Virtual Care for Executives: Strategic ROI and Implementation in Healthcare

August 25, 2025 / Bryan Reynolds

Beyond the Virtual Visit: A C-Suite Guide to the Business of Virtual Care

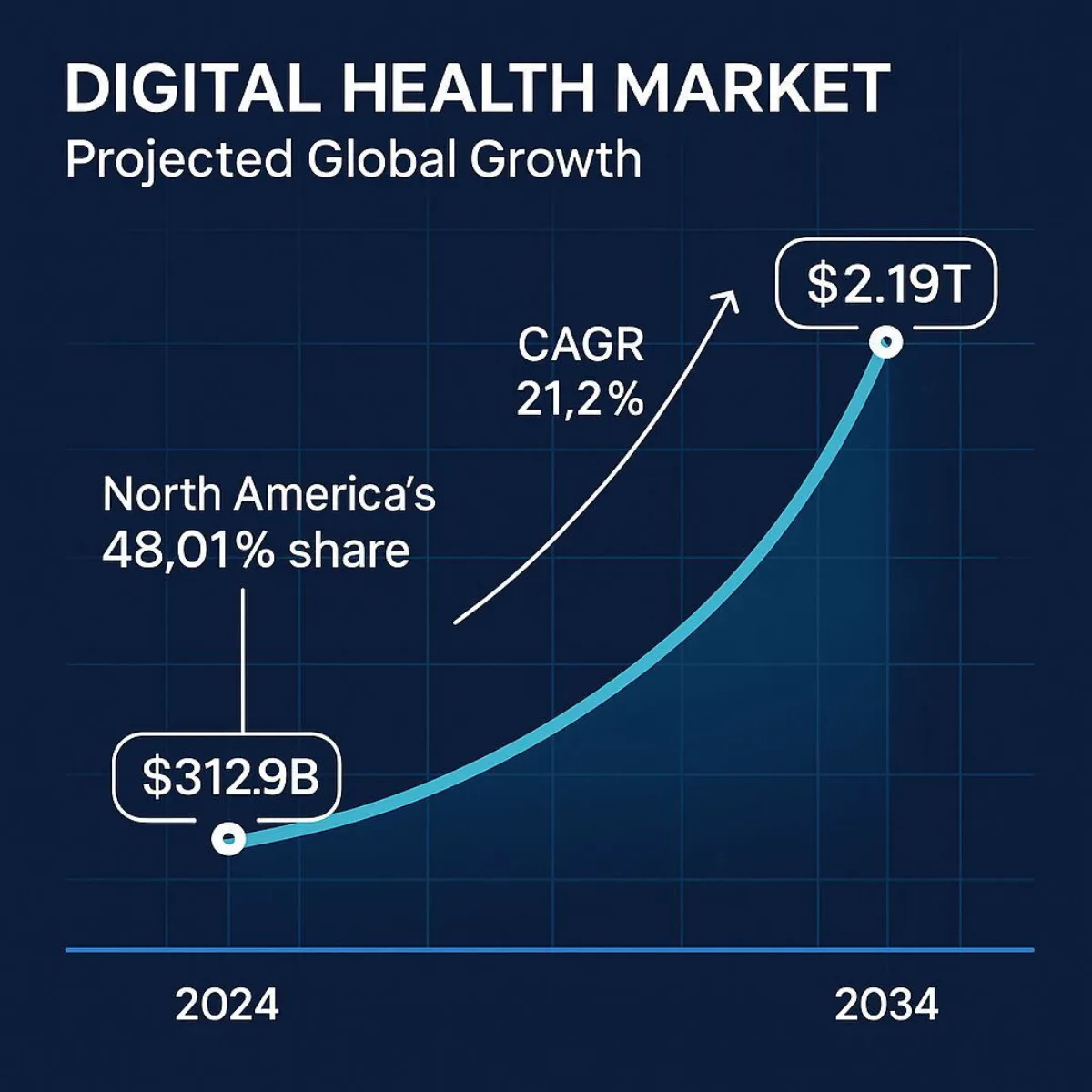

The global telemedicine market is forecasted to surge from USD 104.64 billion in 2024 to an astounding USD 334.80 billion by 2032, demonstrating a robust 16.9% compound annual growth rate. The broader digital health market, of which virtual care is a cornerstone, presents an even larger opportunity, projected to eclipse USD 2.19 trillion by 2034. These are not the figures of a niche market or a fleeting trend. They represent a seismic, irreversible shift in the fundamental business of healthcare.

For years, the promise of digital health remained largely on the horizon. The COVID-19 pandemic did not create this transformation; it acted as a powerful accelerant, compressing a decade of predicted adoption into a matter of months. Now, as the dust settles, a critical strategic error for any healthcare executive would be to view this shift as a temporary, crisis-driven anomaly. The focus must now pivot from reactive adoption to proactive, long-term strategic integration. This is no longer about simply offering a video call option; it's about architecting a digital-first ecosystem that enhances operational efficiency, drives financial performance, and delivers superior patient outcomes. This guide is designed for the C-suite—the CTOs, CFOs, and COOs—tasked with navigating this new landscape. It moves beyond the basics to address the critical business questions: Where is the tangible ROI? What are the hidden implementation risks? And how can technology be leveraged to build a sustainable competitive advantage in the new era of healthcare?

