The 2025 Startup Success Blueprint: Funding, Tools, and Resources for Founders

August 06, 2025 / Bryan ReynoldsThe Founder's Playbook for 2025: A Baytech Consulting Guide to Resources, Funding, and Tools

The path from a groundbreaking idea to a scalable enterprise has never been more accessible, yet the landscape is fraught with complexity. Founders today are inundated with choices—which accelerator to join, what funding instrument to use, which software to build on. Making the right strategic decisions early on is the critical determinant of success. This playbook, developed by the experts at Baytech Consulting, is not just another list of resources. It is a comprehensive, data-backed strategic guide designed to demystify the ecosystem, clarify the fundraising journey, and equip you with the operational toolkit needed to build, grow, and scale your company in 2025 and beyond.

I. Building Your Foundation: Leveraging the Startup Ecosystem

Before seeking significant funding, founders must leverage crucial support systems to build a strong, defensible foundation for growth. This initial phase is about tapping into external expertise, networks, and non-dilutive capital to validate the business model and de-risk the venture for future investors.

A. Launchpads for Growth: Choosing the Right Accelerator

Startup accelerators provide intensive, cohort-based programs that offer seed investment, mentorship, and networking opportunities to early-stage companies. However, the true value of these programs has evolved. With the increasing availability of early-stage capital, the small checks offered by accelerators are often secondary to the strategic advantages their networks and brand prestige provide. The choice of an accelerator is therefore a primary strategic decision that can set a startup's entire trajectory.

The Powerhouses (Y Combinator, Techstars, 500 Global)

The world's top accelerators have distinct philosophies and offer unique advantages.

- Y Combinator (YC) is widely regarded as the gold standard for its intense, biannual program focused on achieving scalability and significant market impact. Its track record, which includes titans like Dropbox and Airbnb, has made the YC brand synonymous with startup excellence. For many, acceptance into YC provides a powerful "trust signal," a form of validation that is invaluable when approaching future investors, partners, and top-tier talent.

- Techstars distinguishes itself through its unparalleled global mentorship network, operating under a "Give First" philosophy. This culture of helping entrepreneurs without expectation of immediate return fosters deep, lasting relationships that provide value long after the three-month program concludes. With over 3,100 mentors from companies like Google, Nike, and Amazon, and a portfolio market cap exceeding $127 billion, Techstars offers a robust framework for innovation across a wide array of industries.

- 500 Global (formerly 500 Startups) has carved out a unique position with its commitment to global inclusivity, actively nurturing talent from underrepresented backgrounds. This focus on diversity fuels a broad spectrum of creative solutions and provides participants with access to a vast international network, making it a powerful launchpad for startups with global ambitions from day one.

Niche and Corporate Accelerators

Beyond the generalist powerhouses, a growing ecosystem of specialized accelerators offers targeted advantages. The choice between a generalist and a specialized program should be dictated by a startup's business model and target market.

- Industry-Specific Accelerators: For startups in highly regulated or specialized fields, niche accelerators provide deep domain expertise. Programs like The Mint Accelerator by Better Tomorrow Ventures, for example, are built entirely around the needs of early-stage fintech founders, offering focused guidance on financial infrastructure, compliance, and market access.

Corporate Accelerators: These programs, run by large enterprises, offer a distinct and powerful advantage for B2B startups: a direct path to enterprise customers. Programs like Microsoft for Startups, Siemens for Startups, and Salesforce Accelerate provide not only platform credits (up to $150,000 in Azure credits from Microsoft) but also invaluable opportunities for co-selling, strategic partnerships, and integration into established enterprise ecosystems. For a startup building an application for the Salesforce ecosystem, the access to the AppExchange marketplace provided by Salesforce Accelerate can be far more valuable than a cash investment. Similarly, a B2B fintech startup may find that landing a pilot program with Visa or UBS through the

Plug and Play Tech Center is the single most important milestone for validating its technology and securing future funding.

B. Beyond Capital: The Power of Mentorship and Community

As early-stage capital becomes more commoditized, the defensible value of support programs increasingly lies in their human networks. Access to high-quality mentorship and a strong peer community can be the difference between costly trial-and-error and accelerated, strategic growth.

Structured Mentorship Platforms

The rise of digital platforms has democratized access to elite mentorship, allowing founders to connect with experienced operators for targeted advice on specific challenges.

- MentorCruise and ADPList offer vast, curated networks of mentors from leading global companies such as Google, Meta, Microsoft, and Amazon. These platforms enable founders to book one-on-one sessions to tackle specific problems, from refining a fundraising pitch to optimizing a growth marketing strategy. ADPList notably provides its services for free, aiming to make mentorship accessible to all.

- GrowthMentor focuses on connecting founders with experts in growth marketing, product development, and fundraising, providing a community of specialists who have successfully scaled startups themselves.

- MentorPass positions itself as a premium service with a highly vetted network of top-tier founders and operators (e.g., the founder of Native, which exited for $100M) and a quality guarantee. This model is designed for founders who wish to build an entire advisory team of mentors to guide their growth.

