Revolutionizing Real Estate: AI's Role in the Future of Brokerage

December 03, 2025 / Bryan Reynolds

The AI-Powered Agent: How Artificial Intelligence is Reshaping the Real Estate Funnel

You're seeing AI everywhere, from ChatGPT creating marketing copy to smart home devices managing thermostats. As a brokerage owner or a technology leader in the real estate space, you're asking the right question: How will this actually change my brokerage's workflow, my agents' productivity, and my bottom line?

The answer is simple and profound: Artificial Intelligence represents the most significant operational shift in the real estate industry since the internet brought the MLS online. While the internet gave agents access to a global library of listings—a passive, informational change—AI provides them with active, superhuman capabilities. It delivers the power of predictive analysis, intelligent automation, and data-driven decision-making directly into their hands. This isn't just a new tool; it's a new paradigm for how real estate is bought, sold, and managed.

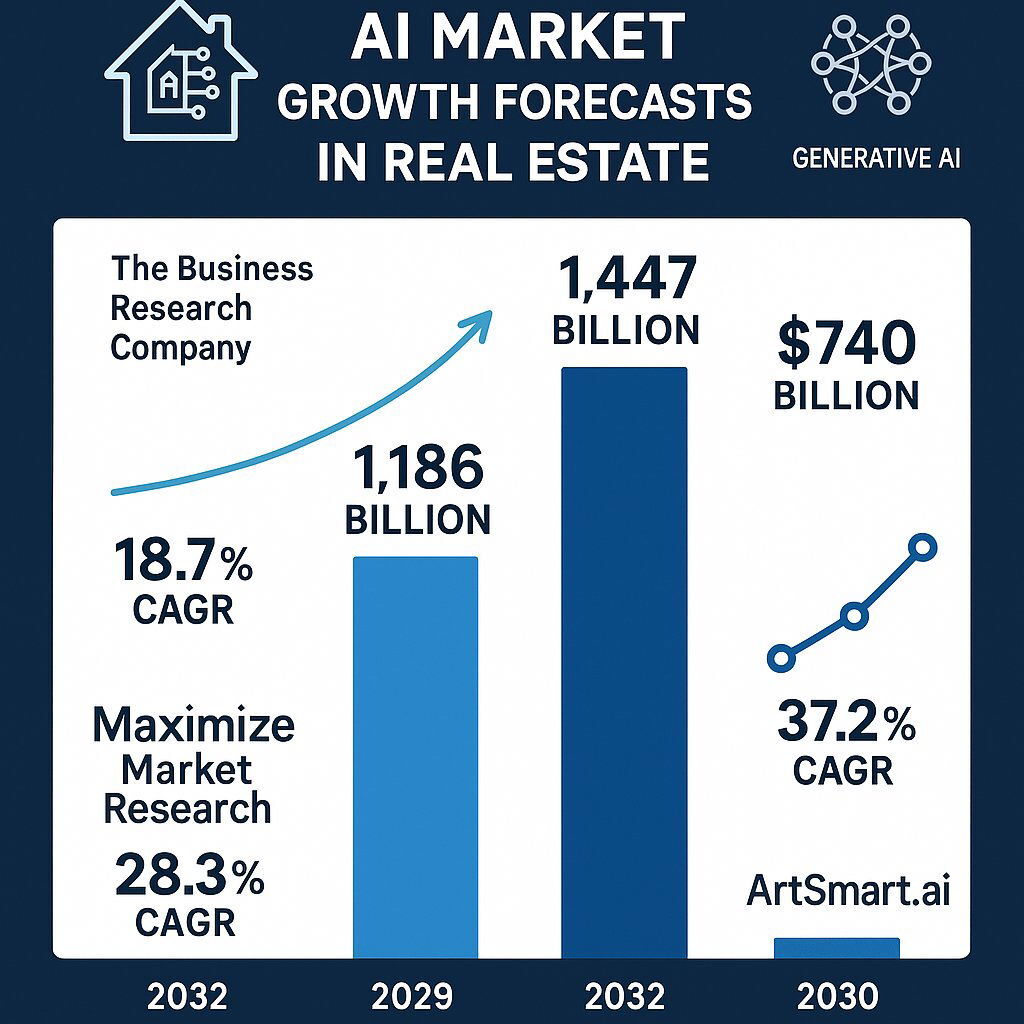

The urgency to understand and adopt this technology is not driven by hype, but by a massive, quantifiable economic transformation. The AI in real estate market is not a niche trend; it's an economic juggernaut. Market forecasts, while varying slightly in their exact figures, all point to the same explosive trajectory. This isn't just growth; it's a land rush for technological dominance, and the brokerages that act now will be the market leaders of tomorrow.

| Source/Analyst Firm | Market Segment | Forecast Period | Projected Market Size | Compound Annual Growth Rate (CAGR) |

|---|---|---|---|---|

| The Business Research Company | Overall AI in RE | 2024–2029 | $975.24 billion | 34.1% |

| Maximize Market Research | Overall AI in RE | 2024–2030 | $1803.45 billion | 35% |

| Precedence Research | Generative AI in RE | 2024–2034 | $1302.12 million | 11.52% |

| ArtSmart.ai (citing TBRC) | Overall AI in RE | 2024-2033 | $41.5 billion | 30.5% |

This report provides a comprehensive journey through the entire real estate funnel—from lead generation to closing and beyond—to reveal exactly where and how AI is creating an unassailable competitive advantage. It is a roadmap for brokerage owners and CTOs looking to navigate this new landscape and build a more efficient, profitable, and future-proof business.

Top of Funnel: From Predictive Prospecting to Intelligent Nurturing

For decades, the top of the real estate funnel has been a mix of art, science, and sheer luck. Success often depended on being in the right place at the right time. AI transforms this unpredictable activity into a data-driven science. It enables agents to find and engage the right leads, at the right time, with the right message—and it does much of the work automatically.

Predictive Prospecting: Identifying Sellers Before They Even Know They're Selling

