Law Firm Transformation 2025: Overcoming Security, Data, and Efficiency Roadblocks

August 16, 2025 / Bryan ReynoldsThe Executive's Playbook: How to Solve the Four Core Challenges Crippling Your Law Firm's Profitability and Security in 2025

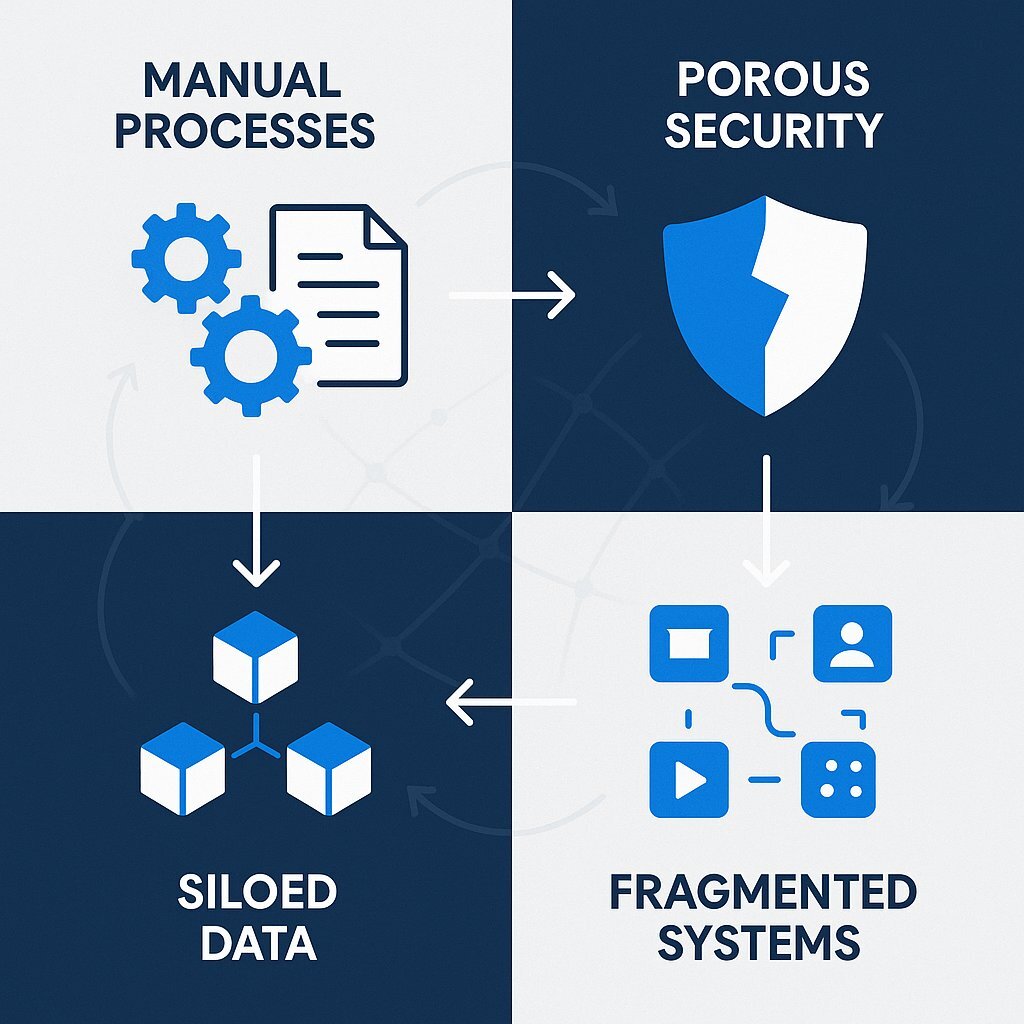

In 2024, the average cost of a data breach reached a staggering $4.88 million. This figure, which has seen its largest year-over-year jump since the pandemic, is more than just a statistic; it is a potential extinction-level event for an under-insured law firm. This clear and present danger, however, is not merely an external threat. It is a risk magnified exponentially by a set of deep-seated internal inefficiencies that plague the legal industry. The four core challenges of modern legal operations—manual processes, porous security, siloed data, and fragmented systems—are not separate issues. They are a tightly woven knot of escalating risk and hemorrhaging revenue that quietly undermines firm profitability.

This article is not another high-level report on legal tech trends. It is a strategic playbook for Chief Technology Officers and Chief Financial Officers, designed to answer your most pressing questions about technology, risk, and the path to a more resilient and profitable future. We will dissect each of these four challenges, quantify its true impact on your bottom line, and provide a clear, actionable framework for transforming your firm's technology from a debilitating cost center into its most powerful competitive asset.

Why Is Our Administrative Overhead So High? What Is the True Cost of Inefficient Document Management?

For executives scrutinizing the firm's profit and loss statement, rising operational costs can be a persistent source of concern. The answer often lies not in isolated expenses, but in the systemic drag of inefficient processes, particularly the manual management of documents. This is not a matter of annoyance; it is a direct and quantifiable drain on a firm's most valuable and perishable asset: the time of its legal professionals.