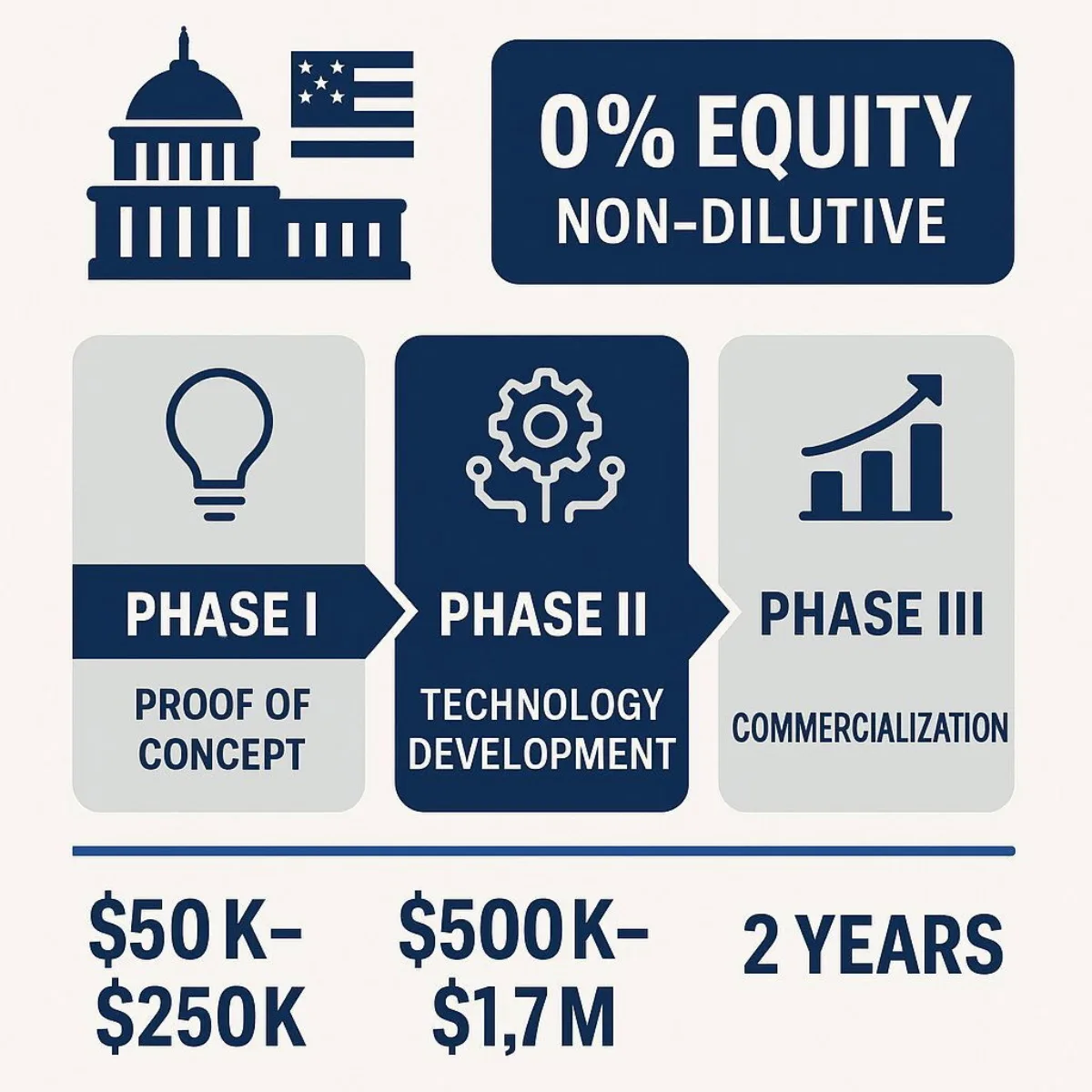

SBIR/STTR federal grant phases: a founder-friendly, non-dilutive capital pathway.

The Unseen Value of Founder Communities

While mentorship provides top-down guidance, peer networks offer crucial lateral support. These communities are a vital source of practical advice, market validation, and emotional resilience from others who intimately understand the founder's journey.

- Startup Grind is the world's largest startup community, with over 5 million members and 600 chapters across 125 countries. Its combination of local events and flagship global conferences provides unparalleled opportunities for networking and learning from both peers and industry leaders.

- Indie Hackers, created by Y Combinator, serves a specific but vital segment of the ecosystem: bootstrapped and self-funded founders. It provides a platform for sharing journeys and exchanging advice on sustainable growth, customer acquisition, and revenue generation outside the traditional venture capital track. For founders building profitable businesses without external funding, this community is an invaluable resource.

- Founders Network is an exclusive, invite-only community for experienced tech founders, offering a trusted space for peer mentorship and problem-solving among a curated group of entrepreneurs.

C. Unlocking Non-Dilutive Capital: A Primer on Government Grants

For technology-focused startups, government grants represent one of the most powerful and underutilized forms of capital. This funding is non-dilutive, meaning founders receive cash without giving up any equity or ownership in their company. Securing a prestigious grant does more than just extend a startup's runway; it provides a powerful form of third-party technical validation that can significantly strengthen a founder's negotiating position in future funding rounds.

