expense: In the face of increasingly sophisticated threats, cybersecurity is no longer an optional add-on or a feature to be bolted on at the end of a project. It is a mission-critical, ongoing investment. Enterprise cybersecurity budgets are projected to continue growing at a rate of over 14% year-over-year. A 2026 software budget must include dedicated funds for implementing modern security paradigms like Zero Trust architecture, leveraging AI-enhanced threat detection systems, and conducting regular third-party security audits and penetration tests.

- The Rise of Cloud FinOps: The era of unconstrained cloud expansion is ending. As cloud adoption has matured, so too have concerns about rampant and inefficient spending on cloud services. FinOps—a cultural and operational practice that brings financial accountability to the variable spending model of the cloud—is becoming an essential discipline for any organization with a significant cloud footprint. A 2026 budget must plan for the costs of cloud cost management and optimization tools, and potentially for hiring or training dedicated FinOps professionals whose role is to monitor, forecast, and optimize cloud spend to prevent waste.

- The Growing Regulatory Burden: The global regulatory landscape for technology is becoming more complex. New regulations, most notably the EU AI Act which takes full effect in 2025, will impose new compliance obligations on many software products. Budgets for 2026 must anticipate the costs associated with meeting these new standards, which may include developing new governance features, conducting external model audits, and investing in compliance management tooling.

The confluence of these powerful trends—the dual nature of AI, the bifurcating labor market, and the rise of new, mandatory cost centers—demands a fundamental rethinking of the budgeting process itself. The traditional model of creating a static, project-based budget for a 12-month period is becoming obsolete. The variables are too dynamic and interconnected. An AI tool might slash development time for one feature, freeing up capital that is immediately needed to counter a new cybersecurity threat. Cloud spend can fluctuate dramatically based on user adoption, requiring active financial management. The old model is too rigid to accommodate this reality.

By 2026, the most effective technology leaders will manage their budgets not as static plans, but as dynamic investment portfolios. This portfolio approach involves continuously assessing and reallocating capital across several key areas: 1) investments in efficiency tools (like AI coding assistants) to lower the baseline cost of development; 2) investments in strategic capabilities (like custom AI models) with a long-term ROI horizon; and 3) investments in resilience and optimization (like cybersecurity platforms and FinOps). This active, portfolio-based financial management provides the agility required to navigate the complex and often conflicting financial pressures of the modern technology landscape.

Section 6: The CFO's Corner: Justifying the Investment with Advanced ROI Analysis

Ultimately, a software budget is a proposal for capital allocation that must withstand the rigorous scrutiny of an organization's financial leadership. To secure approval, the proposal must be framed not as a list of costs, but as a compelling business case backed by a sound financial analysis. This section provides the toolkit necessary to build that case, moving beyond simplistic metrics to the more sophisticated models of Return on Investment (ROI) that resonate with CFOs and boards of directors. For more, discover modern CFO-oriented ROI dashboards with software testing ROI strategies in B2B environments.

6.1 Beyond Simple ROI: A Primer on TCO, NPV, and Payback Period

While the basic ROI formula is a useful starting point, it is often insufficient for evaluating a complex, multi-year investment like custom software. A truly professional business case will incorporate several more advanced financial metrics.

- Simple ROI: The standard formula is

$ROI (%) = ((Net Profit / Total Costs)) * 100$. It provides a quick, high-level measure of profitability. For example, a project costing $50,000 that generates an additional $20,000 in net profit has a simple ROI of 40%. However, its primary weakness is that it treats all costs and returns as if they occur at a single point in time, ignoring the crucial element of timing. - Total Cost of Ownership (TCO): This is a more holistic and realistic approach to calculating the "cost" side of the ROI equation. Instead of focusing solely on the upfront development price, TCO captures all direct and indirect expenses incurred throughout the entire lifecycle of the software. This includes:

- Direct Costs: Initial development, implementation, configuration, data migration, and user training.

- Indirect & Recurring Costs: Ongoing annual maintenance, subscription or licensing fees, infrastructure and hosting costs, internal resource time, and future upgrades.

TCO provides a far more accurate picture of the total investment being made.