The Problem Quantified: A Drain on Your Most Valuable Asset—Time

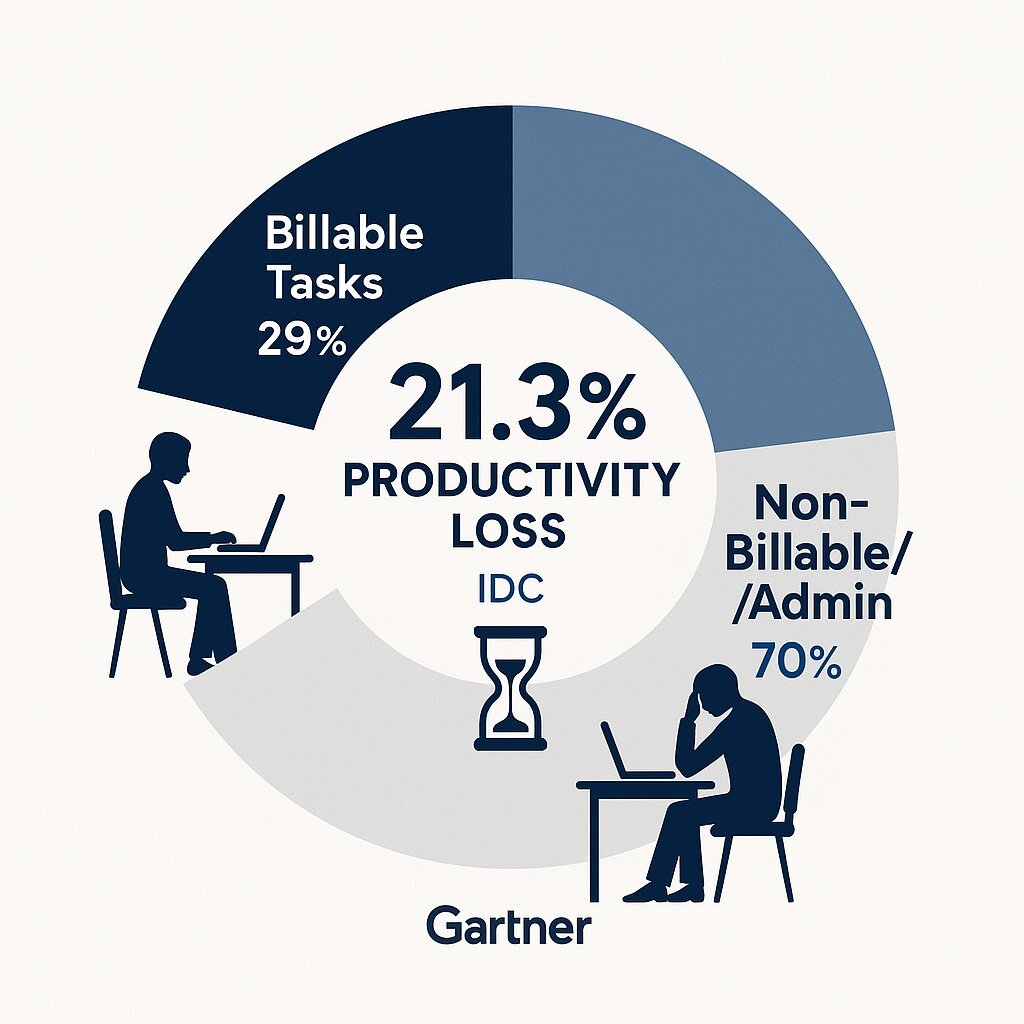

The central issue is the profound misallocation of high-value human capital. Highly paid and highly skilled legal professionals are spending a staggering portion of their day on low-value, non-billable administrative work. According to a landmark report from Thomson Reuters, attorneys spend, on average, a mere 29% of their workday on billable tasks. For in-house legal teams, the situation is even more alarming; a 2023 Gartner study found that legal professionals can spend up to 70% of their time on routine document handling and other administrative burdens.

This is not a subjective feeling of being busy; it is a measurable loss of productivity that directly impacts revenue. Research from IDC reveals that poor document management is responsible for a 21.3% loss in overall productivity. A primary driver of this loss is the simple act of finding information. Employees across industries spend an average of 30% of their workday just searching for documents. For a team of attorneys and paralegals, this inefficiency translates into thousands of lost billable hours every year.

The problem is deeply rooted in outdated methods and a failure to centralize information. An astounding 45% of small and midsize businesses still rely on paper records for critical data. Even for firms that have digitized, the chaos often persists. A shocking 85% of crucial business documents are stored within individual email inboxes, creating a fragmented, unsearchable, and profoundly insecure repository of the firm's most vital information.

Beyond Lost Time: The Cascade of Financial and Operational Risk

The consequences of this inefficiency extend far beyond lost billable hours, creating a cascade of direct financial losses and escalating operational risks. The cost to reproduce a single lost document, for instance, has been calculated at $220 in labor. While seemingly small, these costs accumulate rapidly in a disorganized environment.