America's Seed Fund (SBIR & STTR Programs)

The Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs are the cornerstones of non-dilutive funding in the United States. Collectively known as America's Seed Fund, these programs award over $4 billion annually to small businesses to conduct federal Research & Development (R&D) with the potential for commercialization.

- Program Structure: The fund operates in three phases, providing a clear development path:

- Phase I (Proof of Concept): Awards range from $50,000 to $275,000 over 6-12 months to establish the technical merit and feasibility of an idea.

- Phase II (Technology Development): Following a successful Phase I, companies can apply for awards of up to $1.8 million over 24 months to continue R&D efforts and develop a prototype.

- Phase III (Commercialization): The objective of this phase is for the small business to pursue commercialization based on the Phase I/II R&D. No SBIR funds are awarded in this phase.

- Key Benefits: The most significant benefit is that the government takes 0% equity and makes no claim on intellectual property. Eligibility is broad, open to U.S.-based small businesses with fewer than 500 employees that are seeking equity-free funding to develop technology that could support government missions.

Strategic Alignment and Broader Grant Landscape

The key to securing these highly competitive grants is demonstrating a clear alignment between the startup's technology and the specific R&D needs of a participating federal agency, such as the Department of Defense or the National Science Foundation. The application process itself is rigorous, forcing founders to sharpen their technical roadmap and commercialization plan. This process provides immense strategic value, as a successful SBIR Phase II award serves as a powerful signal to venture capitalists that the core technology has been thoroughly vetted and de-risked by government experts. This validation can lead to a higher valuation and more favorable terms in a startup's first priced equity round.

Beyond the federal SBIR/STTR programs, founders should also explore state-level business grants, which often align with local economic development goals, as well as industry-specific grants from trade associations and private foundation grants, such as the Tory Burch Foundation Fellowship for women-owned businesses.

II. Fueling the Engine: A Founder's Masterclass in Fundraising

Fundraising is a defining process in a startup's life. It is not merely about securing capital but about finding the right partners on the right terms at the right time. This section provides a comprehensive guide to the fundraising lifecycle, from high-level strategic choices to the granular details of deal structures, empowering founders to manage their capital and cap table with strategic foresight.

