Revolutionizing Finance: How AI is Elevating CFOs to Strategic Leaders in 2025

September 27, 2025 / Bryan ReynoldsBeyond the Ledger—Answering the Call for Strategic Leadership

For today’s Chief Financial Officer, the role is defined by a fundamental tension: the relentless demand for flawless operational execution clashes with the C-suite’s growing expectation for forward-looking strategic partnership. The board no longer looks to the finance function merely for a pristine record of the past; it seeks a predictive oracle for the future. Yet, this strategic calling is often drowned out by the noise of the back office. A staggering 70% of CFOs identify their team's already-heavy workload as the single biggest roadblock to creating value from data and technology. The finance function, traditionally transactional and process-oriented, finds itself buried under a mountain of repetitive tasks, running faster just to stand still.

This creates a paradox. How can a team consumed by tactical burdens become the agile, empowering force the business needs to navigate uncertainty? The answer lies not in working harder, but in fundamentally rewiring how the work gets done. Artificial intelligence (AI) and automation are the catalysts for this transformation. They are not threats to the finance professional but powerful enablers that, as one expert aptly put it, "take the robot out of the human". By automating the mundane, these technologies liberate human capital to focus on what matters most: interpretation, strategy, and influence.

This is not an incremental upgrade; it is a reinvention of the finance function's identity. The adoption of AI-powered solutions is the enabling condition that resolves the conflict between operations and strategy. It provides the only viable path for the finance team to meet the new expectations of the business, elevating the CFO from a historical scorekeeper to a strategic innovator, influencer, and protector of the enterprise. This is the future of finance—a future where technology doesn't replace human judgment but amplifies it to unprecedented levels.

The End of "Business as Usual": Why the Traditional Finance Function is Unsustainable

The operating model that has defined corporate finance for decades is no longer fit for purpose. It is buckling under the combined weight of an exponential increase in data, a more complex risk environment, and a rapidly shifting talent landscape. These are not isolated challenges; they form a self-reinforcing negative feedback loop that threatens the function's effectiveness and relevance.

