Unlocking the Strategic Power of Build vs. Buy: The 6-Factor Framework

September 29, 2025 / Bryan ReynoldsThe Build vs. Buy Decision Matrix: A 6-Factor Model for Enterprise Leaders

The Strategic Inflection Point: Why 'Build vs. Buy' is a C-Suite Decision, Not an IT Problem

The decision to build custom software or buy a commercial off-the-shelf (COTS) solution is one of the most consequential choices a modern enterprise can make. For decades, this was framed as a technical dilemma, a cost-benefit analysis relegated to the IT department. Today, that view is dangerously obsolete. This is no longer just an IT problem; it is a fundamental strategic inflection point that dictates a company's competitive posture, operational agility, and long-term capacity for innovation. A recent survey crystallizes this paradigm shift, revealing that an overwhelming 75% of IT decision-makers now believe bespoke software development leads to superior business outcomes. The conversation has irrevocably moved from cost-saving to value-creation.

The urgency of this shift is driven by a powerful, yet often unseen, force: the commoditization of business processes. The widespread adoption of popular COTS platforms for core functions like customer relationship management (CRM) or enterprise resource planning (ERP) has inadvertently created a "sea of sameness". When an entire industry operates on the same underlying software, competitors are bound by the same logic, the same workflow constraints, and the same vendor-dictated innovation cycles. In this environment, achieving a genuine, sustainable competitive advantage through process excellence becomes nearly impossible. This operational homogeneity is a quiet but potent strategic threat.

The move toward custom software is a strategic rebellion against this commoditization. It is a C-suite-level recognition that a company's unique operational formula—its specific way of serving customers, managing its supply chain, or analyzing data—

is its advantage. Codifying that advantage in proprietary technology transforms it from a set of processes into a tangible, defensible asset. This is the essence of engineering a "Tailored Tech Advantage." A custom solution is not just software; it is the architectural blueprint of a company's competitive moat.

This strategic re-evaluation is reflected in market dynamics. The global custom software development market, valued at approximately $43.21 billion in 2024, is projected to surge to over $146.18 billion by 2030, expanding at a compound annual growth rate (CAGR) of over 22%. This exponential growth is not merely a sign of increased IT spending. It is empirical evidence of a widespread strategic pivot among enterprise leaders. The decision is shifting from a tactical operational expenditure (OpEx)—renting a service to solve an immediate problem—to a strategic capital expenditure (CapEx)—investing in the creation of a long-term asset that generates unique value.

