Rethink Build vs. Buy: Unlock Competitive Advantage in 2025

September 28, 2025 / Bryan ReynoldsStop Asking 'Build vs. Buy.' Start Asking 'What to Differentiate.'

A Strategic Framework for Technology Leaders to Build a Lasting Competitive Advantage

The End of an Era: Why the 'Build vs. Buy' Debate Is Holding You Back

For decades, technology leaders have been conditioned to frame one of their most critical decisions as a simple binary choice: build or buy? This question, once a straightforward evaluation of in-house development versus off-the-shelf software, has become a strategic dead end. In today's hyper-competitive landscape, shaped by the rapid evolution of cloud platforms, API ecosystems, and artificial intelligence, the monolithic 'build vs. buy' debate is not just outdated; it's actively detrimental to innovation and long-term competitive health. It forces leaders into a false dichotomy, pitting speed against control and cost against customization, often resulting in suboptimal compromises that lead to wasted resources, regulatory missteps, and critical missed market opportunities.

The modern technology landscape is no longer a simple choice between two extremes. It is a rich spectrum of possibilities, including pure custom builds, building on top of existing platforms, consuming SaaS solutions, and leveraging low-code/no-code tools. This complexity renders the old binary question obsolete. Organizations that cling to it risk significant strategic drift. Indeed, studies show that enterprises implementing structured decision-making frameworks that go beyond simple cost analysis report 30-40% fewer implementation failures and achieve far better alignment between technology and business objectives. In fast-moving industries, where a six-month deployment delay can translate directly into a permanent loss of market share, the slow, simplistic nature of the traditional build-buy analysis has become an unacceptable liability.

The fundamental flaw in the old debate lies in a misunderstanding of how the "buy" option has transformed. Historically, "buying" meant acquiring a monolithic, on-premise Commercial Off-The-Shelf (COTS) application—a closed box with limited flexibility. Today, "buying" often means subscribing to a cloud-native platform (SaaS or PaaS) that offers a robust ecosystem of APIs. This evolution from purchasing a

product to adopting a platform is the single most important shift. A modern "buy" decision is no longer an endpoint; it is a foundation upon which differentiating capabilities can be built.

This shift exposes the hidden danger of focusing the debate solely on cost. A traditional Total Cost of Ownership (TCO) analysis might suggest a 'buy' option is cheaper, but it fails to account for the accumulation of "strategic debt." When an organization buys a solution for a core business function, it effectively outsources its innovation roadmap to the vendor. Any competitive feature gained through that vendor may initially be exclusive, but it is inevitably rolled into the standard offering for all customers, including direct competitors. The true long-term cost is not measured in licensing fees but in the erosion of competitive differentiation.

The New Strategic Imperative: A Framework for Competitive Differentiation

To escape the limitations of the past, technology leaders must reframe the objective. The primary purpose of any significant technology investment is not merely to acquire functionality but to create a sustainable competitive advantage. This requires a new guiding principle:

Buy for parity, build for advantage. It is exceptionally difficult to build and maintain a competitive edge with a tool that a rival can purchase just as easily. The strategic imperative, therefore, is to meticulously analyze the business, identify which capabilities are core to its competitive moat, and focus precious resources on building and owning those differentiators.

This approach transforms the technology stack from a collection of tools into a strategic portfolio of capabilities. Each component must be classified: is it a "table stakes" function required for basic operations, or is it a core differentiator that drives the company's unique value proposition? This is not merely a technical exercise; it is a fundamental business decision that demands rigorous IT governance and deep alignment with corporate strategy.

This framework fundamentally redefines the role of the technology leader and the allocation of their most critical asset: engineering capacity. The true constraint in any technology organization is the finite time and talent of its engineering team. Every engineering hour spent building or maintaining a commodity function—such as an internal payroll system or a basic helpdesk—is an hour not spent developing a feature that wins a new enterprise client, increases customer lifetime value, or creates a new revenue stream. This framework is, at its core, a resource allocation model designed to maximize the strategic return on engineering talent.

By adopting this mindset, the CTO or VP of Engineering transitions from being perceived as a manager of a cost center to a driver of value creation. The conversation with the CFO and CEO shifts from procurement and budget defense to strategic investment. By classifying capabilities and focusing the organization's best minds on building true differentiators, the technology leader can directly articulate how their budget is constructing a defensible competitive moat and driving measurable business growth.