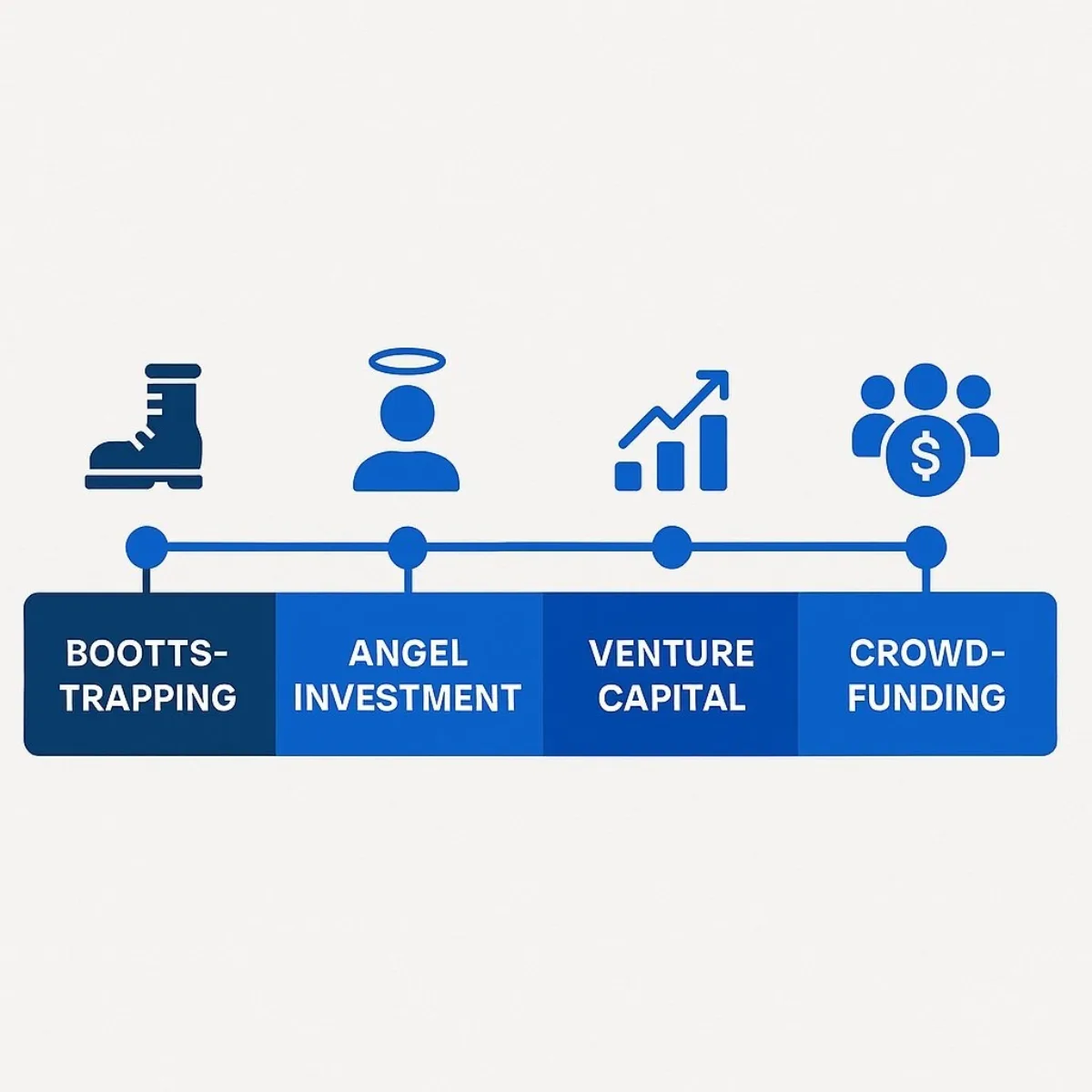

A. The Capital Spectrum: From Bootstrapping to Venture Capital

Founders face a fundamental choice in how to finance their growth, with each path involving significant trade-offs between control, speed, and external pressure.

- Bootstrapping: This involves self-funding the business through personal savings, credit card debt, or revenue from early customers. The primary advantage is absolute control; the founder retains 100% ownership and decision-making power. This path also enforces a culture of financial discipline and a relentless focus on generating revenue. However, the limitation is the pace of growth, as the company is constrained by its own cash flow, which can make it difficult to scale quickly in competitive markets.

- Angel Investment: Angel investors are typically high-net-worth individuals, often successful former entrepreneurs, who invest their own money in early-stage companies in exchange for equity. This is often considered "smart money" because, beyond capital, angels can provide invaluable mentorship, industry expertise, and access to their networks. This is the first step on the path of equity dilution, but it brings in critical external validation and guidance.

- Venture Capital (VC): Venture capital firms invest institutional money (from pension funds, endowments, etc.) into startups with the potential for high growth. VC funding provides substantial capital—far more than most angels—enabling rapid scaling, aggressive marketing, and market capture. The trade-off is significant: founders give up a substantial equity stake and often a board seat, subjecting the company to intense pressure to meet aggressive growth targets and achieve a 10x or greater return for the fund.

- Alternative Paths: Crowdfunding platforms like Kickstarter allow startups to raise capital from a large number of individuals, often in exchange for early access to a product. This can be a powerful way to validate market demand and build a community of early adopters before full-scale production.

B. Navigating the Rounds: What Investors Expect from Pre-Seed to Series C

The venture funding journey is a narrative arc that must evolve at each stage. Early on, investors bet on a compelling story and a talented team. Later, they demand hard data that proves the story is becoming a reality and can scale into a massive business. The failure to make this transition from storyteller to data analyst is a primary reason why so few seed-stage companies successfully raise a Series A round.

- Pre-Seed & Seed Stage: This is the first "official" external funding round, where the focus is on the founding team, the vision, and early evidence of traction, such as a minimum viable product (MVP) and initial user feedback. Funding at this stage, typically ranging from $50,000 to $2.5 million, comes from angel investors, accelerators, and early-stage VCs. The capital is used to build out the product, make key hires, and begin the search for product-market fit.

- Series A: This is the first significant institutional round and represents a major inflection point. To raise a Series A, a startup must have moved beyond a great idea to demonstrate proven product-market fit, supported by clear growth metrics, positive unit economics, and a scalable business model. Investors, now primarily professional VCs, are no longer investing in a dream; they are investing in a predictable machine for growth. Funding rounds typically range from $2.5 million to $18.75 million and are used to scale operations and optimize the growth engine.

- Series B & C (Growth Stage): These later-stage rounds are for companies that have successfully scaled their growth machine and are focused on market expansion, competitive dominance, and developing new product lines. Investors, including growth-stage VCs and private equity firms, are looking for a clear and defensible market leader with a predictable path to a major exit event (an IPO or a large acquisition). Funding amounts increase significantly, from $18.75 million to well over $100 million.

C. Demystifying the Term Sheet: An In-Depth Guide to Early-Stage Deal Structures

For early-stage rounds where a formal valuation is difficult and time-consuming, startups typically raise money using convertible instruments. Understanding the nuances of these agreements is critical for founders.