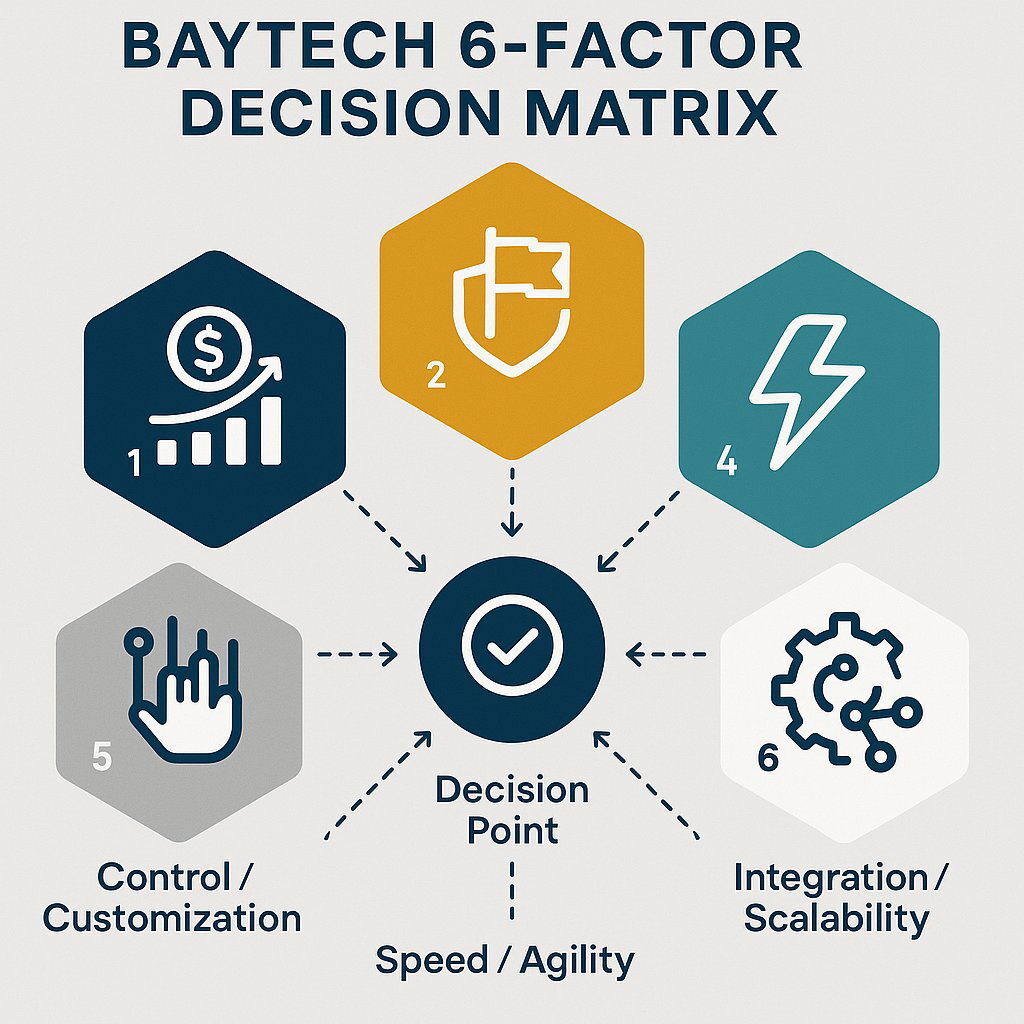

To navigate this high-stakes decision, leaders need to move beyond simplistic pro-and-con lists. This report introduces Baytech Consulting's proprietary 6-Factor Decision Matrix, a comprehensive framework designed for enterprise leaders. It provides a structured, data-backed methodology to make a holistic choice that aligns technology investment with durable, long-term business strategy.

The Baytech 6-Factor Decision Matrix: A Framework for Data-Backed Choices

The decision to build, buy, or blend software solutions requires a multi-faceted analysis that balances financial realities with strategic ambitions. The following six factors provide a comprehensive framework for evaluating these complex trade-offs, ensuring that the final choice is not just technically sound but strategically optimal.

Factor 1: Total Cost of Ownership (TCO) & Strategic ROI

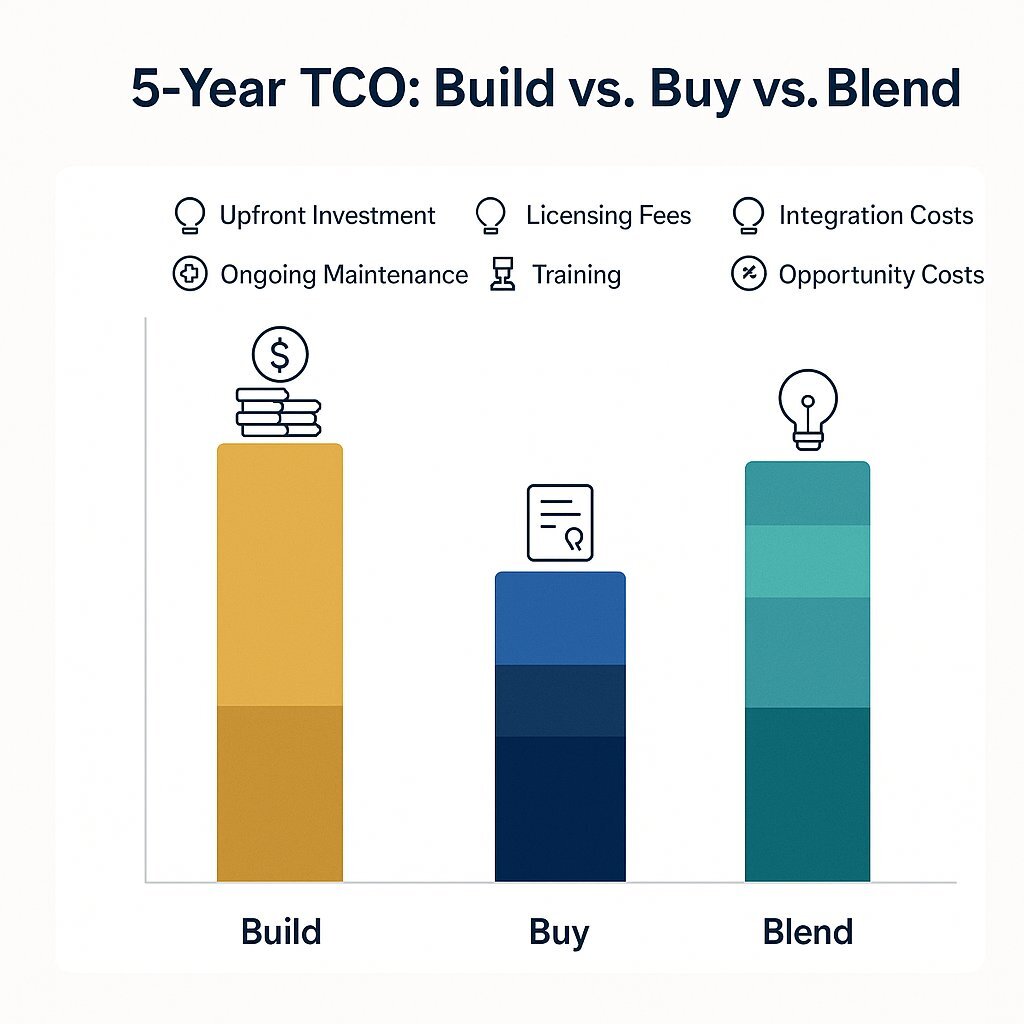

The initial price tag is the most misleading metric in the build versus buy debate. A true financial analysis demands a multi-year Total Cost of Ownership (TCO) model that rigorously accounts for a vast array of direct and indirect costs over the software's entire lifecycle. For those budgeting for custom software solutions, looking beyond upfront rates to consider hidden recurring costs is essential.