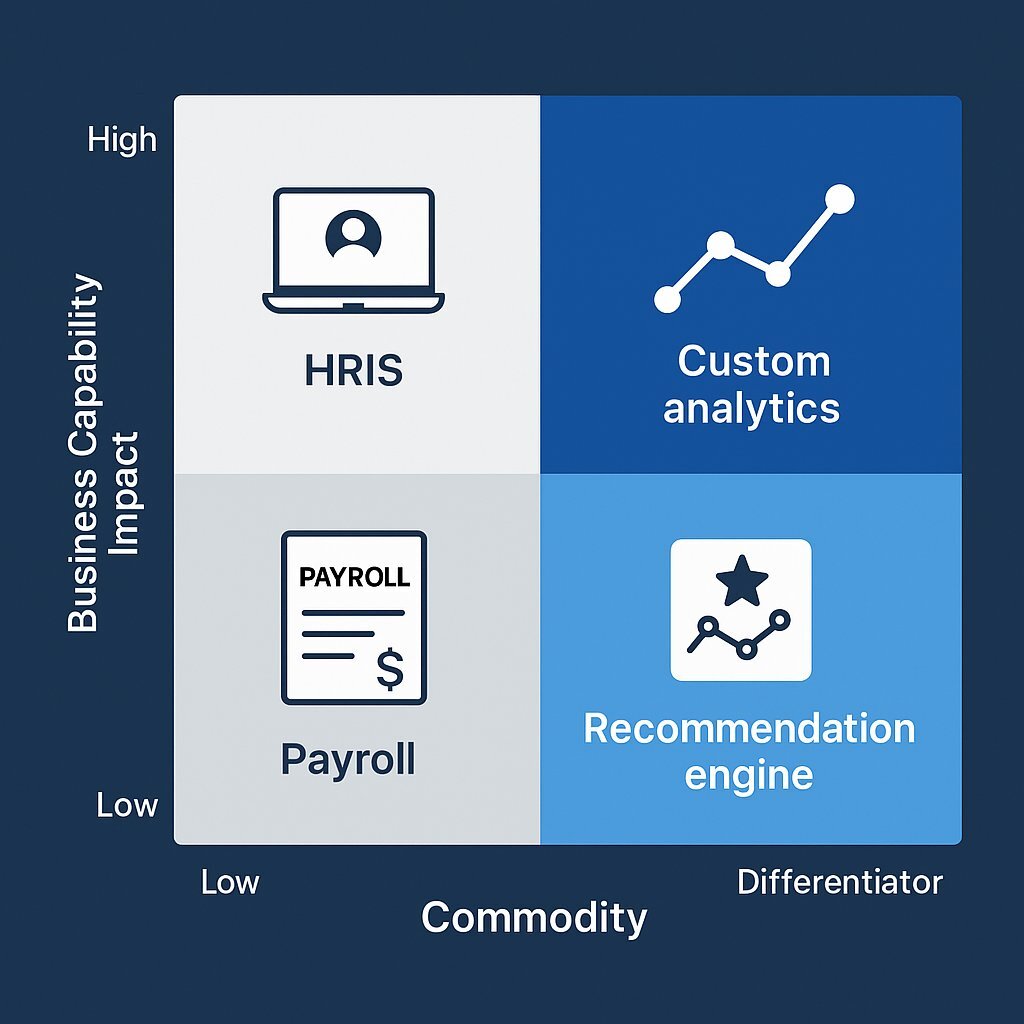

The Differentiator-Commodity Matrix: Your Litmus Test for Technology Investment

To implement this framework, leaders need a practical tool to move from abstract strategy to concrete action. The Differentiator-Commodity Matrix provides a structured methodology for deconstructing a business into its constituent capabilities and classifying each one on the spectrum from pure commodity to true differentiator.

A commodity capability is a standardized, interchangeable function necessary for business operations but providing no unique competitive value. Competition among vendors for these capabilities is driven almost entirely by price, not features. Examples include HR information systems, payroll processing, or generic accounting software. These are functions an organization must

have to operate, but they are not the reason it wins.

A differentiator, conversely, is a capability that is core to the business model, represents unique intellectual property, and is perceived by customers as superior to alternatives. These are the "secret sauce" components that are difficult to replicate and directly contribute to market leadership. Famous examples include Netflix's AI-driven recommendation engine, which is responsible for over 80% of content streamed, or Ocado's custom-built robotic fulfillment software, which can assemble a 50-item grocery order in under five minutes.