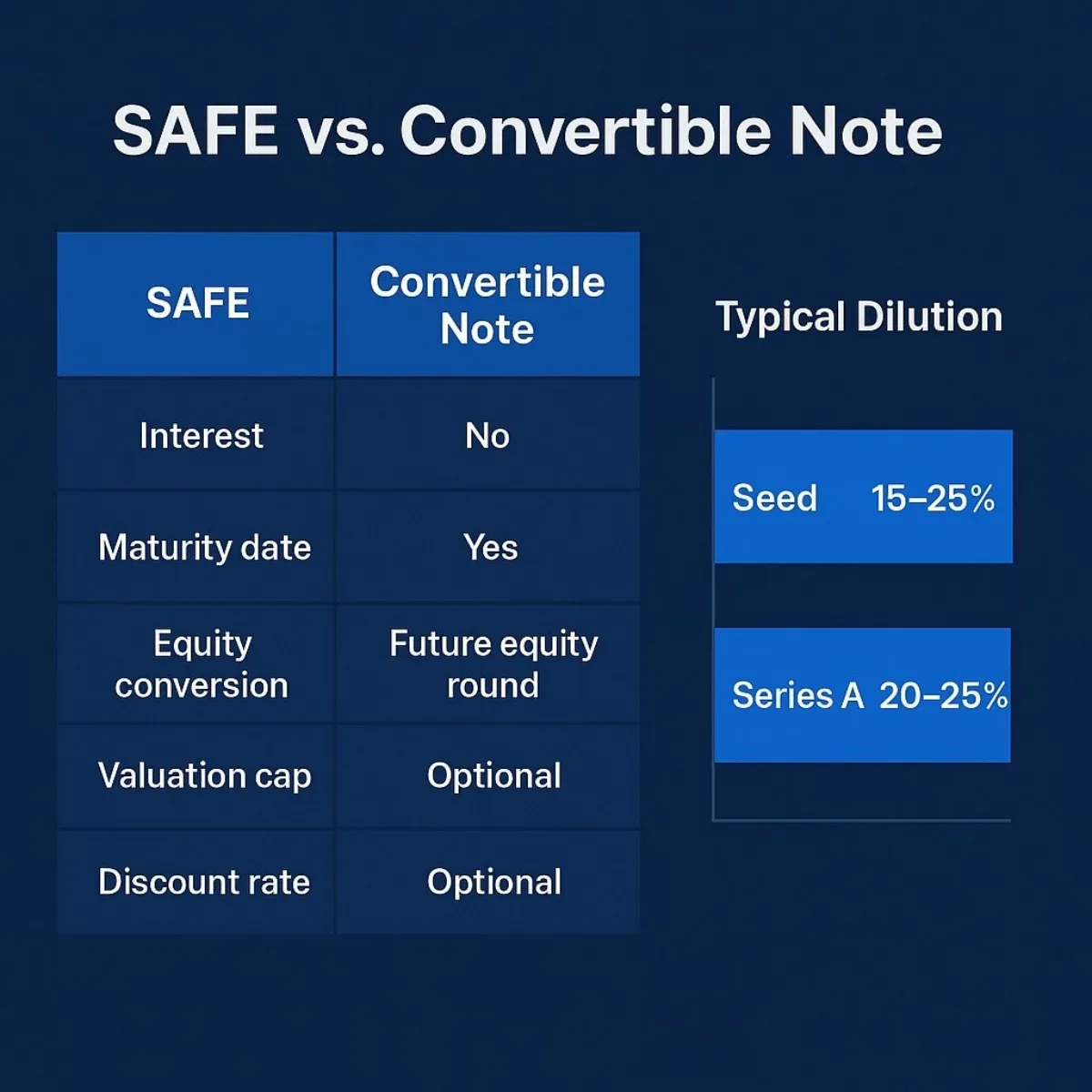

SAFE vs. Convertible Note: The Founder's Choice

The two most common instruments for early-stage fundraising are the Simple Agreement for Future Equity (SAFE) and the convertible note. While both delay valuation, they are fundamentally different.

Convertible Note: This is a debt instrument. The investor loans the startup money, which accrues interest (typically 5-8% annually) and has a

maturity date (usually 18-24 months) by which it must be repaid or converted to equity. The maturity date creates a "ticking clock" that gives investors leverage; if the startup fails to raise a priced round by that date, investors can demand repayment, potentially forcing the company into bankruptcy or a disadvantageous conversion.

SAFE (Simple Agreement for Future Equity): Pioneered by Y Combinator, a SAFE is not debt but rather a warrant or promise for future equity. It has

no interest rate and no maturity date. This is a profound shift that favors the founder. By removing the repayment obligation and the deadline, the SAFE eliminates the leverage held by convertible note investors, giving the founder more control over the timing of their next fundraise and making the company more resilient. Due to its simplicity and founder-friendly terms, the SAFE has become the default instrument for most early-seed-stage deals.

Key Terms Explained (Valuation Cap & Discount Rate)

To reward early investors for taking on the highest risk, convertible instruments include terms that allow them to convert their investment into equity at a lower effective price than later investors. The investor receives the benefit of whichever term—the valuation cap or the discount rate—provides the better price.

- Valuation Cap: This sets a maximum valuation at which the investor's money converts into equity. It protects early investors from being overly diluted if the company's valuation skyrockets. For example, an investor puts in $200,000 on a SAFE with a $5 million valuation cap. The company later raises a Series A at a $10 million pre-money valuation. The SAFE holder converts at the $5 million cap, effectively getting twice as many shares for their money as the Series A investors. Valuation caps for early rounds typically range from $4 million to $20 million.

- Discount Rate: This gives the investor a percentage discount off the share price paid by investors in the next funding round. Discounts typically range from 10% to 35%, with 20% being common. For example, if the Series A investors pay $1.00 per share and the SAFE has a 20% discount, the SAFE holder converts at $0.80 per share.

