The Great AI Pullback: Evidence Why Enterprises Are Halting Pilots Before They Scale

September 22, 2025 / Bryan ReynoldsThe Great AI Correction: Why Corporate America Is Quietly Hitting 'Pause' on AI Pilots (And What You Should Do About It)

Leadership teams grapple with the ROI gap in AI investments.

Introduction: The $100 Billion Question

Corporate America is in the midst of an artificial intelligence investment boom of historic proportions. In 2024 alone, U.S. private AI investment surged to an astonishing $109.1 billion, with generative AI attracting $33.9 billion globally. The adoption figures are equally staggering: 78% of organizations now report using AI in some capacity, a dramatic leap from 55% just the year before. The global AI market is on a trajectory to exceed $240 billion, as the use of generative AI in business functions has jumped from 55% to 75% in a single year. This rapid growth has led many analysts to warn of an emerging AI bubble, where speculative investments and overhyped expectations could pose significant risks to the market.

Major tech giants are fueling this surge, with companies like Google serving as a prime example of aggressive investment and adoption in AI technologies.

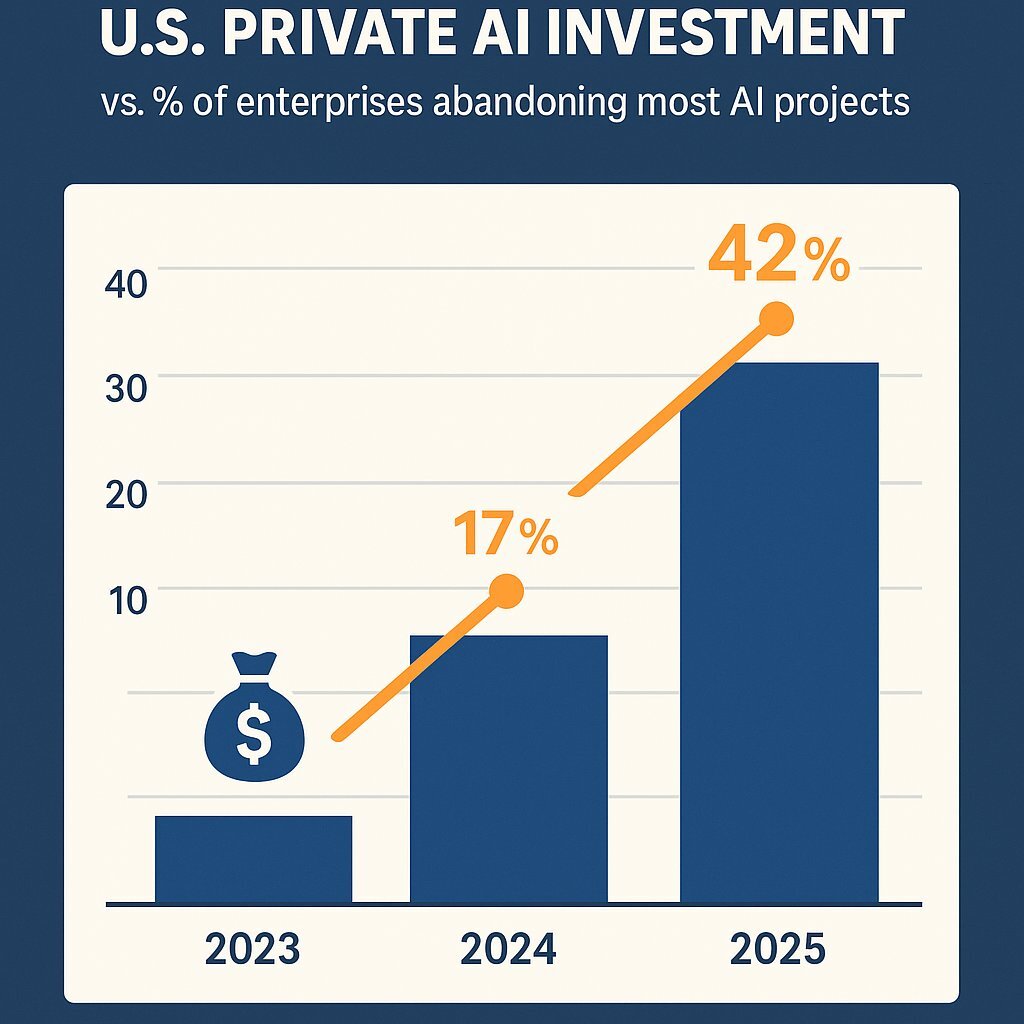

Yet, beneath this tidal wave of capital and enthusiasm, a troubling counter-narrative is emerging from boardrooms and IT departments. A shadow story of stalled projects, squandered budgets, and mounting executive frustration. The data is as stark as it is concerning: the share of companies abandoning the majority of their AI initiatives has skyrocketed from 17% in 2024 to a staggering 42% in 2025. On average, nearly half—46%—of all AI proofs-of-concept are being scrapped before they ever see the light of day in a production environment. These concerns about sustainability and overvaluation are fueling fears that a bubble may be forming, as organizations struggle to realize tangible ROI. For example, IBM's Watson Health project was once heralded as a revolutionary AI solution but ultimately failed to deliver on its promises, leading to its discontinuation and serving as a cautionary tale of overhyped expectations.