The Data Deluge and Workload Crisis

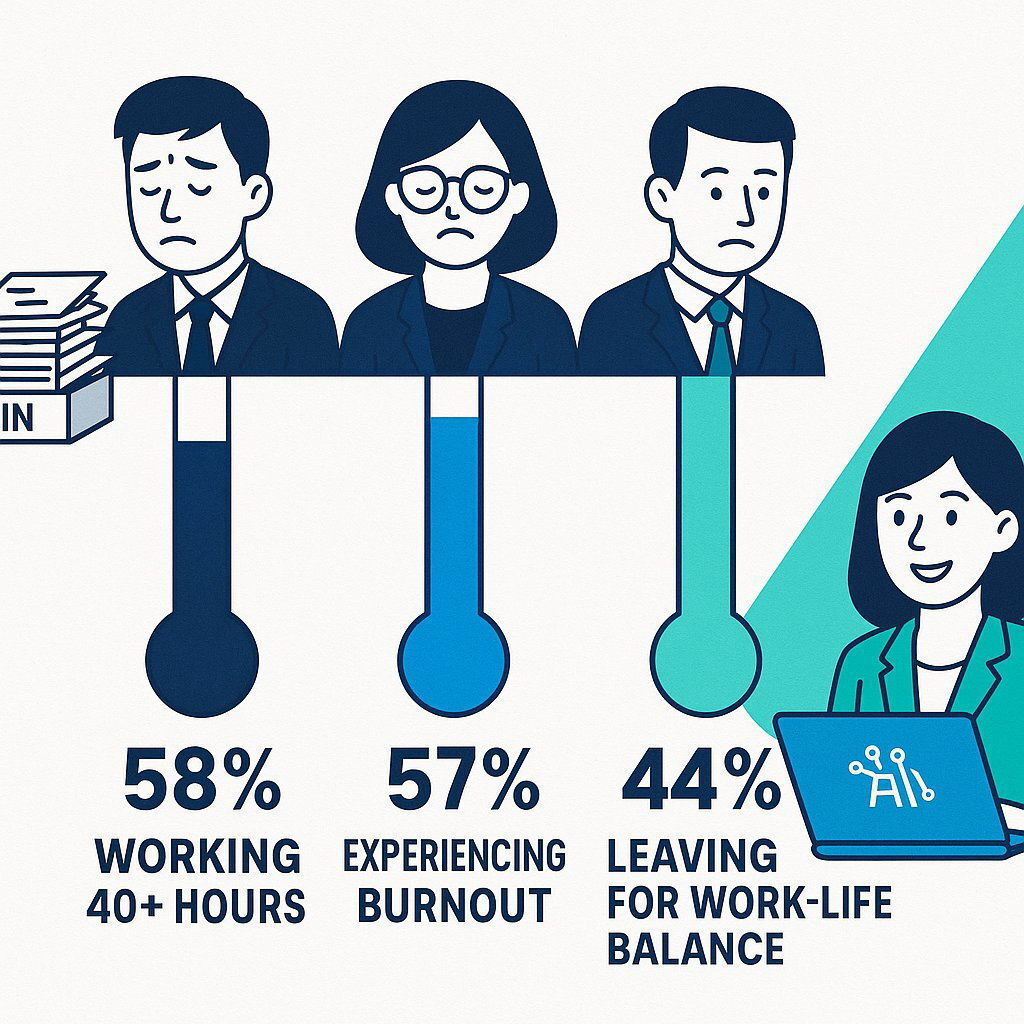

The modern enterprise runs on data, but for many finance teams, this has led to operational paralysis. An overwhelming 94% of businesses report struggling with repetitive, time-consuming tasks that could be streamlined through automation. This manual drudgery translates directly into unsustainable workloads. Current finance professionals paint a stark picture: 58% work 40 hours or more per week, and a concerning 57% have experienced burnout firsthand. This isn't just a morale issue; it's a primary driver of turnover, with work-life balance (44%) and burnout (35%) cited as the top reasons for employees leaving.

The Evolving Risk Environment

While finance teams are stretched thin managing routine operations, the external environment has become more volatile. A full 65% of executives report a substantial rise in the volume and complexity of risks over the past five years. Manual, periodic reviews and historical analysis are simply inadequate for managing threats—from fraud to market volatility—that evolve in real time. The traditional, retrospective approach to risk management leaves the organization dangerously exposed.

The Looming Talent Crisis

Perhaps the most critical threat is the impending talent cliff. An estimated 75% of people in accounting are at or nearing retirement age, creating a massive experience vacuum that will be difficult to fill. This problem is compounded by a pipeline issue. The transactional, process-oriented nature of traditional finance roles is proving unattractive to the next generation of talent. According to a Deloitte survey, only 24% of Gen Zs see financial institutions as desirable places to work, with 44% stating they have rejected jobs that did not align with their values of purpose and impact. They seek creative, technology-driven roles, not careers centered on manual data entry and reconciliation.

This confluence of factors creates a vicious cycle. The heavy reliance on manual tasks leads to burnout and high turnover. The unappealing nature of this work makes it difficult to attract new, digitally-native talent. The resulting talent shortage places an even greater burden on the remaining team members, deepening the burnout and making it impossible to dedicate time to the strategic, value-added work that would actually make the roles more engaging. AI-powered automation is the circuit breaker. By systematically eliminating the mundane, it directly addresses the root cause of burnout, transforms finance into a more attractive and tech-forward career path, and frees the essential human capital needed to tackle the complex strategic challenges of today's business environment.

From Tactical Burden to Strategic Advantage: How AI is Automating the Back Office