What is the C-Suite Actually Discussing? A Clear Definition of the Virtual Care Ecosystem

Strategic planning and investment demand precision. In the boardroom, the terms "virtual care," "telehealth," and "telemedicine" are often used interchangeably, but this ambiguity can lead to misaligned strategies and misallocated capital. A clear understanding of the landscape is the foundational first step toward developing a sound financial and operational plan. The failure to grasp the full scope of the ecosystem means an organization might invest heavily in one area while overlooking far greater opportunities for cost savings and revenue generation in another.

The most significant financial burdens and opportunities for ROI in healthcare often lie in the management of chronic diseases. These conditions are best managed through continuous, proactive engagement—the domain of Remote Patient Monitoring and mHealth. A narrow focus on replacing in-person visits with video calls overlooks the immense value of a broader virtual care strategy that can fundamentally change the cost and quality equation for an organization's highest-risk, highest-cost patient populations.

The Virtual Care Hierarchy

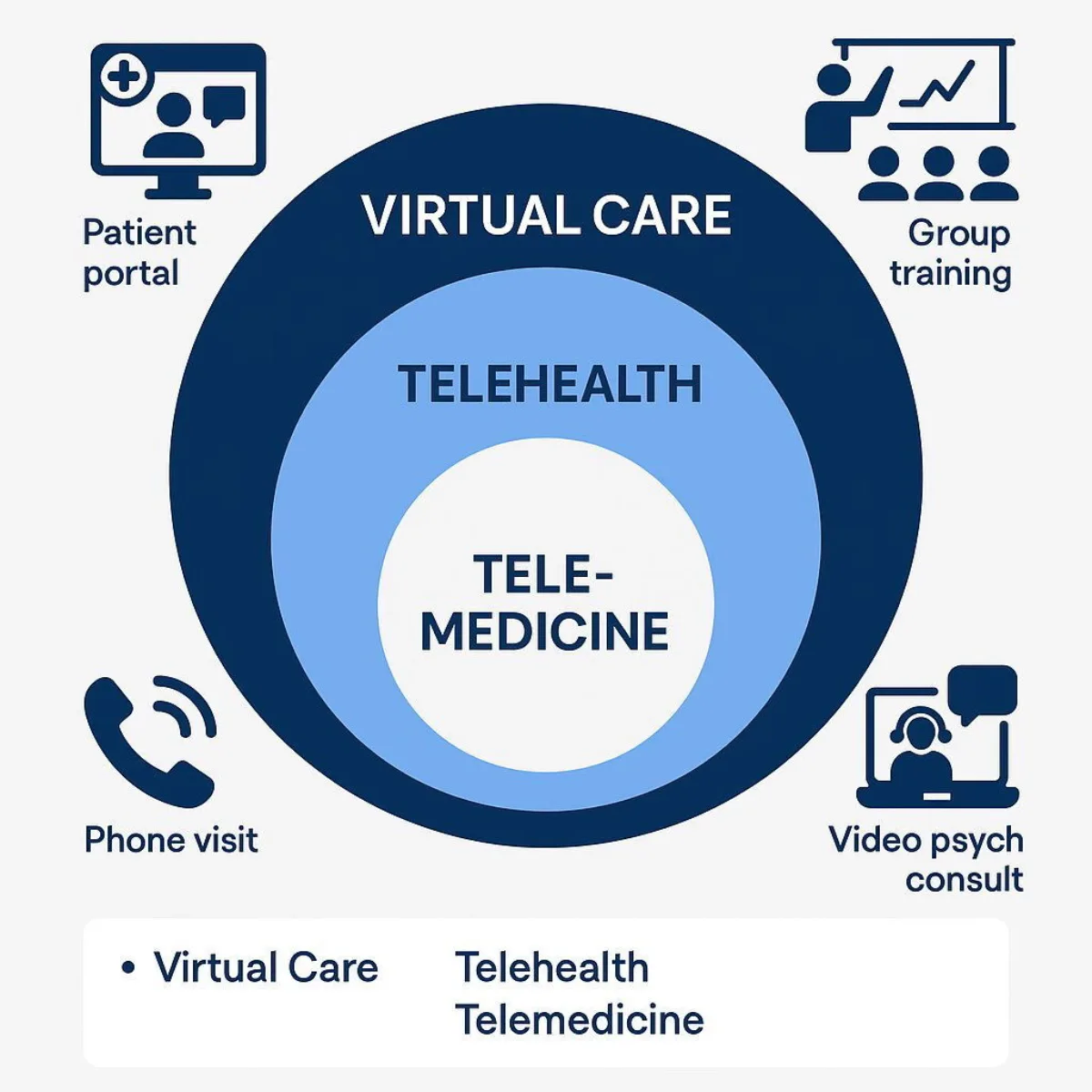

The ecosystem is best understood as a set of nested concepts:

- Virtual Care: This is the broadest, all-encompassing term. It includes every digital interaction between patients and providers, covering both clinical and non-clinical activities. It's the digital front door to the entire healthcare experience, from using a patient portal to schedule an appointment and message a nurse to having a video consultation and receiving educational materials.

- Telehealth: A significant subset of virtual care, telehealth focuses specifically on the remote delivery of clinical healthcare services and health-related education. It's about using technology to provide care and share knowledge when distance is a critical factor.

- Telemedicine: The most specific term and a subset of telehealth, telemedicine typically refers to the remote practice of medicine—a clinician using technology to diagnose and treat a patient. The classic example is a real-time video consultation with a specialist.