This leads to the hundred-billion-dollar question being asked in hushed tones by CFOs and CTOs across the country: How is it possible that as investment sextuples, the rate of outright project abandonment more than doubles?

This phenomenon is not a signal to retreat from AI. It is a market-wide, painful, but ultimately necessary correction. The velocity of failure is currently outpacing the velocity of investment, indicating a systemic flaw not in the technology itself, but in the dominant approach to its implementation. As a result, many now expect a reset in market expectations, with investors and executives becoming more cautious in their outlook following recent high-profile failures. The very hype driving the investment frenzy has created a pressure-cooker environment, forcing rushed, ill-conceived projects that are predisposed to failure. The current “retreat” is a direct and logical consequence of this unsustainable dynamic. It is the critical moment when leadership must stop chasing hype and start building durable, strategic value. This report is the definitive playbook for making that pivot.

"We're Investing Millions in AI. Why Aren't We Seeing a Return?"

The anxiety palpable in executive suites is not unfounded; it is a rational response to a growing and well-documented chasm between financial outlay and tangible business value. Despite significant amounts of money being spent on AI initiatives, most AI pilots are not increasing the company's profit, and the expected returns are often elusive. The disconnect between the promise of AI and its current reality on the profit and loss (P&L) statement is becoming too large to ignore. Companies need to carefully account for the true ROI of their AI investments, as organizations continue to struggle to find measurable business impact from these technologies. There is a growing sense among leaders that the hype is not matching reality, yet most people outside of technical teams may not realize the extent of these failures.

The Investment Deluge vs. The Value Drought

The projections for AI’s economic impact are monumental. Forecasts suggest AI will contribute as much as $15.7 trillion to the global economy by 2030, with the market growing at a compound annual growth rate (CAGR) of over 20%. In response, nearly 90% of enterprises are increasing their generative AI investments, determined not to be left behind. Much of this surge is driven by the hype around large language models, which have become the centerpiece of recent AI advancements and investment cycles.

But the returns on this massive spend are proving profoundly elusive. A landmark 2025 study from MIT’s Networked Agents and Decentralized AI (NANDA) initiative delivered a sobering verdict: despite an enterprise investment of $30 to $40 billion, a shocking 95% of generative AI pilot projects are failing to move the needle on profitability . This aligns with forecasts from leading analyst firms. Gartner, for instance, predicts that over 40% of agentic AI projects—those designed to operate autonomously—will be canceled by the end of 2027 due to escalating costs, unclear business value, or inadequate risk controls. Further research reveals that more than half of IT leaders admit their AI projects are not yet profitable, meaning for every success story, there is at least one initiative that has yet to deliver a return on investment. Honestly, the gap between the hype and reality is stark, and many of the claims about AI's transformative impact are simply a lie.

This has given rise to a productivity paradox. While individual employees are seeing real efficiency gains using off-the-shelf tools like ChatGPT or Microsoft Copilot for discrete tasks, these benefits are not translating into systemic, enterprise-level P&L impact. AI is often used to write code or documentation, but this is typically low-value work, and the written outputs frequently require significant human oversight to ensure quality. Many programmers have wrote code that looks functional but is deeply flawed—AI-generated outputs can suffer from the same issues, highlighting the ongoing need for human review. In reality, AI excels at automating simple tasks and handling behind-the-scenes stuff, but its limitations become clear when compared to humans, especially in complex or nuanced scenarios. For established firms, AI adoption

initially reduces productivity . The disruption caused by workflow redesign, staff training, and integration with legacy systems creates a short-term dip in performance, a cost that many organizations have failed to anticipate. The continued need for human oversight, and the inability of AI to fully replace humans in critical decision-making, further limits productivity gains.

