AI in Mortgage Lending: Transformation, Risks & Roadmap for Responsible Adoption

August 10, 2025 / Bryan Reynolds

The Algorithmic Lender: Navigating AI's Transformation of the Mortgage Industry

Executive Summary

Artificial intelligence (AI) is no longer a futuristic concept but a foundational technology that is actively reshaping the mortgage industry. For lenders, it represents a paradigm shift from manual, paper-laden processes to automated, data-driven workflows, creating unprecedented opportunities for efficiency, accuracy, and growth. This report provides a comprehensive analysis of AI's impact across the entire mortgage lifecycle, from origination and underwriting to servicing and compliance. It details the profound operational benefits and enhanced customer experiences that AI enables, while also providing a sober assessment of the critical, enterprise-level risks that accompany its adoption.

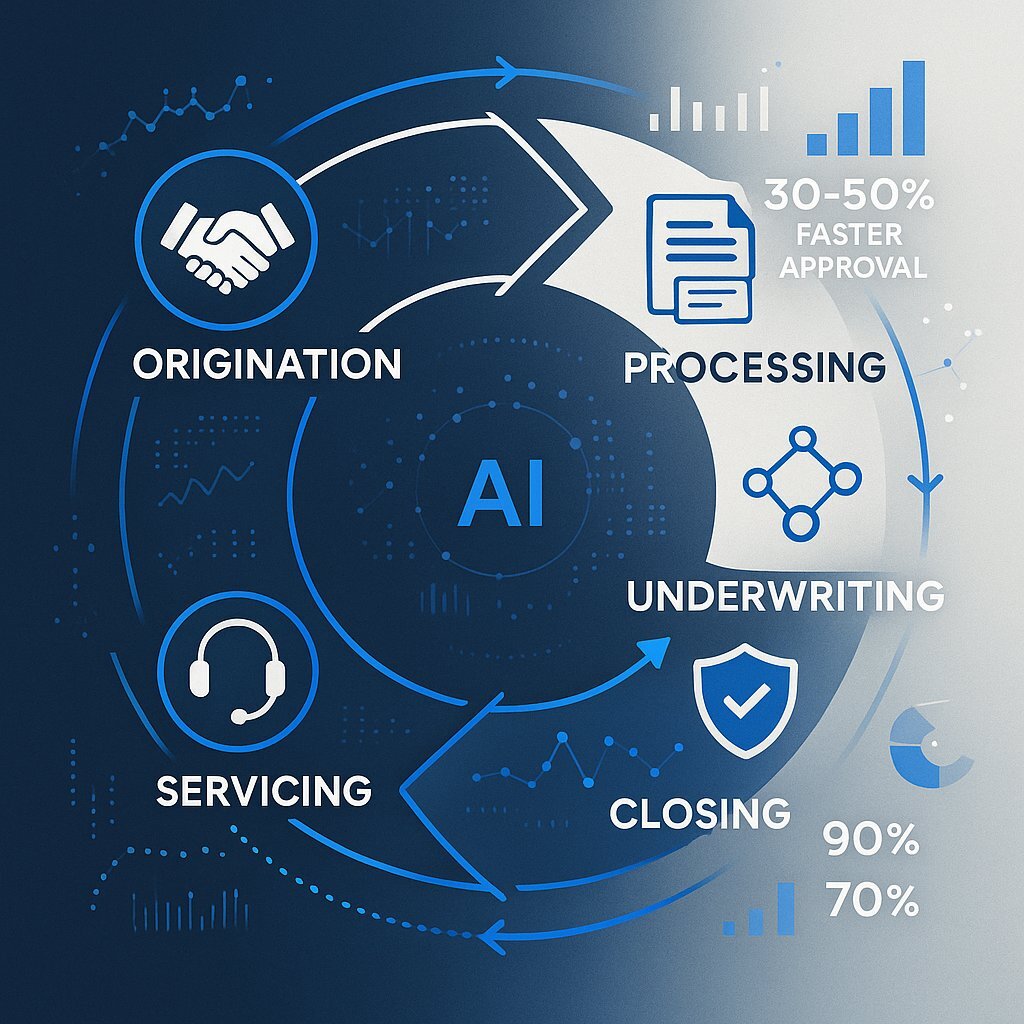

The integration of technologies like machine learning (ML), natural language processing (NLP), and generative AI is delivering quantifiable results. Lenders are reporting reductions in loan processing times of 30-50%, decreases in operational costs of nearly 30%, and significant improvements in fraud detection, with some institutions seeing a 50% reduction in fraud cases. For customers, this translates into a faster, more transparent, and highly personalized borrowing experience, with 24/7 access to information and loan products tailored to their unique financial circumstances.