Understanding Dilution: Realistic Benchmarks

Equity dilution is the reduction in ownership percentage for existing shareholders when new shares are issued. Founders must view their equity not as a static resource but as a "dilution budget" to be spent strategically across the company's lifecycle. Giving away too much equity too early can signal a lack of leverage and deter later-stage investors, who may worry that the founding team is no longer sufficiently incentivized to drive the company toward a large outcome.

- Angel/Seed Round Dilution: In a typical seed round, founders should expect to sell between 15% and 25% of the company. Exceeding 30% dilution in this first round is a significant red flag that can severely complicate future fundraising efforts.

- Series A Dilution: The industry standard for a Series A round is a dilution of 20% to 25%. Venture capital funds are structured to target this level of ownership to ensure that a successful exit will generate a meaningful return for their limited partners. This negotiation between the amount raised and the pre-money valuation determines the final dilution percentage.

III. The Modern Founder's Toolkit: Your Essential Software Stack

Moving from high-level strategy to daily execution requires a modern, integrated software stack. The right tools automate manual processes, provide clear visibility into business performance, and scale with the company. The choice of these foundational tools is a long-term strategic commitment, as the costs of switching—in terms of data migration and team retraining—can be immense.

A. Orchestrating Success: The Project Management Command Center

Project management software is the operational nervous system of a startup, organizing tasks, tracking progress, and facilitating collaboration. The market is crowded, but four platforms stand out for their utility and scalability.

- ClickUp: Often positioned as the "all-in-one" solution, ClickUp is a highly powerful and customizable platform suitable for nearly any workflow or methodology. It consolidates tasks, documents, goals, and communication into a single interface. Its robust free plan and affordable paid tiers offer excellent value, though its sheer number of features can present a steep learning curve for new users.

- Monday.com: Praised for its visually appealing, intuitive, and user-friendly interface, monday.com is an excellent choice for new teams or those prioritizing ease of use. Its color-coded boards and drag-and-drop functionality make it easy to adapt to various workflows. While its free plan is limited, its paid plans offer a strong balance of visual simplicity and powerful features.

- Asana: Asana's primary strength lies in its robust task management capabilities and its extensive library of over 100 native integrations. Its free plan is one of the most generous available, supporting up to 10 users with unlimited projects and tasks, making it ideal for startups that rely on a diverse ecosystem of other software tools.

- Trello: Trello champions simplicity with its best-in-class Kanban board experience. Its visual, card-based system is incredibly intuitive for organizing tasks and tracking straightforward workflows. For teams that need a simple, visual, and highly effective tool without the complexity of other platforms, Trello's excellent free plan is often the perfect starting point.

The selection of a project management tool should be driven by a team's specific needs regarding complexity, budget, and existing software stack.

| Tool | Key Features | Starting Price (per user/mo) | Free Plan Generosity | Ideal Startup Profile |

|---|---|---|---|---|

| Monday.com | Highly visual UI, 25+ project views, extensive customization, strong automations | $9 (billed annually) | Limited (2 users) | New teams or cross-functional teams that need a highly visual and user-friendly interface to get started quickly. |

| ClickUp | All-in-one platform, deep customization, integrated docs, goals, and chat, AI features | $7 (billed annually) | Excellent (unlimited users, multiple tools) | Technical or data-oriented teams that need a single, powerful platform to manage complex, multi-faceted projects. |

| Asana | Strong task management, multiple project views, excellent integration library, good for repetitive workflows | $10.99 (billed annually) | Generous (up to 10 users, unlimited projects) | Structured teams that rely on numerous other software tools and need seamless integrations to create a unified workflow. |

| Trello | Simple Kanban UI, strong automations (Butler), excellent mobile app, easy onboarding | $5 (billed annually) | Excellent (unlimited cards, 10 boards) | Small teams or visual learners who need a simple, intuitive, and checklist-style tool for managing straightforward projects. |

B. From Leads to Loyalty: CRM and Marketing Automation

An integrated Customer Relationship Management (CRM) and marketing automation stack is the engine of a startup's growth. These systems capture, nurture, and convert leads into loyal customers at scale.

The CRM Core: HubSpot has become a dominant force in the startup world, largely due to its powerful and perpetually free CRM. This provides a frictionless on-ramp for startups to build their customer database. As they grow, they can seamlessly upgrade to HubSpot's integrated Marketing, Sales, and Service Hubs, creating a unified platform for the entire customer lifecycle. This "freemium" model creates a strong path dependency; once a startup builds its processes on the HubSpot platform, the cost and complexity of switching to a competitor become prohibitively high. For teams with a more singular focus on sales execution,

Pipedrive offers a highly visual and intuitive sales pipeline management tool. As startups mature and require enterprise-grade functionality, they will often migrate to

Salesforce, the global leader in CRM.