The Four Primary Modalities of Delivery

Within this ecosystem, care is delivered through four principal modalities, each addressing different clinical needs and business objectives:

- Live Video (Synchronous Communication): This is the most familiar form of telemedicine—a real-time, two-way audio-visual consultation between a patient and a provider. It effectively simulates an in-person visit for a wide range of consultative, diagnostic, and treatment services.

- Store-and-Forward (Asynchronous Communication): This highly efficient modality involves the secure transmission of medical information, such as digital images (X-rays, MRIs, photos), documents, and pre-recorded videos, to a practitioner for review at a later time. It is exceptionally effective in specialties like dermatology, radiology, pathology, and wound care, as it allows specialists to review cases when it is convenient for them, overcoming scheduling and geographical barriers.

- Remote Patient Monitoring (RPM): A transformative approach for chronic disease management, RPM uses connected devices—such as wearable sensors, smartwatches, blood pressure cuffs, and glucometers—to collect and transmit patient health data from their homes. This allows providers to track vital signs and other key metrics continuously, enabling proactive interventions that can prevent costly emergency room visits and hospitalizations.

- mHealth (Mobile Health): This rapidly growing field leverages the ubiquity of mobile devices like smartphones and tablets to support health and public health practices. Applications range from targeted text messages that promote healthy behaviors and medication adherence to sophisticated apps that help patients manage chronic conditions and wide-scale alerts about disease outbreaks.

| Term | Scope | Primary Focus | Example |

|---|---|---|---|

| Virtual Care | Broadest (Umbrella Term) | All digital patient/provider interactions | A patient using a portal to schedule an appointment, message a nurse, and have a video visit. |

| Telehealth | Subset of Virtual Care | Remote delivery of clinical services & education | A group of rural doctors attending a virtual training session on a new procedure. |

| Telemedicine | Subset of Telehealth | Remote clinical diagnosis and treatment | A patient having a live video consultation with a psychiatrist for medication management. |

The Market Mandate: Why Virtual Care is Now a Boardroom Imperative

The decision to invest in virtual care is no longer a question of innovation; it is a response to an undeniable market mandate. The quantitative data shows a sector experiencing explosive, sustainable growth, driven by a fundamental and permanent shift in both provider workflows and patient expectations. For executives, ignoring this trend is not a neutral stance; it is a decision that carries significant competitive risk.

A Market in Hypergrowth

The sheer scale of the financial opportunity commands attention. North America currently dominates this landscape, holding a 48.01% market share in 2024, making it the key competitive arena for healthcare organizations. This growth is underpinned by a radical shift in adoption. Post-pandemic, telehealth adoption is now 17 times higher than it was previously. This is reflected on the provider side, where the percentage of office-based physicians using telemedicine skyrocketed from a mere 16.0% in 2019 to 80.5% in 2021. This is not a temporary spike; it is the establishment of a new baseline for care delivery.

The Pull of Patient Demand

Crucially, this market is being pulled by consumer demand, not just pushed by provider necessity. The patient experience with virtual care during the pandemic was overwhelmingly positive, creating a powerful new set of expectations.

- High Satisfaction and Retention: An overwhelming 94% of consumers who have had a virtual visit are willing to have another one, a significant leap from 80% in 2020. This high rate of satisfaction indicates that virtual care has successfully moved from a forced alternative to a preferred option for many.

- Convenience as a Competitive Differentiator: The availability of virtual health is now a primary factor in patient choice. A striking 24% of consumers report they would be willing to switch doctors to ensure they have access to virtual visit options. This willingness is even more pronounced among younger, digitally native, and often commercially insured demographics: 43% of millennials and 33% of Gen Z would switch, compared to just 7% of baby boomers.

This data reveals a fundamental disruption in the traditional healthcare business model, which has long relied on patient inertia and geographic loyalty as a competitive moat. That moat is now being breached by digital convenience. A competitor with a superior, user-friendly virtual experience can now attract and retain patients from a much wider geographic area, effectively erasing traditional service boundaries and transforming the competitive landscape from a local one to a regional or even national one. For a CFO or CEO, this reframes the virtual care investment decision. It is no longer just a "cost-saving measure" but a critical "revenue protection and market share growth strategy." It's about building a digital defense against new, digitally-native competitors who are unencumbered by legacy systems and physical footprints.

Chart 1: The Exponential Growth of the Digital Health Market (A bar or line chart visualizing the growth of the Digital Health Market from its 2024 valuation of USD 312.9 billion to its 2034 projection of USD 2.19 trillion, with the 21.2% CAGR clearly labeled. Data from.)