For "buy" decisions, the lower upfront cost of a COTS solution is often an illusion that masks a much higher long-term TCO. The most significant driver is the perpetual nature of licensing and subscription fees, which can escalate unpredictably as user counts grow or as vendors move previously included features into higher-priced tiers. Annual support and maintenance fees alone often range between 22-25% of the initial purchase price. Beyond these recurring fees lie a host of often-underestimated expenses: costly and complex integration with existing systems (which can increase total project costs by up to 40%), data migration, extensive user training, and the cost of paying for bloated feature sets that go largely unused. Studies indicate that as much as 85-90% of the features in off-the-shelf products are completely ignored by customers, representing significant wasted expenditure.

Conversely, the TCO reality for a "build" decision is characterized by a significant upfront capital investment. This initial outlay covers development team salaries, infrastructure setup, and rigorous quality assurance, which can account for 20-30% of total development costs. Custom solutions can range from $30,000 for simple applications to well over $1,000,000 for complex enterprise systems. However, once built, the ongoing costs are more predictable. Annual maintenance, which covers bug fixes, security patches, and minor updates, is a planned and budgeted expense, typically falling between 15-25% of the initial development cost. A critical, and often overlooked, component of the "build" TCO is the opportunity cost: every hour an internal development team spends building an internal tool is an hour not spent improving the core, revenue-generating product. This strategic trade-off must be factored into the equation, though it is a risk that can be mitigated by engaging an external development partner.

The financial model chosen is not merely an accounting decision; it serves as a proxy for the organization's strategic commitment. A "build" decision, structured as a capital expenditure, creates a lasting asset on the company's balance sheet. Such decisions inherently demand a higher level of strategic scrutiny and long-term justification. If an organization is hesitant to fund a large upfront build, it may be a powerful signal that the capability is not truly perceived as a core differentiator, making a "buy" or "blend" approach more appropriate. In this way, the TCO model can reveal an organization's true strategic priorities.

Finally, the analysis must extend to Strategic Return on Investment (ROI). COTS solutions provide immediate, tangible value but this value may be limited by the software's generic nature, while ongoing costs steadily erode long-term ROI. Custom software, despite a longer initial payback period—typically achieved within two to three years—delivers a significantly higher long-term ROI. This superior return is driven by radical operational efficiency gains (often a 20-30% increase), the ability to launch unique market offerings, and the creation of a valuable, proprietary intellectual property asset. However, this path carries its own financial risks; large IT projects run over budget 45% of the time while delivering 56% less value than originally planned.

Factor 2: Strategic Impact & Competitive Moat

The single most important question in this entire framework is whether the software capability under consideration is a core market differentiator or a functional commodity. The answer to this question should dictate the entire strategy.

Building a custom solution is strategically imperative when the business process itself is the competitive advantage. This applies to proprietary pricing algorithms, unique customer personalization engines that drive loyalty, or hyper-efficient logistics workflows that competitors cannot match. Custom software allows a business to codify its "secret sauce," creating unique services and operational models that are impossible for rivals to replicate because they are embedded in a proprietary asset they do not own and cannot purchase. Case studies of Agile adoption from various industries demonstrate the power of this approach, with custom solutions driving tangible results like a 200% increase in targeted web traffic or a 60% time savings through unique automation.

Conversely, buying a COTS solution is the logical choice for standardized, non-differentiating business functions. These are the "table stakes" capabilities required to operate but which offer no competitive advantage, such as payroll processing, general ledger accounting, or standard HR information systems. For these commodity functions, adopting the industry best practices embedded within a mature COTS product is far more efficient and cost-effective than attempting to reinvent the wheel. Here, the goal is operational parity and efficiency, not strategic differentiation.

To aid in this analysis, leaders can employ strategic frameworks. Wardley Mapping, for example, helps organizations visualize their value chain and distinguish between novel, differentiating capabilities and mature, commoditized ones, providing a clear guide for where to build and where to buy. Similarly, the GSO (Growth, Scale, Optimize) framework helps clarify the primary business objective—whether it's attracting new customers, expanding services sustainably, or enhancing profit margins—before a path is chosen, ensuring the solution aligns with the intended strategic outcome.

It is crucial to recognize that a "buy" decision is not merely an acquisition of technology; it is an adoption of the vendor's opinionated view of a business process. COTS software is designed for a mass market, embedding "best practices" that are, by definition, generic and standardized. When a company adopts this software, it is frequently forced to alter its own unique internal workflows to fit the software's rigid structure. This forced adaptation gradually standardizes the company's processes, making them more like those of its competitors who use the same software. Over time, this can lead to a subtle but significant erosion of the unique operational habits and cultural DNA that were once a source of competitive advantage.