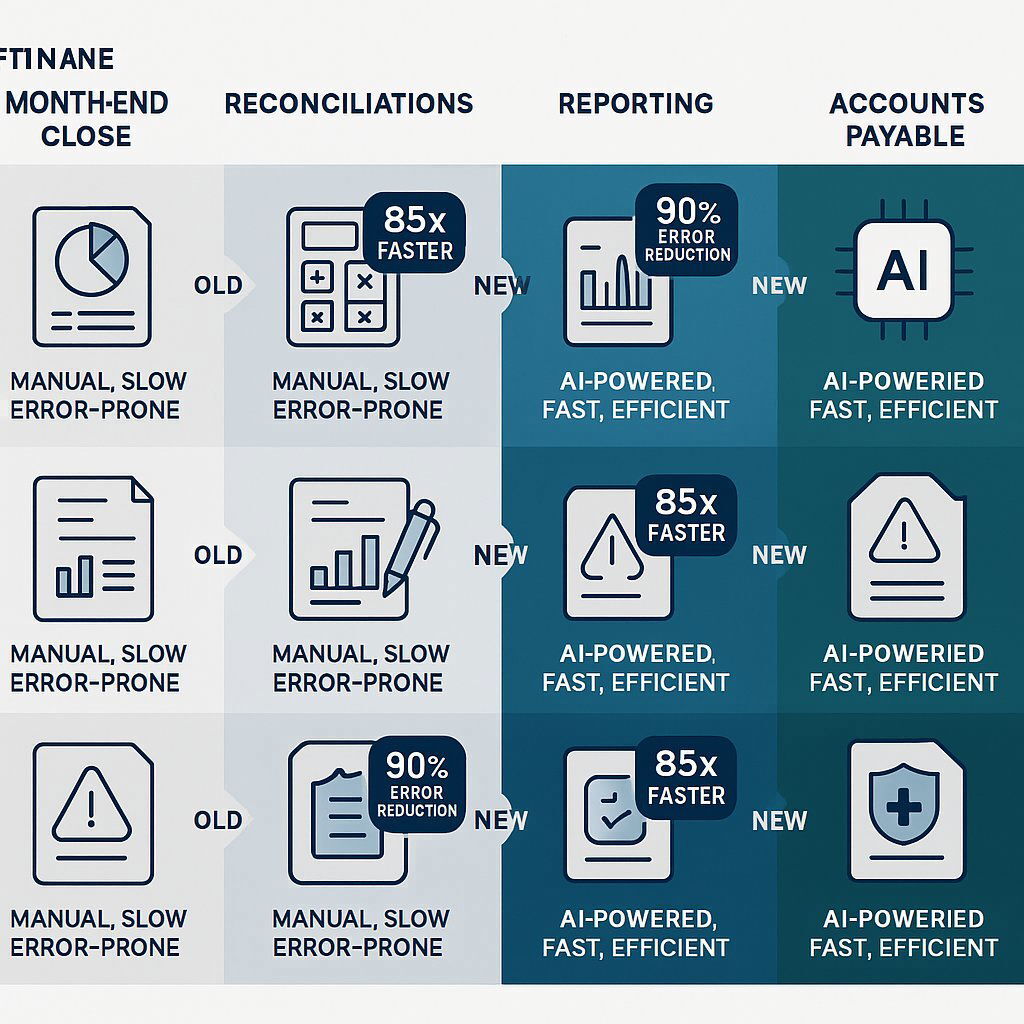

The most immediate and tangible impact of AI in finance is the radical transformation of core operational processes. What once consumed weeks of manual effort can now be accomplished with greater speed and accuracy in a fraction of the time. This isn't about incremental improvement; it's a step-change in efficiency that redefines the finance department's capacity and cost structure.

AI and intelligent automation are being deployed across the entire spectrum of back-office functions, including accounts payable and receivable, reconciliations, month-end close, compliance monitoring, and transaction capture. The results are staggering. Organizations implementing these technologies report completing financial processes up to 85 times faster and accelerating reconciliations by a factor of 100. The impact on accuracy is equally profound, with a 90% reduction in reporting errors, virtually eliminating the costly rework and reputational risk associated with manual mistakes.

This operational uplift delivers a powerful and rapid return on investment, typically realized within just 6 to 12 months of implementation. Real-world case studies provide compelling evidence of this value. One financial institution used an AI-driven system to reduce its loan processing time by 40%, while another leveraged AI to cut its claims processing time in half. These are not isolated examples; they represent a new performance benchmark for the modern finance function.

The table below provides a clear, at-a-glance summary of the concrete operational improvements delivered by AI, illustrating the powerful business case for automation.

| Finance Process | Traditional Challenge (Manual) | AI-Powered Outcome | Key Metrics & Source |

|---|---|---|---|

| Month-End Close | Days or weeks of manual journal entries, reconciliations, and reporting. High risk of human error. | Automated data consolidation, journal entry suggestions, and report generation. | Up to 85x faster completion. |

| Reconciliations | Tedious, line-by-line matching of transactions across multiple systems. | Real-time, automated matching of vast transaction volumes, with intelligent exception flagging. | Up to 100x faster. |

| Reporting | Time-consuming data gathering and manual report creation, often with stale data. | Automated generation of real-time dashboards and reports with commentary. | 90% reduction in reporting errors. |

| Accounts Payable | Manual invoice data entry, lengthy approval workflows, risk of duplicate payments. | AI-driven invoice capture (OCR), automated approval routing, and fraud detection. | Reduces manual work by up to 90%. |

| Compliance | Labor-intensive monitoring of transactions and regulatory changes. | Proactive, real-time monitoring of all transactions against compliance rules. | A 15% increase in automation can cut compliance costs by 10%. |

By offloading these tedious, data-crunching tasks to intelligent systems, finance professionals are liberated from the monotonous work that has defined their roles for decades. This allows them to redirect their expertise toward higher-value activities that require human judgment, critical thinking, and strategic insight.