Automating Engagement: To personalize communication at scale, CRMs are connected to marketing automation platforms. For e-commerce startups, Klaviyo is a leader, offering deep integration with platforms like Shopify and advanced email and SMS automation based on customer behavior. For B2B or SaaS companies with more complex customer journeys,

ActiveCampaign excels with its sophisticated workflow builder that combines email marketing, CRM, and automation.

C. Financial & HR Command Center: The Backbone of Your Operations

A streamlined and scalable back office is essential for maintaining financial health, ensuring compliance, and managing a growing team. The modern startup stack consists of best-in-class, cloud-based solutions that integrate seamlessly.

The Modern Finance Stack: The foundation of any startup's financial operations is its accounting software. QuickBooks Online is the undisputed industry standard, valued for its ease of use, comprehensive features, and vast ecosystem of integrations with banks, payroll systems, and payment processors. This is complemented by modern corporate card and expense management solutions like

Brex, which provide startups with credit without requiring personal guarantees from the founders, along with powerful tools for managing employee spending. Finally, as soon as a startup raises external capital or issues employee stock options, an equity management platform becomes essential.

Carta is the market leader, providing a single source of truth for managing the cap table, stock options, and 409A valuations.

People Operations: For managing HR and payroll, startups need solutions that are simple, compliant, and can scale. Gusto is a popular choice for early-stage companies due to its incredibly simple interface for running payroll, managing benefits, and onboarding new employees. As a company grows and its needs become more complex—hiring in multiple states, managing more sophisticated benefits, and tracking performance—it may graduate to an all-in-one platform like

Rippling or BambooHR. These platforms represent a "re-bundling" of the back office, aiming to unify HR, IT, and finance into a single, centralized system.

IV. Engineering for Scale: Building a Resilient Technical Infrastructure

The foundational technology choices made in a startup's early days have long-lasting consequences. Selecting a stable, scalable, and well-understood tech stack is a strategic decision that reduces technical risk and accelerates product development, providing a significant competitive advantage.