Unpacking the ROI: The Triple Bottom Line of a Virtual Care Strategy

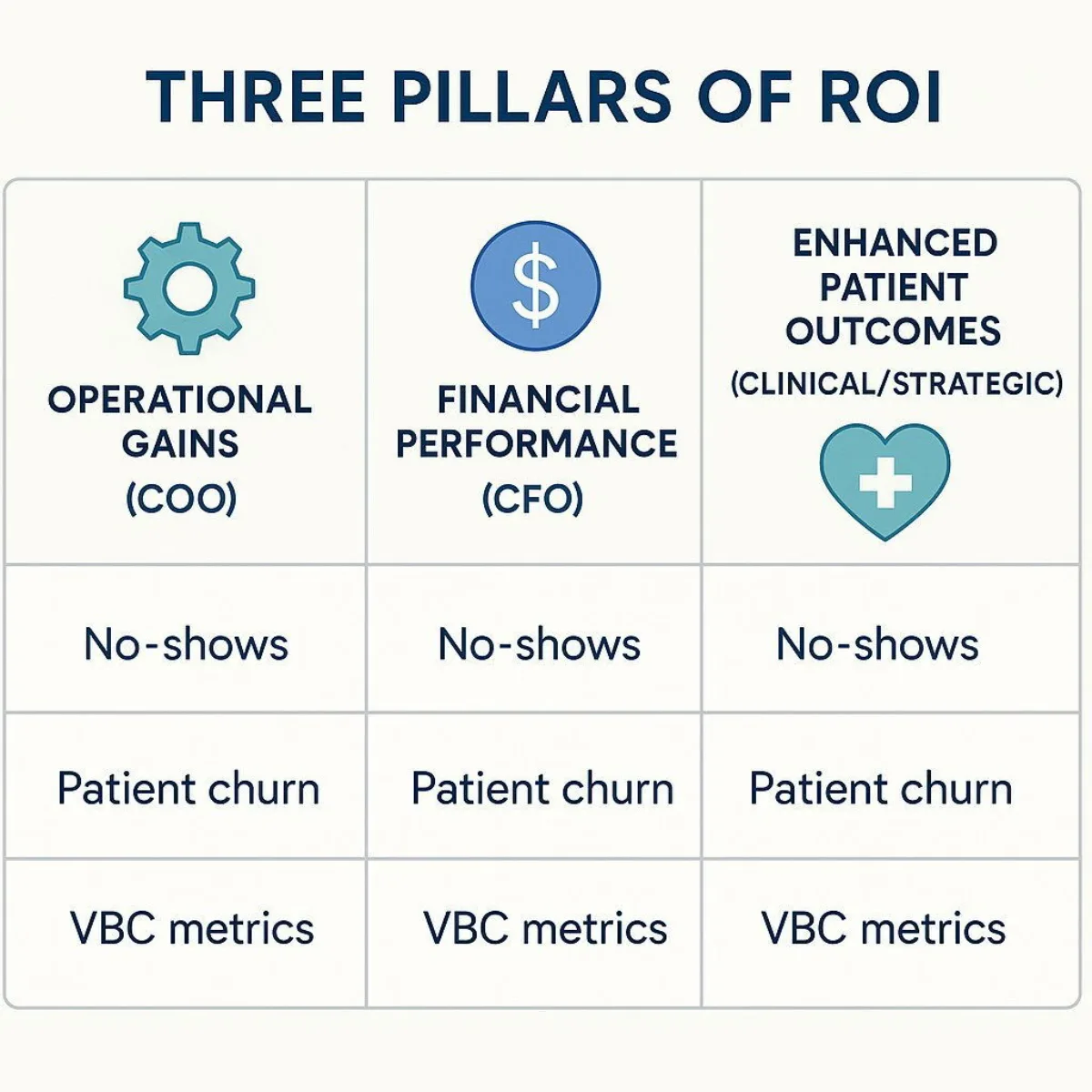

For any major capital expenditure, the C-suite demands a clear and compelling return on investment. The business case for a sophisticated virtual care platform rests on a powerful triple bottom line: measurable operational gains, enhanced financial performance, and improved patient outcomes that align with the future of healthcare reimbursement. The analysis must move beyond a simplistic comparison of per-visit costs to a holistic view of how virtual care impacts the entire enterprise.

Pillar 1: Operational Gains (The COO's Perspective)

Virtual care is a powerful lever for optimizing healthcare operations. By digitizing workflows and shifting the point of care, organizations can unlock significant efficiencies.

- Reduced Physical Overhead: One of the most direct benefits is the ability to operate with lower overhead costs. Virtual consultations reduce the need for large physical clinic spaces, expensive maintenance, and extensive administrative support staff, allowing resources to be redirected toward direct patient care.

- Streamlined Clinical Workflows: Custom-developed virtual care platforms can automate time-consuming administrative tasks such as appointment scheduling, documentation, and billing. This frees up clinical staff to focus on higher-value activities, allowing providers to consult more patients in less time and increasing overall productivity.

- Minimized No-Shows and Readmissions: The convenience of virtual visits significantly reduces the rate of missed appointments. More strategically, the use of Remote Patient Monitoring for post-discharge follow-up allows for early detection of complications, dramatically reducing costly and often penalized hospital readmissions—a key performance indicator for any health system.

Pillar 2: Financial Performance (The CFO's Perspective)

The financial impact of a well-executed virtual care strategy is multifaceted, encompassing both direct cost savings and new avenues for revenue growth.

- Demonstrable Cost Savings: The data on cost reduction is compelling. One study review found that a telehealth program saved a single practice $24,352, while another analysis showed that patients save between $147 and $186 per virtual visit by eliminating expenses related to travel, parking, childcare, and time off from work. Extrapolated across the entire industry, the Federal Communications Commission estimates that telehealth technologies could save the U.S. healthcare system up to $305 billion annually.

- Revenue Enhancement and Patient Retention: A robust virtual care offering is a powerful tool for market expansion. It can attract new patients from outside an organization's traditional geographic catchment area and significantly increase the retention of existing patients who prioritize convenience. For hospital systems, tele-specialty consults can enable them to retain higher-acuity, higher-reimbursement cases that might otherwise have been transferred to another facility, directly boosting the bottom line.