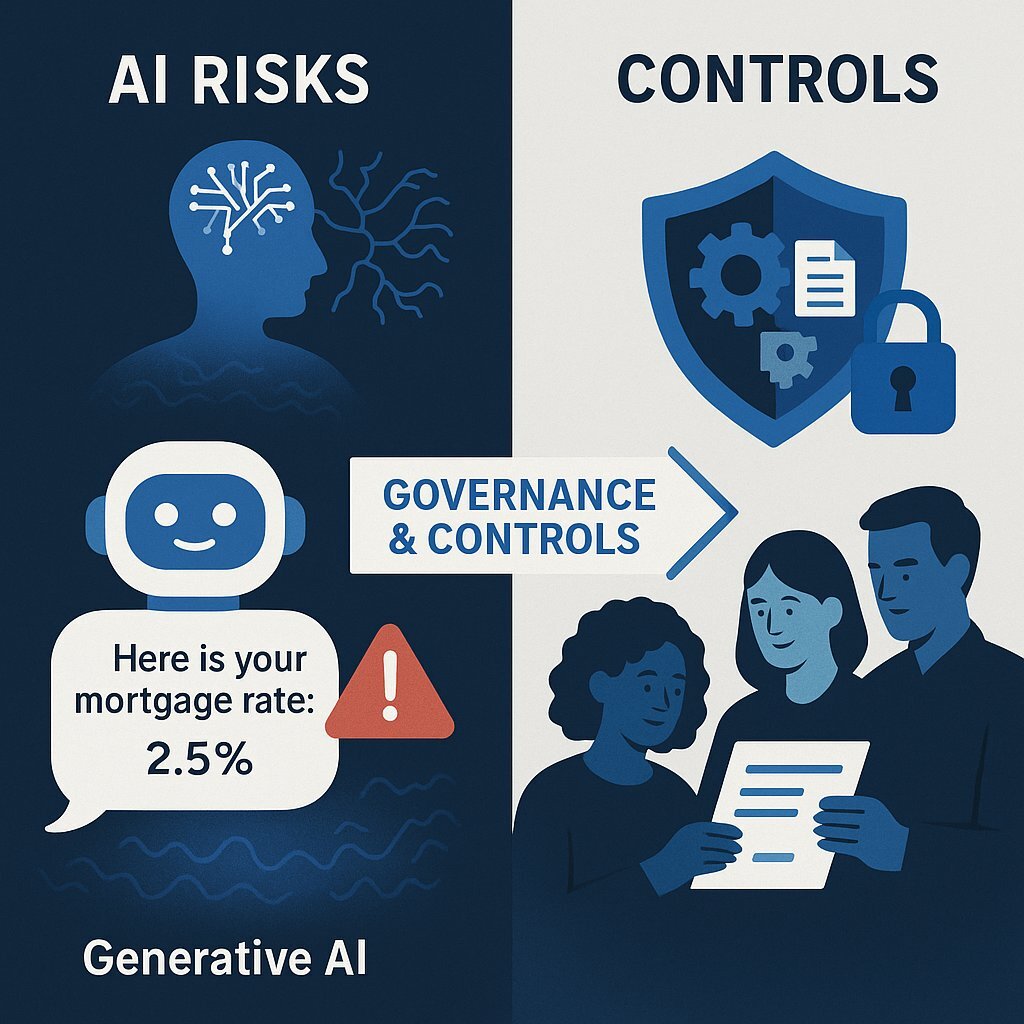

However, this transformation is not without peril. The very power that makes AI so effective also introduces significant challenges that must be managed with strategic foresight. The risk of algorithmic bias, or "digital redlining," where AI models perpetuate historical discrimination, poses a profound ethical and regulatory threat. The emergence of generative AI brings the risk of "hallucinations"—confidently delivered but false information—which can lead to severe financial and legal consequences in a high-stakes mortgage transaction. These risks, coupled with persistent challenges in data security, regulatory compliance, and legacy system integration, demand a robust governance framework.

The future leaders in the mortgage industry will be those who master the art of responsible innovation. Success is not merely about adopting AI but about embedding it within a culture of ethical stewardship and rigorous risk management. It requires balancing technological ambition with a steadfast commitment to fairness, transparency, and accountability. This report serves as a strategic guide for navigating this new landscape, offering a roadmap for harnessing AI's power while mitigating its inherent risks.

Part I: The New Mortgage Lifecycle: AI Integration from Application to Servicing

The traditional mortgage process has long been characterized by siloed departments, manual handoffs, and a reliance on paper-based documentation, leading to inefficiencies, errors, and a frustrating experience for borrowers. The integration of artificial intelligence is fundamentally re-architecting this legacy structure into a seamless, data-driven workflow. AI is not merely automating individual tasks; it is creating a holistic, interconnected data ecosystem that spans the entire lifecycle, from the first customer interaction to the final loan payment. This interconnectedness breaks down the traditional barriers between origination, underwriting, and servicing, creating a continuous data thread that enables a more intelligent, responsive, and efficient lending operation. An insight gained at one stage, such as a risk pattern identified in servicing, can be instantly fed back to refine the underwriting models for all future loans, creating a powerful, self-improving feedback loop. Lenders are transitioning from being mere loan processors to becoming managers of a dynamic, learning system, where the intelligent management of the entire lifecycle data stream becomes the primary competitive advantage.

Revolutionizing Origination and Customer Engagement

The transformation begins at the very first touchpoint with a potential borrower. AI is reshaping how lenders attract, engage, and support customers during the initial stages of the mortgage journey.

AI-Powered Customer Acquisition and Interaction Lenders are leveraging predictive analytics to sift through vast market and consumer datasets to identify individuals who are likely to seek mortgage financing. This allows for highly targeted and personalized marketing outreach, moving beyond generic campaigns to connect with high-probability leads. Industry data shows that lenders implementing these AI-driven acquisition strategies have seen a 34% increase in qualified lead generation while simultaneously reducing customer acquisition costs by approximately 22%.

24/7 Customer Support with Chatbots and Virtual Assistants Once a potential customer engages, AI-powered chatbots and virtual assistants have become the new frontline of customer service. These tools provide immediate, round-the-clock responses to borrower inquiries, answer questions about loan products, and guide applicants through the initial stages of the process without the need for human intervention. This constant availability dramatically improves accessibility and customer satisfaction. Some financial institutions have successfully automated over 90% of their initial customer queries using these systems.

The technology is evolving beyond simple Q&A bots. More advanced conversational AI platforms, such as the "Betsy" system used by Better Mortgage, are deeply integrated with the core loan origination engine. This allows them to access an applicant's specific file and provide personalized, context-aware answers to complex questions, a significant leap from generic script-based responses.

Personalized Loan Recommendations AI algorithms are also being used to deliver a more customized and consultative experience from the outset. By performing a rapid analysis of a borrower's initial financial data, AI systems can generate tailored loan recommendations and customized mortgage offers. This moves the industry away from a one-size-fits-all approach, making borrowers feel that their unique financial situation is understood and being catered to, which enhances trust and engagement early in the process.

The Core Transformation - Intelligent Processing and Underwriting

The most profound impact of AI is felt in the core operational engine of mortgage lending: the processing and underwriting of loan applications. This stage, historically the most time-consuming and labor-intensive, is being completely transformed by intelligent automation.