The traditional method of "farming" a neighborhood involved blanketing an area with mailers and hoping for a response. AI-powered predictive analytics platforms have rendered this approach obsolete. Tools like Smartzip and Top Producer's Smart Targeting feature move beyond simple demographics to analyze thousands of disparate data points in real-time. These platforms ingest everything from historical property data and current market trends to local economic indicators, online browsing habits, and even social media sentiment to build sophisticated predictive models.

The result is a fundamental paradigm shift from reactive to proactive business development. Instead of waiting for a "For Sale" sign to appear, agents are presented with a data-backed list of homeowners who are statistically most likely to sell within the next 6-12 months. This allows them to focus their marketing spend and outreach efforts with surgical precision, engaging potential clients long before competitors are even aware an opportunity exists. It's the difference between fishing with a net and fishing with a heat-seeking missile.

The 24/7 Automated Nurturing Engine

Once a lead is identified, the race to respond begins. It's a well-established industry principle that a lead's value decays rapidly with every passing minute. Human agents, however, cannot be available 24/7. They sleep, attend meetings, and conduct showings, creating unavoidable gaps in response time. AI-infused Customer Relationship Management (CRM) systems and specialized platforms have completely solved this problem.

Companies like CINC and Funnel Leasing offer AI assistants that engage new leads instantly, regardless of the time of day. When a potential buyer or seller submits a form on a brokerage's website at 10 PM, an AI chatbot like CINC's "Alex" can immediately initiate a conversation via text or email. It can ask initial qualifying questions, provide requested information, and begin a personalized nurturing sequence—all without any human intervention.

The return on this investment is direct and measurable. The real estate software provider Funnel Leasing reports that its platform has led to a 33% increase in tour-to-lease conversion rates . This is because the AI-driven follow-up ensures every lead is engaged promptly and consistently, making them more "vested" in the process by the time they speak to a human agent. Perhaps more revealing is the finding that

69% of tours scheduled via their Virtual Assistant were booked after standard business hours . This single statistic demonstrates that AI isn't just making agents faster; it's capturing a massive segment of the market that was previously being lost entirely due to the limitations of a 9-to-5 workday. For a brokerage, this means their addressable market of engaged leads effectively expands without any increase in advertising spend, simply by plugging the "after-hours" lead leakage.