The market is clearly bifurcating. One group is achieving minor, individual-level productivity boosts with readily available tools—the low-hanging fruit of the AI revolution. The other, larger group is struggling, and mostly failing, to achieve the deep, operational transformation that generates lasting competitive advantage. The 95% failure rate is not about unused ChatGPT licenses; it is about the systemic failure of strategic, integrated AI systems to deliver on their promise. This has significant implications for workers, as job roles shift and concerns about displacement grow, especially in white-collar sectors. While some AI startups are seen as unjustifiably cheap relative to their hype, others are overvalued, reflecting the speculative nature of the current investment boom. Meanwhile, technologies like quantum computing offer a stark contrast—less hype, but potentially more substantive breakthroughs. Ultimately, the real value may come from new ideas about how to leverage AI effectively, rather than the technology itself, and the level of organizational or political support will play a crucial role in determining which initiatives succeed or fail.

Infographic: AI investment vs. project abandonment, 2023–2025.

The AI Investment-Value Gap

The following chart illustrates the widening chasm between the capital flowing into AI and the escalating rate of project failure. While investment continues its steep ascent, the percentage of enterprises abandoning their initiatives is accelerating even faster, painting a clear picture of diminishing returns at an industry-wide scale.

| Year | U.S. Private AI Investment ($ Billions) | % of Enterprises Abandoning Most AI Initiatives |

|---|---|---|

| 2023 | ~$2.3 Billion | - |

| 2024 | $109.1 Billion | 17% |

| 2025 | Projected Increase | 42% |

Note: The chart visually represents the trend of rapidly increasing investment against an even more rapidly accelerating project abandonment rate, highlighting the core problem addressed in this report.

The Market Implications of the AI Pullback

The recent AI pullback is sending ripples through the stock market, prompting investors and fund managers to take a hard look at the true value of artificial intelligence in driving business growth. As the vast majority of ai pilots fail to deliver meaningful productivity gains, the initial euphoria that fueled soaring valuations is giving way to a more cautious, data-driven approach. This shift is already being reflected in the price to earnings ratio of leading AI-related stocks, with companies like Nvidia and Meta facing increased scrutiny over whether their earnings can justify their sky-high valuations.

For fund managers, the AI pullback means reassessing portfolio strategies and weighing the risks and rewards of investing in companies that have staked their future on artificial intelligence. The stock market, once buoyed by the promise of exponential growth from AI, is now grappling with the reality that many companies are struggling to translate AI investments into tangible business results. As a result, investors are demanding clearer evidence of productivity gains and sustainable profit before rewarding companies with premium valuations.

This recalibration comes at a time when the US economy is already navigating significant uncertainty, with inflation and fluctuating interest rates adding to the complexity. The AI pullback could contribute to broader market volatility, as companies adjust their earnings forecasts and growth projections in light of more realistic expectations for AI-driven returns. Ultimately, this correction may lead to a healthier, more sustainable market environment—one where the true value of AI is measured not by hype, but by its proven impact on business performance and the bottom line.

"What's Actually Going Wrong? The Four Hidden Killers of AI Pilots"

Understanding the "what"—the gap between investment and value—is the first step. The more critical question for leadership is "why." The high failure rate is not a matter of bad luck; it is the result of a consistent set of strategic and operational missteps. Analysis of hundreds of stalled and abandoned projects reveals four recurring patterns—the hidden killers of AI pilots.

Killer #1: The Data Delusion ("Garbage In, Gospel Out")