Automated Document Processing A typical mortgage application can generate thousands of pages of documentation, from pay stubs and tax returns to bank statements and property appraisals. Manually processing this volume of paper is a primary source of delays and errors. AI technologies like Natural Language Processing (NLP), Optical Character Recognition (OCR), and Computer Vision form the cornerstone of a new, automated approach. These systems can "read" and understand scanned documents, automatically extracting, classifying, and verifying key data points. The efficiency gains are staggering, with financial institutions reporting that AI-powered document processing reduces verification time by as much as 85% and improves data accuracy rates to over 99%.

Intelligent Data Verification and Analysis Beyond simple extraction, AI systems intelligently cross-reference the data they capture. Information from a tax return can be automatically compared against a pay stub and bank statements to ensure consistency and flag discrepancies for review. This automated verification minimizes the risk of human error in data entry, a problem that has traditionally plagued as much as 40% of the manual lending process, and reduces the need for costly rework later in the cycle.

Automated Underwriting Systems (AUS) The evolution of AUS is central to the AI story. Industry-standard platforms from government-sponsored enterprises (GSEs), such as Fannie Mae's Desktop Underwriter® (DU®) and Freddie Mac's Loan Product Advisor® (LPA®), are being infused with increasingly sophisticated AI and machine learning capabilities. These enhanced systems can analyze a borrower's complete profile against a vast set of guidelines and risk factors to render an underwriting decision with unprecedented speed and consistency. This automation has been shown to reduce underwriting time by 30-50%, and some specialized AI underwriting engines, like that from Candor Technology, can now approve certain FHA loans in as little as 90 seconds.

Automated Property Valuation AI is also revolutionizing the appraisal process. AI-driven Automated Valuation Models (AVMs) and Automated Collateral Evaluation (ACE) tools analyze immense datasets—including historical sales, current market trends, property characteristics, and even satellite imagery—to generate instant and highly accurate property valuations. This eliminates the time and expense of a traditional manual appraisal in many cases. The impact is significant; Freddie Mac's ACE+ program, for instance, has saved borrowers more than $2 billion in appraisal costs since its introduction in 2017.

Advanced Risk Assessment and Credit Decisioning

AI enables a more sophisticated and nuanced approach to evaluating risk, moving beyond the limitations of traditional credit scoring models to create a more holistic and predictive picture of a borrower's creditworthiness.

Predictive Analytics for Credit Risk Machine learning models are the engine of modern risk assessment. They can analyze hundreds, or even thousands, of data points to identify subtle patterns in a borrower's financial behavior that are predictive of their likelihood to default. This goes far beyond a simple FICO score. A study by Fannie Mae found that these AI models demonstrate a 15% increase in accuracy when predicting borrower default risk compared to traditional methods. This superior predictive power allows lenders to make more confident and profitable lending decisions.

The Role of Alternative Data A key advantage of AI is its ability to incorporate and analyze alternative data sources that are often ignored by traditional models. This can include a history of on-time rental payments, consistent utility bill payments, or stable cash flow patterns in bank accounts. By leveraging this data, AI can help build a credit profile for "thin-file" applicants—such as young people, immigrants, or self-employed individuals—who may be perfectly creditworthy but lack a traditional credit history. This holds the promise of responsibly expanding access to homeownership for previously underserved populations.

Dynamic Interest Rate Determination Traditionally, interest rates are set based on broad risk tiers. AI allows for a more dynamic and personalized approach. Models can assess an individual borrower's specific risk profile in real-time and, when combined with current market data, generate a more customized and competitive interest rate. This moves the industry away from static rate sheets and toward truly individualized pricing.

Post-Approval Automation: Servicing and Portfolio Management

The role of AI does not end once a loan is closed. It continues to add value throughout the long-term servicing of the mortgage, enhancing both operational efficiency and the customer experience.

Automated Loan Servicing Many routine servicing tasks are ripe for automation. Robotic Process Automation (RPA) can handle functions like processing monthly payments, sending out statements and reminders, and managing escrow accounts for taxes and insurance. This reduces manual effort, minimizes errors, and lowers servicing costs.

Proactive Customer Support in Servicing AI-powered chatbots and virtual assistants remain valuable tools for customers post-closing, providing 24/7 support for common inquiries about loan balances, payment schedules, or escrow analysis. More advanced applications of AI involve predictive analytics. By analyzing payment patterns and other data, these systems can identify borrowers who may be at future risk of delinquency or default. This allows servicers to be proactive, reaching out to offer support, counseling, or loss mitigation options like loan modifications before a borrower falls into serious trouble.

Continuous Compliance and Reporting The regulatory landscape is in constant flux. AI systems can be configured to continuously monitor for changes in lending regulations, such as Anti-Money Laundering (AML) and Know-Your-Customer (KYC) standards. They can automatically ensure that processes and documentation remain compliant, flagging any potential issues for review and simplifying the generation of complex regulatory reports.

Table 1: AI Applications Across the Mortgage Lifecycle

The following table provides a structured overview of how specific AI technologies are being deployed across the mortgage value chain, transforming key functions and creating value for both lenders and borrowers.

