The Vibe Coding Trap: Why Cheap AI Code Costs a Fortune

February 02, 2026 / Bryan Reynolds

Executive Summary: The Fiscal Paradox of the AI Era

In February 2025, Andrej Karpathy, a central figure in the modern artificial intelligence revolution and former OpenAI co-founder, introduced the lexicon of software development to a new, provocative term: "Vibe Coding".

In its idealized form, Vibe Coding represents the ultimate democratization of digital creation—a paradigm shift where natural language prompts ("vibes") replace rigorous syntax, and Large Language Models (LLMs) handle the implementation details. For the casual observer or the non-technical stakeholder, this promises a utopia of efficiency: software assets created at a fraction of the historical cost, products launched in weekends rather than quarters, and a drastic reduction in the Capital Expenditure (CapEx) traditionally required to bring digital products to market.

However, for the Strategic Chief Financial Officer (CFO), "Vibe Coding" presents a complex, multi-layered, and potentially dangerous financial paradox. We stand at a precipice where the fundamental economics of software production are inverting. While the initial acquisition costs of these digital assets are significantly lower—creating an attractive immediate entry on the balance sheet—the long-term operational reality is starkly different. We are witnessing a phenomenon where savings realized in the build phase are frequently not "savings" at all, but rather deferred costs that reappear as aggressive Operational Expenditure (OpEx) inflation, asset impairment risks, and a new, insidious form of off-balance-sheet liability known as "Comprehension Debt".

This report provides an exhaustive financial and operational analysis of AI-generated code from the perspective of the modern finance leader. It moves beyond the hype of generative AI to scrutinize the Total Cost of Ownership (TCO), the risks to Intellectual Property (IP) and corporate valuation, and the specific accounting implications of "black box" codebases under frameworks like ASC 350-40. Furthermore, it presents a balanced strategic path forward, leveraging the methodologies of Baytech Consulting—specifically "Tailored Tech Advantage" and "Rapid Agile Deployment"—to secure the efficiency gains of AI without mortgaging the enterprise's future.

Part I: The New Asset Class and Its Hidden Liabilities

1.1 Defining "Vibe Coding" in the Enterprise Context

To effectively manage an asset class, one must first rigorously define it. "Vibe Coding" is distinct from traditional software engineering, and this distinction is not merely semantic—it is structural and financial. In a traditional software engineering workflow, a human architect designs a system's logic, ensuring modularity, security, and scalability, and then writes the code to execute that design. The "intent" (what the software should do) and the "implementation" (how the software does it) are tightly coupled in the human mind. The engineer understands the causal link between every line of code and the business outcome it drives.

In the Vibe Coding paradigm, this linkage is severed. The human provides a high-level "intent" via a natural language prompt, and the AI generates the "implementation" probabilistically. The human operator often accepts this output without fully reviewing, auditing, or understanding the underlying logic, provided the software appears to function as requested on the surface.

Karpathy himself noted the cavalier nature of this workflow, stating, "I just see stuff, say stuff, run stuff, and copy paste stuff, and it mostly works". While acceptable for a hobbyist, "mostly works" is a catastrophic standard for enterprise financial systems, customer-facing platforms, or AI-driven software development at scale.

From a financial perspective, this shifts the nature of the software asset:

- Traditional Code: A deterministic asset where the cost structure is labor-heavy upfront (High CapEx) but maintenance is generally predictable and linear (Stable OpEx).

- Vibe Code: A probabilistic asset where the upfront cost is negligible (Low CapEx) but the internal logic is opaque, leading to highly volatile, exponential, and escalating maintenance costs (High OpEx).

This distinction is critical for the CFO because it changes the risk profile of the Intangible Assets on the balance sheet. A Vibe Coded application is not a static asset; it is a decaying asset that accumulates interest—technical and comprehension interest—at a rate that often exceeds the hurdle rate of the investment itself.