Pillar 3: Enhanced Patient Outcomes (The Clinical and Strategic Perspective)

Ultimately, the most profound value of virtual care lies in its ability to improve the health of patients, particularly those with chronic conditions who account for a disproportionate share of healthcare spending.

- Transforming Chronic Disease Management: This is where virtual care, especially RPM, becomes a game-changer. Continuous, remote tracking of vital signs for conditions like hypertension, diabetes, and heart failure allows care teams to intervene proactively at the first sign of trouble. This prevents acute events, reduces emergency room visits, and avoids costly hospitalizations. One RPM initiative, for example, successfully helped 74% of its participating hypertension patients achieve a controlled blood pressure of less than 140/90.

- Expanding Access and Promoting Equity: Virtual care is a critical tool for overcoming long-standing barriers to healthcare. It removes the obstacles of travel time, transportation costs, and mobility issues, providing essential access to primary and specialty care for patients in rural, remote, and medically underserved communities.

While these three pillars each present a strong case, their true power is realized when viewed through a strategic lens. The true, long-term ROI of virtual care is not measured in fee-for-service (FFS) cost savings per visit, but in its role as an enabling technology for success in value-based care (VBC) models. The initial, most obvious ROI calculation focuses on the transactional efficiency of a virtual visit versus an in-person one. However, the entire healthcare industry is being pushed by major payers, including the Centers for Medicare & Medicaid Services (CMS), toward VBC, where reimbursement is tied to patient outcomes and cost control, not the volume of services performed. A robust virtual care platform provides the fundamental infrastructure required to succeed in this new paradigm. It is the toolkit for proactive population health management, which is the key to maximizing quality-based reimbursements and shared savings in VBC contracts. For a CFO, the strategic imperative is to stop viewing virtual care ROI through an outdated FFS lens and instead see it as the foundational investment for winning in the future of healthcare reimbursement.

| ROI Category | Key Financial Levers | Measurement Metrics |

|---|---|---|

| Revenue Enhancement | New Patient Volume, Patient Retention, Higher Acuity Mix | Increase in patient panel size, Reduction in patient churn rate, Change in average revenue per case |

| Cost Reduction | Lower Overhead, Reduced Readmissions, Staff Efficiency | Decrease in facility costs per encounter, Reduction in 30-day readmission penalties, Increase in patients managed per FTE |

| Value-Based Performance | Improved Health Outcomes, Higher Patient Satisfaction | Performance on VBC quality metrics (e.g., HbA1c control), Patient satisfaction scores (e.g., HCAHPS) |