A powerful technical methodology for this deconstruction process is found in the principles of Domain-Driven Design (DDD). DDD allows architects to divide a large, complex system into distinct "Bounded Contexts," which are explicit boundaries around specific business domains or capabilities. Once identified, these contexts can be classified as Core (Differentiator), Supportive (necessary but not differentiating), or Generic (Commodity), providing a rigorous, architectural foundation for the strategic analysis.

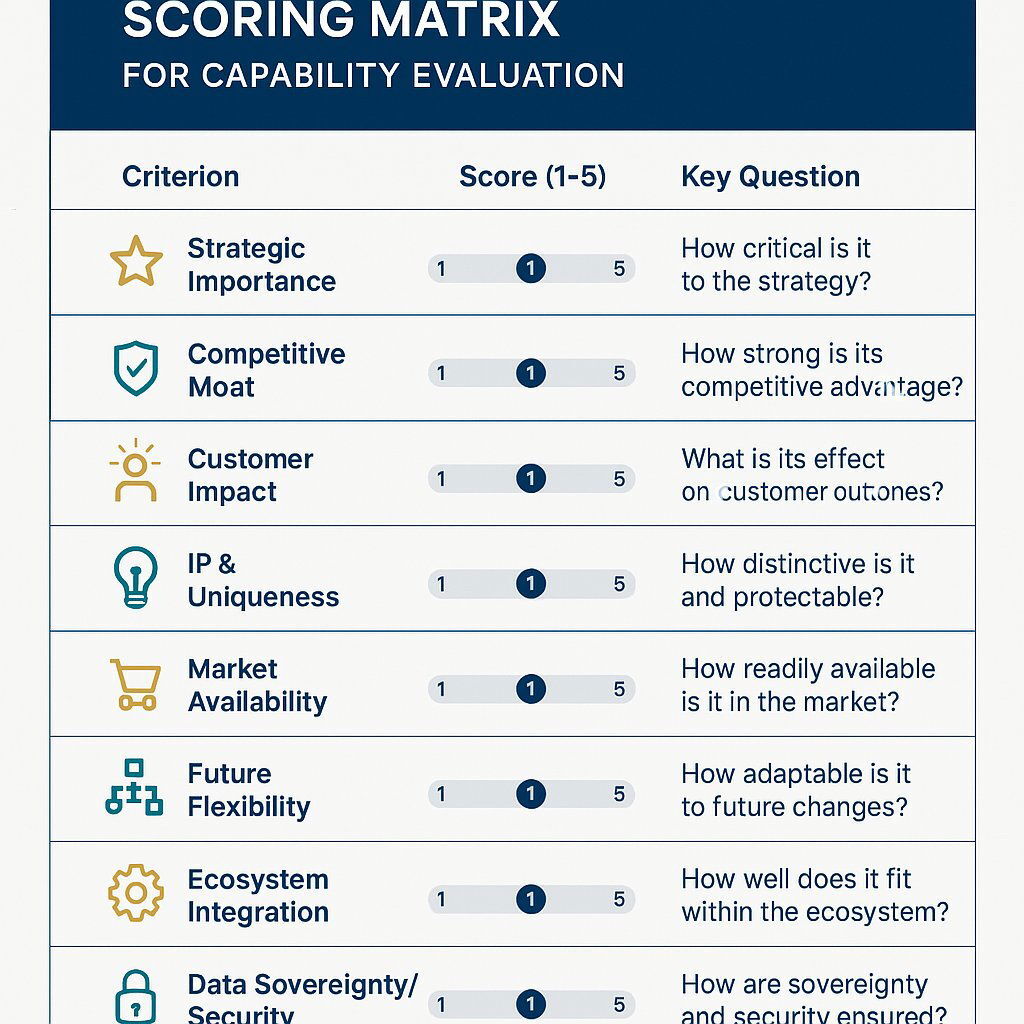

The following matrix translates these concepts into a practical scoring mechanism, enabling a data-driven discussion among stakeholders to classify each business capability systematically.

By scoring each business capability against these criteria, a clear picture emerges, allowing leaders to map their entire technology portfolio and identify precisely where to invest their build capacity for maximum impact.