Furthermore, the true power of AI in marketing extends beyond mere automation to achieve hyper-personalization at a scale that was previously impossible. A human agent might segment their database into a few broad categories, but an AI system can create dozens of micro-segments based on a prospect's specific online behavior—the properties they viewed, the links they clicked, and the features they lingered on. Generative AI can then draft multiple, unique property descriptions for a single listing, each tailored to a different buyer persona. An investor might see a description emphasizing cap rates and rental history, while a family sees one highlighting the local school district and backyard size. This allows a single property to be marketed with a multitude of angles simultaneously, dramatically increasing its resonance and appeal across a wider range of potential buyers.

Middle of Funnel: Automating Qualification to Elevate the Human Touch

The middle of the funnel is where the most significant administrative burden has traditionally fallen on agents—fielding initial inquiries, answering repetitive questions, and scheduling appointments. AI agents in software development are now automating this entire stage, liberating agents from time-consuming tasks and allowing them to focus on the high-value, relationship-driven activities that build trust and close deals.

Your Most Efficient Agent is a Bot

The front line of client interaction for a modern brokerage is increasingly an AI-powered chatbot or virtual assistant (VA). These are not the clunky, frustrating bots of the past. Modern solutions from companies like Structurely, ActivePipe, and Funnel Leasing are sophisticated, conversational, and deeply integrated into the real estate workflow.

When a prospect lands on a brokerage website, these VAs can instantly handle a wide range of inquiries. They can answer frequently asked questions ("What are the property taxes?" "Is there a virtual tour available?"), pre-qualify leads by asking about their budget, financing status, and desired timeline, and then seamlessly schedule a showing directly on an agent's calendar.

The sheer volume of work these systems can handle is staggering. Funnel Leasing's platform, for instance, handles 86% of all initial inquiries for its clients through its AI assistant. This creates a powerful "qualification filter" that protects an agent's most valuable and finite asset: their time. Without AI, agents spend a significant portion of their day on the phone with prospects who are merely curious, not yet serious, or financially unqualified. This is a major source of inefficiency and burnout. The AI acts as a 24/7 triage nurse, collecting vital information upfront. By the time a lead is handed off to a human agent, they have already been vetted. The agent can enter the first conversation knowing they are speaking with a motivated and qualified individual. This transforms the nature of that first human interaction from a transactional fact-finding mission into a strategic conversation focused on building rapport and understanding the client's nuanced needs.

Freeing Agents for What Matters: From Task-Doer to Trusted Advisor

The persistent fear that AI will replace real estate agents is fundamentally misplaced. AI doesn't replace people; it replaces tasks—specifically, the repetitive, low-value administrative tasks that prevent agents from doing their best work. By automating the administrative drag, AI empowers agents to dedicate more of their time and energy to the activities that require uniquely human skills: empathy, complex negotiation, strategic problem-solving, and building long-term relationships.

For a brokerage owner, the benefits are twofold. First, agent productivity skyrockets. An agent who isn't bogged down by scheduling and data entry can handle a larger volume of high-quality leads and close more deals. Second, agent satisfaction and retention improve dramatically. Burnout is a chronic issue in the industry, often fueled by the relentless pressure of administrative tasks. By removing this burden, brokerages can create a more sustainable and rewarding work environment. Clients of Funnel have reported that its AI tools free up their teams to "focus on our residents and deliver that above and beyond experience," which directly leads to higher job satisfaction and lower turnover. This shift allows the brokerage's key performance indicators to evolve. Instead of measuring raw "number of leads," the focus can shift to "number of AI-qualified appointments," a metric that serves as a far more accurate predictor of future revenue.

Bottom of Funnel: Closing Deals with Data-Driven Confidence

As a deal moves toward the closing table, uncertainty and emotion can often derail the process. At this critical stage, AI serves as a powerful antidote, replacing "gut feel" and subjective opinion with data-driven certainty. This objective foundation builds immense trust with clients, strengthens an agent's negotiating position, and ultimately de-risks the transaction for all parties involved.