Factor 3: Speed-to-Value & Long-Term Agility

The conventional wisdom that "buying is faster" requires a more nuanced examination. The conversation must evolve from a simplistic focus on "time-to-market" to a more strategic consideration of "time-to-value" and, critically, long-term agility. While COTS solutions offer rapid initial deployment, custom software built with modern, agile methodologies can deliver tailored value on a comparable timeline and provides vastly superior agility over the long run.

The initial speed of a COTS implementation is its primary advantage. Basic setup can often be completed in days or weeks, with more complex integrations and customizations taking between three and nine months. This is the ideal path when speed of deployment is the single most critical business driver. In contrast, traditional, "waterfall" custom development projects are notoriously slow, often taking 12 to 24 months to reach full production. However, this model is largely outdated. Modern agile development practices enable the launch of a Minimum Viable Product (MVP) in a timeframe of one to nine months, with some simpler applications ready in as little as two to four months. This dramatically shortens the initial time-to-value, making the "build" path competitive with COTS even on the dimension of speed.

The true divergence appears when considering long-term agility. With a COTS solution, an organization's ability to innovate and adapt is fundamentally constrained by the vendor's product roadmap. The business becomes dependent on the vendor's update schedule, feature prioritization, and strategic direction, which may not align with its own evolving needs. This dependency creates a significant strategic risk, effectively outsourcing a portion of the company's agility to a third party. In stark contrast, owning the codebase provides complete control. It empowers the business to pivot, add features, and respond to market shifts or customer feedback without any external dependencies. This is why 70% of businesses report improved agility and innovation after implementing custom systems.

Ultimately, the choice between build and buy is a choice between two different types of speed. The "buy" path offers a high "speed of initiation"—the ability to get a functional system up and running very quickly. However, once implemented, the "speed of iteration"—the rate at which that system can be changed, adapted, or enhanced—is slow and controlled by an external party. The "build" path has a slower speed of initiation but, once an agile development cycle is established, it offers an extremely high speed of iteration. A CIO must therefore decide which type of speed is more strategically valuable. For a stable, commoditized process, speed of initiation is key. For a dynamic, differentiating process where continuous improvement and market responsiveness are paramount, speed of iteration is the decisive advantage.