Beyond the Binary: Mastering the 'Bounded Buy' Strategy

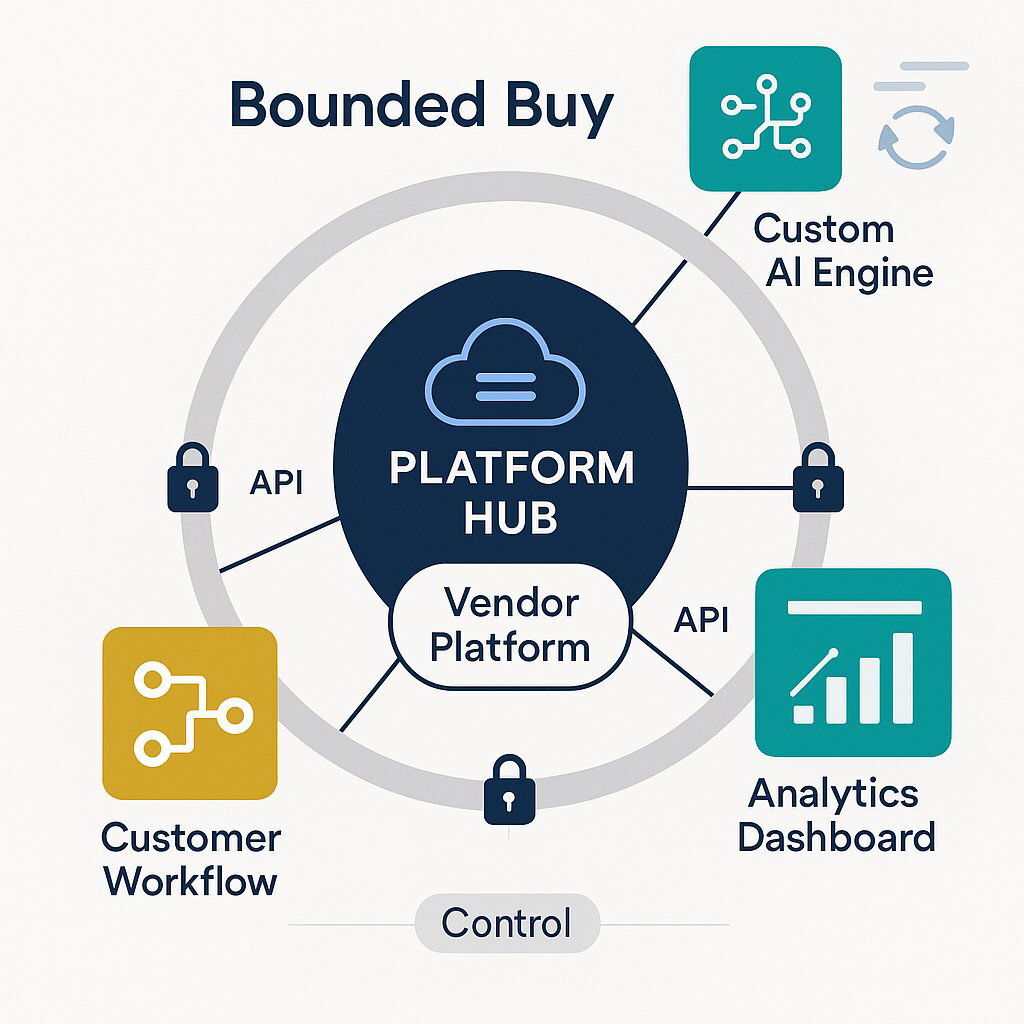

Once capabilities are classified, the framework gives rise to a powerful execution model: the Bounded Buy. This is a sophisticated hybrid strategy that intelligently combines the speed and stability of commercial platforms with the strategic advantage of custom development. It moves beyond the simplistic binary choice to create a flexible, resilient, and highly competitive technology ecosystem.

The Bounded Buy strategy involves purchasing a best-in-class COTS or SaaS platform to handle commodity or generic functions, while explicitly drawing a hard architectural boundary around it. This boundary is designed to prevent the vendor's platform from dictating the company's entire technology roadmap. The core principle is to buy the stable "hub" and custom-build the innovative "spokes." This is not about light customization or configuration; it is about developing distinct, high-value applications that integrate with the platform to deliver a unique competitive advantage.

This strategy is only viable because of the rise of API-first architecture. The "bought" platform must provide a comprehensive, well-documented, and robust set of APIs that allow custom-built applications to seamlessly and securely interact with its data and services. This enables a loosely coupled architecture where the company's core intellectual property—the custom-built differentiators—is not locked into a single vendor's proprietary ecosystem.