The End of Guesswork: Instant, Unbiased Property Valuations

Determining the right price for a property is arguably the most crucial and contentious part of any real estate transaction. AI-powered Automated Valuation Models (AVMs) have transformed this process from a time-consuming art into a rapid science. Platforms from industry giants like Zillow (with its "Zestimate"), Redfin, and specialized data firms like HouseCanary leverage machine learning to analyze millions of data points in seconds.

These AVMs go far beyond a simple comparative market analysis (CMA). They ingest and weigh a vast array of variables, including:

- Transactional Data: Historical sales prices, time on market, and price adjustments for comparable properties.

- Property Characteristics: Square footage, number of bedrooms and bathrooms, age, lot size, and specific features.

- Market Dynamics: Current inventory levels, absorption rates, and broader economic trends.

- Geospatial Data: Proximity to schools, parks, public transit, and other amenities.

- Image Analysis: Some advanced models can even analyze photos to assess a property's condition, finishes, and curb appeal, factoring those qualitative aspects into the valuation.

This technology is not about replacing an agent's expertise but augmenting it. An agent who walks into a listing presentation with a comprehensive, data-backed report from one of these platforms immediately establishes a higher level of credibility. The conversation shifts from a subjective "this is what I think it's worth" to a collaborative, objective "this is what the data shows it's worth, and here's why." This transparency is the bedrock of client trust. The continuous improvement of these models has solidified their place in the industry. Zillow's Zestimate, for example, has refined its AI algorithms to the point where the median error rate for on-market homes is now below 2%, making it a trusted benchmark for millions of consumers and professionals alike.

The Market Crystal Ball: Predictive Analytics for a Competitive Edge

Beyond valuing a single property, AI provides a macroeconomic lens to forecast market trends. By analyzing leading economic indicators, demographic shifts, local development plans, and interest rate changes, AI models can predict future market movements with increasing accuracy.

This capability transforms an agent from a simple facilitator of transactions into a true strategic advisor. Armed with predictive data, an agent can offer invaluable counsel to their clients. For a seller, this might mean advising them to list in three months when the model predicts a seasonal price peak. For a buyer, it could involve identifying an up-and-coming neighborhood poised for significant appreciation due to planned infrastructure projects. This level of data-driven foresight is a powerful differentiator that elevates the agent's value proposition and justifies their commission.

This flood of accessible data fundamentally changes the agent's role in the ecosystem. In the pre-internet era, an agent's primary value was their exclusive access to the MLS. The first wave of property tech, led by Zillow, democratized access to basic listing information. Now, AI is democratizing access to sophisticated valuation and market data. A client can get a Zestimate or a market forecast on their own. While this might seem like a threat, it is a profound opportunity. The agent's value is no longer in being a gatekeeper of information but in becoming a strategic interpreter of it. A top agent can now sit with a client and say, "The AI model provides a baseline valuation of $500,000. However, the model doesn't know about the brand-new roof we installed last year, nor can it fully price in the impact of the new light rail station planned two blocks away. That is why, based on my market expertise, I recommend we list at $525,000." In this scenario, the agent uses the AI's data as a transparent starting point, then adds their invaluable human context and expertise, proving their worth and building unshakable trust.

Beyond the Close: Revolutionizing Brokerage Operations & Profitability

For brokerage owners and CTOs, the impact of AI extends far beyond individual transactions. The most significant long-term value and competitive advantage may well come from AI's ability to streamline back-office operations, slash overhead, and create unprecedented efficiencies at scale.