| Lifecycle Stage | Key Function | AI Technology Applied | Description & Impact | Key Vendor/Platform Examples |

|---|---|---|---|---|

| Loan Origination | Customer Acquisition & Engagement | Predictive Analytics, Generative AI | Tailors marketing and identifies high-intent borrowers. AI-powered chatbots provide 24/7 support and personalized guidance. | InstaMortgage, Blend, CustomGPT.ai |

| Processing | Document & Data Management | NLP, OCR, Computer Vision | Automates data extraction from documents, reducing verification time by up to 85% and errors to <1%. | Ocrolus, Gateless |

| Underwriting | Credit & Risk Assessment | Machine Learning, Predictive Analytics | Analyzes hundreds of data points, including alternative data, to assess default risk with 15% greater accuracy than traditional models. Reduces processing time by 30-50%. | Zest AI, Candor Technology, Fannie Mae's DU®, Freddie Mac's LPA® |

| Underwriting | Property Valuation | Machine Learning (AVMs) | Generates instant, accurate property valuations, saving borrowers billions in appraisal fees. | Fannie Mae's Collateral Underwriter®, Freddie Mac's ACE+ |

| Closing | Compliance & Fraud Detection | Machine Learning, Anomaly Detection | Scans applications for patterns indicative of fraud, reducing fraud cases by up to 50%. Ensures adherence to regulations like TILA and RESPA. | Fannie Mae/Palantir, Resistant AI |

| Servicing | Customer Support & Portfolio Management | RPA, Conversational AI, Predictive Analytics | Automates payment processing and reminders. Chatbots handle servicing queries. Predictive models identify at-risk borrowers for proactive outreach. | Often part of core banking platforms. |

Part II: The Business Case for AI: Quantifying Benefits and Enhancing Experiences

The widespread and accelerating adoption of AI in the mortgage industry is propelled by a clear and compelling value proposition. For lenders, it offers a powerful antidote to rising costs and shrinking margins. For customers, it promises to transform a notoriously stressful process into one that is fast, transparent, and personalized. The benefits are not merely theoretical; they are being quantified in real-world applications, creating a virtuous cycle of competitive advantage. The operational efficiencies and cost savings achieved through AI are not just one-time gains. They free up significant capital and, just as importantly, valuable human resources. This allows leading firms to reinvest in developing more sophisticated AI models, creating better customer experiences, and further enhancing their technological capabilities. This dynamic creates a feedback loop where efficiency gains fuel a better customer journey, which in turn drives more business and generates richer data, leading to even more advanced AI and greater efficiency. Lenders who fail to make these initial investments risk being caught in a vicious cycle of high costs, poor service, and diminishing market share, while their AI-enabled competitors accelerate away.

The Lender's Advantage: A Paradigm Shift in Operational Efficiency

For mortgage lenders, AI is a foundational technology for improving productivity, managing costs, and enabling scalable growth.

Accelerating the Process Speed is a critical competitive differentiator, and AI delivers it in abundance. By automating the most time-consuming aspects of processing and underwriting, lenders are reporting dramatic reductions in the time it takes to get a loan from application to close. Across the industry, lenders using AI solutions have reduced mortgage approval timelines by 30-50%. A 2023 Fannie Mae study of financial institutions that have implemented comprehensive AI solutions found an average reduction of 41% in overall loan processing time. This speed also translates to greater business agility. An academic analysis revealed that fintech lenders, who are typically heavy adopters of AI and automation, are twice as resilient to processing slowdowns during periods of high application volume compared to their traditional counterparts.

Slashing Operational Costs In recent years, the cost to originate a single mortgage has swelled to over $10,000, putting immense pressure on lender profitability. AI directly addresses this challenge by automating manual, labor-intensive tasks that have historically required significant human capital. The same Fannie Mae study that highlighted time savings also reported a 29% average decrease in operational costs for lenders using AI. The potential savings are substantial on a per-loan basis as well. In May 2025, Freddie Mac announced enhancements to its AI-powered underwriting tools, estimating that lenders who fully utilize the automation could save up to $1,500 per loan. A 2024 report from McKinsey further substantiates these gains, noting that 60% of financial institutions surveyed confirmed they had already achieved measurable cost reductions and productivity gains from their AI initiatives.

Improving Accuracy and Scalability Manual processes are inherently prone to human error, which can lead to costly rework, compliance issues, or loan buybacks from investors. AI systems, by contrast, apply rules and calculations with perfect consistency, dramatically improving accuracy. This enhanced accuracy is complemented by a crucial benefit: scalability. AI allows lending operations to handle significant fluctuations in application volume without the disruptive and expensive cycles of hiring and layoffs that have long plagued the mortgage industry. The technology can scale to meet demand, providing a level of business agility that is difficult to achieve with a fixed human workforce.

Several organizations are already demonstrating these benefits. Freddie Mac's 2025 update to its Loan Product Advisor® (LPA®) not only projects per-loan savings but is also expected to shorten loan production cycle times by an average of five days. Its LPA Choice® feature has already enabled an additional 18,000 borrowers to qualify for a mortgage. Elsewhere, HomeTrust Bank successfully reduced its document review process by 40% using an AI-powered platform, while fintech company Blend Labs introduced an AI-driven "Copilot" that helps loan officers generate pre-approval letters in a matter of minutes, not hours.

Fortifying the Portfolio: Superior Fraud Detection and Risk Mitigation

Beyond efficiency, AI provides a powerful layer of defense against fraud and helps lenders manage credit risk with greater precision.

Advanced Fraud Detection AI systems, particularly those using machine learning, are uniquely capable of identifying complex and subtle patterns of fraud that are often invisible to the human eye. By analyzing vast datasets in real-time, these systems can spot anomalies in borrower information, inconsistencies across documents, and suspicious transaction patterns that may indicate fraudulent activity.

A landmark move in this area occurred in May 2025, when Fannie Mae announced a strategic partnership with the AI software company Palantir to launch a new "Crime Detection Unit". The initiative is designed to leverage Palantir's cutting-edge AI to analyze millions of datasets and uncover previously undetectable patterns of mortgage fraud. The initial focus is on tackling sophisticated schemes like occupancy fraud within Fannie Mae's substantial multifamily loan portfolio, with the goal of saving the housing market millions in future losses. This partnership builds on Fannie Mae's previous successes with AI, where internal implementation of machine learning for fraud detection had already contributed to a 50% reduction in mortgage fraud cases.

The benefits are not limited to large GSEs. Habito, an online mortgage broker in the UK, faced a growing challenge with sophisticated digital document fraud. By partnering with Resistant AI, Habito was able to improve its fraud detection capabilities by 32% and significantly reduce the time its financial crime team spent on investigations, allowing them to focus on the highest-risk cases.