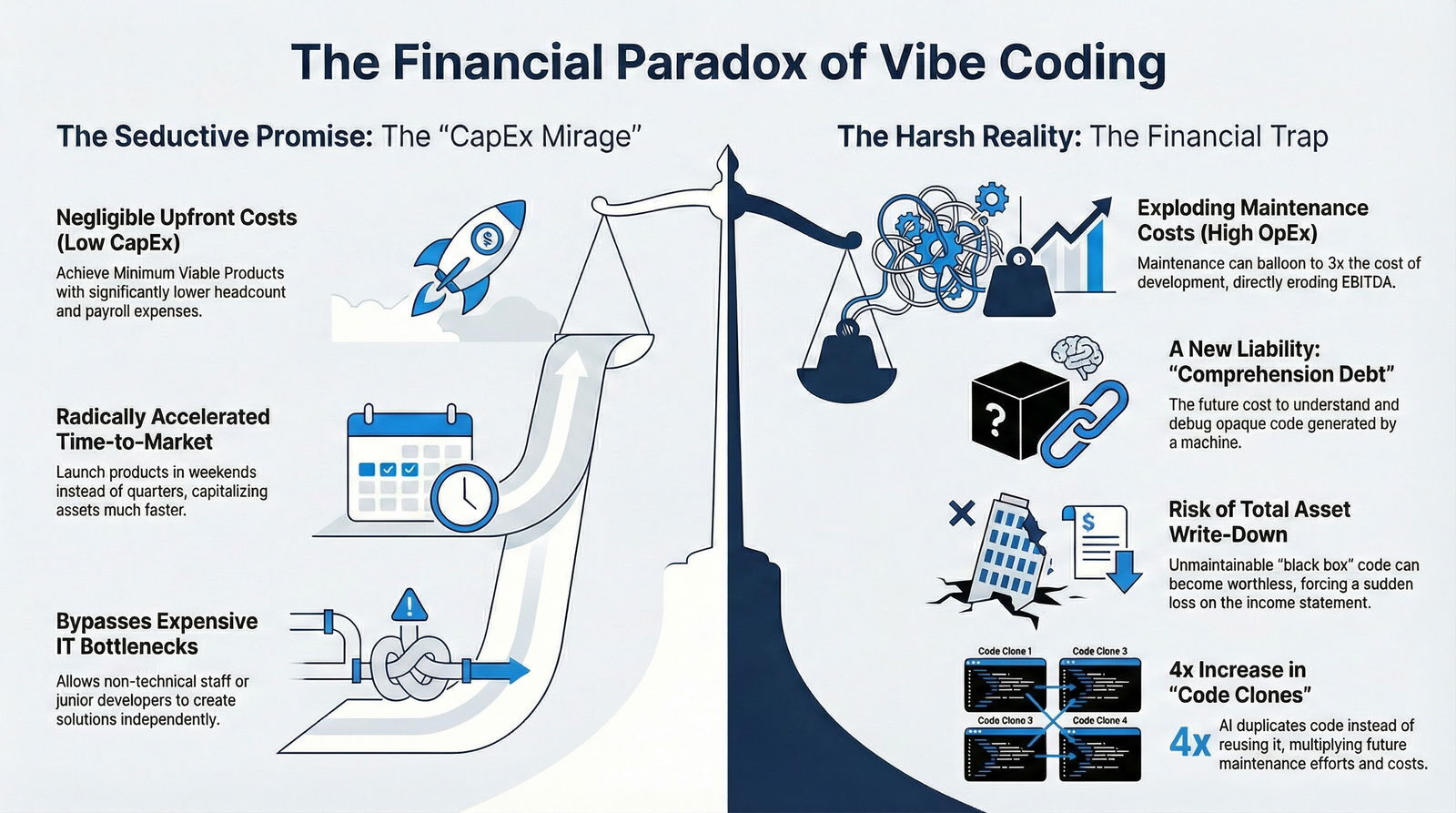

1.2 The Allure of the "CapEx Mirage"

For a CFO, the initial numbers surrounding Vibe Coding are undeniably seductive. Software development has historically been a major capital sink. Teams of senior engineers are expensive, the recruiting cycle is long, and the time-to-market (TTM) can be frustratingly slow. In a high-interest-rate environment where capital efficiency is paramount, any technology that promises to slash development costs is met with enthusiasm.

Early data and industry sentiment suggest that AI-assisted development can reduce the time required to generate code by 30-50% for certain routine tasks. For a startup, a scale-up, or a lean enterprise business unit, this efficiency translates to several attractive financial metrics:

- Reduced Cash Burn: Achieving a Minimum Viable Product (MVP) or a Proof of Concept (PoC) with significantly lower headcount and payroll expense.