More concerning is the increased risk of error. A Deloitte study found that manual contract review has an average error rate of 4.3%. While that percentage may appear minor, a single missed or misinterpreted clause in a high-value contract can expose the firm and its clients to millions of dollars in liability. This operational bottleneck also has a direct and measurable impact on top-line revenue. When legal departments become a chokepoint, business opportunities evaporate. A survey by PwC revealed that 64% of business leaders reported losing deals specifically because of delays in the contracting process. Inefficiency is not just an internal problem; it is actively preventing revenue growth.

The Vicious Cycle of Inefficiency and Talent Drain

These statistics paint a grim picture, but they only tell part of the story. Beneath the surface of wasted hours and direct costs lies a destructive, self-perpetuating cycle that erodes a firm's long-term health, culture, and profitability. The constant administrative burden and high caseloads overwhelm attorneys and paralegals, leading to widespread frustration and burnout as they are reduced to what one report calls "highly paid document processors". This environment fuels an above-average attrition rate compared to other corporate functions.

As a result, firms that fail to invest in modern, efficient technology find it increasingly difficult to attract and retain top talent, particularly younger attorneys who have grown up with and expect to use sophisticated digital tools. When these experienced professionals leave, they take with them years of invaluable, uncodified institutional knowledge about clients, cases, and the firm's strategic risk tolerance—knowledge that is often trapped in their personal email archives or convoluted folder structures. This high turnover disrupts case continuity, damages client relationships, and forces the firm into a costly and repetitive cycle of hiring and retraining. New talent is brought into the same broken system, perpetuating the cycle of frustration. This represents a critical hidden cost that a standard P&L statement will not reveal, but one that a forward-thinking CFO must understand and address.

| Metric | Statistic | Source | Implication for Your Firm |

|---|---|---|---|

| Time on Non-Billable Admin Tasks | Up to 70% of workday | Gartner | Direct loss of billable revenue; inflated overhead. |

| Productivity Loss from Poor Search | 21.3% | IDC | Nearly a quarter of your payroll is wasted on inefficient processes. |

| Cost to Recreate One Lost Document | $220 | M-Files | A direct, quantifiable cost for every instance of lost information. |

| Manual Contract Review Error Rate | 4.3% | Deloitte | Significant, unmanaged liability risk in every contract. |

| Deals Lost Due to Contract Delays | 64% of leaders report this | PwC | Inefficiency is directly preventing top-line revenue growth. |

Our Data Is Our Biggest Asset and Greatest Liability. How Do We Secure It Without Grinding Operations to a Halt?

For the modern law firm's leadership, data presents a fundamental paradox. It is simultaneously the firm's most valuable asset—the repository of its intellectual capital and client trust—and its single greatest liability. The challenge for CTOs and CFOs is to navigate this duality: enabling the firm to leverage its data for competitive advantage while building an impenetrable fortress to protect it from ever-more sophisticated threats. This requires a strategic shift, reframing security from a purely defensive cost center to a core business imperative and, ultimately, a competitive advantage.

The Escalating Threat Landscape: More Sophisticated, More Costly

Law firms are prime targets for cybercriminals for a simple reason: they are, as one report notes, "treasure troves" of the world's most sensitive information, including personally identifiable information (PII), confidential M&A details, valuable intellectual property, and privileged attorney-client communications. The financial consequences of a breach are severe. The global average cost has surged to $4.88 million, a 10% year-over-year increase that represents the largest jump since the pandemic. This figure encompasses not only direct costs like incident response, legal fees, and regulatory fines but also massive, often unquantified, indirect costs such as business disruption, customer churn, and long-term reputational damage.

The nature of these attacks is also evolving. Organized criminal syndicates are orchestrating highly sophisticated ransomware attacks and electronic funds transfer (EFT) fraud that render traditional defenses insufficient. Basic security hygiene, such as complex passwords and even multi-factor authentication (MFA), is no longer a reliable safeguard against these advanced threats. The frequency of successful attacks is also on the rise. In the first five months of 2024 alone, 21 law firms reported data breaches, a pace set to easily surpass the 28 firms that reported breaches in the entirety of 2023—and this is widely understood to be a significant undercount of the true number of incidents.

The Compliance Maze: A Patchwork of Global Regulations

Beyond the active threats posed by cybercriminals, law firms must navigate an increasingly complex and unforgiving web of data privacy regulations. Frameworks like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) are no longer abstract legal concepts; they are strict, enforceable mandates. These laws grant individuals significant rights over their personal data, including the right to know how it is used, to limit its collection, and to demand its deletion.

Failure to comply can result in heavy regulatory scrutiny and substantial financial penalties. The challenge is magnified for firms with a national or international presence, as they must adhere to a patchwork of varying and sometimes conflicting jurisdictional requirements. For example, data sovereignty laws in countries like Germany and France require that certain client data be physically stored within their borders, a requirement that generic, US-centric cloud solutions may not be able to meet.