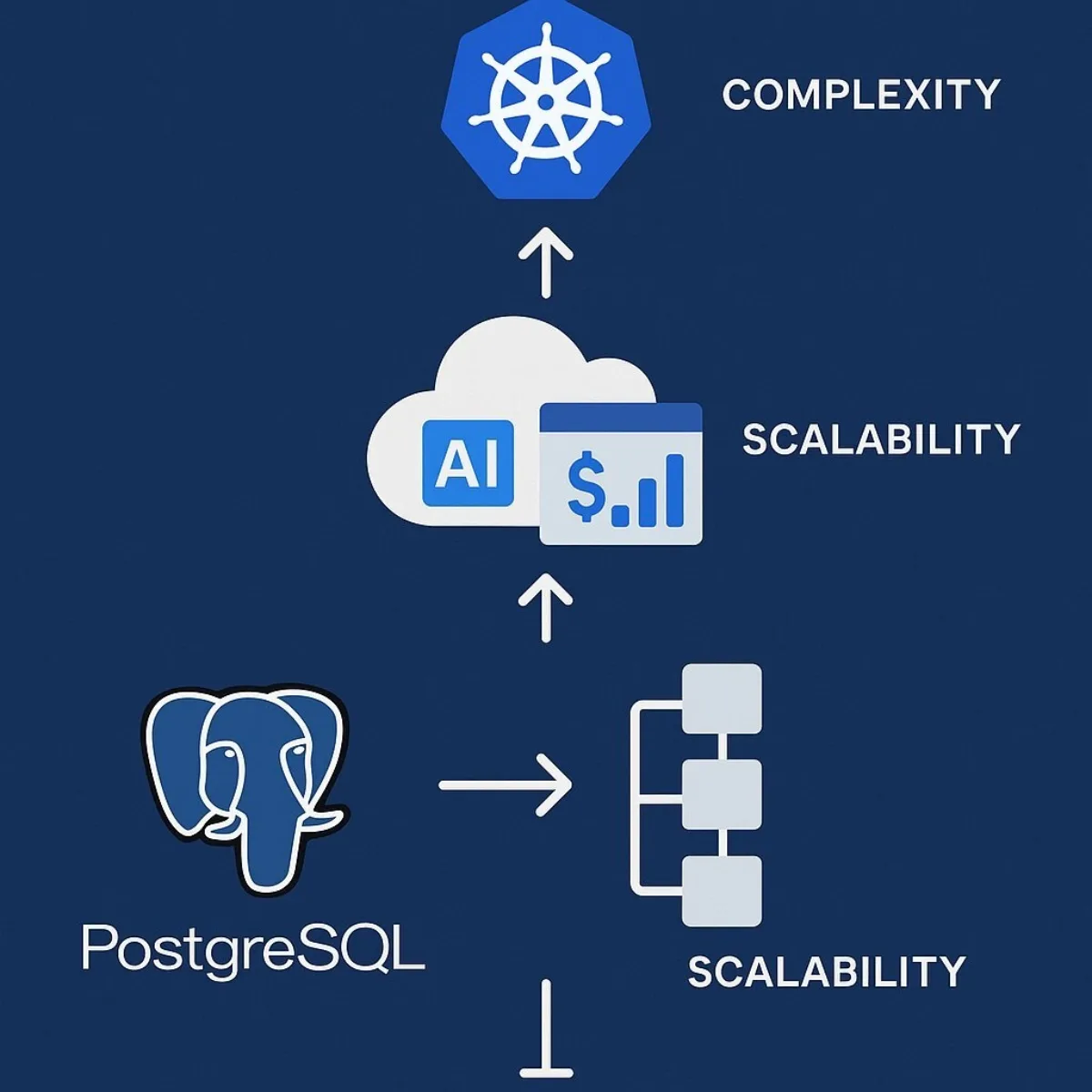

A. The Database Decision: Why PostgreSQL is the Startup Default

For new ventures, the choice of a relational database has increasingly converged on PostgreSQL. This is not a matter of trend but a strategic decision to de-risk the technical foundation of the company.

- Technical & Business Case: PostgreSQL is open-source and free, which eliminates prohibitive licensing costs—a critical factor for cash-constrained startups. More importantly, it provides a feature set that is on par with, and in many cases superior to, expensive commercial databases. It offers robust support for advanced data types, including native JSON and geospatial data, and features like full-text search. This flexibility allows developers to handle a wide variety of data models within a single, reliable system, avoiding the complexity of managing multiple specialized databases. Its strict adherence to SQL standards and full ACID compliance ensure the highest levels of data integrity, and its reputation for stability and performance makes it a safe, scalable choice that can grow with the company from MVP to enterprise scale.

B. The Cloud Advantage: Leveraging Azure for Cost-Effective Growth

Cloud platforms like Microsoft Azure provide far more than just rentable servers; they offer a strategic toolkit that can act as a force multiplier for a startup's engineering team.

- Beyond Infrastructure: Azure provides a suite of managed services—from databases to AI and machine learning tools—that handle the operational heavy lifting of maintaining infrastructure, allowing a small engineering team to focus on building the core product. The platform is designed for scale, with features like dynamic autoscaling to handle unpredictable traffic surges, integrated monitoring tools for real-time visibility, and a global network of data centers that enables a startup to expand into new regions without complex manual configuration.

Cost Management and Credits: A primary concern for any startup is managing its financial runway. Azure provides built-in cost management features, offering real-time visibility into cloud spending with breakdowns by service or team, and tools to set budgets and automate the shutdown of idle development or staging environments. Furthermore, programs like

Microsoft for Startups Founders Hub provide access to significant Azure credits (up to $150,000), technical support, and development tools, dramatically reducing the initial financial burden of building on a world-class cloud platform.

C. To K8s or Not to K8s?: A Pragmatic Approach to Kubernetes

Kubernetes has become the de facto standard for orchestrating containerized applications at scale. Its power is undeniable, but its complexity is often underestimated by early-stage teams.

- The Power and the Peril: Kubernetes provides a robust framework for automating the deployment, scaling, and management of applications, enabling advanced strategies like zero-downtime deployments, automated failover, and cloud portability across providers like AWS, Azure, and GCP. For a company operating at significant scale, these capabilities are mission-critical.

The Tipping Point for Adoption: However, for the vast majority of early-stage startups, adopting Kubernetes is a premature optimization that can be actively harmful. The platform is incredibly complex to set up and manage correctly, requiring deep expertise in networking, security, and infrastructure configuration. The true cost of adopting Kubernetes early is the opportunity cost. Every hour an engineer spends configuring YAML files, debugging cluster networking, or managing Helm charts is an hour they are not spending on building product features that customers value and will pay for. One YC startup reported that after switching

away from an unnecessarily complex Kubernetes setup to a simpler PaaS solution, they were able to ship three major features in the following month alone. The pragmatic approach for most startups is to begin with simpler, managed services offered by their cloud provider and only consider migrating to Kubernetes when the operational pain of manual scaling and the strategic need for multi-cloud resilience clearly outweighs the significant overhead and cognitive load that Kubernetes introduces.

Conclusion

Building a successful startup in 2025 is an exercise in strategic sequencing. It is about knowing which resource to tap, which funding to seek, and which tool to implement at the right stage of the journey. The most successful founders are not those who simply have the best idea, but those who masterfully orchestrate these elements—leveraging the ecosystem for a strong start, navigating the fundraising landscape with strategic foresight, and building their operations on a foundation of scalable, efficient tools. This playbook provides the map; the journey is yours to command.

About Baytech

At Baytech Consulting, we specialize in guiding businesses through this process, helping you build scalable, efficient, and high-performing software that evolves with your needs. Our MVP first approach helps our clients minimize upfront costs and maximize ROI. Ready to take the next step in your software development journey? Contact us today to learn how we can help you achieve your goals with a phased development approach.

About the Author

Bryan Reynolds is an accomplished technology executive with more than 25 years of experience leading innovation in the software industry. As the CEO and founder of Baytech Consulting, he has built a reputation for delivering custom software solutions that help businesses streamline operations, enhance customer experiences, and drive growth.

Bryan’s expertise spans custom software development, cloud infrastructure, artificial intelligence, and strategic business consulting, making him a trusted advisor and thought leader across a wide range of industries.