- Accelerated Capitalization: Moving assets from the "Work in Progress" (WIP) ledger to "In Service" faster, thereby triggering amortization schedules earlier and theoretically realizing value sooner.

- Lower Barrier to Entry: Allowing non-technical staff or junior developers to "build" solutions, seemingly bypassing the expensive bottleneck of senior IT architecture and engineering.

However, we term this the "CapEx Mirage." It is a mirage because it relies on the flawed assumption that the code generated by the AI is of equal quality, security, and maintainability to code written by a human professional. This is the critical fallacy. As we will explore in depth, the "discount" obtained at the prompt interface is essentially a high-interest, predatory loan taken out against the future stability of the IT infrastructure. The "savings" are not erased; they are merely displaced to a different accounting period and a different line item—maintenance. This dynamic shows up clearly when you examine the economics of AI coding assistants and the AI Productivity Paradox.

Part II: The Anatomy of "Comprehension Debt"

2.1 Moving Beyond Technical Debt

"Technical Debt" is a concept familiar to most technology executives and increasingly understood by finance leaders. It refers to the implied cost of additional rework caused by choosing an easy or limited solution now instead of using a better approach that would take longer. In traditional engineering, technical debt is often a conscious, strategic trade-off—a bridge loan taken to meet a critical deadline, with a plan to pay it back (refactor) later.

In the era of AI and Vibe Coding, we face a new, more dangerous variant: Comprehension Debt. Defined by industry experts as "the future cost developers will pay to understand, modify, and debug code they did not write, which was generated by a machine", Comprehension Debt differs from traditional Technical Debt in three fundamental and financially material ways:

- Lack of Intent: In traditional technical debt, the engineer knows why they took a shortcut. They understand the "interest rate" of their decision. In Vibe Coding, the "author" (the AI) has no intent, and the human prompter often does not understand the output. When the code breaks, there is no "why" to reconstruct—only a forensic analysis of a probabilistic output. The team is not debugging; they are performing archaeology on a machine hallucination.

- Scale of Production: A human team is physically limited in how much debt they can create. AI can generate thousands of lines of code in seconds. An AI-assisted team can accumulate Comprehension Debt at an exponential rate, vastly outstripping their ability to audit or understand it.

- Opacity (The Black Box): The "Black Box Effect" means that as the codebase grows via Vibe Coding, the percentage of logic actually understood by the human team shrinks. This leads to a "Scaling Wall" where the system becomes too complex to modify safely, often right when the business needs to scale.

2.2 The "Spaghetti Microservices" Phenomenon

One of the most profound structural impacts of Vibe Coding is the erosion of software architecture. AI models optimize for the "next token"—the immediate completion of the prompt. They lack a holistic view of the system architecture, data integrity, or future scalability needs. They solve the problem in isolation, without regard for the whole.

This results in a phenomenon known as "Spaghetti Microservices": distributed systems that have the complexity of enterprise-grade architectures (like Netflix) but the structural integrity of a house of cards.

- Code Duplication: Research from GitClear (2025) analyzing 211 million lines of code found a 4x increase in "code clones" (duplicated code) and a sharp decline in refactoring. AI tends to solve a problem by generating new code rather than reusing existing functions.

- The Maintenance Nightmare: For the CFO, duplication is a cost multiplier. If a business logic rule changes (e.g., a tax calculation or a compliance requirement), it must be updated in one place in a clean codebase. In a Vibe Coded base, it might need to be updated in 50 unknown locations. Missing one leads to financial errors, regulatory liability, and system downtime.

Part III: The Financial Trap – OpEx Explosion and EBITDA Erosion

3.1 The OpEx Multiplier: 3x Maintenance Costs

Standard industry benchmarks historically suggest that maintenance accounts for 50-80% of a software's Total Cost of Ownership (TCO) over its lifecycle. However, these benchmarks assume "clean," human-authored code with a logical structure.

With AI-generated code, emerging data indicates that maintenance costs can balloon to 3x the cost of development. Why does this multiplier exist?