- Net Present Value (NPV): This is a cornerstone of corporate finance and a critical metric for any CFO. NPV addresses the primary weakness of simple ROI by accounting for the time value of money—the principle that a dollar received in the future is worth less than a dollar received today. NPV calculates the present-day value of all future cash flows (both inflows from benefits and outflows from costs) associated with the project, discounted at a specific rate (often the company's weighted average cost of capital). A positive NPV indicates that the project is expected to generate more value than it costs, making it a financially acceptable investment.

- Payback Period: This metric calculates the length of time required for the cumulative net cash flows from the project to equal the initial investment. It is a simple and intuitive measure of risk and liquidity. A shorter payback period generally indicates a less risky investment, as the initial capital is recouped more quickly.

6.2 Quantifying the Intangibles: Placing Value on Enhanced Productivity, Customer Satisfaction, and Competitive Advantage

One of the greatest challenges in calculating software ROI is assigning a monetary value to its "soft" or intangible benefits. However, with a structured approach, these benefits can be translated into financial terms.

- Increased Efficiency & Productivity: This is often the most straightforward intangible to quantify. The process involves identifying a specific workflow that the software will improve, measuring the time currently spent on that workflow, and estimating the time that will be spent after the software is implemented. The time saved can then be converted into a dollar value. For example, if new software reduces the time spent processing a service request from 6 hours to 2 hours, and the average hourly cost of an employee is $22, the savings per request is 4 hours * $22 = $88. Multiplied by the number of requests per year, this becomes a significant and quantifiable tangible benefit.

- Improved Customer Satisfaction & Retention: While "happier customers" is an abstract concept, its financial impact can be estimated. High user adoption and satisfaction rates are leading indicators of ROI. Leaders can link software features to specific business metrics. For instance, one can analyze historical data to determine the financial value of a 1% increase in the customer retention rate. Then, a reasonable estimate can be made of how much the new software's improved user experience will impact that retention rate, allowing for a defensible financial projection.

- Enhanced Decision-Making and Competitive Advantage: These are the most difficult benefits to quantify but are often the most strategically important. The value here can be framed through scenario analysis. For example, a business case could model the financial impact of improved inventory management enabled by the software, projecting a reduction in carrying costs or a decrease in stock-outs. The value of competitive advantage can be illustrated by estimating the potential market share gain or the cost of not making the investment and falling behind competitors.

6.3 A Practical Framework for Building the Business Case and Tracking Long-Term Value

A successful investment proposal follows a clear, logical, and data-driven process.

- Step-by-Step Business Case Development:

- Align with Strategic Objectives: Begin by clearly stating the business goals the software will achieve. Is it to increase market share, reduce operational costs, or improve compliance?

- Estimate Comprehensive Costs (TCO): Use the TCO framework to build a complete picture of all costs over a 3- to 5-year horizon.

- Quantify Tangible Benefits: Calculate the direct financial gains from cost savings and new revenue generation.

- Estimate the Value of Intangible Benefits: Use the methods described above to assign a reasonable financial value to improvements in productivity, retention, and other soft metrics.

- Build a Financial Model: Construct a spreadsheet that clearly lays out the costs and benefits over time and calculates the key financial metrics: Simple ROI, TCO, Payback Period, and, most importantly, NPV.

- Conduct a Risk Analysis: Do not present a single set of numbers. Instead, build out three scenarios: a pessimistic case (high costs, low benefits), a most likely case, and an optimistic case (low costs, high benefits). This demonstrates a thorough understanding of the project's risks and provides a more credible range of potential outcomes.

- Post-Launch Value Tracking: The financial analysis does not conclude upon budget approval. To ensure the anticipated ROI is realized, organizations must track key performance indicators (KPIs) after the software is launched. These KPIs should be directly linked to the benefits outlined in the original business case. Relevant metrics include user adoption rates, changes in process cycle time, reductions in error rates, customer satisfaction scores (NPS), and direct impacts on revenue or costs. Regularly measuring the actual ROI against the anticipated ROI validates the initial investment decision and provides the data needed to justify future enhancements and continued investment in the platform.