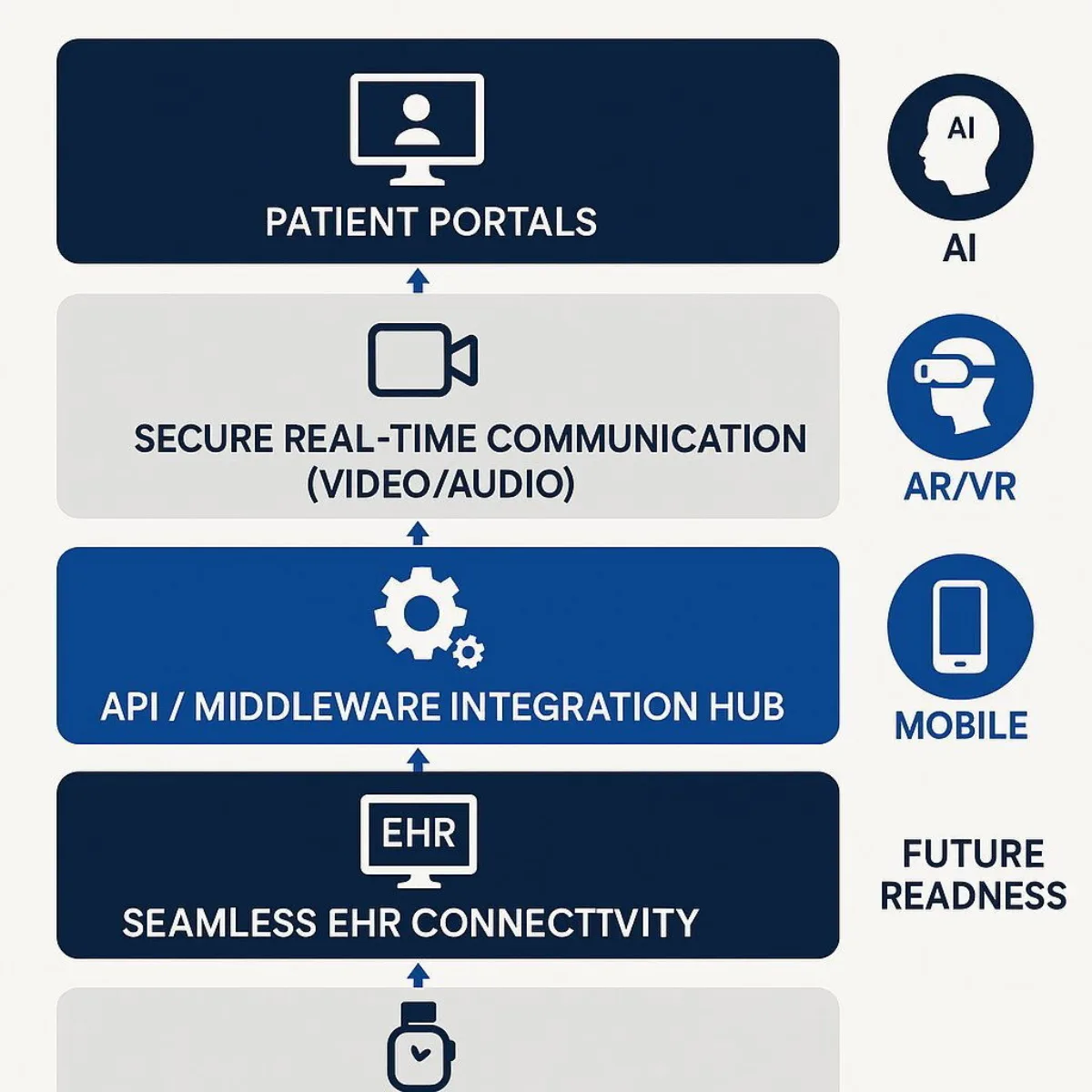

The Technology Engine: Architecting a Future-Proof Virtual Care Platform

To capitalize on the strategic promise of virtual care, organizations must build a technology foundation that is not only robust and secure today but also flexible and extensible enough to accommodate the innovations of tomorrow. A modern virtual care platform is far more than a video conferencing application; it is a complex, integrated ecosystem requiring a thoughtful architectural approach.

The Foundational Stack

At its core, a comprehensive virtual care platform must seamlessly integrate several key components: secure, real-time communication tools (audio and video), deep connectivity with electronic health record (EHR) and practice management systems, secure digital platforms for asynchronous data exchange, and intuitive patient portals that serve as the single point of entry for the patient's digital experience.

The Next Frontier of Innovation

A forward-looking technology strategy must anticipate and plan for the next wave of innovation that will redefine care delivery. When surveyed about their top investment priorities, healthcare executives overwhelmingly point to a handful of transformative technologies.

- Artificial Intelligence (AI): AI is the top emerging technology priority. It is already being deployed to analyze vast amounts of EHR data to support clinical diagnoses, personalize treatment plans, and optimize workflows. AI-powered "virtual sitter" solutions, for example, can enable a single remote staff member to monitor up to 25% more patients, addressing staffing shortages and improving inpatient safety. For a closer look at how machine learning and emerging AI analytics are shaping digital health platforms, see our executive guide on AI, Machine Learning, and LLMs for Business Leaders.

- Augmented and Virtual Reality (AR/VR): The market for AR/VR in healthcare is projected to grow more than tenfold, from approximately $4 billion in 2024 to over $46 billion by 2032. Current and emerging applications are stunning in their potential: immersive surgical training simulations that improve skill and reduce risk, AR overlays that give surgeons "X-ray vision" by projecting 3D anatomical models directly onto a patient's body during a procedure, and engaging in-home physical therapy and mental health treatments.

- Internet of Things (IoT): IoT is the essential interoperability backbone for Remote Patient Monitoring. The proliferation of wearables and connected home medical devices enables the real-time collection of physiological data, forming the foundation for preventive care, remote diagnostics, and highly personalized medicine.

- Emerging Technologies: Looking further ahead, technologies like blockchain and advanced robotics hold significant promise. Blockchain could provide unprecedented levels of data security and interoperability for health information exchange, while advanced robotics are poised to play a greater role in automating tasks for telemedicine, elder care, and even surgical procedures.

This complex and rapidly evolving technology landscape presents a critical strategic choice for executives: buy a collection of off-the-shelf point solutions or build a custom, integrated platform. The term "technology stack" is a dangerous misnomer; in reality, it is not a neat stack but a messy, dynamic, and interconnected ecosystem. The most critical strategic failure for a CTO is not choosing the wrong video vendor; it is failing to build a flexible, API-driven central architecture that can integrate legacy systems (the EHR), a rapidly expanding universe of third-party devices (IoT), and future applications (AI/VR).

Off-the-shelf products are often closed, proprietary systems—the very definition of an interoperability nightmare. They create new data silos instead of breaking down old ones, leading to fragmented workflows and mounting technical debt. The architectural platform itself, not any single application, becomes the core competitive advantage. Therefore, the most important technology decision is not about a single feature but about owning the central data and integration hub. A custom-developed platform, built on modern principles like microservices and APIs, provides the long-term strategic flexibility that a patchwork of siloed, off-the-shelf products simply cannot deliver. This is the central value proposition of a strategic development partner—one that recognizes pitfalls of fragmented, one-size-fits-all healthcare solutions, as described in our analysis on AI risks and custom solutions for the enterprise.

From Blueprint to Reality: Navigating the Critical Implementation Challenges

The path from a strategic vision for virtual care to a fully operational, adopted, and value-generating platform is fraught with technical and operational hurdles. Many promising initiatives falter during implementation, turning a planned investment into a costly write-off. Understanding and proactively mitigating these challenges is paramount for success.