- The "Debugging Tax": Junior engineers or AI agents struggle to fix bugs in code they did not write. Research shows that while developers feel faster using AI, they often take longer to complete tasks when correctness is measured, due to the time spent debugging subtle hallucinations. This wasted time is direct payroll leakage.

- Churn and Rework: GitClear's data shows a spike in "code churn"—code that is written and then deleted or rewritten within two weeks. High churn indicates that the initial "Vibe" output was flawed, leading to wasted payroll hours (OpEx) that produce no asset value. The company pays for the code twice: once to generate it, and once to delete and replace it.

3.2 The Impact on EBITDA and Valuation

For the Strategic CFO, the shift from CapEx (Development) to OpEx (Maintenance) has direct implications for corporate valuation, particularly EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). This is not just an operational issue; it is a valuation issue.

- CapEx vs. OpEx Treatment:

- Development Phase: Salaries and external costs for creating new software functionality are typically capitalized (CapEx) under ASC 350-40. This moves the expense off the P&L and onto the Balance Sheet, preserving EBITDA in the current period.

- Maintenance Phase: Costs for fixing bugs, patching security, and "keeping the lights on" are expensed immediately (OpEx). This directly reduces EBITDA.

- The Valuation Hit:

- If a company relies on Vibe Coding, it may show strong EBITDA during the initial build (due to low cost and high capitalization).

- However, as the "Comprehension Debt" comes due in years 2-3, the maintenance burden explodes. The company must hire more senior (expensive) engineers just to maintain the status quo and keep the system running.

- Result: EBITDA margins compress significantly. Since technology companies are often valued on EBITDA multiples, a decrease in margin due to high "technical interest payments" can significantly erode enterprise value. This mirrors the long-run patterns seen when teams chase short-term speed with AI instead of building sustainable modern software architectures like headless platforms.

Simulated Financial Scenario: Consider a B2B SaaS company with $10M in annual revenue.

- Scenario A (Strategic Engineering): Maintenance costs stabilize at 2M (20% of Revenue). EBITDA = 3M.

- Scenario B (Vibe Coding Legacy): Maintenance costs swell to 5M (50% of Revenue) due to the debt burden. EBITDA = 0M.

- Valuation Impact: At a 10x EBITDA multiple, Scenario A is worth 30M. Scenario B is effectively worth 0 (or valued on revenue at a steep discount due to unprofitability).

Part IV: Balance Sheet Risks – Asset Impairment and Obsolescence

4.1 ASC 350-40 and the Risk of Write-Downs

Under US GAAP, specifically ASC 350-40 (Internal-Use Software), companies capitalize the costs of developing internal software. However, a fundamental requirement for capitalization is that the asset must have "probable future economic benefit."

If a Vibe-Coded software asset becomes "unmaintainable" due to extreme spaghetti code or security flaws (hitting the "Scaling Wall"), it may trigger an impairment event.

- Impairment Indicators: According to accounting standards, indicators include "a significant adverse change in the extent or manner in which the asset is used," or "an expectation that the asset will be sold or disposed of significantly before the end of its previously estimated useful life".

- The Write-Down: If the engineering team declares that the AI-generated codebase is "toxic" and must be rewritten from scratch—a common outcome when the complexity exceeds the AI's context window—the CFO is forced to write down the remaining book value of that asset.

- Financial Consequence: This write-down hits the Income Statement as a sudden, large non-operating expense. It shocks Earnings Per Share (EPS), distorts the quarter's results, and signals a failure of management oversight to investors and the board. Similar write-down risks are now appearing in portfolios that leaned heavily into "move fast" AI development without the kind of risk frameworks outlined in modern software investment risk strategies.

4.2 The "Shadow AI" Security Liability

Security is no longer solely a technology concern; it is a CFO concern due to the massive financial liability associated with data breaches. The average cost of a data breach has reached $9.44 million, a figure that can wipe out quarterly profits for many mid-sized firms.

Vibe Coding introduces profound "Shadow AI" risks:

- Vulnerable Dependencies: AI models often hallucinate or select outdated, deprecated, or insecure software libraries to solve a problem. Without human review, these vulnerabilities are baked into the production environment.

- Attack Surface Expansion: The "bloat" of duplicated code creates a larger surface area for attackers to hide exploits. The more code you have, the more places there are for a breach to occur.