| Part 1: Total Cost of Ownership (TCO) Calculation (5-Year Projection) | Year 1 | Year 2 | Year 3-5 (Avg) |

|---|---|---|---|

| A. Direct Costs | |||

| Initial Development & Design | [...] | 0 | 0 |

| Implementation & Data Migration | [...] | 0 | 0 |

| Hardware & Infrastructure Setup | [...] | 0 | 0 |

| B. Indirect & Recurring Costs | |||

| Annual Maintenance & Support (15% of Dev) | [...] | [...] | [...] |

| Infrastructure & Hosting Fees | [...] | [...] | [...] |

| Third-Party Licensing/API Fees | [...] | [...] | [...] |

| User Training & Onboarding | [...] | [...] | [...] |

| Total Costs (TCO) | [...] | [...] | [...] |

| Part 2: Benefit Quantification (Annual Projection) | Year 1 | Year 2 | Year 3-5 (Avg) |

| C. Tangible Benefits (Gains) | |||

| Productivity Savings (e.g., Hrs Saved x Rate) | [...] | [...] | [...] |

| Operational Cost Reduction (e.g., legacy systems retired) | [...] | [...] | [...] |

| Increased Revenue (e.g., higher conversion/retention) | [...] | [...] | [...] |

| D. Intangible Benefits (Valuation) | |||

| Value of Improved Data for Decision-Making | [...] | [...] | [...] |

| Value of Enhanced Brand Reputation/Compliance | [...] | [...] | [...] |

| Total Benefits (Gains) | [...] | [...] | [...] |

| Part 3: Key Financial Metrics | Calculation | Result | |

| Net Profit (Total Benefits - TCO) | [...] | [...] | |

| Simple ROI (%) | (Net Profit / TCO) * 100 | [...] % | |

| Payback Period (Years) | Time to recoup initial investment | [...] Years | |

| Net Present Value (NPV) | Sum of discounted future cash flows | [...] | |

| Part 4: Risk-Adjusted Scenario Analysis | Pessimistic | Most Likely | Optimistic |

| Projected NPV | [...] | [...] | [...] |

| Projected ROI (%) | [...]% | [...]% | [...]% |

Conclusion

The process of budgeting for a custom software project in 2026 has evolved into a complex, multi-faceted strategic exercise. It is no longer sufficient to focus on minimizing upfront development costs. Instead, forward-thinking organizations must adopt a holistic perspective that prioritizes long-term value, manages a portfolio of evolving risks, and aligns technology investment directly with core business objectives.

The analysis reveals several critical conclusions for leaders planning future software investments:

- Upfront Strategy is the Point of Maximum Financial Leverage: The data consistently shows that the discovery, planning, and design phases, while representing a small fraction of the initial budget, have an outsized impact on the Total Cost of Ownership. A disciplined and even marginally higher investment in these early stages directly mitigates the risks of scope creep and technical debt, which are the primary drivers of budget overruns during the far more expensive development and maintenance phases.

- Sourcing is a Strategic Trade-off, Not Just a Cost Decision: The global talent market offers compelling opportunities for labor cost reduction. However, a purely cost-driven offshoring strategy for complex projects is fraught with hidden expenses related to communication friction, quality control, and a loss of strategic agility. The optimal approach for 2026 is a nuanced, "blended-shore" model that keeps core strategic functions onshore while leveraging nearshore talent for well-defined development, thereby balancing cost, control, and collaboration.

- The Budget Itself Must Become Agile: The technological and economic landscape of 2026 is too dynamic for static, annual budgets. The simultaneous emergence of AI as both a productivity tool and a major new expense category, combined with a bifurcating labor market and escalating mandatory costs for cybersecurity and compliance, renders the traditional project budget obsolete. Technology leaders must transition to a more fluid, portfolio-based financial management system, continuously reallocating capital to optimize efficiency, build strategic capabilities, and ensure operational resilience.

- Financial Justification Requires Sophistication: Securing capital for major technology initiatives demands a business case that speaks the language of the CFO. Simple ROI calculations are no longer sufficient. A defensible proposal must be built upon a comprehensive understanding of Total Cost of Ownership, include risk-adjusted scenarios, and feature sophisticated metrics like Net Present Value that account for the time value of money and long-term financial impact.

Ultimately, budgeting for custom software in 2026 is an act of strategic foresight. It requires leaders to look beyond the immediate project and to model the financial implications of their decisions over the entire lifecycle of the asset they are creating. By embracing a disciplined, value-driven, and dynamic approach to financial planning, organizations can ensure that their investments in custom software are not merely expenses to be managed, but powerful engines for innovation, efficiency, and sustained competitive advantage.

Appendix

A. Budgeting Checklist for Project Kick-off

Use this checklist to ensure all critical financial and strategic questions are addressed before finalizing a software development budget.