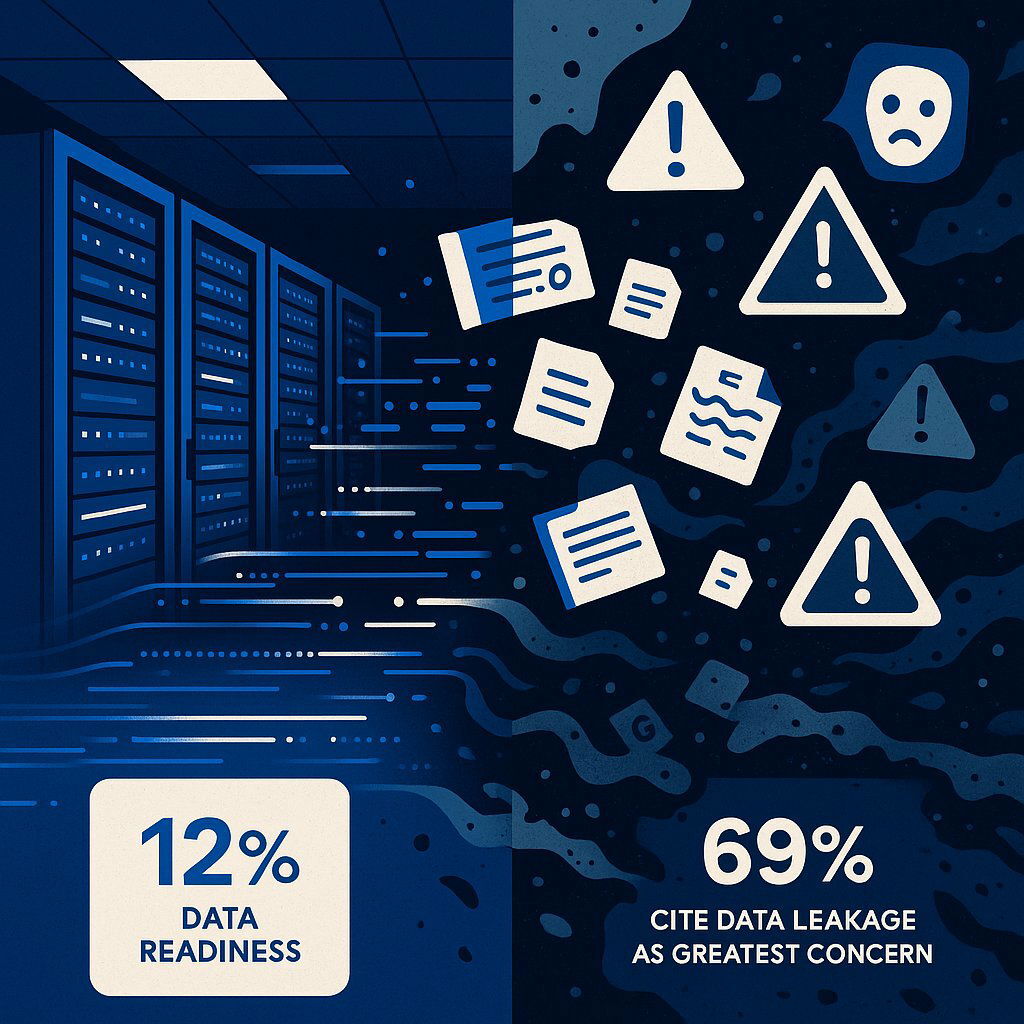

The single greatest cause of AI project failure is a foundational one: organizations are building AI-powered penthouses on data foundations made of "wet sand". The unassailable truth of AI is that its outputs are only as good as its inputs. Yet, a stunningly low

12% of organizations report that their data is of sufficient quality and accessibility for AI . This is the central crisis of the current AI boom. The top challenge inhibiting AI progress is not a lack of algorithms or compute power, but data governance, cited by 62% of leaders. Forrester Research confirms this, identifying data issues as the number one challenge for all digital transformation leaders.

"Garbage in, gospel out": How poor data undermines AI success.

This poor data hygiene has catastrophic consequences. It leads directly to inaccurate models, biased outputs, and confident-sounding "hallucinations" that erode user trust and can lead to disastrous business decisions. This flood of unreliable outputs has been termed the "Slopocene era," a time when AI's rapid growth has unleashed a torrent of untrustworthy information. The risks extend beyond mere inaccuracy. A June 2025 study found that 69% of organizations cite AI-powered data leaks as their top security concern, yet nearly half (47%) have no AI-specific security controls in place, leaving them dangerously exposed.

Killer #2: Pilot Purgatory ("Stuck in the Lab")

The second killer is the chasm between the controlled environment of a lab and the chaotic reality of a live business. An AI model that performs beautifully in a clean, isolated sandbox often fails to survive its first contact with the enterprise's complex ecosystem. The numbers are bleak: on average, only 48% of AI projects ever make it into production. A separate report found that two-thirds of enterprises admit they are unable to successfully transition their pilots into a production environment.

This phenomenon is known as "pilot paralysis." Teams launch proofs-of-concept without a clear path to deployment. Critical integration challenges—including secure authentication with legacy systems, navigating complex compliance and regulatory workflows, and training real users on new processes—are often ignored until it is too late. By the time an executive requests a go-live date, the project team discovers that the compliance requirements are insurmountable and the business case remains purely theoretical. This results in a corporate graveyard of abandoned prototypes—millions of dollars spent on projects that were technically successful but operationally useless, fueling a deep and justified cynicism among senior leadership.

Killer #3: The Strategy Gap ("A Solution in Search of a Problem")

Many AI projects are doomed from their inception because they begin with the wrong question. Instead of starting with a critical business problem, teams become mesmerized by the technology itself. This "model fetishism," where engineering teams spend months optimizing technical scores while ignoring the business case, is a common failure pattern. As one business school analysis notes, the goal becomes finding a problem to fit a "cool" new tool, rather than finding the right tool to solve an existing, costly problem.