Executing a Bounded Buy is a direct and deliberate defense against the "Vendor King" anti-pattern. This common pitfall occurs when a 'buy' decision for one capability slowly expands its scope, a phenomenon known as scope creep, until the vendor's platform and its limitations dictate the architecture and stifle innovation across the entire organization. The Bounded Buy strategy mitigates this risk by defining the vendor solution's "bounded context" at the outset and enforcing that boundary technically through architectural patterns like API gateways or anti-corruption layers.

This model also creates a highly effective "two-speed" technology organization by design. The purchased commodity platforms provide stability, security, and predictable, slower release cycles managed by the vendor. In contrast, the custom-built differentiating components can be developed using agile, iterative methodologies, allowing for rapid innovation and experimentation precisely where it creates the most market impact. This hybrid approach provides a stable, reliable core while enabling the business to innovate at the competitive edge—a critical capability for modern enterprises.

The Hybrid Approach in Action: Real-World Examples

The Bounded Buy strategy is not merely theoretical; it is being successfully executed by market-leading companies across a wide range of industries to create and sustain their competitive advantage. These examples demonstrate a clear and repeatable pattern: buy a robust platform for parity, and build a unique solution for differentiation.

E-commerce (Differentiator: Personalized Customer Experience): Leading online retailers often buy a platform like Shopify Plus, which provides a world-class, scalable foundation for the commodity functions of e-commerce: product catalogs, shopping carts, and payment processing. They then

build custom, AI-powered recommendation engines that analyze user behavior in real-time to provide a uniquely curated shopping experience. These custom applications integrate with Shopify via its extensive APIs, driving higher average order value (AOV) and customer lifetime value (LTV) that generic storefronts cannot match.

Fintech (Differentiator: Proprietary Risk Analytics): Innovative lending companies frequently buy a platform like Salesforce Financial Services Cloud to manage the commodity aspects of their business, such as customer relationship management, lead tracking, and basic compliance workflows. Their core competitive advantage, however, lies in their ability to assess risk more accurately than traditional banks. They

build a custom, machine-learning-based risk assessment model that ingests unique data sets to power their underwriting decisions. This custom-built IP, which can be developed with a partner like Baytech Consulting, integrates seamlessly with Salesforce, pulling customer data and pushing proprietary risk scores back to the loan officers, enabling faster, more accurate, and more profitable lending.

Healthcare (Differentiator: Predictive Patient Outcomes): Modern healthcare providers are leveraging cloud platforms to revolutionize care. They can buy foundational, HIPAA-eligible services from providers like AWS for Healthcare, using tools like Amazon HealthLake for the secure storage and management of electronic health records (EHR)—the commodity backend. On top of this secure foundation, they

build custom predictive analytics platforms using services like Amazon SageMaker. These proprietary systems analyze vast, anonymized patient data sets to predict disease progression, identify at-risk populations, and recommend proactive interventions—a powerful differentiator that improves patient outcomes and reduces costs.

Gaming (Differentiator: Unique Matchmaking Algorithm): In the highly competitive gaming industry, player engagement is paramount. Game studios buy backend services like Amazon GameLift or Azure PlayFab to handle commodity infrastructure such as multiplayer servers, leaderboards, and player identity management. The "magic" that keeps players engaged is often the matchmaking system. Studios

build custom, serverless matchmaking services that use proprietary algorithms to connect players based on a complex mix of skill, behavior, latency, and social connections. This custom-built logic, often an extension of a service like GameLift FlexMatch, creates more balanced and enjoyable matches, directly leading to higher player retention and reduced churn.

These cases highlight a consistent strategic pattern. The table below summarizes this powerful model.

| Industry | The 'Bought' Commodity Platform | The 'Built' Differentiator (The Competitive Moat) | Strategic Outcome |

|---|---|---|---|

| E-commerce | Shopify Plus | Custom AI-powered recommendation engine & loyalty program | Increased AOV, higher customer LTV, unique brand experience. |

| Fintech | Salesforce Financial Services Cloud | Proprietary AI-driven risk assessment & underwriting model | More accurate lending decisions, lower default rates, faster approvals. |

| Healthcare | AWS for Healthcare (HealthLake, S3) | Custom predictive analytics platform for patient outcomes | Proactive care delivery, improved patient outcomes, operational efficiency. |

| Gaming | Amazon GameLift | Custom skill-based matchmaking algorithm (FlexMatch customization) | Higher player engagement, longer session times, reduced churn. |