- Audit Failure: In regulated industries (finance, healthcare, aviation), software must be auditable. "Black Box" code that no human fully understands may fail compliance audits (SOC2, HIPAA, GDPR), leading to fines, legal action, and reputational damage. This is why many enterprises are now embracing private AI "walled garden" architectures to keep models, data, and code secure and governable.

Part V: The Balanced Solution – Baytech’s Strategic Approach

The analysis thus far paints a grim picture of unchecked AI adoption. However, the solution is not to reject AI—that would be a strategic error in a competitive market. The solution is to govern it. This is where Baytech Consulting distinguishes itself with a methodology designed for the "Strategic CFO" who demands both efficiency and longevity.

5.1 Tailored Tech Advantage: The "Human-in-the-Loop" Shield

Baytech’s Tailored Tech Advantage creates a firewall against Comprehension Debt. Instead of allowing "vibes" to dictate architecture, Baytech employs a human-led, AI-accelerated model.

- Architecture First: Senior Architects (Humans) define the system structure, data flow, API contracts, and security boundaries before any AI is prompted. This ensures the "skeleton" of the asset is sound, scalable, and aligned with business goals.

- AI as the "Junior Developer": AI is used strictly for low-risk, high-volume tasks (boilerplate generation, unit test writing, documentation) where verification is easy. It is not allowed to architect the core business logic or security protocols. This approach aligns closely with Baytech’s broader AI-powered development services, where AI is a tool, not an uncontrolled decision-maker.

- Code Sovereignty: Every line of AI-generated code is reviewed, refactored, and "owned" by a human engineer. This eliminates the "Black Box," ensuring that the asset remains readable, maintainable, and IP-protectable.

5.2 Rapid Agile Deployment: Speed Without the Hangover

The counter-argument to rigorous engineering is usually "slowness." Baytech’s Rapid Agile Deployment refutes this by optimizing the process, not just the coding.

- Context Engineering vs. Vibe Coding: Instead of vague prompts ("vibe coding"), Baytech engineers use "Context Engineering"—providing the LLM with the full project context, style guides, and architectural constraints. This produces code that is already compliant with corporate standards, significantly reducing the "Debugging Tax" and rework, and dovetails with proven Agile software development practices.

- Sustainable Velocity: While Vibe Coding offers a burst of speed in Month 1 followed by a crash in Month 6, Baytech’s approach maintains a high, steady velocity. For the CFO, this means predictable release schedules and predictable budgeting.

Part VI: Actionable Advice for the Strategic CFO

To navigate this transition, the CFO must evolve from a passive observer of IT costs to an active participant in technology governance. You cannot manage what you do not measure.

6.1 The New KPIs for the AI Era

Traditional metrics like "Lines of Code" or simple "Velocity" are now meaningless, as AI can inflate them infinitely without adding value. The CFO should demand the following new KPIs from the Technology office to assess the true health of digital assets:

| Metric | Definition | Why it Matters to the CFO |

|---|---|---|

| Comprehension Margin | The percentage of the codebase that senior engineers fully understand and can modify without AI assistance. | A proxy for Operational Risk. A low margin (<50%) suggests high future OpEx and reliance on "black box" logic. |

| Code Churn Rate | The percentage of code rewritten or deleted within 2 weeks of creation. | A proxy for Waste. High churn (>20%) indicates Vibe Coding inefficiencies are burning payroll without creating assets. |

| Maintenance-to-Build Ratio | The ratio of OpEx (fix/sustain) to CapEx (new features) spend. | A proxy for Asset Quality. A rising ratio signals technical debt accumulation that will choke innovation. |

| IP Sovereignty Score | The percentage of code modules that are human-verified, architected, and IP-protected. | A proxy for Valuation Risk during due diligence, M&A, or audits. |

6.2 The "Vibe Audit": 3 Questions for Your CTO

- "Do we have a strict 'Human-in-the-Loop' policy for all committed code?"

- Red Flag: "No, the AI is accurate enough," or "We don't have time for reviews."

- Green Flag: "Yes, we use AI for drafting and acceleration, but no code enters the master branch without human review, refactoring, and automated testing."

- "How are we accounting for 'Comprehension Debt' in our hiring and staffing plan?"

- Red Flag: "AI makes us 10x faster so we can hire fewer seniors and more juniors."