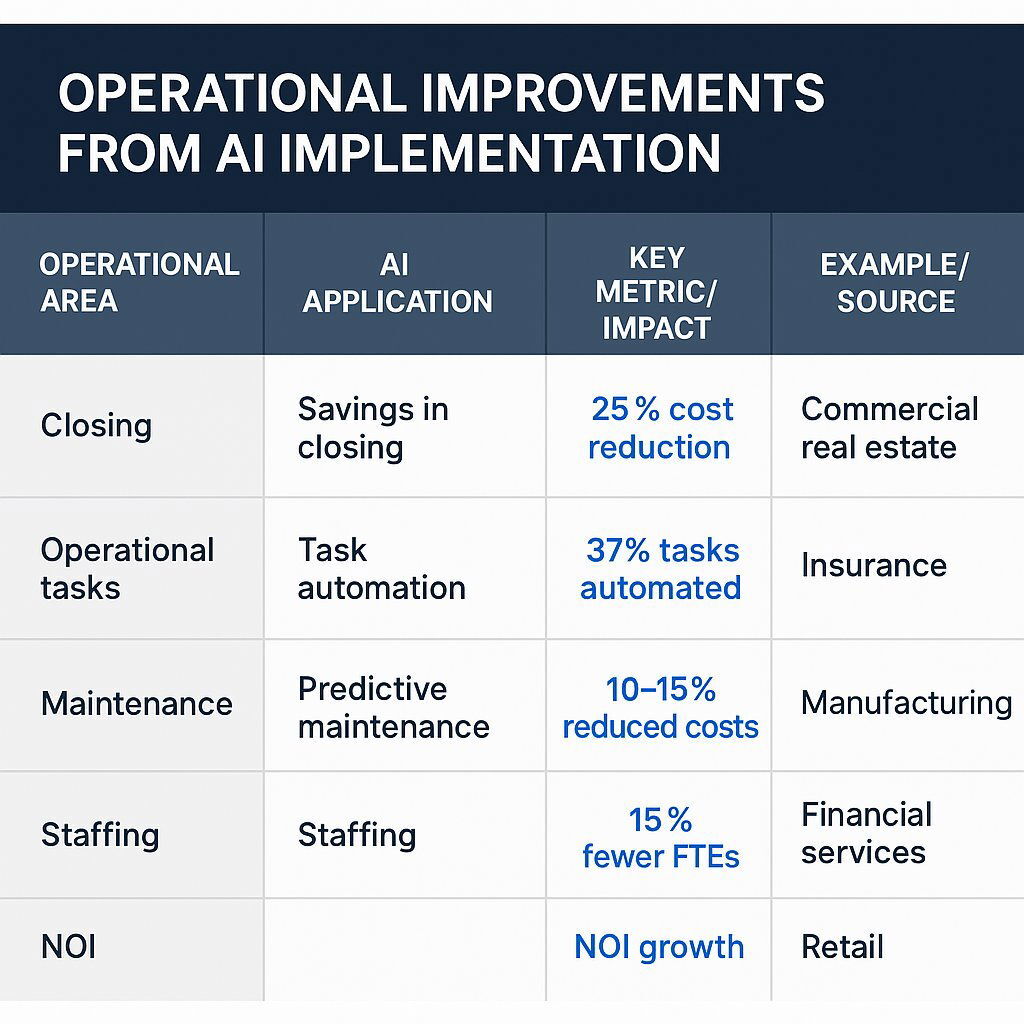

The Automated Back Office: Slashing Administrative Drag

The period between contract and closing is notoriously paper-intensive and fraught with administrative bottlenecks. AI is systematically dismantling these inefficiencies. Intelligent Document Processing (IDP) tools can now read, understand, and extract key information from complex legal documents like purchase agreements, leases, and closing statements. These systems can automatically flag missing signatures, identify non-standard clauses, and ensure compliance, dramatically reducing the time and risk associated with manual document review.

The case of Rexera, a real estate technology company, provides a stunning example of the ROI. By using AI to automate closing workflows, the company processes 5 million pages of real estate documents every month . This automation saves an average of 4 hours of manual work per transaction and has reduced operational costs for its customers by a staggering 25% . These are not abstract benefits; they are hard, tangible savings that flow directly to the bottom line.

From Reactive Repairs to Predictive Maintenance

For brokerages with a property management division, AI offers a revolutionary approach to maintenance. The traditional model is reactive: a tenant calls when something breaks, leading to emergency repairs, higher costs, and dissatisfied residents. AI flips this model on its head.