The Economics of Differentiation: A 5-Year TCO and ROI Analysis

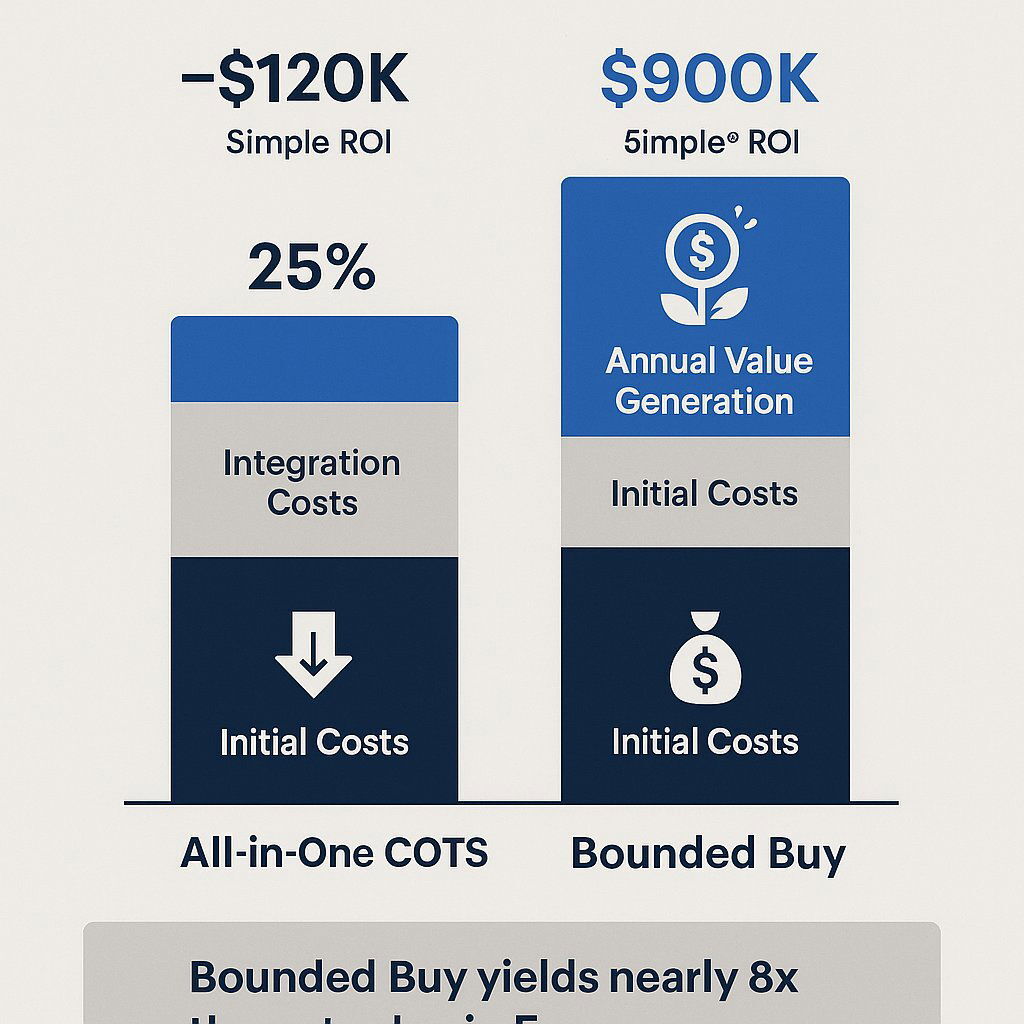

The strategic argument for the Bounded Buy approach is compelling, but it must also be financially sound. A comprehensive financial analysis reveals that while this strategy may require a higher initial capital expenditure, it often delivers a vastly superior long-term return on investment by creating tangible business value that monolithic COTS solutions cannot replicate.

A proper TCO analysis must deconstruct all associated costs over a multi-year horizon. For a build decision, this includes initial development, ongoing maintenance (typically 15-25% of the initial cost annually), infrastructure, and the overhead of the internal team. For a

buy decision, the TCO includes not just the initial subscription or license fees but also significant and often underestimated costs for implementation, integration (which can add 40% to the initial cost), customization, per-user scaling fees, and training. The iceberg of hidden costs associated with COTS solutions can quickly erode their perceived upfront savings.