The Customer Dividend: Speed, Personalization, and Transparency

Ultimately, the most significant impact of AI may be on the end user: the borrower. For them, AI is transforming the mortgage process from an ordeal into a modern, digital experience.

Dramatically Faster Approvals For a homebuyer in a competitive market, time is of the essence. The stress and uncertainty of waiting weeks for a loan decision can be immense. This is where AI delivers its most tangible benefit to the customer. Data from the Mortgage Bankers Association shows that AI-powered lenders can deliver initial approval decisions 70% faster than their traditional counterparts. Reducing a process that once took weeks down to a matter of days—or in some cases, hours—is a revolutionary improvement in the customer experience.

Hyper-Personalization AI is enabling a fundamental shift from generic, one-size-fits-all mortgage products to highly personalized solutions. By analyzing an individual's complete financial profile, AI algorithms can recommend optimal loan structures, terms, and interest rates that are tailored to their specific needs and circumstances. This level of personalization is highly valued by consumers, with one study indicating that 72% of them prefer personalized experiences.

Enhanced Accessibility and Transparency The traditional mortgage process has often been described as a "black box," with borrowers left in the dark about the status of their application. AI-powered platforms are changing this by providing 24/7 access to information and real-time status updates via online portals and chatbots. This newfound transparency demystifies the process, reduces anxiety, and improves overall customer satisfaction and trust. The adoption of these tools is growing rapidly; a 2025 survey from Veterans United Home Loans revealed that one in three homebuyers now use AI at some point during their homebuying journey, with younger generations leading the charge.

Table 2: Quantifiable Benefits of AI in Mortgage Lending

This table aggregates key performance indicators from various industry reports and studies, providing a data-driven overview of AI's impact on efficiency, cost, risk, and customer outcomes.

| Benefit Category | Metric | Data Point / Statistic | Source / Context |

|---|---|---|---|

| Operational Efficiency (Time) | Reduction in Processing Time | 30-50% | General lender reports on AI-driven approval timelines. |

| Reduction in Processing Time | 41% | Fannie Mae study on lenders using comprehensive AI solutions. | |

| Faster Initial Approval | 70% | Mortgage Bankers Association data on AI-powered lenders. | |

| Reduced Document Verification Time | 85% | Financial institutions report on AI-powered document processing. | |

| Reduced Loan Production Cycle | 5 days | Freddie Mac analysis of lenders using its LPA® automation. | |

| Operational Efficiency (Cost) | Reduction in Operational Costs | 29% | Fannie Mae study on lenders using comprehensive AI solutions. |

| Savings Per Loan | Up to $1,500 | Freddie Mac estimate for lenders fully utilizing LPA® automation. | |

| Reduced Customer Acquisition Cost | ~22% | Industry data for lenders using AI-driven acquisition strategies. | |

| Cost of Origination (Baseline) | >$10,000 per loan | Industry data highlighting the high cost AI aims to reduce. | |

| Risk & Fraud Mitigation | Reduction in Mortgage Fraud Cases | 50% | Fannie Mae's results from implementing ML-based fraud detection. |

| Improved Fraud Detection | 32% | Case study of Habito using Resistant AI for document forensics. | |

| Increased Default Prediction Accuracy | 15% | Fannie Mae study comparing AI models to traditional methods. | |

| Reduction in Default Rates | 31% | Study on lenders using AI-enhanced underwriting. | |

| Customer & Market Impact | Increased Qualified Lead Generation | 34% | Industry data for lenders using AI-driven acquisition strategies. |

| Increased Approval for Qualified Borrowers | 23% | Study on lenders using AI-enhanced underwriting, expanding access. | |

| Increased Lender AI Adoption | From 15% (2023) to 38% (2024) | Stratmor Group study showing rapid adoption of AI/ML. | |

| Automation of Workflow | Up to 97% | Potential automation level cited for certain mortgage workflows. |

Part III: Navigating the Perils: A Framework for Managing AI-Induced Risks

While the benefits of AI are compelling, they are accompanied by a new class of complex and significant risks. These challenges are not merely technical; they strike at the heart of a lender's ethical responsibilities, regulatory obligations, and brand reputation. The risks associated with AI—algorithmic bias, data privacy, model hallucinations, and security vulnerabilities—are not independent threats. They are deeply interconnected and can create compounding failures. For example, a model trained on biased data can lead to a discriminatory lending decision. If that decision is challenged, the model's "black box" nature may make it impossible to explain, resulting in a regulatory violation. If a generative AI chatbot then hallucinates a false justification for that decision, it creates direct legal liability. If the biased data itself is compromised in a security breach, the result is a catastrophic cascade of legal, financial, and reputational damage. This interconnectedness means that managing AI risk cannot be done in silos. It requires a holistic, integrated governance framework that addresses bias, explainability, security, and reliability simultaneously, elevating AI risk management from a departmental task to a board-level strategic priority.

The Specter of Digital Redlining: Confronting Algorithmic Bias

The most significant ethical and legal challenge posed by AI in mortgage lending is the risk of algorithmic bias. This issue threatens to undermine decades of progress in fair lending and has become a primary focus for regulators.

The Core Problem: Biased Data, Biased Outcomes AI models learn by identifying patterns in the data they are trained on. The core problem is that historical lending data is not neutral; it reflects decades of societal biases and discriminatory practices, such as redlining, where financial services were systematically denied to minority communities. If an AI model is trained on this biased data without correction, it will inevitably learn, perpetuate, and even amplify these discriminatory patterns on a massive scale. This phenomenon is often referred to as "digital redlining".

The problem extends beyond historical data. Even seemingly neutral alternative data points can function as proxies for protected characteristics like race or gender. For instance, studies have shown correlations between credit risk and factors like the type of mobile phone a person uses (Android vs. iPhone) or their email provider (Yahoo vs. a premium service), which can indirectly correlate with socioeconomic status and race, leading to unintentionally discriminatory outcomes.