This technology-first approach is a direct violation of sound business strategy. Projects are launched without clear objectives, measurable key performance indicators (KPIs), or alignment with the company's P&L goals. Forrester has explicitly warned that most firms underdeliver on AI's potential because they treat it as a tech initiative instead of a fundamental business transformation. The inevitable result is a project that cannot be defended when a senior executive asks the simple, brutal question: "What have we achieved?". This lack of a clear, defensible business case is a primary driver behind Gartner's prediction of mass project cancellations.

Killer #4: The "One-Size-Fits-None" Trap

The fourth killer is an over-reliance on generic, off-the-shelf AI tools to solve unique and complex business challenges. While these pre-packaged solutions offer the allure of rapid deployment and lower initial costs, they often fall short where it matters most: creating a sustainable competitive advantage. These tools, by design, are built for the average use case. They often lack the flexibility to integrate deeply with a company's specific legacy systems, the security protocols to handle sensitive proprietary data, and the nuance to understand a company's unique operational workflows.

While these tools are effective for commoditized tasks like summarizing meeting notes or drafting generic emails, they cannot, by definition, leverage the unique data and processes that differentiate a business in the marketplace. This reality is reflected in the strategies of high-performing organizations. McKinsey's 2024 State of AI report found that the companies extracting the most value from AI show a strong preference for "highly customized or bespoke solutions". By defaulting to generic tools for strategic challenges, many companies are inadvertently choosing to compete on a level playing field, paying recurring licensing fees for solutions that fail to create a true, defensible moat around their business.

These four killers do not operate in isolation. They are deeply interconnected in a predictable, causal chain of failure. An organization that begins with a vague goal like "we need to use AI" (Strategy Gap) is far more likely to grab a convenient, off-the-shelf tool that seems to fit (One-Size-Fits-None Trap). Because the project started with the tool, not the business problem, the hard work of assessing data readiness and mapping out complex integration paths was never properly scoped or funded. The team builds a proof-of-concept in a clean sandbox, and it works. But when they attempt to move to production, they collide with the harsh reality of messy, siloed data (Data Delusion) and legacy system incompatibility (Pilot Purgatory). The project stalls, the budget is exhausted, and another pilot is sent to the graveyard. This reveals that the current wave of AI failure is not a series of independent problems, but a systemic breakdown stemming from a fundamentally flawed approach.

"So, Should We Cut Our AI Budget? Or Is There a Smarter Way Forward?"

Faced with this sobering reality, the reflexive action for many leaders is to pull back, cut budgets, and wait for the dust to settle. This would be a strategic error. The correct response is not to cut the AI budget, but to refocus it with surgical precision. The playbook of the successful 5% provides a clear, actionable framework that directly counters the four killers of AI pilots. It requires a radical shift in approach, moving from technology-centric experimentation to business-centric problem-solving.

Actionable Advice 1: Start with the P&L, Not the Platform

The single most important shift is to reframe every AI initiative around a painful, measurable business problem. The successful 5% of organizations "pick one pain point, execute well". The guiding question must change from "What can we do with AI?" to "What is our most expensive, inefficient, or frustrating business process, and can AI be the most effective way to fix it?". This problem-first orientation ensures that every dollar invested is tied to a clear, defensible business outcome.

Evidence strongly supports this approach. McKinsey's research shows that organizations achieving significant financial returns from AI are twice as likely to have redesigned their end-to-end business workflows before they even begin selecting AI models or tools. Success begins by defining clear goals and KPIs that are explicitly aligned with the overall strategic objectives of the business, ensuring that the project's value can be measured and communicated in the language of the C-suite: revenue growth, cost reduction, and risk mitigation.