Security-by-Design as a Revenue Enabler

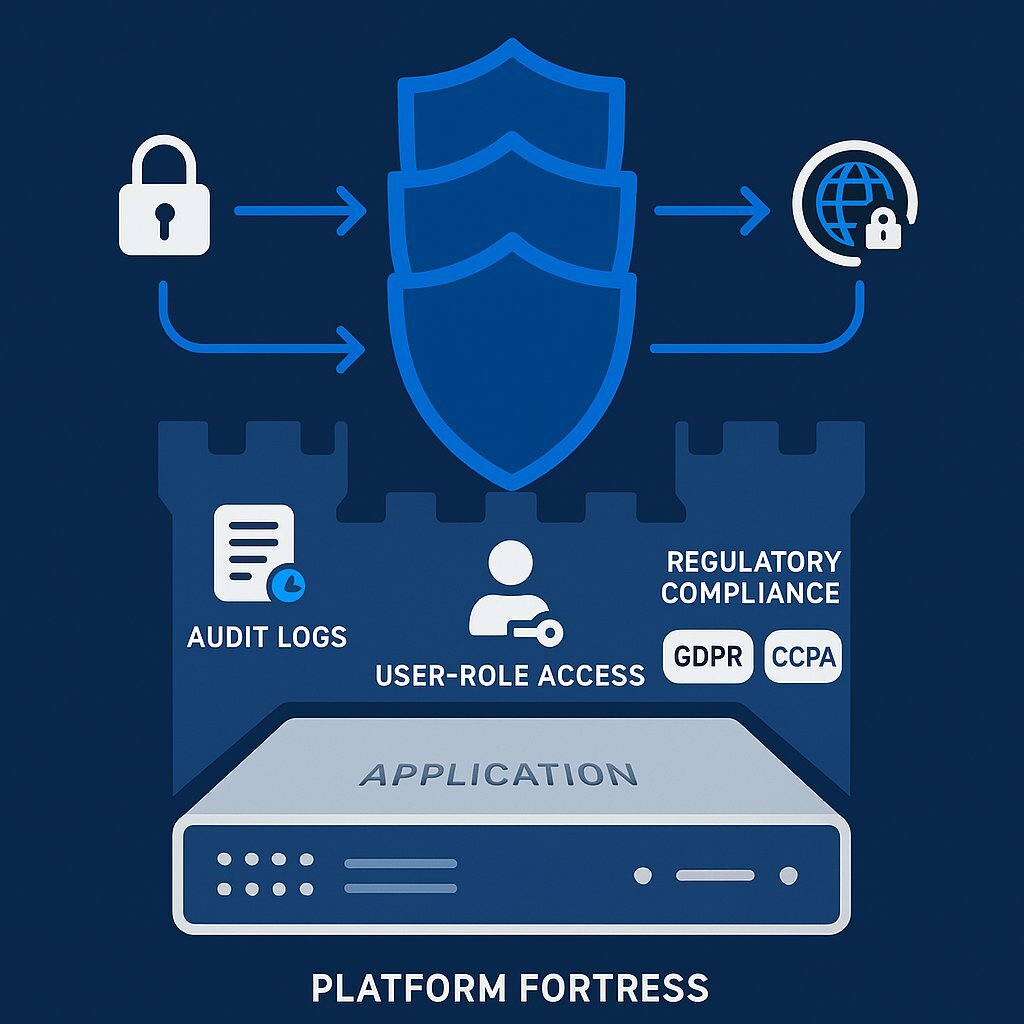

The traditional approach to technology security—attempting to bolt on security features to generic, off-the-shelf software—is fundamentally broken. In today's high-stakes environment, a modern, resilient law firm must treat security not as an add-on, but as a core architectural principle from day one. This "Security-by-Design" philosophy, a hallmark of custom-developed software, is the key to transforming security from a defensive cost into a powerful and persuasive competitive differentiator.

The problem with off-the-shelf systems is that they are built for a general audience and offer a one-size-fits-all security model. Law firms, however, have unique and highly specific security needs driven by their ethical obligations and the sensitive nature of their data. This gap has not gone unnoticed by clients. Sophisticated corporate clients are now conducting increasingly rigorous security audits of their outside counsel, viewing a law firm's weak security posture as a direct and unacceptable threat to their own business operations and data.

This client-driven scrutiny creates a strategic opportunity. A law firm that can proactively demonstrate a superior, bespoke security architecture is not just mitigating its own risk; it is creating a powerful selling point that builds trust and justifies premium fees. Custom software is the enabler of this strategy. It allows a firm to embed specific security and compliance controls directly into its operational DNA. This includes implementing granular, role-based access controls that enforce the principle of least privilege; deploying end-to-end encryption tailored to specific data types and client requirements; creating immutable audit trails to prove compliance; and automating the enforcement of complex data retention policies.

With a custom-built, security-first platform, a firm can confidently go to market and articulate a compelling value proposition: "We don't just use secure software; we built our entire operation around a security architecture designed from the ground up to protect your most sensitive information." This shifts the client conversation away from a commoditized discussion of price and toward a much more valuable and defensible conversation about trust and partnership.