The Shift from Scorekeeper to Oracle: AI-Powered Predictive Insights

While back-office automation delivers profound efficiency gains, the most transformative impact of AI lies in its ability to elevate the finance function from a reactive, historical scorekeeper to a proactive, predictive oracle for the business. This is where the CFO truly evolves into a strategic co-pilot. AI-powered tools don't just report

that revenue dropped; they can analyze countless variables to explain why it dropped and model what is likely to happen next.

Forecasting with Unprecedented Confidence

Traditional forecasting, often confined to the limitations of spreadsheets and human analysis, is being revolutionized. AI and machine learning (ML) models can ingest and analyze massive, unstructured datasets—including macroeconomic indicators, supply chain signals, market news, and even social media sentiment—at a speed and scale no human team could ever match. This leads to a quantum leap in forecast accuracy. The proof is in the performance: AI-led hedge funds, for instance, have generated average returns of 34% over three years, compared to just 12% for the global hedge fund industry. This predictive power allows CFOs to anticipate market shifts, optimize resource allocation, and manage liquidity with far greater precision.

"What If?" on Demand: The Power of Dynamic Scenario Planning

Perhaps the most powerful strategic capability unlocked by AI is dynamic scenario planning. In the past, modeling the financial impact of a potential business disruption was a painstaking process that could take analysts weeks. As a result, organizations could only explore a limited number of "what-if" scenarios, leaving them unprepared for unexpected events.

Generative AI and AI agents completely change this paradigm. Now, finance teams can model complex scenarios in minutes, not weeks. A CFO can instantly compare the financial implications of slow growth versus a rapid recovery. An operations leader can model the impact of a port closure coinciding with a raw material shortage overnight. A marketing director can test how a premium pricing strategy would perform if a rival introduced a discount line.

This capability transforms financial planning from a static, periodic exercise into a continuous, iterative strategic conversation. It effectively democratizes strategic inquiry. The Head of Sales can ask an AI copilot, "What is the impact on our cash runway if we lose our largest client next quarter?" and receive a data-backed answer in seconds. This fundamentally alters the CFO's role. No longer the bottleneck for analysis, the CFO becomes the architect of this powerful AI-driven decision engine. They are the strategic partner who helps other leaders interpret the results, challenge assumptions, and, most importantly, ask better questions. This shift elevates the finance function's influence across the entire organization, cementing the CFO's position as an indispensable strategic advisor.

The Talent Imperative: Building the Finance Team of Tomorrow

The technological transformation of the finance function is inseparable from a human one. Embracing AI and automation is not just about implementing new software; it's about cultivating a new generation of talent with a fundamentally different skill set. For CFOs, leading this talent evolution may be the most critical challenge—and opportunity—of their careers.

Acknowledging the Skills Gap

The data on this front is sobering and demands urgent attention. Digital talent is underrepresented on finance teams by a staggering 50-75%. This is not a perceived gap; it is a chasm. Two out of three finance leaders agree that the digital skills gap within their teams is actively growing, not shrinking. This deficiency directly hinders the ability of the finance function to harness the potential of new technologies and deliver on its strategic mandate. Further complicating the matter are clear generational and gender divides in AI readiness and confidence, which, if left unaddressed, risk deepening existing workforce inequalities.