Factor 4: Ecosystem Integration & Scalability

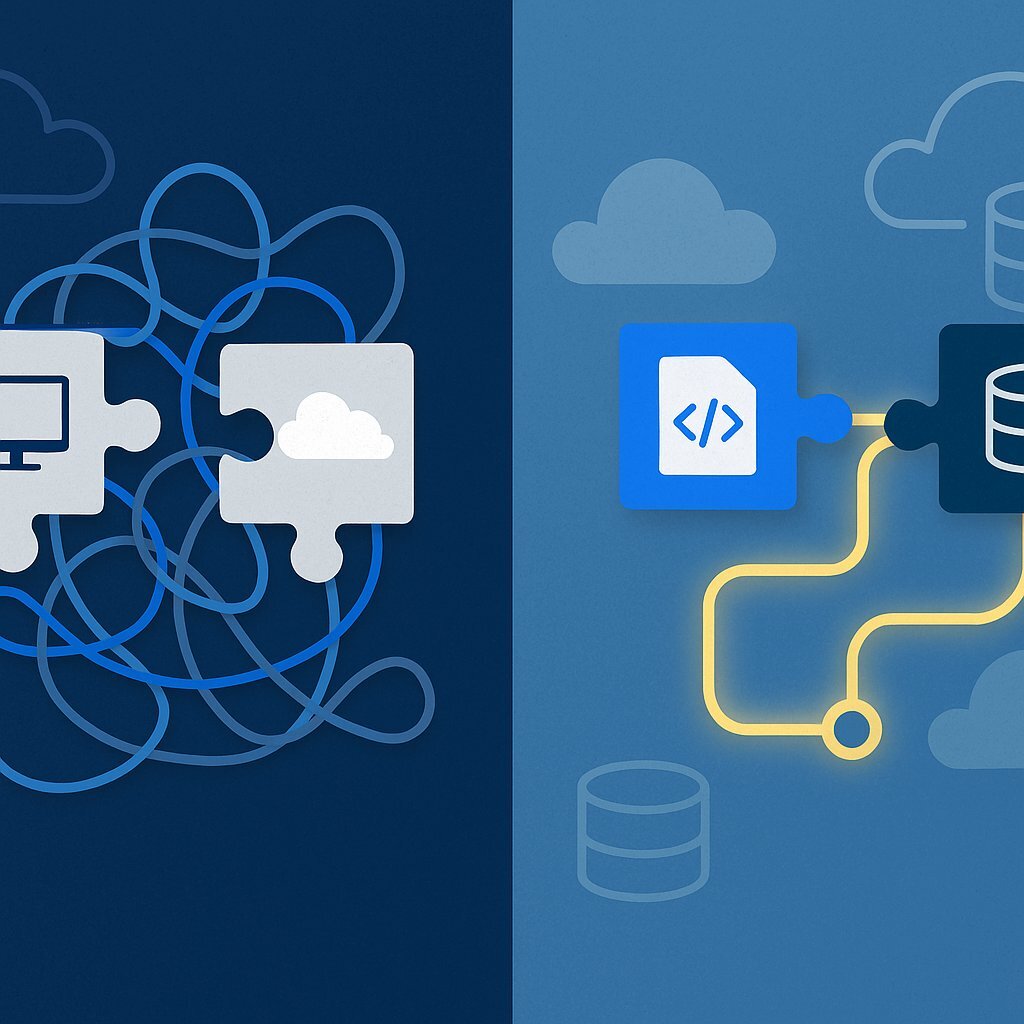

In a modern enterprise, no software operates in a vacuum. Its value is determined not only by its standalone features but by its ability to integrate seamlessly with the existing technology stack and to scale gracefully as the business grows. These two factors are critical and are often the primary deal-breakers for COTS solutions.

Integration is arguably the most common and costly challenge in COTS implementations. Off-the-shelf products often have rigid or poorly documented APIs, making it difficult to connect them with legacy systems, proprietary databases, or other specialized software. This friction leads to fragmented data silos, forces employees into inefficient manual workarounds, and creates "process debt" that accumulates over time, eroding productivity. In many cases, the cost and complexity of trying to force an integration can completely negate the initial benefits of the COTS solution. In contrast, custom software is designed from the ground up to be a perfect citizen within the existing ecosystem. Integrations are not an afterthought but a core architectural consideration, ensuring smooth, real-time data flow and eliminating operational friction. For organizations modernizing operations, exploring cloud-native architecture can further support seamless scalability and integration.

Scalability presents another significant risk with COTS products. Vendors often penalize growth through tiered pricing models that escalate sharply with an increase in users, data volume, or transaction throughput. Beyond the financial penalties, the platform's underlying architecture may contain hidden performance bottlenecks that only become apparent once the business has already outgrown the system, leading to costly and disruptive migrations. A custom solution, however, is architected with future growth as a primary requirement. It is designed to handle increasing loads without performance degradation or punitive cost increases, providing long-term architectural stability and predictable operational costs.

The integration discussion serves as a crucial litmus test for a vendor's true partnership model versus a simple transactional sale. A vendor focused on a quick sale will often downplay integration complexities, making broad promises about easy connections via standard APIs. However, the reality of most enterprise ecosystems is that they are a complex mix of modern and legacy systems with unique data models. A true partner vendor will engage in a deep discovery process, acknowledge these complexities, and offer robust professional services or highly flexible APIs to ensure a successful integration. They understand that their product's value is entirely contingent on how well it functions within the client's

actual environment. A vendor who dismisses or trivializes integration concerns is signaling a transactional mindset and poses a significant risk to the project's ultimate success.

Factor 5: Control, Customization & Future-Proofing

This factor evaluates the fundamental trade-off between the convenience of a managed, third-party service and the strategic power of owning and directing a company's technological destiny.

When an organization buys a COTS solution, it is ceding a significant degree of control to the vendor. The business becomes dependent on the vendor's financial stability, their security practices, their product roadmap, and the quality of their customer support. This creates multiple points of external risk. If the vendor is acquired by a competitor, decides to pivot its product strategy, discontinues a critical feature, or goes out of business, the client's core operations can be severely disrupted. This is the definition of vendor lock-in. Building, on the other hand, confers complete ownership of the intellectual property and the source code. The organization retains full control over development priorities, the update schedule, and the long-term evolution of the platform, ensuring it remains perfectly aligned with business strategy at all times.

This dichotomy extends to customization. COTS software typically offers limited "customization" that is, in reality, just configuration within a set of predefined parameters. True functional changes, if possible at all, often require expensive professional services from the vendor and can be broken by future updates. Custom software, by its nature, offers limitless customization. It can be meticulously crafted to be a perfect digital reflection of a company's unique workflows and processes, streamlining operations and maximizing efficiency.

The decision to build is therefore intrinsically linked to a commitment to cultivating internal talent. Opting to "build" necessitates hiring, developing, and retaining a team of skilled engineers, architects, and product managers. Over time, this in-house team develops deep institutional knowledge of both the business's unique processes and the custom software that powers them. This accumulated expertise makes the team incredibly efficient at future iterations and innovations, creating a powerful, self-reinforcing cycle. The strategic asset becomes not just the software itself, but the team that understands it from the inside out. Conversely, a strategy that relies heavily on buying can lead to the atrophy of internal technical skills, increasing dependence on external vendors and diminishing the organization's long-term capacity for technology-driven innovation.

Factor 6: Risk, Security & Compliance

Both the build and buy paths present unique and significant risk profiles that must be meticulously evaluated, particularly for organizations operating in highly regulated industries. For those considering their approach to software supply chain security, it's crucial to weigh not just product risk, but wider operational and compliance vulnerabilities.

The risks associated with a "build" decision are primarily internal and centered on execution. The project itself could fail to meet its objectives; as noted earlier, large IT projects have a high rate of running over budget and under-delivering on promised value. Success is also highly dependent on talent. The scarcity of specialized developers and the time it takes to recruit them is a major challenge that can delay projects and inflate costs. Perhaps the largest hidden risk of building is the accumulation of technical debt. Without a dedicated annual maintenance budget (15-25% of the initial build cost) and disciplined engineering practices, shortcuts and suboptimal code can accumulate, making the system brittle, slow, and exponentially more expensive to modify or maintain over time.