My Teams Waste Hours Searching for Information Across Disconnected Systems. Is There a Better Way?

The daily operational reality for many law firms is one of organized chaos. Information, the lifeblood of legal practice, is scattered across a fragmented landscape of disconnected systems, creating data silos that cripple productivity, inflate costs, and introduce significant risk. For CTOs, this is a primary source of operational friction. For CFOs, it represents a massive, often hidden, financial drain and a barrier to leveraging the firm's data for strategic advantage.

The Anatomy of a Siloed Firm: A Daily Reality of Disconnected Work

The typical law firm operates on a patchwork of disparate software tools that do not communicate with one another. A central document management system (DMS) may exist, but it rarely talks to the separate billing platform, the firm-wide accounting system, or the ubiquitous black holes of individual email inboxes and shared network drives. This is not a niche issue. According to a study by AIIM, a staggering

74% of document and records management systems fail to integrate with other core business applications.

This lack of integration forces legal professionals into a constant, mind-numbing cycle of manually re-entering the same data into multiple platforms—a practice that is not only a colossal waste of time but also a primary driver of costly errors. The problem is being compounded by the explosion of modern communication tools. Critical case-related information and evidence are now scattered across platforms like Slack, iMessage, Zoom, and WhatsApp. These informal channels are frequently overlooked during discovery processes, creating massive and often unknown compliance gaps and legal risks.

The High Cost of Chaos: E-Discovery and Institutional Amnesia

Nowhere is the staggering cost of data silos more apparent than in the realm of e-discovery. The process of collecting, reviewing, and producing documents for litigation is a major expense driver for any firm. Document review remains the single largest component of these costs, accounting for 64% of total e-discovery spending in 2024. When a discovery request arrives, a reactive, manual search across a firm's fragmented systems causes these costs to skyrocket. Legal teams and expensive external vendors spend an enormous amount of time and budget simply trying to locate, consolidate, and reconcile information from different sources before the substantive review can even begin. This inefficiency is why, in some cases, managing a single gigabyte of data through the entire review process can cost tens of thousands of dollars.

This fragmentation also leads to a form of corporate amnesia, preventing the firm from leveraging its most valuable asset: its own accumulated institutional knowledge. Without a unified, searchable repository of information, critical insights from past cases, expert witness testimonies, successful legal arguments, and detailed client histories remain locked away in isolated systems, inaccessible to the attorneys who need them most.

The Integration-AI Nexus: Unlocking True Intelligence

As the legal industry rushes to embrace the promise of Artificial Intelligence, many firms are discovering a harsh reality: a siloed data environment severely cripples AI's effectiveness. The true, transformative potential of AI—evolving from a simple tool for task automation into a powerful engine for strategic intelligence—can only be unlocked after solving the foundational problem of system integration. A unified data strategy is the mandatory prerequisite for a successful AI strategy.

Experts predict that the strategic adoption of AI will be a key factor separating the most successful firms from the rest of the pack in the coming years. Firms are eager to deploy AI for advanced legal research, automated contract analysis, and even predictive analytics for case strategy. However, an AI tool is only as intelligent as the data it can access. If an AI-powered contract analysis tool cannot see historical agreements in the DMS, related billing data from the finance system, and relevant client communications from email archives, its insights will be superficial, incomplete, and potentially misleading. As one group of experts noted, disjointed AI tools are a key challenge facing the industry.