Real-World Evidence and Regulatory Scrutiny This is not a theoretical concern. An investigation by The Markup found that in 2019, lenders were more likely to deny home loans to people of color than to white applicants with identical on-paper financial profiles. A 2021 study in the

Journal of Financial Economics found that minority borrowers were charged interest rates that were nearly 8 percent higher and were rejected 14 percent more often than comparable privileged groups. Federal fair lending laws, including the Fair Housing Act (FHA) and the Equal Credit Opportunity Act (ECOA), apply unequivocally to AI-driven lending decisions. Regulators are keenly focused on this issue, with agencies like the CFPB and FHFA demanding that lenders ensure their algorithms are fair and transparent. The opaque, "black box" nature of some complex AI models presents a significant challenge, as it can be difficult for lenders to explain

why a decision was made, which is a key requirement for regulatory compliance.

Mitigation Strategies Addressing algorithmic bias requires a proactive and multi-faceted approach:

- Diverse and Representative Training Data: The foundational step is to ensure that the data used to train AI models is inclusive and accurately represents the full spectrum of the population the lender serves. This may involve actively seeking out and incorporating alternative data that provides a more equitable view of creditworthiness.

- Fairness-Aware Modeling: Lenders and their technology partners must move beyond optimizing models solely for predictive accuracy. This involves intentionally designing models to co-optimize for fairness. Techniques like "Distribution Matching," which trains a model to produce similar outcomes for protected and control groups, or "DualFair," which actively de-biases datasets, are emerging as critical tools.

- Regular Auditing and Bias Detection: Bias is not a one-time fix. It requires continuous monitoring. Lenders must implement regular audits of their AI systems, using statistical fairness metrics to test for disparate impacts on protected groups. Partnering with third-party AI auditing firms can provide independent validation.

- Human-in-the-Loop (HITL) Oversight: Automation cannot be absolute. Maintaining meaningful human oversight is a crucial backstop. This means establishing clear workflows where human underwriters review and have the authority to override questionable or high-risk AI decisions, particularly those involving declined applications from protected classes.

The Hallucination Problem: Ensuring Factual Grounding in Generative AI

The rise of powerful generative AI models, such as Large Language Models (LLMs), introduces a new and insidious risk: AI hallucinations.

Defining AI Hallucinations An AI hallucination occurs when a generative model produces an output that is factually incorrect, misleading, or entirely fabricated, yet presents it with the same fluency and confidence as a factual statement. This is not a random glitch; it is a byproduct of how these models work. They are designed to predict the next most probable word in a sequence to create human-like text, not to access a database of facts. Research from the AI startup Vectara suggests that current generative models can hallucinate anywhere from 3% to 27% of the time, depending on the complexity of the task.

Specific Risks in a Mortgage Context In the high-stakes, highly regulated world of mortgage lending, a hallucination can have devastating consequences:

- Incorrect Financial Analysis: An AI tool summarizing a borrower's file for an underwriter could invent income sources or fabricate asset values, leading to a disastrously bad loan decision and significant financial loss.

- Compliance Breaches: A generative AI assistant could misstate a key requirement of the Truth in Lending Act (TILA) or the Real Estate Settlement Procedures Act (RESPA), or invent a compliance step that doesn't exist, exposing the lender to regulatory action and severe penalties.

- Misleading Customer Communication: An AI chatbot could provide a borrower with a fabricated mortgage rate, give incorrect advice about loan products, or invent reasons for a loan denial, leading to customer harm, loss of trust, and potential lawsuits.

- Reputational Damage: Acting on hallucinated insights, whether for internal decisions or external communication, can severely damage an institution's reputation and erode the trust of customers, investors, and regulators.

Mitigation Strategies for Mortgage Companies Fortunately, there are effective technical and procedural strategies to combat hallucinations:

- Retrieval-Augmented Generation (RAG): This is the leading technical solution. A RAG architecture prevents the AI from relying solely on its vast, general training data. Instead, when asked a question, the system is first forced to retrieve relevant information from a small, trusted, and up-to-date knowledge base—such as the lender's official underwriting guidelines, product manuals, and regulatory compliance documents. The AI is then instructed to generate its answer based only on the information it has retrieved. This grounds the model in factual, company-approved data and dramatically reduces the likelihood of fabrication.

- Domain-Specific Fine-Tuning: Lenders can further improve accuracy by fine-tuning a general-purpose LLM on their own high-quality, proprietary mortgage data. This process effectively makes the model a specialist in the lender's specific domain, reducing knowledge gaps and the tendency to invent answers.

- AI Guardrails and Verification: These are automated checks and balances that monitor the AI's output. For example, a guardrail could automatically flag any generated interest rate that falls outside a pre-defined plausible range or cross-verify a factual claim against a source database before it is shown to a user.

- Human Oversight and Spot-Checking: As with bias, human review is the ultimate safeguard. Lenders must establish clear protocols for when human verification of AI-generated content is required, especially for high-stakes outputs like compliance reports, loan summaries, or direct financial advice. Employees must be trained and empowered to challenge and override the AI's output.

The Governance Gauntlet: Data Privacy, Security, and Integration

Beyond the novel risks of bias and hallucinations, lenders must also navigate more traditional but equally critical operational and technical challenges.

Data Privacy and Security The mortgage process is built on a foundation of highly sensitive data, including personal identifiers, income details, and financial histories. AI systems, which process this data at an unprecedented scale, represent a high-value target for cybercriminals. Lenders must implement enterprise-grade security frameworks, including robust data encryption, strict access controls, and regular security audits, to protect against data breaches and ensure compliance with privacy regulations like the GDPR and the California Consumer Privacy Act (CCPA).

Legacy System Integration A significant practical barrier for many established financial institutions is their reliance on aging, often siloed legacy systems. These older platforms are frequently incompatible with modern, API-driven AI technologies, making integration difficult and costly. A successful AI strategy often requires a parallel strategy for infrastructure modernization, which represents a major strategic and financial commitment. Learn more in our full guide on legacy software modernization for scalability.