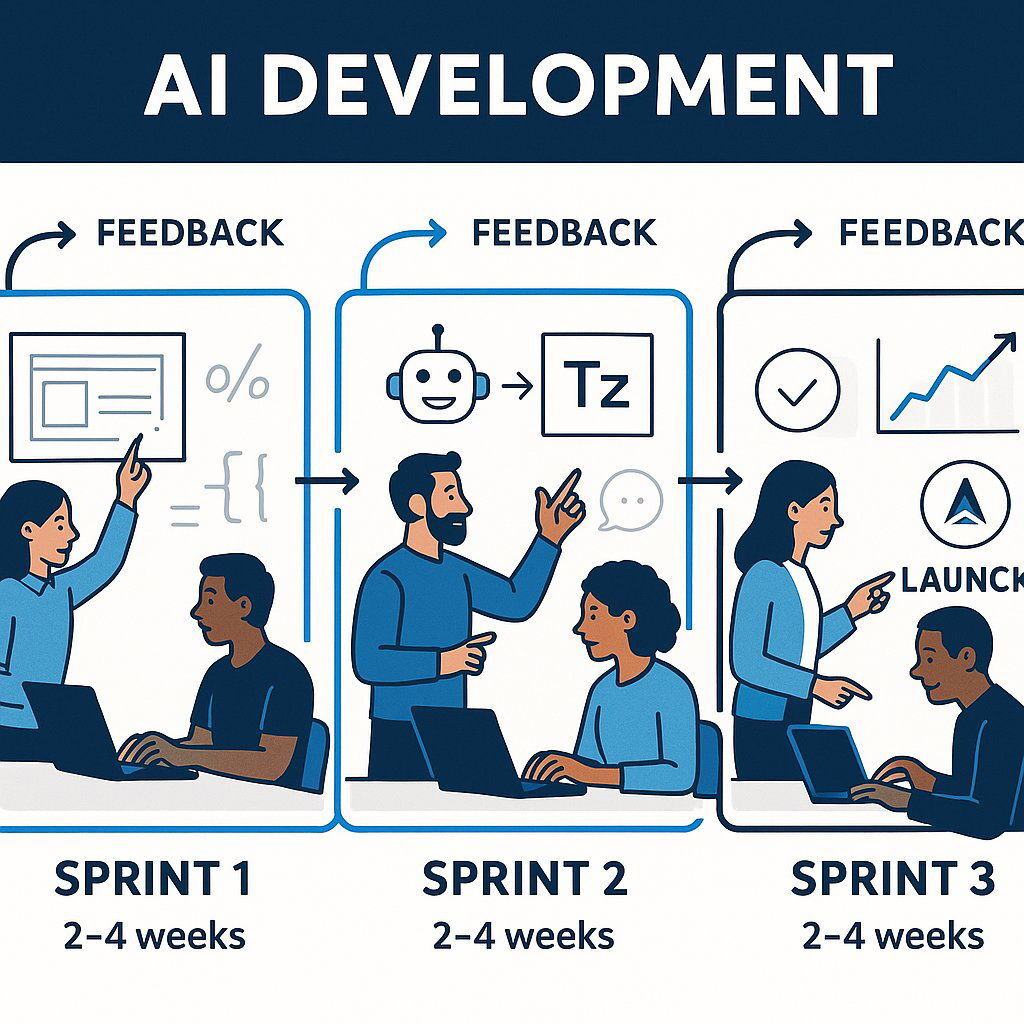

Actionable Advice 2: Ditch the "Big Bang" for Agile Sprints

Agile, iterative sprints speed up AI success and reduce risk.

AI development is not like traditional software or application development. It is fundamentally a "data game"—an experimental, iterative process of discovery where requirements change and insights emerge as the project progresses. Attempting to manage such a project with a rigid, waterfall-style "big bang" approach is a recipe for failure. The long planning cycles and inflexible roadmaps of traditional IT are ill-suited for the dynamic nature of AI.

Instead, leading organizations adopt an agile methodology, breaking down large, ambitious projects into small, manageable increments or "sprints," typically lasting two to four weeks. Each sprint is focused on delivering a small, testable piece of functionality. This approach allows teams to "fail early" and inexpensively on some ideas, learn from real-world data, de-risk the overall investment, and prove value incrementally to stakeholders.

This agile, iterative methodology is a radical departure from traditional IT project management. It requires a different skillset, a different culture, and a different mindset—one that embraces experimentation and rapid learning. This is why many leaders who are part of the successful 5% choose not to go it alone. They partner with specialist firms like Baytech Consulting , who leverage rapid agile deployment to move from concept to a value-generating reality in weeks, not years. This ensures solutions are built for specific business workflows, not just dropped on top of them, providing a direct antidote to the "Pilot Purgatory" trap.