I. Value & Strategy Alignment

- [ ] Have we quantified the primary business value of this project (e.g., projected revenue increase, cost savings, efficiency gains)?

- [ ] Does this project directly align with our organization's strategic goals for the next 1-3 years?

- [ ] Have we defined clear, measurable Key Performance Indicators (KPIs) to track the project's success post-launch?

II. Scope & Requirements Definition

- [ ] Have we completed a thorough Discovery phase with all key stakeholders?

- [ ] Do we have a detailed Software Requirements Specification (SRS) document that defines both functional and non-functional requirements?

- [ ] Have we defined the scope for a Minimum Viable Product (MVP) to prioritize core features and de-risk the initial launch?

- [ ] Is there a formal Change Control Process in place to manage any requests that deviate from the initial scope?

III. Cost Estimation & Sourcing

- [ ] Have we obtained a ballpark estimate from both an internal team (if applicable) and at least two external vendors?

- [ ] Does our budget account for all phases of the lifecycle, including annual maintenance (15-20% of initial cost)?

- [ ] Have we analyzed the cost-benefit trade-offs of onshore, nearshore, and offshore development models?

- [ ] Have we chosen the appropriate pricing model (Fixed Price, T&M, Hybrid) that aligns with our project's level of uncertainty and our risk tolerance?

IV. Team & Resource Planning

- [ ] Have we defined the necessary team composition (roles, seniority) required for the project?

- [ ] Does the budget reflect accurate, market-rate hourly costs for the required talent in our chosen geographic region?

- [ ] Have we accounted for the indirect cost of our internal team's time (project management, stakeholder feedback, testing)?

V. Risk & Contingency

- [ ] Have we secured funding for at least 150% of the ballpark estimate to serve as a contingency fund?

- [ ] Have we used the "Hidden Costs Checklist" (Table 4) to identify and budget for often-overlooked expenses (e.g., API fees, data migration, user training)?

- [ ] Have we conducted a risk analysis, including pessimistic and optimistic scenarios, to create a budget range?

VI. 2026 Horizon Planning

- [ ] Does the budget account for licensing costs for AI-powered developer productivity tools?

- [ ] If the project includes custom AI features, is there a separate, detailed budget for data acquisition, model training, and specialized talent?

- [ ] Does the budget include line items for advanced cybersecurity measures, cloud cost management (FinOps) tools, and potential regulatory compliance audits?

B. Sample Software Requirements Specification (SRS) Outline

This template provides a standard structure for an SRS document, which is the foundation of an accurate budget. Adapt this outline to fit the specific needs of your project.

1.0 Introduction

- 1.1 Purpose: Clearly state the purpose of this document and the software product it describes.

- 1.2 Intended Audience: Define who should read this document (e.g., developers, project managers, QA, stakeholders, executives).

- 1.3 Product Scope: Describe the software's boundaries, its key objectives, and how it aligns with business goals.

- 1.4 Definitions, Acronyms, and Abbreviations: Create a glossary for any specialized terminology used throughout the document.

2.0 Overall Description

- 2.1 Product Perspective: Describe the product's relationship to other systems or as part of a larger product family.

- 2.2 User Personas and Characteristics: Describe the different types of users who will interact with the software and their typical skill levels.

- 2.3 Operating Environment: Detail the environment in which the software will operate (e.g., hardware platform, OS versions, browser compatibility).

- 2.4 Design and Implementation Constraints: List any constraints that will limit developer options (e.g., required use of a specific database, regulatory compliance, hardware limitations).

- 2.5 Assumptions and Dependencies: List any assumed factors that, if changed, could affect the requirements.

3.0 System Features and Requirements

- 3.1 Functional Requirements: This is the core of the SRS. Detail the specific behaviors and functions of the system.

- 3.1.1 Feature X (e.g., User Authentication)

- FR-1.1.1: Description of the requirement (e.g., "The system shall allow users to register with an email and password.").

- FR-1.1.2: Use a structured format (e.g., "When a user submits valid credentials, the system shall grant them access to their dashboard.").

- 3.1.1 Feature X (e.g., User Authentication)

- 3.2 External Interface Requirements

- 3.2.1 User Interfaces: Describe the logical characteristics of each user interface (e.g., screen layout, GUI standards).

- 3.2.2 Hardware Interfaces: Describe the logical and physical characteristics of each interface between the software and hardware components.