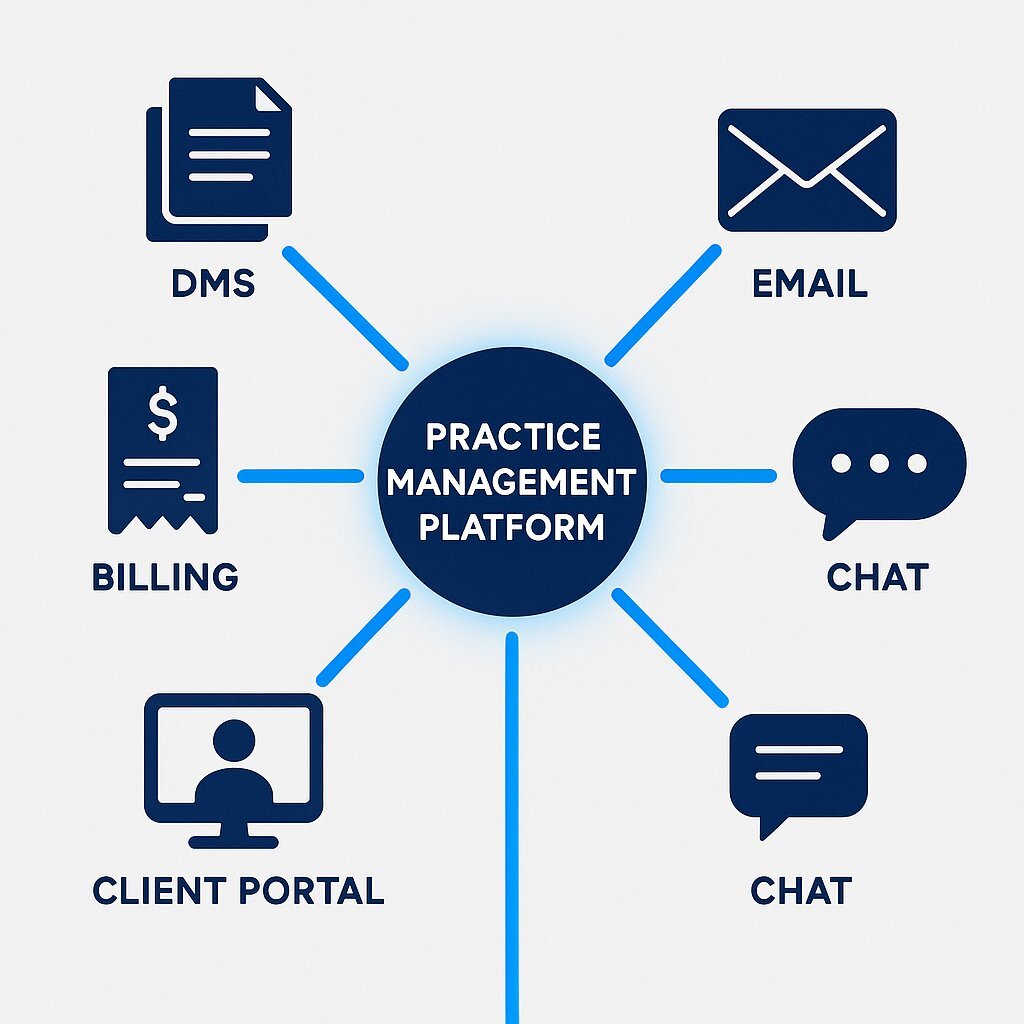

The solution to this problem lies in building a robust, integrated data ecosystem powered by custom Application Programming Interfaces (APIs). APIs act as secure, real-time bridges between different software systems, allowing them to communicate and share data seamlessly. A custom-built practice management platform can serve as the central nervous system for the firm, using APIs to pull data from all other critical systems—including the DMS, billing software, court e-filing systems, and client portals—into a single, unified data repository.

With this unified data source in place, an AI layer can finally perform truly powerful, cross-functional analysis. It can correlate specific clauses from a new contract with the financial outcomes of past litigation, identify billing patterns that may signal client dissatisfaction or risk, and provide attorneys with a holistic, 360-degree view of a case, client, or matter. This represents the leap from basic automation to genuine business intelligence. The path forward is clear: integration must come first, and then AI's full potential can be unleashed.

!( https://i.imgur.com/k6Lq58c.png )