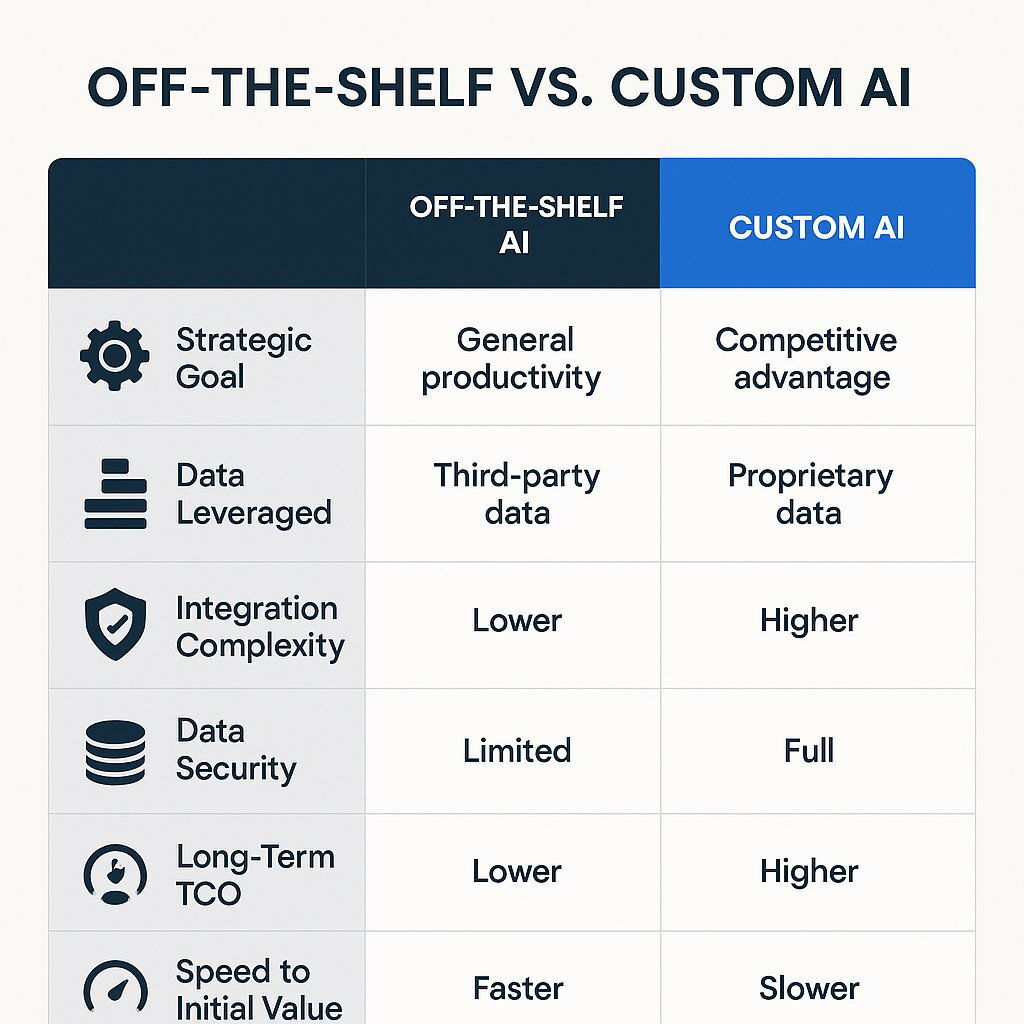

Actionable Advice 3: Make the "Build vs. Buy" Decision Strategically

The choice between buying an off-the-shelf solution and building a custom one is not a simple technical decision; it is one of the most critical strategic decisions a leadership team can make. There is a role for both, and the key is to apply them to the right problems. Generic, commoditized tools are perfectly suitable for generic, commoditized tasks. However, creating a true, sustainable competitive advantage requires leveraging a company's most valuable assets: its unique proprietary data and its finely tuned business processes.

The data presents a nuanced picture that requires careful interpretation. One study found that companies that bought AI tools saw their projects succeed 67% of the time, compared to only 33% for projects built entirely in-house. This speaks to the difficulty of building from scratch and the speed-to-market advantage of purchasing a ready-made solution. However, as previously noted, McKinsey's research on

top performers —those generating significant financial returns—found that they are the ones who build or commission "highly customized or bespoke solutions". If you're interested in learning why many IT leaders are choosing custom software as a path to success, explore the latest executive insights from industry research.

The synthesis of these findings is clear: buying is often the fastest way to get a solution, but building or tailoring is the only way to get the right solution for your most strategic challenges. The following decision matrix is designed to help executives make this choice not as technologists, but as business strategists.

Custom vs. Off-the-Shelf AI: An Executive's Decision Matrix

Key differences between buying and building AI solutions.

| Feature | Off-the-Shelf AI Solution | Custom-Tailored AI Solution (e.g., Baytech Consulting) |

|---|---|---|

| Strategic Goal | General productivity boost, automating common tasks. | Creating a unique competitive advantage, solving a core business problem. |

| Data Leveraged | General, public, or standardized industry data. | Proprietary company data, unique customer insights, specific operational data. |

| Integration Complexity | Standalone or simple API connections to modern systems. | Deep integration with complex legacy systems, ERPs, and core operational workflows. |

| Data Security & Control | Relies on vendor's standard security protocols and data policies. | Full data sovereignty, custom security protocols, adherence to strict compliance. |

| Long-Term TCO | Low initial cost, but high recurring subscription fees that scale with usage. | Higher initial investment, but lower/no recurring fees and full ownership of IP. |

| Speed to Initial Value | Faster deployment for basic use cases, but with limited impact. | Slower initial build, but delivers deeper, more strategic, and higher-impact value. |