Third-Party Vendor Risk Given the complexity of building AI systems, many lenders will opt to partner with third-party technology vendors rather than building everything in-house. While this can accelerate adoption, it also introduces significant third-party risk. Lenders retain ultimate responsibility for the outcomes of the AI they use, even if it is provided by a vendor. Therefore, they must conduct exhaustive due diligence on potential partners, scrutinizing their security practices, data handling protocols, model transparency, and commitment to ethical AI principles.

Dependency and Business Continuity As AI becomes more deeply embedded in core operations, it creates a new potential point of failure. An overreliance on AI systems without adequate backup plans is a significant operational risk. Lenders must develop and regularly test comprehensive business continuity and disaster recovery plans that specifically address what happens if a critical AI system fails or must be taken offline.

Table 3: Risk Mitigation Framework for AI in Mortgages

This framework serves as a practical risk register, translating the complex challenges of AI into manageable categories with clear business impacts and actionable control strategies for leadership.

| Risk Category | Specific Risk | Potential Business Impact | Actionable Mitigation Strategies |

|---|---|---|---|

| Ethical & Compliance Risk | Algorithmic Bias / Digital Redlining | Regulatory fines (ECOA/FHA violations), reputational damage, reduced market access, lawsuits. | - Use diverse, representative training data. - Conduct regular fairness audits and bias testing. - Implement "Explainable AI" (XAI) to ensure transparency. - Maintain robust human-in-the-loop oversight. |

| Generative AI Risk | AI Hallucinations | Financial loss from bad decisions, compliance breaches from incorrect advice, erosion of customer and employee trust, legal liability. | - Implement Retrieval-Augmented Generation (RAG) with a trusted knowledge base. - Fine-tune models on high-quality, domain-specific data. - Establish AI guardrails and verification layers. - Mandate human review for high-stakes outputs. |

| Operational & Technical Risk | Data Privacy & Security Breach | Regulatory penalties (GDPR/CCPA), loss of customer trust, financial liability for data loss. | - Implement enterprise-grade security, data encryption, and access controls. - Anonymize sensitive data where possible. - Conduct thorough due diligence on third-party vendor security. |

| Legacy System Integration Failure | High implementation costs, project delays, inability to leverage AI effectively, operational disruptions. | - Conduct a thorough evaluation of current infrastructure. - Develop a strategic, phased modernization plan. - Partner with experienced technology providers for integration. | |

| Overreliance on Technology | Systemic failure if AI goes offline, inability to operate manually, loss of institutional knowledge. | - Maintain a balance between automation and human expertise. - Develop and test business continuity and disaster recovery plans for AI systems. - Ensure staff are trained to question and override AI when necessary. |

Part IV: The Strategic Imperative: A Roadmap for AI Adoption

Successfully integrating AI into a mortgage lending operation is not merely a technology project; it is a fundamental organizational transformation. The greatest obstacles are often not technical but are rooted in strategy, culture, data readiness, and people. Lenders who treat AI adoption as a simple software procurement are destined for disappointment. Success requires a holistic, top-down approach that involves a clear strategic vision, a commitment to modernizing infrastructure, and a plan for evolving the workforce. It demands a cultural shift towards data-driven decision-making, where insights are trusted but rigorously verified. The initial and most critical step is an honest assessment of organizational readiness, which is less about the technology itself and more about the institution's capacity to manage such a profound change.

Assessing AI Readiness: Is Your Organization Prepared?

Before making significant investments, lenders must conduct a thorough internal audit to determine their readiness for AI. The suitability of AI is not universal; it depends entirely on a lender's specific challenges, strategic goals, and existing capabilities.

Key assessment areas include:

- Strategic Goals: The first step is to move beyond the hype and clearly define the business problems AI is intended to solve. Is the primary objective to reduce origination costs by a specific percentage, cut fraud losses, shorten approval times, or improve the customer experience? Without clear, quantifiable goals, an AI initiative will lack direction and its success will be impossible to measure.

- Data Infrastructure: AI models are only as good as the data they are trained on. Lenders must critically assess the quality, accessibility, and structure of their existing data. Is customer and loan data centralized and clean, or is it fragmented across siloed, legacy systems? Embarking on an AI project with poor quality data is a recipe for failure, as it will lead to inaccurate models and biased outcomes.

- Technological Maturity: A realistic evaluation of the current technology stack is essential. Can existing systems support modern, API-based AI tools, or will a major infrastructure overhaul be required first? Attempting to bolt sophisticated AI onto outdated legacy systems is a common point of failure that leads to project delays and budget overruns.

- Organizational Culture & Skills: AI adoption is as much a cultural challenge as a technical one. The organization must be prepared to embrace data-driven decision-making and empower employees to work alongside intelligent systems. Critically, leadership must identify any skill gaps in areas like data science, AI model management, and compliance oversight. A plan to address these gaps, either through strategic hiring or robust internal training programs, is a prerequisite for success.

A Phased Approach to Implementation

The consensus among experts and early adopters is that a "big bang" approach to AI implementation is fraught with risk. A more prudent and effective strategy is a phased, iterative approach that builds momentum and organizational buy-in over time.

- Start Small and Iterate: Rather than attempting to automate the entire mortgage lifecycle at once, lenders should begin by identifying specific, low-risk, high-impact areas where AI can provide a quick win. This could be automating a specific document verification step or implementing a customer service chatbot for a single product line. Starting small allows the organization to learn, demonstrate value, and build confidence before tackling more complex challenges.

- The Pilot Program: A formal pilot program is an effective way to introduce new AI tools in a controlled environment. By assembling a small, influential team to test the technology, lenders can surface potential issues with data, workflows, or user adoption early in the process. The success stories and feedback from this pilot group become powerful internal marketing tools that help build support for a broader rollout.

- Partner Strategically: Choosing the right technology provider is a critical decision. Lenders should seek partners, not just vendors—companies that are willing to collaborate closely, provide transparency into their models, and demonstrate a strong commitment to ethical AI and regulatory compliance. Thorough due diligence on a vendor's capabilities, security posture, and support model is essential.