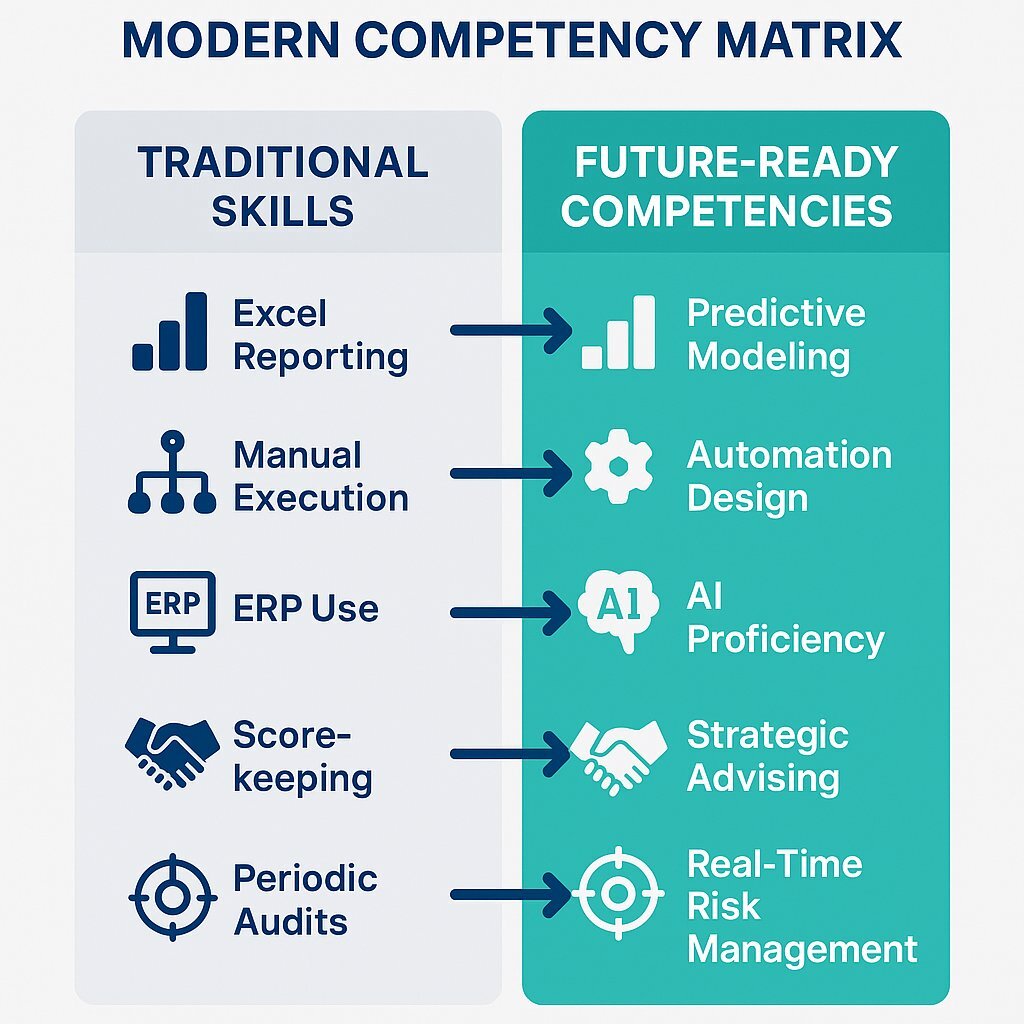

The New Competency Matrix

The skills that defined a successful finance professional a decade ago are no longer sufficient. The modern finance team requires a hybrid blend of technical fluency, analytical prowess, and strategic business acumen. Core accounting principles remain foundational, but they must be augmented with new competencies like AI literacy, data management, proficiency with AI-enabled platforms, and change management. In fact, a recent survey revealed that FP&A professionals now consider data storytelling and communication (87%) to be more critical skills for the future than traditional modeling and analytics (65%).

The following table contrasts the traditional finance skill set with the future-ready competencies required in an AI-powered world, providing a clear framework for talent assessment and development.

| Domain | Traditional Finance Skill | Future-Ready Competency (AI-Enabled) | Why It Matters |

|---|---|---|---|

| Data & Analytics | Historical Data Reporting (Excel) | Predictive Modeling & Data Storytelling | Moves from reporting the past to predicting the future and influencing decisions. |

| Process Management | Manual Process Execution | Automation Design & Workflow Optimization | Shifts focus from doing the work to designing automated systems that do the work. |

| Technology | ERP System User | AI Tool Proficiency & Prompt Engineering | Requires direct interaction with and command of AI systems to extract value. |

| Business Partnership | Financial Controller / Scorekeeper | Strategic Advisor & Business Catalyst | Uses data-driven insights to challenge assumptions and drive cross-functional strategy. |

| Risk Management | Periodic Audits & Controls | Proactive Anomaly Detection & Real-Time Risk Sensing | Manages risk continuously and preemptively, not just retrospectively. |

The CFO as Chief Talent Officer

The responsibility for bridging this talent gap falls squarely on the CFO. This requires a proactive, multi-pronged strategy. It begins with auditing current processes to identify the most impactful opportunities for automation and then educating the team on the business benefits of AI, framing it as an opportunity for professional growth, not a threat of replacement. The next step is to invest in structured, targeted upskilling programs. This is not about turning accountants into data scientists; it's about equipping them with the AI literacy and tool proficiency needed to partner effectively with technology. By championing this evolution, the CFO not only future-proofs their department but also transforms it into a destination for top talent seeking to work at the intersection of finance and technology.