However, a simple TCO comparison is insufficient because it treats both options as functionally equivalent, which they are not. The custom-built component in a Bounded Buy strategy is, by definition, a differentiator designed to generate new revenue, create significant operational efficiencies, or increase customer retention. Therefore, the correct financial model is a value analysis that compares the TCO of each option against the business value it generates.

Market data consistently shows the outsized returns of tailored solutions. Organizations report profit increases between 25% and 95% after deploying custom software, and personalized experiences driven by these systems can lead to 80% higher customer acquisition rates. In a competitive sector like e-commerce, a custom solution can help a business outperform its rivals by a factor of 2.5x.

The following 5-year value analysis for a hypothetical fintech company illustrates this principle. The company is comparing an all-in-one COTS lending platform against a Bounded Buy strategy that combines Salesforce with a custom-built underwriting engine.

| Financial Metric | All-in-One COTS Solution | Bounded Buy (Platform + Custom Differentiator) | Analysis |

|---|---|---|---|

| 5-Year TCO | $585,000 | $710,000 | The Bounded Buy strategy requires a higher total investment over 5 years. |

| Annual Value Generation (Revenue/Savings) | $150,000 | $400,000 | The custom differentiator is projected to generate 2.6x more value annually because it solves a core business problem uniquely. |

| 5-Year Total Value | $750,000 | $2,000,000 | |

| 5-Year Net Value (Value - TCO) | $165,000 | $1,290,000 | The Bounded Buy strategy delivers nearly 8x the net value over 5 years. |

| Simple ROI (ROI = NetProfit / TotalInvestment × 100) | 28% | 181% | This is the key metric for the board and stakeholders. |

This analysis makes the financial trade-off explicit. The higher upfront investment in building a strategic differentiator is justified by its ability to generate disproportionately higher value, resulting in a far superior net return for the business.

From Strategy to Execution: Partnering for Differentiated Advantage

The framework is clear: identify what makes the business unique and invest decisively to build and own that advantage. However, the transition from strategy to execution presents its own set of challenges. Implementing a Bounded Buy strategy and developing an enterprise-grade custom application that integrates deeply with a major commercial platform is a complex undertaking that requires a specialized and often scarce skill set.

Success demands more than just developers; it requires experienced solution architects who can design the resilient bridge between the bought and built systems, API integration experts, DevOps engineers to create a seamless delivery pipeline, and senior developers with deep expertise in the target platform's ecosystem. Attempting to build this capability in-house can be slow and carries significant risk, and it ties up an organization's best internal engineers on complex integration tasks, distracting them from core product innovation.

This is where a strategic partnership becomes the optimal model for execution. The most effective approach is for the internal team to focus on the 'what' and the 'why'—the product vision, the customer needs, and the proprietary business logic that defines the differentiator. They can then partner with a specialized firm like Baytech Consulting to execute the 'how'—the architecture, development, integration, and delivery of the custom software component.

A partnership with Baytech Consulting provides the critical capabilities needed to successfully implement a Bounded Buy strategy. This includes:

- Architectural Expertise: The ability to design a robust, scalable, and secure integration between the chosen commercial platform and the custom-built differentiator, avoiding common pitfalls like the "Vendor King" pattern.

- Enterprise-Grade Quality: The discipline to ensure the custom component is as reliable, secure, and performant as the enterprise platform it connects to, meeting all compliance and operational standards.

- Accelerated Time-to-Value: The capacity to build and deploy the differentiating capability faster than an internal team could be hired, trained, and ramped up, allowing the business to seize market opportunities before competitors can react.

The path to market leadership is no longer a binary choice. It lies in a nuanced, strategic approach that focuses relentlessly on differentiation. For the critical 'build' component of that strategy, collaborating with an expert partner is the most efficient and effective path from vision to value.

About Baytech

At Baytech Consulting, we specialize in guiding businesses through this process, helping you build scalable, efficient, and high-performing software that evolves with your needs. Our MVP first approach helps our clients minimize upfront costs and maximize ROI. Ready to take the next step in your software development journey? Contact us today to learn how we can help you achieve your goals with a phased development approach.

About the Author

Bryan Reynolds is an accomplished technology executive with more than 25 years of experience leading innovation in the software industry. As the CEO and founder of Baytech Consulting, he has built a reputation for delivering custom software solutions that help businesses streamline operations, enhance customer experiences, and drive growth.

Bryan’s expertise spans custom software development, cloud infrastructure, artificial intelligence, and strategic business consulting, making him a trusted advisor and thought leader across a wide range of industries.