The risks of a "buy" decision are largely external. As discussed under the factor of control, the vendor represents a single point of failure. Their business and technical decisions can have a direct and immediate impact on operations. From a security standpoint, a popular COTS product presents a large, uniform, and attractive target for cyberattacks. A single vulnerability discovered in the product can expose all of its customers simultaneously. While custom software is not immune to attack, its unique codebase presents a much smaller and less familiar attack surface. Finally, compliance risk is a major concern. A generic, one-size-fits-all COTS product may not be architected to meet the specific, nuanced compliance requirements of industries like finance (e.g., regulations under the Truth in Lending Act or the Home Ownership and Equity Protection Act) or healthcare (e.g., HIPAA), requiring costly workarounds or exposing the company to significant legal and financial liability.

Within the "build" path, the sub-decision of whether to develop in-house or with an outsourced partner fundamentally alters the risk calculation. Choosing to build with an expert external partner can mitigate several key "build" risks. It directly addresses the talent scarcity risk by providing immediate access to a pool of vetted specialists. It can accelerate time-to-market by leveraging the partner's established processes and expertise. It also brings specialized knowledge that the in-house team may lack, reducing the risk of architectural mistakes or the accumulation of technical debt. This creates a hybrid "build" model that combines the benefits of customization and control with the flexibility and expertise of an external partner. Therefore, a complete risk assessment for the "build" path must evaluate

how the software will be built—in-house, outsourced, or with a blended team—as this choice dramatically changes the project's cost, timeline, and overall risk profile. To ensure long-term success, many organizations explore expert software maintenance models that support security, compliance, and ongoing evolution after launch.

Applying the Matrix: A Practical Scoring Model

The 6-Factor Decision Matrix is designed to be more than a theoretical construct; it is an actionable tool for facilitating a structured, strategic conversation among all key stakeholders—including finance, product, engineering, and business leadership. The goal is not to find a single "correct" number but to use a quantitative process to surface qualitative insights and build consensus around a data-backed decision.

The process begins by assigning a "Strategic Importance Weight" to each of the six factors on a scale of 1 to 5. This step is crucial as it tailors the matrix to the organization's specific context and priorities. For example, a fintech startup operating in a heavily regulated market might assign Risk, Security & Compliance a weight of 5, while a fast-growing retail company might prioritize Strategic Impact & Competitive Moat as its 5.

Next, for each of the six factors, the team should score both the "Build" and "Buy" options on a scale of 1 to 10, based on how well each path aligns with the organization's goals for that factor. The key evaluation questions provided in the matrix below are designed to guide this scoring process and ensure a thorough, consistent analysis.

Finally, the weighted score for each option is calculated by multiplying the score by the strategic importance weight for each factor. The total weighted score for each path provides a quantitative foundation for the final decision, while the discussions and justifications recorded during the scoring process provide invaluable qualitative context.

| Factor | Key Evaluation Questions |

|---|---|

| 1. TCO & Strategic ROI | What is the projected 5-year TCO for each path? Does this create a proprietary asset or a recurring expense? What is the risk of budget overrun vs. unpredictable subscription hikes? |

| 2. Strategic Impact & Competitive Moat | Is this capability a core differentiator or a commodity function? Will this solution create a sustainable competitive advantage that is hard to replicate? |

| 3. Speed-to-Value & Long-Term Agility | Which path delivers meaningful business value faster (MVP vs. implementation)? How quickly can we iterate, adapt, and respond to market changes in the future? Are we dependent on a vendor's roadmap? |

| 4. Ecosystem Integration & Scalability | How seamlessly will this solution integrate with our existing critical systems (e.g., ERP, CRM, legacy platforms)? Will this solution scale with our projected growth without performance degradation or punitive costs? |

| 5. Control, Customization & Future-Proofing | Do we retain full ownership of the IP and source code? How much control do we have over the product roadmap and future development? Does this path expose us to vendor lock-in risk? |

| 6. Risk, Security & Compliance | What are the primary risks (execution, vendor viability, security, compliance)? Does the solution meet our specific industry regulations? Does this path introduce a single point of failure? |

The Matrix in Action: Industry Snapshots

The power of the 6-Factor Decision Matrix lies in its flexibility. The strategic weights assigned to each factor will change dramatically based on industry context, regulatory environment, and competitive landscape. The following snapshots illustrate how the framework can be applied in different sectors.

Financial Services

- Dominant Factor: Risk, Security & Compliance (Weight: 5/5).

- Analysis: The financial services industry operates under a complex and ever-changing web of regulations such as the Dodd-Frank Act, the Home Ownership and Equity Protection Act (HOEPA), and the Truth in Lending Act (TILA). Generic COTS solutions often fail to meet these specific, stringent requirements, creating significant compliance gaps. For functions that touch upon loan origination, risk modeling, or client data management, building custom software is often not just an advantage but an operational necessity to ensure robust, auditable compliance and to implement advanced, business-specific security protocols.