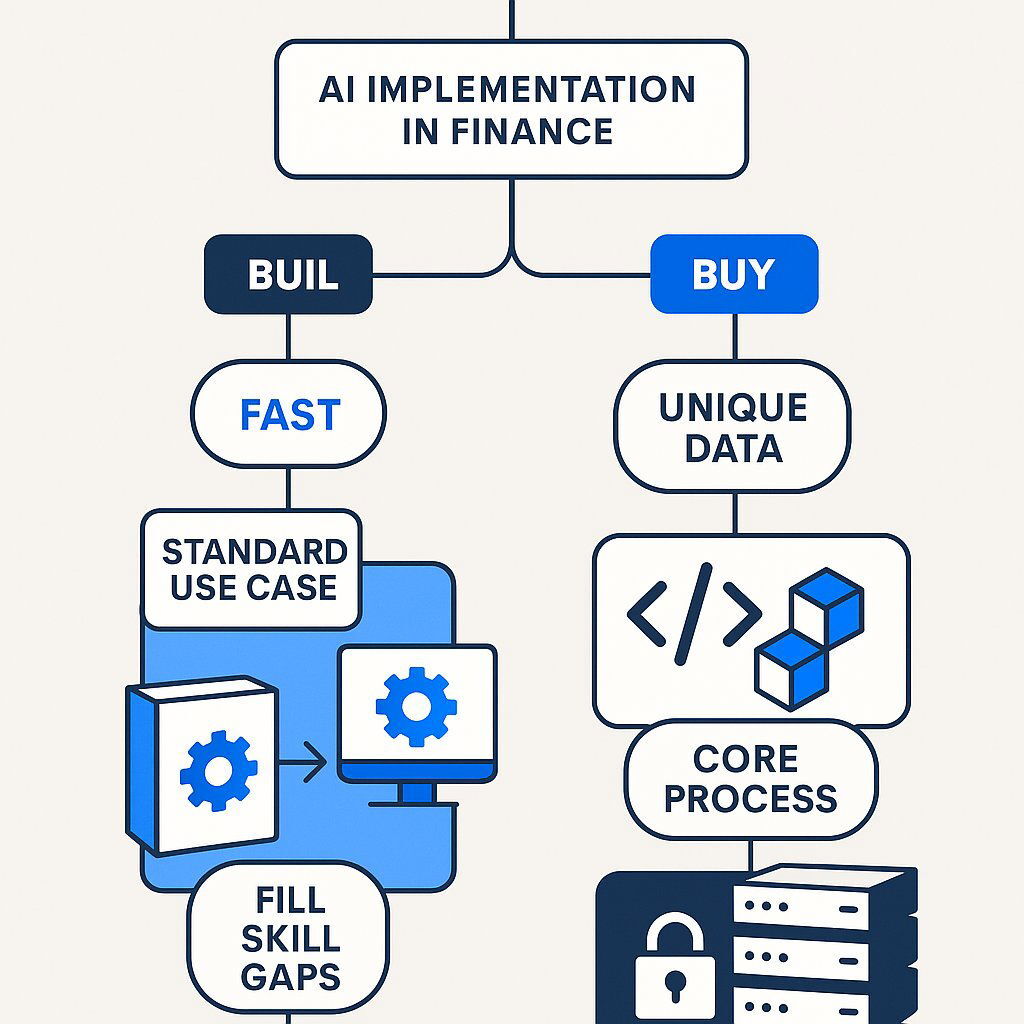

Your Roadmap to the AI-Powered Finance Function: The "Build vs. Buy" Decision

Embarking on the AI journey requires a clear strategy, and one of the first and most critical decisions a CFO will face is whether to buy off-the-shelf AI solutions or build custom ones. This is not merely a technical choice; it is a profound strategic decision that directly impacts competitive advantage, cost, implementation speed, and data control. With some studies indicating that as many as 85% of AI projects fail to deliver on their promise, making the right choice here is paramount.

When to "Buy": The Path to Quick Wins and Efficiency

Purchasing pre-built, off-the-shelf AI solutions from vendors like DataSnipper, Workiva, or Ramp is often the most logical starting point. This approach is ideal under several conditions:

- For Standard Use Cases: If the goal is to automate a common, standardized process like accounts payable, expense management, or basic financial reporting, a market solution has likely already perfected it.