Challenge 1: The Interoperability Impasse

The single greatest technical barrier to successful virtual care implementation is the lack of seamless integration between new telehealth solutions and an organization's existing information systems, most critically the Electronic Health Record (EHR). Without this integration, organizations are left with a "patchwork of disparate solutions" that cannot communicate with one another. This forces clinicians into inefficient and frustrating workarounds, such as toggling between multiple screens and manually re-entering patient data. This duplication of effort is not only a major driver of provider burnout but also a significant patient safety risk, as it creates multiple opportunities for data entry errors and incomplete patient records. The ultimate goal must be a single, unified platform where data from a virtual encounter—notes, prescriptions, diagnoses—automatically and instantly updates the patient's central EHR, creating a single source of truth for the care team.

Challenge 2: Infrastructure and Scalability

A solution that works for a small pilot program of a few dozen users can fail spectacularly when scaled to serve an entire health system. Scaling exposes foundational weaknesses in an organization's IT infrastructure. Many hospitals, particularly older facilities, suffer from Wi-Fi "dark spots," insufficient broadband capacity (a critical issue for rural facilities), and outdated network architectures that cannot reliably handle the demands of real-time, high-definition video and continuous data transmission from hundreds of RPM devices. Hardware limitations also present a significant barrier. End-of-life cameras, consumer-grade tablets that are difficult to secure and manage at scale, and non-upgradable "dumb" in-room televisions all stifle the potential of a comprehensive virtual care program.

Challenge 3: The Trust Imperative - Security and Compliance

In healthcare, trust is non-negotiable. Virtual care platforms handle immense volumes of Protected Health Information (PHI), making them a prime target for cyberattacks. The temporary relaxation of HIPAA enforcement discretion that occurred during the public health emergency has ended. All virtual care platforms and their associated workflows must now be fully compliant with the stringent requirements of the HIPAA Privacy and Security Rules. This involves conducting thorough security risk analyses, implementing robust technical safeguards like end-to-end encryption, developing clear policies and procedures, and ensuring that legally binding Business Associate Agreements (BAAs) are in place with all third-party technology vendors that handle PHI. For lessons on handling sensitive data and governance for high-stakes digital deployments, see how AI is revolutionizing legal discovery—many insights apply for healthcare, too.

The Solution: Mitigating Implementation Risk with a Custom Approach

These formidable challenges highlight the limitations of a one-size-fits-all, off-the-shelf approach. They demand a tailored solution designed to integrate with an organization's unique technical environment and clinical workflows. This is where a strategic development partner like Baytech Consulting provides critical value, directly addressing these risks with proven methodologies and technical expertise.

The biggest hidden cost in a virtual care implementation is not the software license fee, but the massive operational drag and clinical risk created by poor integration. A platform that clinicians find cumbersome will suffer from low adoption, accelerate provider burnout, and introduce unacceptable medical errors. The true "cost" of a cheap, poorly integrated solution is astronomically high in terms of lost productivity, staff turnover, and potential liability. The quality of the integration is the quality of the product. Investing in a custom solution is not a luxury; it is a fundamental risk mitigation strategy against the far greater and less transparent costs of operational failure.

- Baytech's Tailored Tech Advantage: This approach is the direct answer to the interoperability crisis. Instead of forcing a rigid, pre-packaged product onto a complex legacy environment, Baytech's experts design and build custom middleware, APIs, and data integration layers that bridge the gap between existing EHRs and modern virtual care tools. This creates the seamless, unified workflow that clinicians demand and that patient safety requires, transforming a fragmented collection of applications into a cohesive, high-performing platform.

- Baytech's Rapid Agile Deployment: This methodology directly mitigates the financial and operational risks of large-scale IT projects. Rather than a multi-year "big bang" implementation, Baytech develops in short, iterative sprints. This approach delivers a functional Minimum Viable Product (MVP) to users quickly, allowing the organization to begin generating value and gathering critical real-world feedback almost immediately. This de-risks the investment for the CFO and ensures the platform evolves based on the actual needs of clinicians and patients, leading to higher adoption rates and a more effective final product. For a deeper dive into why this approach increases the odds of digital transformation success, especially in complex settings, explore our Agile Methodology blueprint.

The Road Ahead: Strategic Considerations for a Digitally-Integrated Future

Successfully launching a virtual care platform is not the end of the journey; it is the beginning. Long-term success and sustainability require executives to look beyond the initial technology implementation and strategically address the complex human, regulatory, and economic factors that will shape the future of digitally-enabled care.

Factor 1: Bridging the Digital Divide

A critical challenge that is both an ethical imperative and a market reality is the "digital divide." Significant disparities in access to reliable broadband internet, appropriate devices (smartphones, computers), and digital literacy persist across the population. These gaps disproportionately affect patients who are older, live in rural areas, have lower incomes, or belong to minority groups—often the very populations with the highest burden of chronic disease. Data from 2021 showed that video telehealth usage rates were lowest among those without a high school diploma (38.1%) and adults aged 65 and older (43.5%). To ignore this divide is to risk excluding a large and high-need segment of the patient population, exacerbating health inequities.

Actionable Advice: A successful platform must be designed for inclusivity. This means offering multiple modalities of care, including low-bandwidth video options and audio-only telephone consultations, which remain a crucial lifeline for many patients. Proactive strategies can include partnering with community organizations to provide technology training and establishing public access points, such as equipping clinic parking lots with Wi-Fi to allow patients to conduct a video visit from their car. It’s a challenge found not just in healthcare but across other sectors—see how digital-first approaches are making strides toward equity and expanded reach.