Healthcare

- Dominant Factor: Ecosystem Integration & Scalability (Weight: 5/5).

- Analysis: The healthcare ecosystem is notoriously fragmented. The critical need for interoperability between Electronic Health Records (EHRs), patient portals, billing systems, and diagnostic tools is paramount for efficient and safe patient care. COTS solutions frequently exacerbate this problem, creating data silos that hinder communication and workflow. Research shows that even when a "buy" decision is made for a commercial system, it almost always requires substantial custom development work just to achieve the necessary level of integration. Therefore, custom builds are often required to create the seamless, integrated digital infrastructure that modern healthcare delivery demands.

AdTech

- Dominant Factor: Speed-to-Value & Long-Term Agility (Weight: 5/5).

- Analysis: The advertising technology market is hyper-competitive and defined by rapid technological evolution. The ability to quickly innovate on bidding algorithms, fraud detection models, and audience targeting strategies is a core differentiator. Relying on a COTS vendor's generic roadmap and slow update cycle is a recipe for being outmaneuvered by more agile competitors. For any serious player in the AdTech space, developing and owning a custom platform is the industry standard, as it provides the necessary speed and flexibility to compete effectively.

Learning Management Systems (LMS) & CRM

- Dominant Factors: Strategic Impact and Control & Customization.

- Analysis: The decision for systems like LMS or CRM depends heavily on the use case. For generic internal employee training or a small sales team with standard processes, a COTS solution is often sufficient and cost-effective. However, the strategic calculus changes dramatically when these systems are core to the business model. For an organization selling external training or customer education, a custom LMS that reflects the brand and provides a unique, superior user experience becomes a powerful competitive advantage. Similarly, large enterprises with complex, non-standard sales processes often find that generic COTS CRMs are overly complex, poorly adopted by their teams, and fail to align with their actual workflow, necessitating a custom-built solution that is tailored to how they actually sell.