- When Speed is Critical: Off-the-shelf tools can typically be deployed in a matter of months (or even weeks), delivering rapid time-to-value and allowing the finance team to achieve quick wins that build momentum for broader transformation.

- To Bridge Talent Gaps: When in-house AI and data science expertise is limited, buying a solution provides immediate access to sophisticated technology without the need for a massive hiring initiative.

When to "Build": The Path to Defensible Competitive Advantage

While buying is excellent for operational efficiency, building a custom AI solution becomes necessary when the goal is to create a true, sustainable competitive advantage. A custom approach is warranted when:

- The Process is a Core Differentiator: If your method of risk assessment, portfolio management, or financial modeling is unique and central to your business strategy, a generic tool will not suffice. A custom model can codify and scale your proprietary intelligence.

- You Possess Unique Data: The power of any AI model lies in the data it's trained on. If your organization has years of unique historical data—on customer behavior, loan performance, or market dynamics—a custom model trained on this dataset will invariably outperform any off-the-shelf alternative.

- Regulatory and Security Demands are High: In finance, data sovereignty, security, and algorithmic auditability are non-negotiable. Building a custom solution provides complete control over the data environment and ensures that compliance and governance are embedded from the ground up, which is crucial for meeting strict regulatory requirements.

Navigating the "Build" Path with a Strategic Partner

The prospect of a custom build can be daunting, often conjuring images of long timelines (18-36 months is typical for in-house projects) and immense upfront investment. However, "building" does not have to mean hiring an entire data science division from scratch. Partnering with a specialist in custom software development, like

Baytech Consulting , offers a third way—a path that combines the strategic benefits of a custom solution with the speed and expertise of a dedicated technology partner.

This approach directly addresses the primary challenges of the build path. A firm like Baytech provides on-demand access to highly skilled engineers and enterprise-grade quality, mitigating the talent acquisition challenge. Their Tailored Tech Advantage is designed for precisely the scenarios where off-the-shelf products fall short—crafting bespoke AI models that turn a company's unique data and processes into a proprietary asset. Furthermore, a commitment to Rapid Agile Deployment fundamentally de-risks the investment. Instead of a multi-year, monolithic project, an agile methodology delivers value iteratively and transparently, ensuring the solution evolves with business needs and accelerates the return on investment. By leveraging a modern, secure technology stack that includes Kubernetes, Docker, and private cloud servers, a partnership can also satisfy the stringent security and scalability requirements that are paramount for any financial application.

Conclusion: The Strategic CFO Imperative

The transformation of the finance function is no longer a distant vision; it is a present-day imperative. The convergence of AI, automation, and immense data processing power has created an inflection point. For CFOs, this is a moment of profound opportunity—a chance to lead their teams out of the operational trenches and onto the strategic high ground. The choice is not whether to adopt these technologies, but how quickly and effectively to do so. As Nvidia's CEO Jensen Huang aptly warned, "You're not going to lose your job to an AI, but you're going to lose your job to someone who uses AI".

The journey from an overburdened, reactive function to an automated, predictive, and strategic powerhouse is clear. It begins with automating the back office to eliminate manual toil, freeing human capital for higher pursuits. It accelerates by embracing AI-powered analytics to shift from historical reporting to predictive forecasting and dynamic scenario planning. Finally, it is sustained by a deliberate and strategic investment in talent, cultivating the hybrid skills necessary to thrive in an AI-enabled world.

This is the CFO's moment to champion change, to redefine the value and identity of their function, and to become the indispensable strategic co-pilot the business needs to navigate the complexities of the future. The tools are here. The path is clear. The time to lead is now.