- 3.2.3 Software Interfaces: Describe the connections to other software components (e.g., databases, operating systems, third-party APIs).

- 3.3 Non-Functional Requirements (NFRs)

- 3.3.1 Performance Requirements: Specify response times, throughput, resource utilization (e.g., "95% of search queries shall return results in under 1.5 seconds.").

- 3.3.2 Security Requirements: Specify requirements related to access control, data encryption, and protection against malicious use (e.g., "The system must be protected against common SQL injection and XSS vulnerabilities.").

- 3.3.3 Reliability Requirements: Define requirements for system availability and mean time between failures (MTBF).

- 3.3.4 Usability Requirements: Define ease-of-use objectives (e.g., "A new user shall be able to complete [critical task] within 3 minutes without training.").

- 3.3.5 Scalability Requirements: Define the ability of the system to handle growth in users, data, or transactions.

4.0 Other Requirements

- 4.1 Data Requirements: Describe database schema, data retention policies, and data migration needs.

- 4.2 Legal and Regulatory Requirements: Detail any requirements related to laws or industry standards (e.g., GDPR, HIPAA, PCI-DSS).

- 4.3 Internationalization and Localization: Specify requirements for supporting multiple languages, currencies, or cultural conventions.

5.0 Appendices

- 5.1 Use Cases and User Stories: Detailed scenarios of user interactions with the system.

- 5.2 Analysis Models: Include relevant diagrams (e.g., data flow diagrams, state-transition diagrams).

- 5.3 To Be Determined (TBD) List: A list of items that are not yet finalized and require further clarification.

C. ROI Calculation Worksheet

This worksheet provides a template for calculating the key financial metrics needed to build a business case for a custom software project. It is designed to be adapted into a spreadsheet for easy calculation.

| ROI Calculation Worksheet | ||||

|---|---|---|---|---|

| Project Name: | Discount Rate (for NPV): | [e.g., 10%] | ||

| Part 1: Total Cost of Ownership (TCO) Calculation | Year 0 (Initial) | Year 1 | Year 2 | Year 3 |

| Direct Costs | ||||

| Development & Design | [...] | |||

| Implementation & Data Migration | [...] | |||

| Recurring Costs | ||||

| Annual Maintenance & Support | [...] | [...] | [...] | |

| Infrastructure & Hosting Fees | [...] | [...] | [...] | |

| Third-Party Licensing/API Fees | [...] | [...] | [...] | |

| Total Annual Costs | [...] | [...] | [...] | [...] |

| Part 2: Benefit Quantification (Annual) | Year 1 | Year 2 | Year 3 | |

| Tangible Benefits (Gains) | ||||

| Productivity Savings | [...] | [...] | [...] | |

| Operational Cost Reduction | [...] | [...] | [...] | |

| Increased Revenue | [...] | [...] | [...] | |

| Total Annual Benefits | [...] | [...] | [...] | |

| Part 3: Cash Flow Analysis | Year 0 | Year 1 | Year 2 | Year 3 |

| Net Cash Flow (Benefits - Costs) | - [...] | [...] | [...] | [...] |

| Cumulative Cash Flow | - [...] | [...] | [...] | [...] |

| Part 4: Key Financial Metrics | Result | |||

| Total Net Profit (Total Benefits - Total Costs) | [...] | |||

| Simple ROI (%) | `[...]$% | |||

| Payback Period (Years) | `[...]$ Years | |||

| Net Present Value (NPV) | [...] | |||

| Internal Rate of Return (IRR) | `[...]$% |

About Baytech

At Baytech Consulting, we specialize in guiding businesses through this process, helping you build scalable, efficient, and high-performing software that evolves with your needs. Our MVP first approach helps our clients minimize upfront costs and maximize ROI. Ready to take the next step in your software development journey? Contact us today to learn how we can help you achieve your goals with a phased development approach.

About the Author

Bryan Reynolds is an accomplished technology executive with more than 25 years of experience leading innovation in the software industry. As the CEO and founder of Baytech Consulting, he has built a reputation for delivering custom software solutions that help businesses streamline operations, enhance customer experiences, and drive growth.

Bryan’s expertise spans custom software development, cloud infrastructure, artificial intelligence, and strategic business consulting, making him a trusted advisor and thought leader across a wide range of industries.