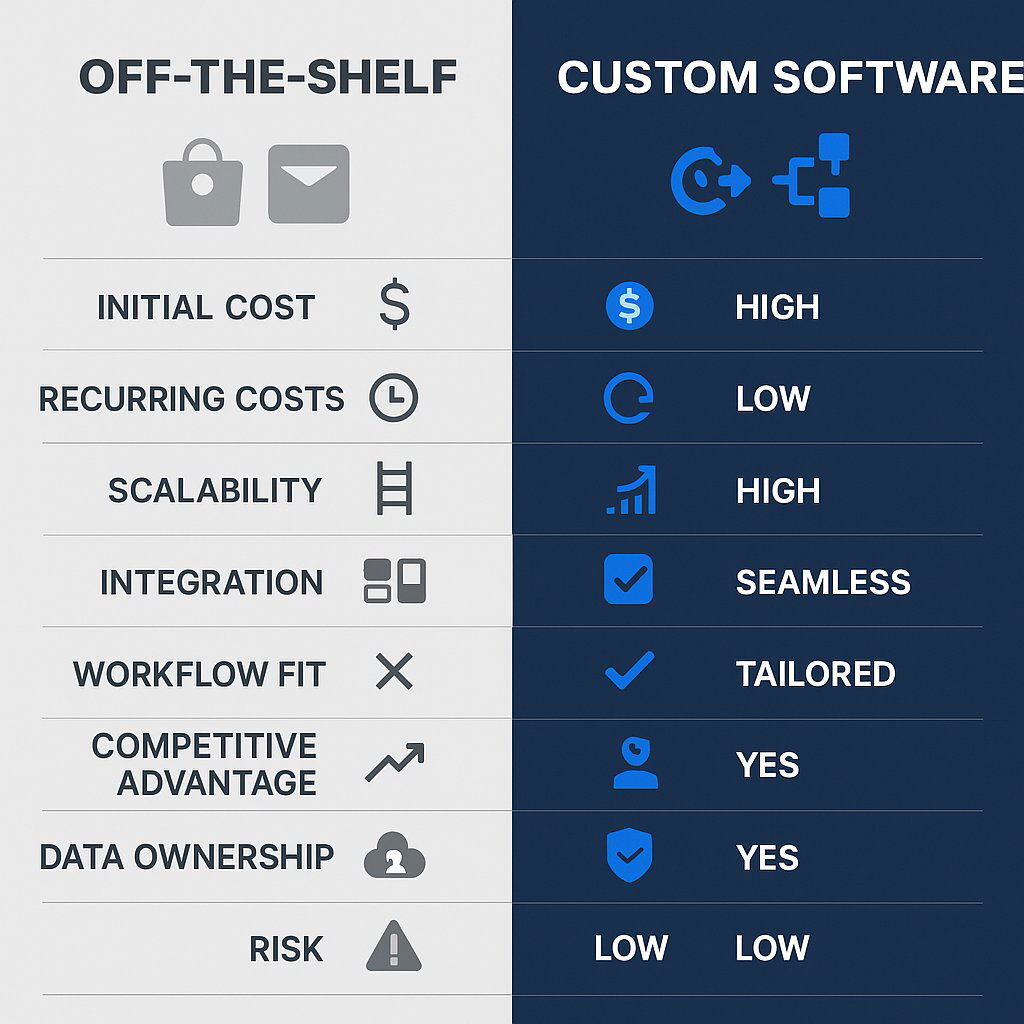

We've Tried Off-the-Shelf Software and It Failed. Why Is a Custom Build a Smarter Investment, Not Just a Bigger Expense?

For many law firm executives, the prospect of a large-scale technology project is met with a healthy dose of skepticism, often born from past experiences with off-the-shelf software that overpromised and underdelivered. This section confronts that skepticism head-on, acknowledging the common failures of Commercial Off-the-Shelf (COTS) products and reframing the "custom vs. COTS" debate. The discussion moves beyond a simple line-item cost comparison to a more sophisticated strategic investment analysis focused on Total Cost of Ownership (TCO), competitive advantage, and financial risk mitigation.

The "One-Size-Fits-None" Problem of COTS

When faced with mounting operational pressures, many firms understandably turn to well-known COTS platforms like Clio, MyCase, or NetDocuments as a first step. The appeal is clear: immediacy of deployment and a seemingly low initial cost. However, this approach contains a fundamental flaw. COTS solutions are, by design, built for a generic "average" firm. They inevitably force a firm with unique, highly-tuned, and often proprietary workflows to make a painful choice: either abandon its successful processes to fit the rigid constraints of the software or create a series of inefficient and error-prone manual workarounds that ultimately defeat the purpose of the technology investment. This friction leads to frustrated users, plummeting adoption rates, and a failure to achieve the desired efficiency gains.

Furthermore, when a firm invests in COTS, it is effectively renting, not owning, a critical piece of its operational infrastructure. The firm cedes strategic control to the vendor, becoming beholden to their product roadmap, unpredictable pricing changes, and the quality of their customer support. The firm's technology becomes a mere commodity, offering no unique competitive differentiation in the marketplace.

The CFO's Blind Spot: Unmasking the True Total Cost of Ownership (TCO)

A CFO's primary tool for evaluating any major capital expenditure is Return on Investment (ROI). However, a simple ROI calculation can be dangerously misleading without first conducting a thorough analysis of the Total Cost of Ownership (TCO). The initial license fee for a COTS product is merely the visible tip of a very large and costly iceberg. The true, long-term costs accumulate relentlessly over time through several channels: high, perpetual per-user subscription fees; expensive and often limited options for customization; costly professional services for integration with other systems; and punitive pricing models that penalize the firm for its own growth.

A custom software solution, by contrast, presents a different financial profile. While the initial development cost is significantly higher, the TCO over a three-to-five-year horizon can be substantially lower. There are no recurring license fees paid to an external vendor. Integration with other systems is designed and built-in from the start, not added as an expensive afterthought. The system is architected to scale with the business without incurring punitive charges. Most importantly, the firm owns the asset outright, transforming a perpetual operational expense into a balance-sheet asset.

Agile Deployment as a Financial De-Risking Strategy

Perhaps the greatest fear for a CFO or CTO contemplating a custom software build is the risk of a catastrophic project failure—a multi-year, monolithic endeavor that goes millions over budget and ultimately fails to deliver the promised value. This is a valid concern, but one that is directly addressed and mitigated by the Agile development methodology, a core tenet of modern software engineering and a cornerstone of the approach used by expert firms like Baytech Consulting. Agile effectively transforms what was once a massive, high-stakes gamble into a series of small, calculated, and value-driven investments.

The traditional "Waterfall" approach to software development involved months of upfront planning, followed by a long and opaque development phase, culminating in a single "big bang" launch at the very end. If the initial assumptions made months or years earlier were wrong, the entire investment was often wasted. Agile turns this model on its head. The project is broken down into small, manageable phases called "sprints," which typically last two to four weeks. At the conclusion of each sprint, a small but complete piece of functional, tested software is delivered to the firm. For a law practice, the very first sprint might deliver something as simple as a streamlined and automated client intake form. This single feature can be deployed immediately, providing tangible value and generating a near-instant return on that portion of the investment.