By integrating with Internet of Things (IoT) sensors in building systems (like HVAC and plumbing) and analyzing historical maintenance records, AI algorithms can predict equipment failures before they happen. The system can detect subtle anomalies in a furnace's performance, for example, and automatically schedule a preventative service call during a low-cost, off-peak time. This proactive approach yields significant financial benefits. According to research from Deloitte, predictive maintenance can reduce overall maintenance costs by

10-15% , cut equipment downtime by up to 50% , and extend the life of critical assets by 20-30% .

The cumulative impact of these operational efficiencies is profound. It allows a brokerage to fundamentally change its financial structure. Traditionally, for a firm to handle more transactions or manage more properties, it needed to hire more people—more transaction coordinators, more administrative staff, more property managers. Growth was directly and linearly tied to a rising payroll. AI-powered automation decouples this relationship. A brokerage can now double its transaction volume without necessarily doubling its back-office headcount because AI is absorbing the increased workload. Analysis from Morgan Stanley found that an incredible 37% of all tasks in the real estate sector can be automated , representing a potential $34 billion in operating efficiencies industry-wide. This allows brokerages to improve their agent-to-unit ratios, operate more leanly, and build a more profitable and resilient business model that can better withstand market fluctuations.

| Operational Area | Key Metric / AI Application | Quantifiable Impact | Source/Example |

|---|---|---|---|

| Closing & Transaction Management | AI Document Processing | 25% reduction in operational costs; 4 hours saved per transaction | Rexera Case Study |

| Overall Brokerage Operations | Task Automation | 37% of all real estate tasks are automatable, creating $34 billion in potential industry savings | Morgan Stanley Research |

| Property Management | Predictive Maintenance | 10-15% reduction in overall maintenance costs | Deloitte |

| Property Management | Lease Administration | Up to 42% reduction in errors in lease administration | Proprli |

| Back-Office Administration | Staffing & Labor Costs | 15% reduction in full-time employees with increased productivity | Morgan Stanley Research |

| Property Operations | Net Operating Income (NOI) | Over 10% increase in NOI through efficiency and new revenue streams | McKinsey & Company |

The Core Strategic Decision: Building a Custom Advantage vs. Buying Off-the-Shelf

Once a brokerage has committed to leveraging AI, the most critical strategic question becomes how . The path chosen—adopting a pre-built, off-the-shelf platform versus investing in a custom-built solution—will fundamentally define the firm's long-term competitive position and its ability to innovate.

The Case for Off-the-Shelf AI: Speed, Accessibility, and Proven Workflows

The market for off-the-shelf AI tools in real estate is mature and robust. There is undeniable value in these solutions. They are designed to be implemented quickly, often in a matter of weeks, with a lower initial financial outlay compared to custom development. These platforms are built around industry best practices and address common, universal pain points. For a brokerage looking to quickly automate its lead nurturing with a proven AI-powered CRM, deploy a 24/7 chatbot on its website, or provide agents with a powerful AVM tool, off-the-shelf options are an excellent starting point. They offer a fast track to realizing the immediate benefits of AI without the complexities of a ground-up development project.

The Case for Custom AI: Your Brokerage's Unique DNA

While off-the-shelf tools are effective at solving common problems, they cannot, by definition, create a unique competitive advantage. If every brokerage is using the same AI-powered CRM, it becomes a baseline operational tool, not a differentiator. This is where the strategic case for custom development becomes compelling.

A custom-built AI solution, developed in partnership with a specialized firm like Baytech Consulting, is crafted to the unique DNA of a specific brokerage. It is not a generic tool; it is a proprietary asset. Such a solution is designed around a firm's specific workflows, trained on its unique historical data, and aligned with its long-term strategic goals. It can be seamlessly integrated with a brokerage's existing, and often complex, tech stack—whether it's built on Azure DevOps, uses Postgres databases, or runs in a Kubernetes environment.