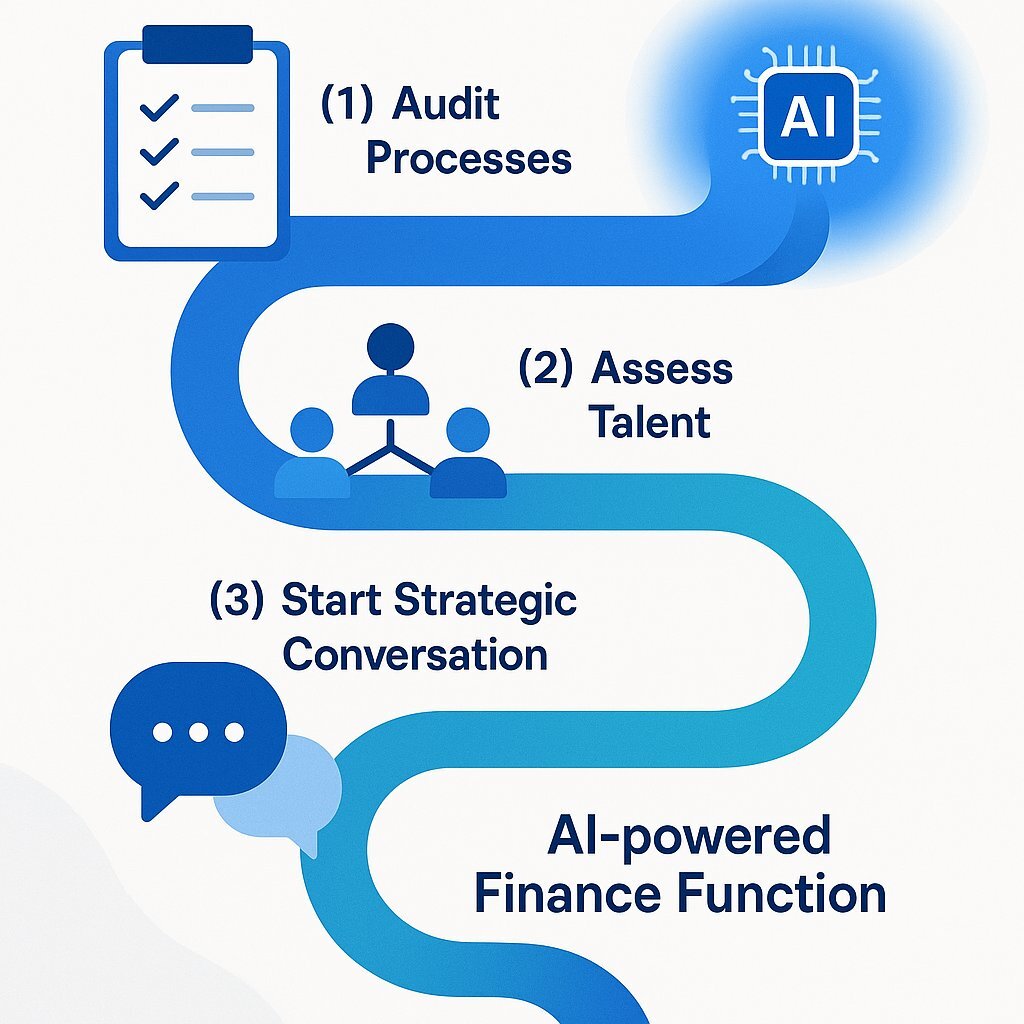

Next Steps for the Forward-Looking CFO

- Audit Your Processes: Begin by identifying the top three most time-consuming, manual, and error-prone tasks within your department. These are your prime candidates for initial automation projects that can deliver quick, demonstrable wins.

- Assess Your Talent: Use the competency matrix in this article as a diagnostic tool. Map your team's current skills against the future-ready competencies and identify the most critical gaps to address through targeted training and development.

- Start the Strategic Conversation: Initiate a dialogue with your CTO and C-suite peers. Frame the discussion not around technology for its own sake, but around how a strategic investment in AI for the finance function can unlock value, mitigate risk, and drive competitive advantage for the entire enterprise.

Further Reading

- https://www.mckinsey.com/capabilities/quantumblack/our-insights/the-state-of-ai

- https://www.gartner.com/en/articles/ai-in-finance

- https://www.armanino.com/articles/evolution-2-ai-redefines-transformational-cfo/

About Baytech

At Baytech Consulting, we specialize in guiding businesses through this process, helping you build scalable, efficient, and high-performing software that evolves with your needs. Our MVP first approach helps our clients minimize upfront costs and maximize ROI. Ready to take the next step in your software development journey? Contact us today to learn how we can help you achieve your goals with a phased development approach.

About the Author

Bryan Reynolds is an accomplished technology executive with more than 25 years of experience leading innovation in the software industry. As the CEO and founder of Baytech Consulting, he has built a reputation for delivering custom software solutions that help businesses streamline operations, enhance customer experiences, and drive growth.

Bryan’s expertise spans custom software development, cloud infrastructure, artificial intelligence, and strategic business consulting, making him a trusted advisor and thought leader across a wide range of industries.