- Green Flag: "We are using AI efficiency to free up our senior engineers for architecture and complex problem solving, not to replace them."

- "What is our strategy for 'Shadow AI' and dependency management?"

- Red Flag: Silence, uncertainty, or vague assurances.

- Green Flag: "We use tools like Baytech’s automated scanners to validate all AI-suggested libraries against a secure allow-list before implementation."

6.3 Strategic Recommendation: The Hybrid Investment

- Avoid: "Pure" Vibe Coding startups or internal teams that promise unrealistic speed without architectural rigor. This is "Subprime Software"—high yield initially, high default risk later. Many such teams lean heavily on quick wins from tools like generative IDEs but ignore the cautionary lessons described in analyses of AI-native IDEs and agentic development platforms.

- Invest: In "AI-Augmented" partners like Baytech Consulting. This is the "Blue Chip" approach—leveraging technology for yield (efficiency) but grounding it in fundamentals (human expertise) to preserve capital and ensure long-term solvency.

Conclusion: Securing the Digital Balance Sheet

The emergence of "Vibe Coding" is a defining moment for the software industry, comparable to the shift to Cloud Computing or the advent of Mobile. Like the Cloud, it offers immense power, flexibility, and the potential for speed. But also like the Cloud, without strict cost governance (FinOps), the bills can accumulate silently and destroy margins.

For the Strategic CFO, the lesson is clear: Code is an asset, but it can easily become a liability.

The low initial CapEx of AI-generated code is a powerful lever, but it must be pulled with caution and oversight. If that lever is used to bypass engineering discipline, it creates a massive "short position" on your own infrastructure—a position that the market (in the form of maintenance costs, security breaches, and valuation haircuts) will eventually force you to close at a steep loss.

By adopting a disciplined, human-centric approach—exemplified by Baytech Consulting’s Tailored Tech Advantage—organizations can harness the speed of AI while building durable, valuable, and audit-ready assets. The future belongs not to those who code by "vibes," but to those who engineer with vision, blending AI with robust DevOps, CI/CD, and repository intelligence practices that keep risk in check.