- Scaling Solutions: Once a pilot has proven successful, a clear roadmap for scaling the solution across the enterprise should be developed. This is not a one-time event but a continuous process of monitoring performance, gathering feedback from users, and working with technology partners to refine and improve the AI models over time.

The Human-AI Synergy: Augmenting, Not Replacing, Expertise

A pervasive fear surrounding AI is that it will eliminate jobs. However, a consistent theme in the mortgage industry is that AI should be viewed as a tool to augment human expertise, not replace it. The goal is to create a powerful synergy where AI handles the repetitive, data-intensive tasks it excels at, freeing up human professionals to focus on the high-value work that requires uniquely human skills. You can explore more about this evolving dynamic in our feature “How Will AI Really Affect Your Operations and People?.”

Redefining Roles The roles of loan officers and underwriters are not disappearing; they are evolving. Instead of spending their days on manual data entry and paperwork, they are becoming managers of AI tools, interpreters of complex data-driven insights, and the crucial human touchpoint for borrowers. Their focus shifts to managing exceptions, handling complex loan scenarios that fall outside standard parameters, and providing the empathy, nuanced judgment, and creative problem-solving that AI cannot replicate.

The Importance of Human Oversight This human element is not just for customer service; it is the ultimate risk management backstop. To guard against the inherent weaknesses of AI, such as bias and hallucinations, lenders must build robust human-in-the-loop processes. This involves establishing clear rules for when human review and approval are mandatory, particularly for adverse decisions like loan denials. Crucially, employees must be trained and empowered to question, challenge, and, when necessary, override the recommendations of an AI system. This commitment to maintaining human judgment as the final arbiter is essential for ensuring fair lending compliance and building trust in the technology. Investing in training programs that teach staff how to work effectively with and interpret the outputs of AI tools is therefore not an optional expense but a critical component of a successful implementation.

Table 4: AI Readiness Assessment Checklist

This checklist provides a practical, self-assessment tool for mortgage companies to evaluate their organizational preparedness for AI adoption across four key pillars: Strategy, Data, Technology, and People.

| Pillar | Assessment Question | Status (Not Ready / Developing / Ready) | Notes & Action Items |

|---|---|---|---|

| Strategy & Governance | Have we clearly defined the specific business problems we want AI to solve (e.g., reduce origination costs by X%, cut fraud by Y%)? | ||

| Do we have an executive-level "AI champion" to lead the initiative? | |||

| Have we established a governance framework for AI, including policies for ethics, bias, and transparency? | |||

| Is our compliance team involved early and equipped to oversee AI-driven decisions? | |||

| Data & Infrastructure | Is our customer and loan data centralized, high-quality, and accessible for AI models? | ||

| Do we have a strategy for integrating or modernizing our legacy systems to support AI tools? | |||

| Do we have robust data security and privacy protocols in place to handle the vast data AI requires? | |||

| Technology & Tools | Have we evaluated potential third-party AI vendors for their technical capabilities, security, and ethical commitments? | ||

| Do we have a plan to start with a low-risk pilot project to prove value before scaling? | |||

| Does our technology stack support key AI mitigation techniques like RAG and Explainable AI (XAI)? | |||

| People & Culture | Does our team have the necessary data science and AI management skills, or do we have a plan to acquire them (hire/train)? | ||

| Have we communicated a clear vision for how AI will augment, not replace, our employees' roles? | |||

| Is there a culture of data-driven decision-making within the organization? | |||

| Have we established clear guidelines for human oversight and when to override AI decisions? |

Conclusion: The Future of Mortgage Lending - An Era of Responsible Innovation

The transformation of the mortgage industry by artificial intelligence is not a distant future; it is a present-day reality that is accelerating with each passing quarter. The evidence is clear: AI delivers a powerful combination of operational efficiency, cost reduction, enhanced risk management, and a vastly improved customer experience. For lenders, the adoption of AI is rapidly shifting from a competitive advantage to a strategic necessity for survival and growth. The ability to process loans faster, more accurately, and at a lower cost while simultaneously offering hyper-personalized products and best-in-class fraud protection is redefining the benchmarks for success.

However, this report has also demonstrated that the path to this future is fraught with significant and complex risks. The potential for AI to inherit and amplify historical biases, the challenge of ensuring factual accuracy in generative models, and the persistent demands of data security and regulatory compliance cannot be understated. These are not mere technical hurdles; they are profound ethical and governance challenges that require board-level attention and a deep institutional commitment to responsible practices.

The long-term winners in this new era of mortgage lending will not be the companies that simply adopt AI the fastest, but those that adopt it the most responsibly. The future belongs to the agile, the data-driven, and, most importantly, the trustworthy. Success will be defined by a dual mandate: to aggressively pursue technological innovation that streamlines processes and delights customers, while simultaneously building and maintaining a robust governance framework that manages the profound risks of bias, privacy, and transparency. The ultimate goal is to create a human-AI synergy—a system where technology handles the scale and complexity of data, freeing human experts to provide the judgment, empathy, and ethical oversight that remain irreplaceable. By embracing this balanced approach, the mortgage industry can harness the full potential of AI to create a more efficient, inclusive, and resilient housing finance ecosystem for all.

About Baytech

At Baytech Consulting, we specialize in guiding businesses through this process, helping you build scalable, efficient, and high-performing software that evolves with your needs. Our MVP first approach helps our clients minimize upfront costs and maximize ROI. Ready to take the next step in your software development journey? Contact us today to learn how we can help you achieve your goals with a phased development approach.

About the Author

Bryan Reynolds is an accomplished technology executive with more than 25 years of experience leading innovation in the software industry. As the CEO and founder of Baytech Consulting, he has built a reputation for delivering custom software solutions that help businesses streamline operations, enhance customer experiences, and drive growth.

Bryan’s expertise spans custom software development, cloud infrastructure, artificial intelligence, and strategic business consulting, making him a trusted advisor and thought leader across a wide range of industries.