The Impact on the Tech Industry and Beyond

The AI pullback is forcing a major reckoning within the tech industry, as companies that once raced to adopt generative ai tools are now rethinking their strategies in light of more sober realities. The initial wave of ai hype promised revolutionary productivity gains and transformative business models, but recent months have revealed that the path to value is far more complex. As a result, tech companies are shifting their focus from flashy demonstrations to practical, scalable applications of generative ai that can deliver measurable results.

This new era is also bringing increased scrutiny to the broader impact of artificial intelligence, especially in areas like climate change and job displacement. Regulators and stakeholders are demanding greater transparency and accountability from companies deploying generative ai, pushing the tech industry to adopt more honest and responsible communication about what these tools can—and cannot—achieve. The world is watching as businesses move from bold promises to concrete evidence, and the need for trust has never been greater.

For investors and companies alike, the story of AI is evolving. The days of unchecked enthusiasm are giving way to a more nuanced understanding of how ai can drive growth and profitability. Businesses are learning that success with ai requires not just cutting-edge technology, but also a clear-eyed assessment of its limitations and a commitment to integrating it thoughtfully into existing workflows. As the tech industry adapts to this new reality, the companies that thrive will be those that balance innovation with honesty, and hype with hard evidence—writing a new chapter in the ongoing story of technology’s role in shaping the future.

Conclusion: Your Next Move in the AI Marathon

The widespread corporate retreat from AI pilots is not the end of the story. It is the end of the beginning. It marks a necessary and healthy market correction—a collective flight from hype-driven spending toward a more pragmatic, value-oriented approach. Success in this next phase will not be defined by having an "AI strategy," but by having a business strategy that intelligently and selectively leverages AI to solve real problems. The path forward requires a fundamental shift in mindset: from technology-first to problem-first, from rigid waterfall planning to nimble agile execution, and from generic, one-size-fits-all tools to tailored, strategic solutions.

This market correction presents a powerful opportunity for decisive leaders. While competitors are paralyzed by the fallout from their failed pilots and slashing budgets out of fear, you can seize the advantage by building a durable, effective AI capability. The time for scattered, unfocused experimentation is over. The time for disciplined, strategic execution is now.

Actionable Next Steps

From business pain point discovery to launching a successful, measurable AI solution.

- This Week (Diagnosis): Convene your senior leadership team. Ban the word "AI" from the room for the first hour. Ask each leader to answer one question: "What is the single most costly, time-consuming, or broken process in your department that, if fixed, would have the greatest impact on our P&L?" Start with the business pain, not the technology.

- This Month (Audit): Task your Chief Data Officer or CTO with conducting a brutal, honest data audit focused only on the top business problem identified in your leadership meeting. Is the data required to solve this specific problem accessible, clean, complete, and governed? Do not allocate a single dollar to model development until the answer to that question is a definitive "yes."

- This Quarter (Pilot Smart): Resist the urge to fund another six-month "science project." Instead, scope a single, four-week agile sprint with a clear, P&L-focused goal. Engage a partner with proven expertise in custom software development and rapid agile deployment to build a minimum viable product that solves one critical piece of the identified business problem. Measure the result against the pre-defined KPI. This is how you de-risk your investment, prove value quickly, and join the 5% of companies that are making AI work.

Supporting Articles for Further Reading

- For Strategy: Harvard Business Review - Competing in the Age of AI

- For Implementation: MIT Sloan Management Review - Generate Value From GenAI With 'Small t' Transformations

- For Data: Forrester - Data Issues Are The Number One Challenge For Digital Transformation Leaders

About Baytech

At Baytech Consulting, we specialize in guiding businesses through this process, helping you build scalable, efficient, and high-performing software that evolves with your needs. Our MVP first approach helps our clients minimize upfront costs and maximize ROI. Ready to take the next step in your software development journey? Contact us today to learn how we can help you achieve your goals with a phased development approach.

About the Author

Bryan Reynolds is an accomplished technology executive with more than 25 years of experience leading innovation in the software industry. As the CEO and founder of Baytech Consulting, he has built a reputation for delivering custom software solutions that help businesses streamline operations, enhance customer experiences, and drive growth.

Bryan’s expertise spans custom software development, cloud infrastructure, artificial intelligence, and strategic business consulting, making him a trusted advisor and thought leader across a wide range of industries.