Factor 2: Navigating the Regulatory Maze

The regulatory landscape for telehealth is a complex and fluid patchwork of state and federal rules that is still evolving in the wake of the pandemic. The broad temporary waivers issued during the Public Health Emergency (PHE) have largely expired, and organizations must now navigate a more stringent and fragmented environment.

- Provider Licensure: The long-standing rule that a clinician must be licensed in the state where the patient is physically located at the time of service remains the standard. This creates significant complexity for health systems that operate across state lines. While interstate licensure compacts for various professions are helping to streamline this process, they are not yet universal, requiring careful compliance management.

- Reimbursement Parity: A key financial variable is whether payers will reimburse a virtual visit at the same rate as a comparable in-person visit. These "payment parity" laws vary dramatically by state and by payer (Medicare, Medicaid, commercial), and they are a major factor in the financial modeling and sustainability of any telehealth program.

- Prescribing Controlled Substances: The federal Ryan Haight Act generally requires an in-person medical evaluation before a provider can prescribe controlled substances. This requirement was waived during the PHE. The DEA has extended these telehealth flexibilities through December 31, 2025, but the permanent rules are still under development. In the interim, states are creating their own, often differing, regulations, creating a challenging compliance environment for providers.

Factor 3: Aligning with Value-Based Care (VBC)

This is the ultimate strategic alignment that ties all other factors together. The healthcare industry's macro-level shift away from fee-for-service and toward value-based care models—such as Accountable Care Organizations (ACOs) and Bundled Payments—is undeniable. In these models, providers are reimbursed based on their ability to deliver high-quality outcomes and control overall costs, not on the sheer volume of services they perform. A robust virtual care infrastructure is no longer an optional add-on in this environment; it is the essential toolkit for success. It provides the means for effective population health management, seamless care coordination, and the proactive, continuous monitoring needed to prevent the high-cost acute events that can devastate performance in a VBC contract.

These regulatory and equity challenges should not be viewed merely as external hurdles to be overcome. They must be treated as core design parameters for any virtual care platform. A rigid, "one-size-fits-all" platform that only offers high-bandwidth video will fail to serve a significant portion of the patient population and may quickly fall out of compliance with the evolving regulatory landscape. A platform's long-term viability is directly contingent on its architectural ability to be customized to meet specific patient needs and divergent regulatory requirements. This is where the inherent flexibility of a custom-built solution becomes a decisive strategic advantage. A platform designed with a modular architecture can support different workflows, multiple communication modalities (video, audio, text), and configurable compliance rule-sets on a per-state or per-patient-population basis. This approach future-proofs the investment against regulatory change and ensures maximum market reach by proactively designing for equity. Consider how custom solutions unlock better alignment—the lesson is clear in every regulated, high-stakes industry.

Conclusion: Your Next Move in the Virtual Care Revolution

The evidence is conclusive: virtual care is not a temporary detour but a permanent restructuring of the healthcare landscape. For C-suite leaders, the strategic imperatives are clear. First, this is a multi-trillion-dollar market shift that can no longer be addressed with pilot programs or piecemeal solutions. A comprehensive, enterprise-wide strategy is essential for survival and growth. Second, the true financial return on this investment is not found in the transactional savings of a single virtual visit. It is unlocked by leveraging a digital platform as the core infrastructure to succeed in the outcome-driven world of value-based care. Finally, a successful implementation hinges on overcoming the critical and interconnected challenges of interoperability with legacy systems, building for enterprise scale, and navigating a complex web of regulatory and equity considerations.

The decision is no longer if an organization should invest in virtual care, but how it will build a platform that delivers a lasting competitive advantage. The path of least resistance—adopting cheap, siloed, off-the-shelf solutions—is a path to operational inefficiency, provider burnout, and strategic obsolescence. The path to market leadership requires a more deliberate approach. It involves partnering with an expert who understands how to navigate the immense technical and strategic complexity of modern healthcare. A partner like Baytech Consulting, with its Tailored Tech Advantage methodology to solve the interoperability crisis and its Rapid Agile Deployment model to de-risk investment, provides the expertise needed to design, build, and scale a future-proof virtual care ecosystem that delivers measurable financial, operational, and clinical returns.

Supporting Articles

- https://www.mckinsey.com/capabilities/strategy-and-corporate-finance/our-insights/how-covid-19-has-pushed-companies-over-the-technology-tipping-point-and-transformed-business-forever

- https://medium.com/@marketing_26756/the-roi-of-telehealth-measuring-the-financial-benefits-for-your-healthcare-practice-9719a6efc0f8

- https://www.thedoctors.com/articles/interoperable-telehealth-patient-safety-considerations/

About Baytech

At Baytech Consulting, we specialize in guiding businesses through this process, helping you build scalable, efficient, and high-performing software that evolves with your needs. Our MVP first approach helps our clients minimize upfront costs and maximize ROI. Ready to take the next step in your software development journey? Contact us today to learn how we can help you achieve your goals with a phased development approach.

About the Author

Bryan Reynolds is an accomplished technology executive with more than 25 years of experience leading innovation in the software industry. As the CEO and founder of Baytech Consulting, he has built a reputation for delivering custom software solutions that help businesses streamline operations, enhance customer experiences, and drive growth.

Bryan’s expertise spans custom software development, cloud infrastructure, artificial intelligence, and strategic business consulting, making him a trusted advisor and thought leader across a wide range of industries.