Relevant Resources

Appendix: Research & Data Synthesis

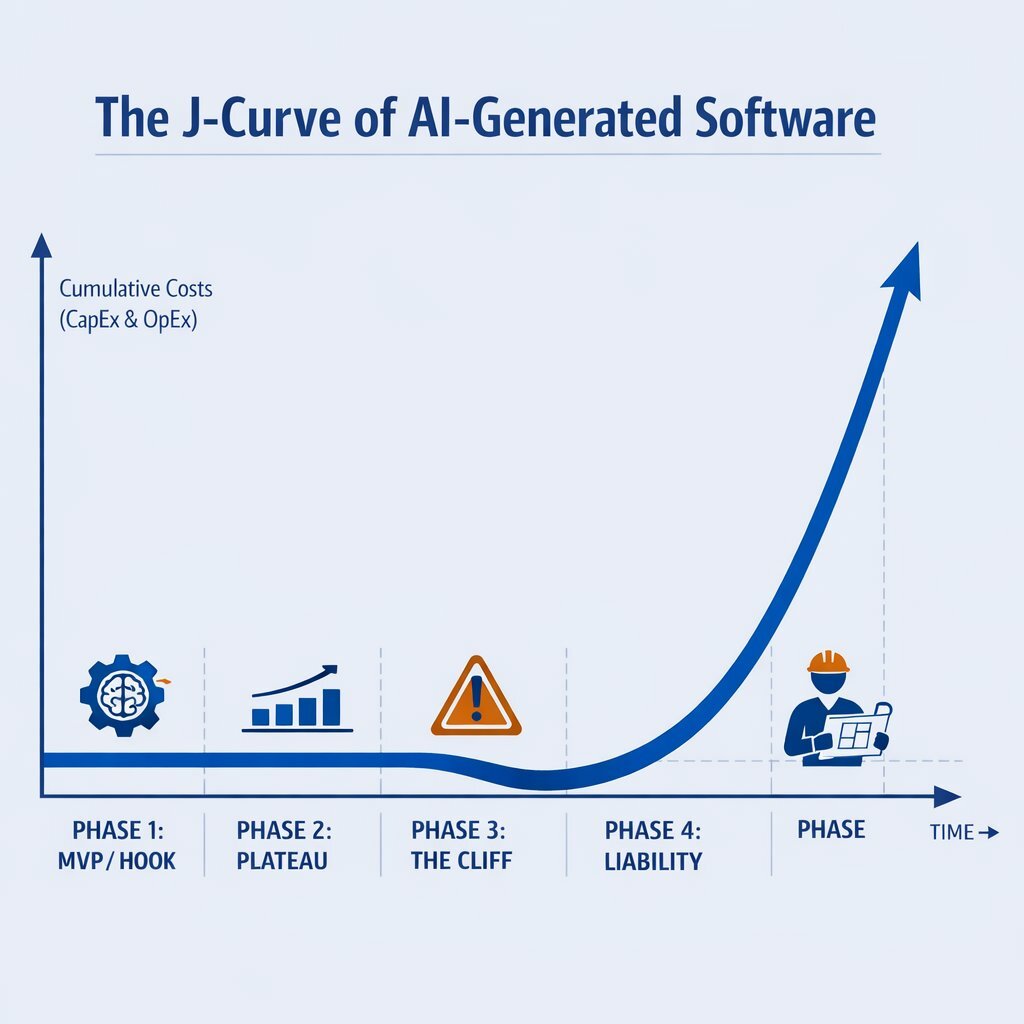

A.1 The "J-Curve" of AI Debt

The financial trajectory of Vibe Coding follows a predictable "J-Curve."

- Phase 1 (The Hook): Zero to MVP. AI tools generate functional prototypes in record time. CapEx is minimized. Founders and CFOs are euphoric about the speed and low cost.

- Phase 2 (The Plateau): Post-Launch. Users request complex features. The AI struggles to integrate new logic into its own "spaghetti" structure. Velocity slows down significantly.

- Phase 3 (The Cliff): The Scaling Wall. The system reaches critical mass (~100k users). Bugs appear faster than they can be fixed. The "Black Box" nature of the code prevents root-cause analysis.

- Phase 4 (The Liability): The Rewrite. The team admits the codebase is unsalvageable. The asset is written down. A new, expensive project is launched to rebuild it properly (often bringing in consultants like Baytech).

A.2 Intellectual Property Risks

Recent legal frameworks in the US and EU suggest that code generated purely by AI without "substantial human creative contribution" may not be copyrightable.

- The "Commodity" Trap: If your core product is vibe-coded, a competitor can prompt an LLM to build the exact same tool. You have no IP moat to protect your market share.

- Baytech’s Solution: By having humans architect the system and refine the code, the "creative contribution" threshold is met, securing the asset as proprietary IP and preserving enterprise value. This IP-aware approach also plays well with broader go-to-market and revenue strategies, especially when combined with predictive and generative AI for revenue growth.

A.3 Human Capital Dynamics

The hidden cost of Vibe Coding is the morale of the engineering team.

- Developer Burnout: Senior engineers despise "janitorial work"—cleaning up messy, incoherent AI code. This leads to dissatisfaction.

- Retention Risk: If your company becomes a "Vibe Coding shop," top talent will leave for organizations that value craftsmanship, leaving you with a codebase that no one knows how to fix. Forward-looking leaders are already focusing on developer happiness and productivity as a core part of their AI strategy.

- Recruiting Costs: Replacing a senior engineer costs 50-200% of their annual salary. This is a hidden OpEx triggered by poor technical culture.

About Baytech

At Baytech Consulting, we specialize in guiding businesses through this process, helping you build scalable, efficient, and high-performing software that evolves with your needs. Our MVP first approach helps our clients minimize upfront costs and maximize ROI. Ready to take the next step in your software development journey? Contact us today to learn how we can help you achieve your goals with a phased development approach.

About the Author

Bryan Reynolds is an accomplished technology executive with more than 25 years of experience leading innovation in the software industry. As the CEO and founder of Baytech Consulting, he has built a reputation for delivering custom software solutions that help businesses streamline operations, enhance customer experiences, and drive growth.

Bryan’s expertise spans custom software development, cloud infrastructure, artificial intelligence, and strategic business consulting, making him a trusted advisor and thought leader across a wide range of industries.