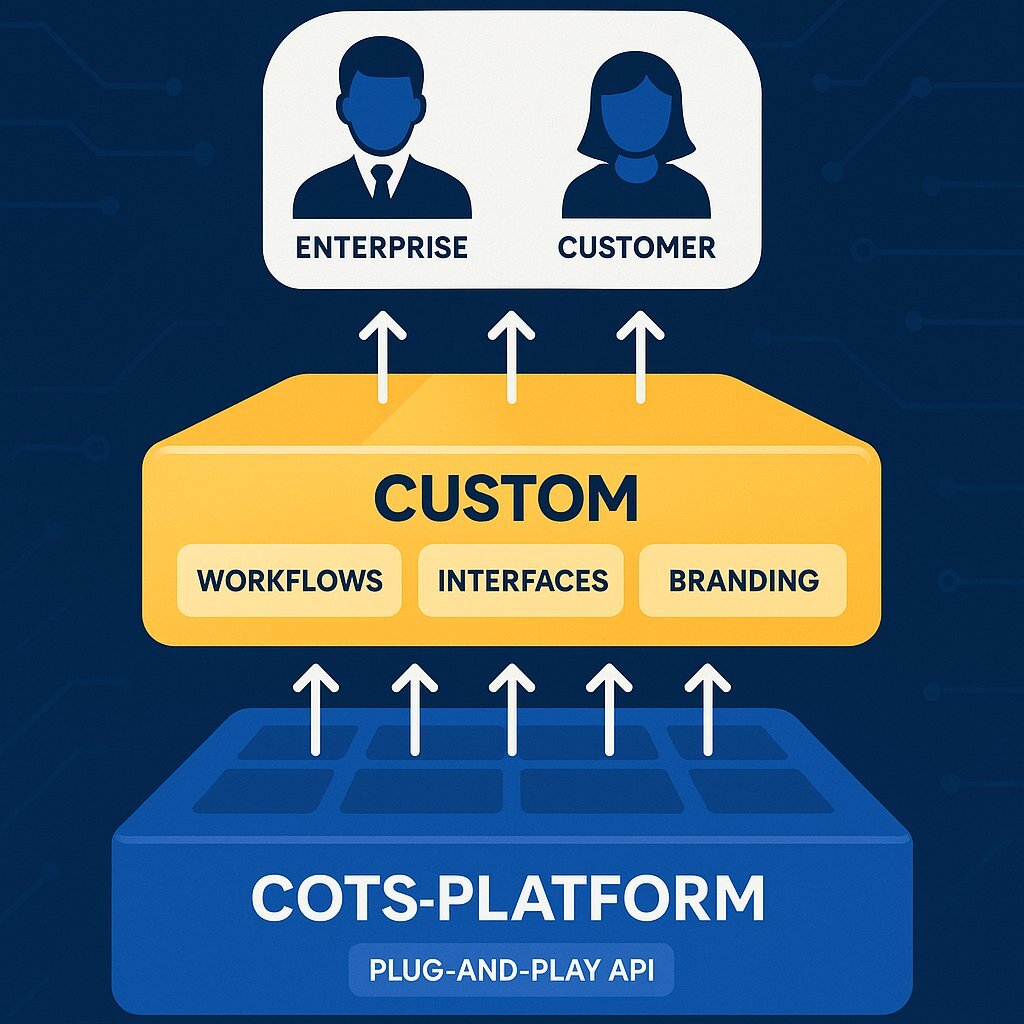

Beyond the Binary: The Strategic Power of the "Blend" Approach

The most sophisticated and increasingly common strategy is not a binary choice between build and buy, but a hybrid "blend" approach. This model, championed by industry analysts, advocates to: "Buy where you can, build where it differentiates, and integrate everything for speed, scale, and compliance". This is the gold standard for modern, agile enterprise architecture.

In practice, this strategy involves leveraging mature COTS solutions for commodity functions while wrapping them with custom-built software for the unique, customer-facing, or differentiating parts of the process. For example, a company might buy a standard, industry-leading payment gateway API but build a completely unique and branded checkout, loyalty, and post-purchase experience that consumes that API.

This "Blend" or "Bounded Buy" approach optimizes the best of both worlds. It accelerates time-to-market and controls costs for non-core elements by using pre-built components. Simultaneously, it allows precious and expensive internal development resources to remain laser-focused on what truly matters for creating a competitive advantage. This hybrid model effectively mitigates the primary risks of a pure "build" (high upfront cost, long timeline) and a pure "buy" (vendor lock-in, lack of differentiation) strategy, offering a path to both efficiency and innovation.

| Metric | Build (Custom) | Buy (COTS) | Blend (Hybrid) |

|---|---|---|---|

| Cost Profile | High upfront CapEx, lower long-term OpEx. Creates a company asset. | Low upfront OpEx, high and potentially escalating long-term OpEx. | Optimized and variable. CapEx is focused only on differentiating components. |

| Time-to-Value | Slower initial deployment (MVP), but high-speed iteration and adaptation. | Fast initial deployment, but slow iteration and adaptation (vendor-dependent). | Fast deployment for commodity parts; focused, agile development for custom parts. |

| Strategic Control | Full ownership of IP, roadmap, and data. No external dependencies. | High dependency on vendor viability, roadmap, and security. High risk of lock-in. | Full control over differentiating components; managed dependency for commodity parts. |

| Competitive Impact | High. Enables unique processes and services that cannot be replicated. | Low. Promotes operational parity and a "sea of sameness" with competitors. | High and focused. Directs investment toward areas of maximum competitive impact. |

| Level of Risk | High execution and talent risk; lower vendor and compliance risk. | Low execution risk; high vendor, security, and long-term strategic risk. | Mitigated. Reduces execution risk on commodities and vendor risk on differentiators. |

Conclusion: Engineering Your Tailored Tech Advantage

The decision to build versus buy software has evolved from a simple financial calculation into one of the most critical strategic evaluations an enterprise leader will face. The choice is no longer about acquiring a tool but about architecting a competitive future. Relying on generic, off-the-shelf solutions for core business functions is a path toward operational commoditization, ceding control and agility to third-party vendors. In contrast, thoughtfully investing in custom software for differentiating capabilities allows an organization to codify its unique strengths, creating a proprietary asset that drives efficiency, innovation, and a sustainable market advantage.

The Baytech 6-Factor Decision Matrix provides a robust framework to navigate this complexity. By systematically evaluating Total Cost of Ownership, Strategic Impact, Agility, Integration, Control, and Risk, leaders can transform a high-stakes, often contentious decision into a structured, data-driven strategic exercise. This process ensures that technology investments are not made in a vacuum but are deeply aligned with the long-term goals of the business.

Ultimately, the goal is to engineer a "Tailored Tech Advantage." This requires a clear-eyed assessment of which capabilities are true differentiators and which are commodities. For the latter, buying is prudent. For the former, building is a strategic imperative. Navigating this process requires not just a framework but expert guidance. As a strategic partner, Baytech Consulting provides the virtual CIO (vCIO) and IT consulting services necessary to conduct this deep analysis, ensuring the right decision is made. Should the path lead to building, our teams are poised to be the development partner that translates that strategic decision into a tangible, high-impact technology asset, accelerating revenue and delivering a quantifiable business advantage.

About Baytech

At Baytech Consulting, we specialize in guiding businesses through this process, helping you build scalable, efficient, and high-performing software that evolves with your needs. Our MVP first approach helps our clients minimize upfront costs and maximize ROI. Ready to take the next step in your software development journey? Contact us today to learn how we can help you achieve your goals with a phased development approach.

About the Author

Bryan Reynolds is an accomplished technology executive with more than 25 years of experience leading innovation in the software industry. As the CEO and founder of Baytech Consulting, he has built a reputation for delivering custom software solutions that help businesses streamline operations, enhance customer experiences, and drive growth.

Bryan’s expertise spans custom software development, cloud infrastructure, artificial intelligence, and strategic business consulting, making him a trusted advisor and thought leader across a wide range of industries.