This tailored approach unlocks a level of performance and strategic advantage that off-the-shelf products cannot match. Imagine a custom lead-scoring algorithm trained on a decade of a brokerage's own transaction data, able to predict which leads will convert with unparalleled accuracy. Or consider a proprietary market analysis tool that incorporates a brokerage's unique local insights. While the upfront investment in time and capital is higher, the long-term ROI of a custom solution is often far greater. It delivers superior performance, offers limitless scalability, and creates a true competitive moat that cannot be easily replicated by competitors.

| Decision Factor | Off-the-Shelf Solution (The "One-Size-Fits-Many" Approach) | Custom-Built Solution (The "Tailored Advantage" Approach) |

|---|---|---|

| Initial Cost | Lower upfront cost, typically a recurring subscription fee (SaaS model). | Higher upfront investment for development, design, and integration. |

| Long-Term ROI | ROI is capped by the tool's features; costs can increase with user scaling. | Higher potential for long-term ROI through proprietary advantages and no recurring license fees. |

| Deployment Speed | Fast. Can often be implemented in weeks. | Slower. Development, testing, and deployment can take several months. |

| Scalability & Flexibility | Limited. Scalability is determined by the vendor's tiered plans and feature roadmap. | High. Built to scale with the business and can be adapted as needs evolve. |

| Integration with Existing Systems | Can be challenging. Relies on standard APIs which may not fit complex or legacy systems. | Seamless. Designed specifically to integrate deeply with the existing tech stack. |

| Data Security & Control | Data is often stored on vendor servers, raising potential compliance and privacy concerns. | Full control. Data remains within the brokerage's environment, ensuring maximum security. |

| Potential for Competitive Differentiation | Low. The same tools are available to all competitors. | High. Creates a unique, proprietary asset and a sustainable competitive advantage. |

Conclusion: Your First Step into the AI-Powered Future

Artificial Intelligence is no longer a futuristic concept discussed in technology circles; it is a present-day reality that is actively and fundamentally reshaping every stage of the real estate funnel. From identifying sellers before they list to automating the complexities of closing, AI is creating a new class of brokerage: one that is faster, smarter, and vastly more efficient. The evidence is clear and overwhelming. Brokerages that embrace this technological shift will not just compete; they will dominate. They will gain an insurmountable advantage in lead conversion, operational efficiency, and ultimately, profitability.

The journey into this new era does not require a blind leap. The most effective first step is a strategic and introspective one. Brokerage leaders should conduct an internal "AI Opportunity Audit." This involves meticulously mapping current workflows—from the very first lead intake to post-close client follow-up—and identifying the top three to five areas that are defined by the most friction, repetition, and manual effort. Is it the after-hours lead leakage? The administrative burden of scheduling showings? The time-consuming process of reviewing contracts? These identified pain points are the prime targets for an initial, high-impact AI implementation.

This transformation is a strategic journey, not a single purchase. Whether the right path begins with deploying a targeted off-the-shelf tool to solve an immediate problem or involves exploring the profound strategic advantage of a custom-built AI engine, the process starts with a clear, honest assessment of a brokerage's unique challenges and goals.

At Baytech Consulting, we specialize in partnering with firms to navigate this exact transformation. Our expertise lies in crafting tailored technology solutions that don't just solve problems but create lasting competitive advantages. The AI-powered future of real estate is here. Let's discuss what yours could look like.

Further Reading

- https://www.morganstanley.com/insights/articles/ai-in-real-estate-2025

- https://theclose.com/best-real-estate-ai-tools/

- Generative AI can change real estate, but the industry must change to reap the benefits

About Baytech

At Baytech Consulting, we specialize in guiding businesses through this process, helping you build scalable, efficient, and high-performing software that evolves with your needs. Our MVP first approach helps our clients minimize upfront costs and maximize ROI. Ready to take the next step in your software development journey? Contact us today to learn how we can help you achieve your goals with a phased development approach.

About the Author

Bryan Reynolds is an accomplished technology executive with more than 25 years of experience leading innovation in the software industry. As the CEO and founder of Baytech Consulting, he has built a reputation for delivering custom software solutions that help businesses streamline operations, enhance customer experiences, and drive growth.

Bryan’s expertise spans custom software development, cloud infrastructure, artificial intelligence, and strategic business consulting, making him a trusted advisor and thought leader across a wide range of industries.