This iterative process creates a continuous feedback loop. The project team gets immediate input from real users, allowing the project plan to adapt and evolve based on real-world needs rather than outdated assumptions. This principle of "responding to change over following a plan" is a core pillar of the Agile Manifesto. For a CFO, this approach provides a powerful mechanism for financial governance and risk control. Funding is tied to the successful delivery of tangible value at each milestone. It eliminates the "all or nothing" financial risk of traditional projects and provides unparalleled transparency into the project's progress, budget, and evolving scope, aligning perfectly with a CFO's mandate for control and predictability.

| Factor | Off-the-Shelf (COTS) Software | Custom Software (via Baytech Consulting) |

|---|---|---|

| Initial Cost | Low to Moderate (License Fees) | High (Development Investment) |

| Recurring Costs | High & Perpetual (Per-user licenses) | Low (Hosting & Maintenance) |

| Integration Costs | High & Often Limited | Built-in during development |

| Scalability | Vendor-controlled, often with cost penalties | Infinitely scalable, designed for your growth |

| Workflow Fit | Generic; forces you to adapt your process | Tailored; built around your unique process |

| Competitive Advantage | None (Commodity tool) | High (Codifies your "secret sauce") |

| Data Ownership & Security | Vendor-controlled; generic security | Full ownership; security-by-design |

| Development Risk | Low (but high adoption risk) | Mitigated via Agile Deployment |

| 5-Year TCO | Often higher than anticipated | Predictable and often lower long-term |

Conclusion: Your Action Plan for Building a Resilient, Profitable Firm

The operational challenges detailed in this analysis—inefficient workflows, mounting security threats, and fragmented data—are no longer just "the cost of doing business." In an era defined by sophisticated cyber risks, evolving client expectations for transparency and value, and the transformative potential of AI in professional services, a disconnected and inefficient technology stack has become an existential threat. A holistic, integrated technology strategy, built upon a custom software foundation, is the only sustainable path to enhanced profitability, robust security, and durable long-term growth.

The path forward requires a shift in mindset, from viewing technology as a reactive expense to embracing it as a proactive, strategic investment. Here is a simple, actionable checklist for executives ready to begin this transformation:

- Conduct an "Inefficiency Audit." For one week, instruct your legal and administrative teams to meticulously track their top three most time-consuming, frustrating, and non-billable administrative tasks. Quantify this lost time and multiply it by the loaded salary cost of those employees. This simple exercise will reveal the staggering, real-dollar cost of your firm's current operational friction.

- Map Your Data Silos. Create a simple visual diagram of your firm's current technology stack. Identify every application where critical data is stored and every point in your workflow where information must be manually re-entered from one system to another. This map will starkly illustrate your greatest integration vulnerabilities and sources of inefficiency.

- Calculate the ROI of Recaptured Partner Time. This is arguably the most critical metric for any law firm. Estimate the number of hours your highest-value partners could reclaim from administrative oversight and low-value tasks if your systems were seamlessly integrated and automated. Then, assign a value to that time—not just its billable rate, but its potential impact when redirected toward strategic business development, client relationship building, or mentoring junior talent. This is the true "soft ROI" that drives sustainable growth.

- Initiate a Strategic Conversation. The next step is not to issue an RFP for a piece of software. It is to find a strategic technology partner who prioritizes understanding your unique business challenges and strategic goals first, and discusses technology second.

Transforming your firm's technological core is a significant undertaking, but it is not a journey you must take alone. The right partner does not simply sell you a pre-packaged product; they collaborate with you to design and build a durable competitive advantage.

At Baytech Consulting, this is our specialty. Our Rapid Agile Deployment methodology is specifically designed to deliver tangible business value quickly and to mitigate the financial risks associated with large-scale projects. Our deep expertise in the legal industry ensures that the solutions we build are not just technologically sound, but are perfectly aligned with your firm's unique operational workflows and strategic objectives.

If you are ready to move beyond temporary fixes and build a secure, efficient, and profitable foundation for your firm's future, let's schedule a strategic consultation. We can help you analyze your current state, model the true ROI of a custom solution, and chart a clear, actionable path forward.

Supporting Articles

- (https://www.clio.com/blog/legal-technology-trends/)

- (https://wp.table.media/wp-content/uploads/2024/07/30132828/Cost-of-a-Data-Breach-Report-2024.pdf)

- (https://www.baytechconsulting.com/blog/cfos-guide-to-calculating-the-roi-of-custom-software-development-2025)

About Baytech

At Baytech Consulting, we specialize in guiding businesses through this process, helping you build scalable, efficient, and high-performing software that evolves with your needs. Our MVP first approach helps our clients minimize upfront costs and maximize ROI. Ready to take the next step in your software development journey? Contact us today to learn how we can help you achieve your goals with a phased development approach.

About the Author

Bryan Reynolds is an accomplished technology executive with more than 25 years of experience leading innovation in the software industry. As the CEO and founder of Baytech Consulting, he has built a reputation for delivering custom software solutions that help businesses streamline operations, enhance customer experiences, and drive growth.

Bryan’s expertise spans custom software development, cloud infrastructure, artificial intelligence, and strategic business consulting, making him a trusted advisor and thought leader across a wide range of industries.